Louisiana Material Storage Lease (For Pipe and Equipment)

Description

How to fill out Material Storage Lease (For Pipe And Equipment)?

If you have to comprehensive, obtain, or print authorized record web templates, use US Legal Forms, the most important assortment of authorized varieties, which can be found on the Internet. Utilize the site`s basic and practical search to find the papers you want. Various web templates for enterprise and person functions are categorized by categories and says, or key phrases. Use US Legal Forms to find the Louisiana Material Storage Lease (For Pipe and Equipment) with a couple of click throughs.

Should you be previously a US Legal Forms client, log in to your bank account and click on the Obtain option to find the Louisiana Material Storage Lease (For Pipe and Equipment). You can even accessibility varieties you previously saved within the My Forms tab of your respective bank account.

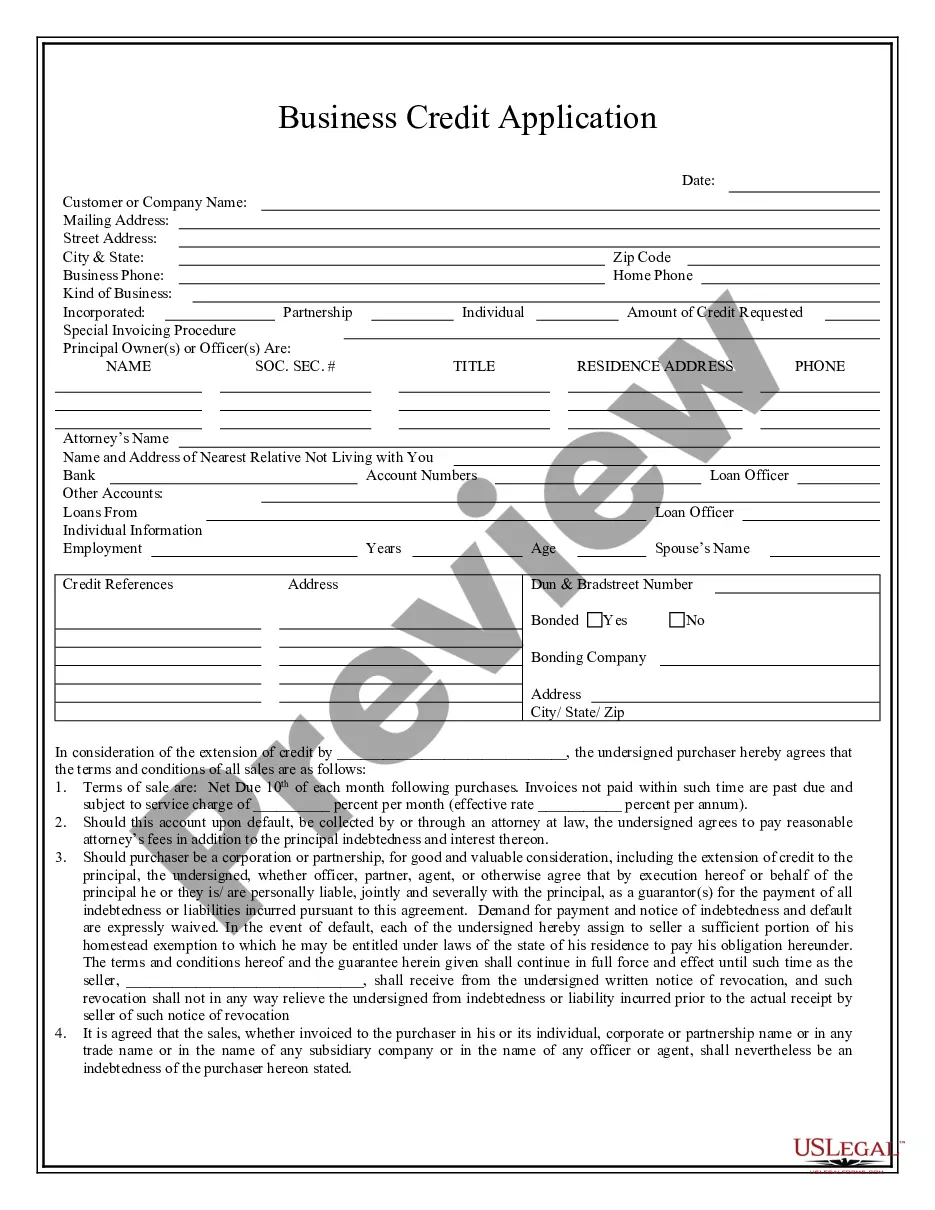

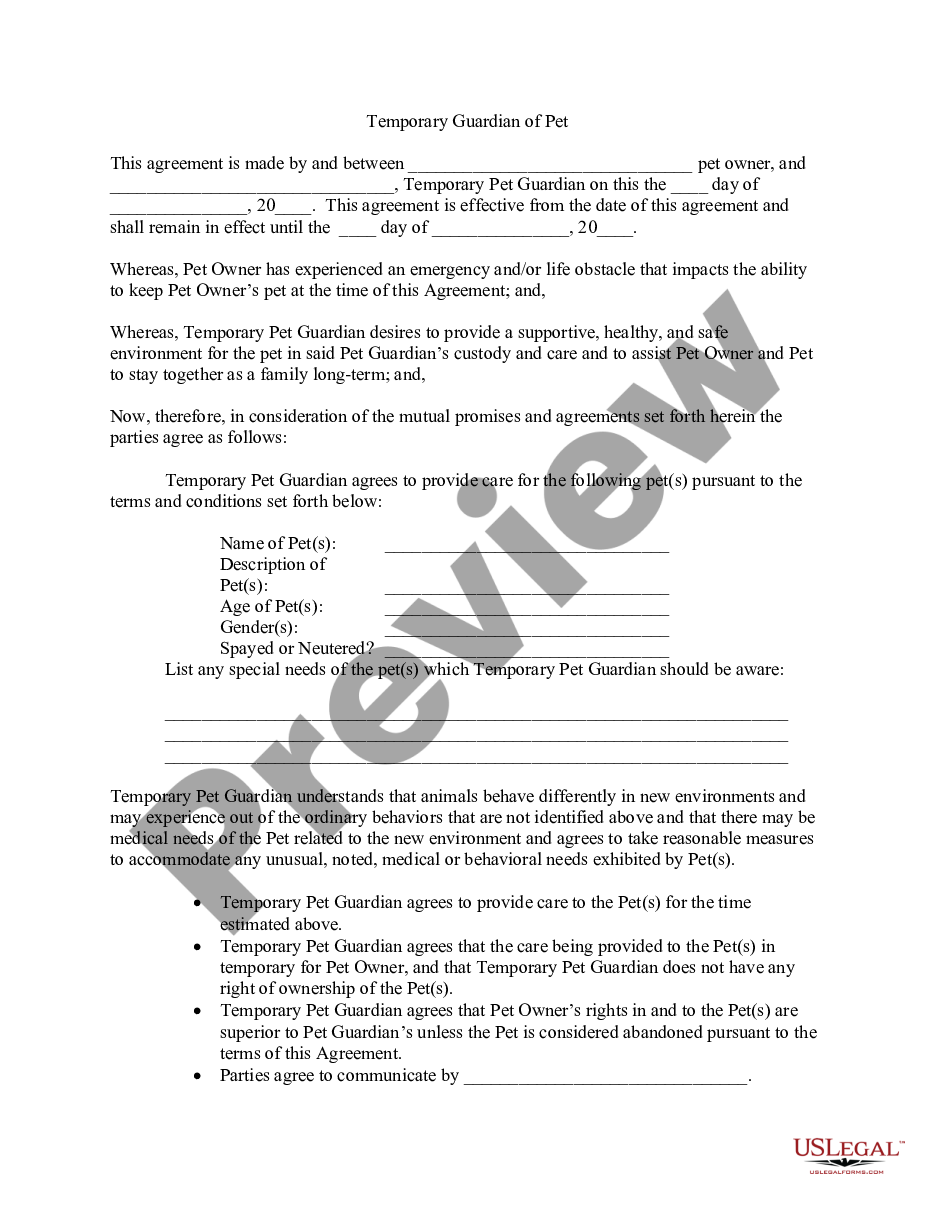

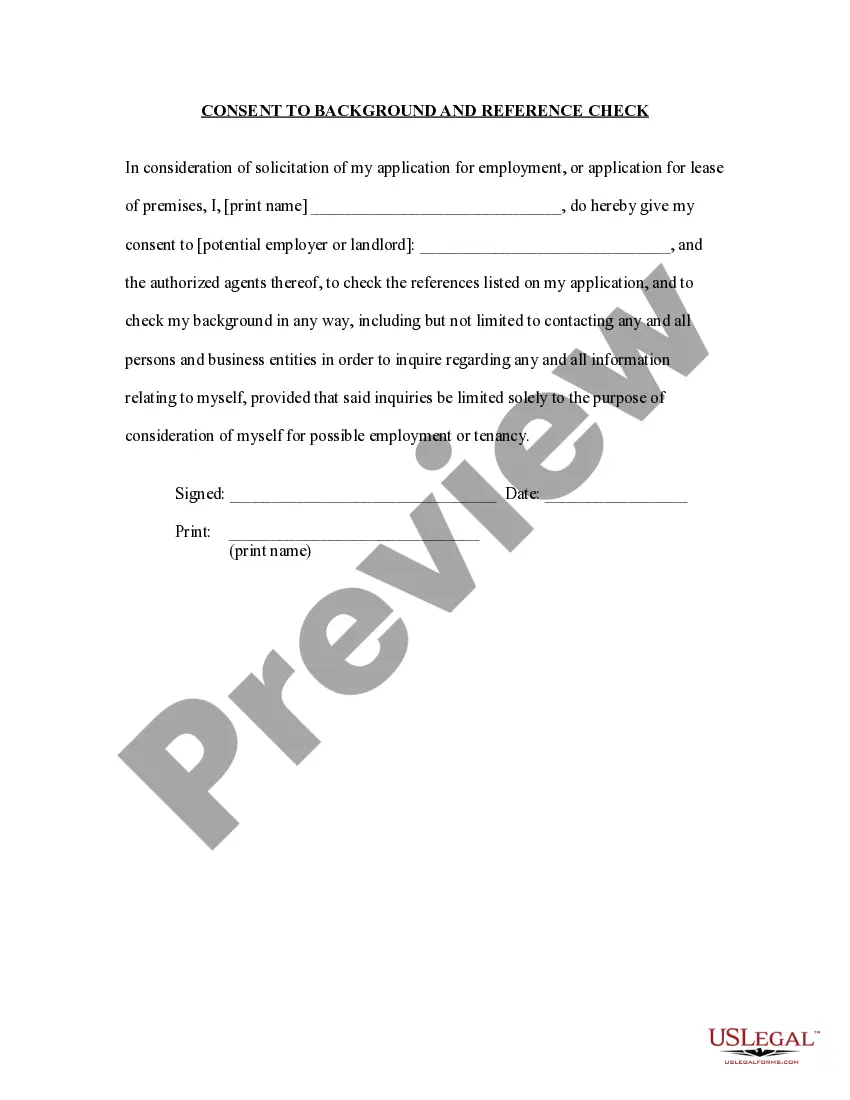

If you work with US Legal Forms for the first time, follow the instructions under:

- Step 1. Make sure you have chosen the form for your appropriate city/land.

- Step 2. Take advantage of the Review method to check out the form`s content. Don`t forget about to learn the description.

- Step 3. Should you be not satisfied together with the kind, utilize the Research area near the top of the screen to locate other models from the authorized kind template.

- Step 4. Once you have located the form you want, select the Get now option. Choose the prices program you like and include your accreditations to register for the bank account.

