Arizona Changing state of incorporation

Description

How to fill out Changing State Of Incorporation?

Have you been within a situation the place you need to have papers for sometimes business or individual purposes virtually every time? There are tons of legitimate papers layouts accessible on the Internet, but locating kinds you can trust is not straightforward. US Legal Forms gives thousands of form layouts, such as the Arizona Changing state of incorporation, that happen to be composed in order to meet federal and state needs.

Should you be currently informed about US Legal Forms site and also have a free account, just log in. Afterward, you are able to download the Arizona Changing state of incorporation design.

If you do not have an profile and would like to begin to use US Legal Forms, follow these steps:

- Discover the form you will need and ensure it is for your correct city/state.

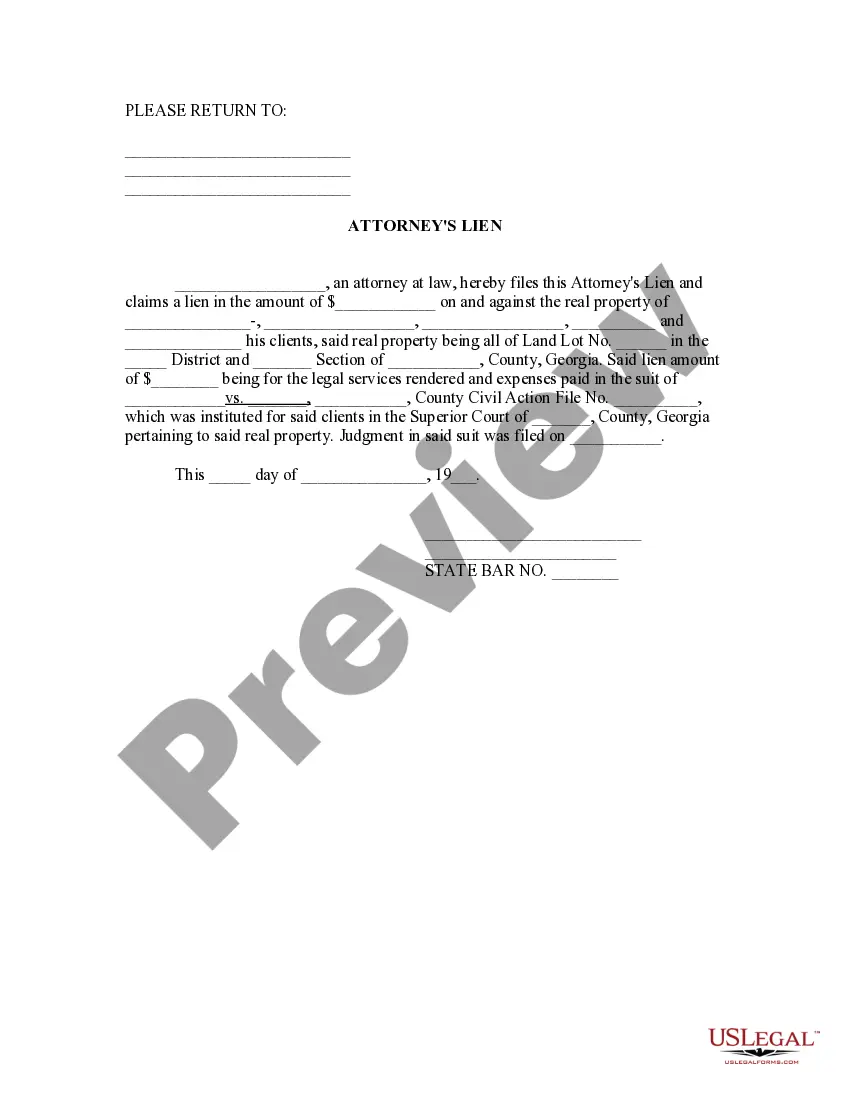

- Make use of the Review option to examine the form.

- See the explanation to ensure that you have selected the proper form.

- In case the form is not what you are searching for, use the Lookup discipline to find the form that suits you and needs.

- If you find the correct form, click Get now.

- Choose the costs strategy you want, fill out the desired information and facts to generate your bank account, and purchase the order making use of your PayPal or bank card.

- Pick a handy data file structure and download your duplicate.

Discover every one of the papers layouts you may have bought in the My Forms menu. You can aquire a more duplicate of Arizona Changing state of incorporation whenever, if necessary. Just select the required form to download or printing the papers design.

Use US Legal Forms, by far the most comprehensive variety of legitimate types, to save efforts and steer clear of faults. The support gives expertly manufactured legitimate papers layouts that you can use for a range of purposes. Generate a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

The primary advantages of forming an LLC in Arizona are: Easy to Form ? With less paperwork and less expenses, formation of an LLC is easier than other business structures. Once the initial paperwork is filed, additional requirements are minimal.

If a foreign entity wants to transact business or conduct affairs in Arizona, it must register with the Arizona Corporation Commission.

Understanding the Difference: Domestic LLCs vs. Foreign Entities. If your LLC is set up in your home state, it's known as a domestic LLC. However, if you wish to do business in a new state other than your home state, your LLC becomes a foreign entity in that new state.

LLC members are taxed at a 15.3% rate, while LLCs that choose C-corp status are taxed at 4.9%. In addition to this state income tax, LLCs pay transaction privilege tax, local city/county taxes, and occasionally industry-specific taxes. Keep reading to learn more about Arizona LLC taxes.

An Arizona LLC can become an LLC of some other state by submitting a Statement of Domestication to the A.C.C. Use the FILE feature to access the form. Read the accompanying Instructions to the Statement of Domestication for more information.

An approved limited liability company name reservation that has not expired may be transferred to another individual or entity by filing with the Arizona Corporation Commission a Notice of Transfer of Limited Liability Company Name Reservation. See A.R.S. § 29-3113.

When updating your Arizona LLC's Articles of Organization, you need to file Articles of Amendment with the Arizona Corporation Commission. Additional forms may also be required, and you may have to publish notice of the amendment. You can file your Articles of Amendment in person, by mail or online for a $25 fee.

To register a foreign corporation in Arizona, you must file an Application for Authority to Transact Business in Arizona with the Arizona Corporation Commission, Corporations Division. You can submit this document by mail, fax, online, or in person.