- Step 5. Approach the financial transaction. You can utilize your charge card or PayPal bank account to accomplish the financial transaction.

- Step 6. Choose the structure from the authorized kind and obtain it in your product.

- Step 7. Complete, modify and print or indicator the Louisiana Material Storage Lease (For Pipe and Equipment).

Every authorized record template you buy is your own permanently. You possess acces to every single kind you saved inside your acccount. Click on the My Forms portion and pick a kind to print or obtain yet again.

Contend and obtain, and print the Louisiana Material Storage Lease (For Pipe and Equipment) with US Legal Forms. There are millions of expert and express-distinct varieties you can utilize for the enterprise or person requirements.

Form popularity

FAQ

In general, construction materials and supplies are taxable, but construction related services are exempt. Louisiana - Construction - Sales and Use - Explanations cch.com ? document ? state ? cons... cch.com ? document ? state ? cons...

Are services taxable in Louisiana? Services in Louisiana are generally not taxable, with important exceptions: furnishing of sleeping rooms by hotels. Does Louisiana Charge Sales Tax on Services? - TaxJar taxjar.com ? blog ? 2022-06-does-louisiana-... taxjar.com ? blog ? 2022-06-does-louisiana-...

The Sale of Computer Programs and Certain Related Services Are Taxable. The sale of programs, including a license to use a program, is also taxable in Texas. Sales tax applies to the entire purchase price, which could involve additional charges for installation, repair, or modification.

In general, computer hardware and canned software are taxable, but custom software and computer services are exempt. Register for a complimentary trial to unlock this document, plus gain access to so much more, including: Expert insights into the industry's hottest topics.

Common consumer-related exemptions include: Food for home consumption; Utilities such as electricity, natural gas and water; Drugs prescribed by a physician or dentists; and. Articles traded-in on new articles. Sales Tax FAQ - Louisiana Department of Revenue Louisiana Department of Revenue (.gov) ? questionsandanswers Louisiana Department of Revenue (.gov) ? questionsandanswers

Services are generally exempt from sales tax in Louisiana. However, businesses that make repairs to tangible personal property and the furnishing of telecommunications services are not exempt. In Louisiana, sales tax is required to be collected from tangible, physical products sold to a consumer.

Effective July 1, 2018, Louisiana has decreased the sales tax rates on telecommunications services and prepaid calling cards as follows: The sales tax rate on intrastate telecommunications services and prepaid calling cards is reduced from 4% to 3.45%.

Prepaid telephone cards and authorization numbers (for state sales or use tax purposes) and work products consisting of the creation, modification, updating, or licensing of canned computer software are specifically defined as tangible personal property by law. Tangible Personal Property - Louisiana Department of Revenue louisiana.gov ? LawsPolicies ? NOI_LAC... louisiana.gov ? LawsPolicies ? NOI_LAC...