Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans

Description

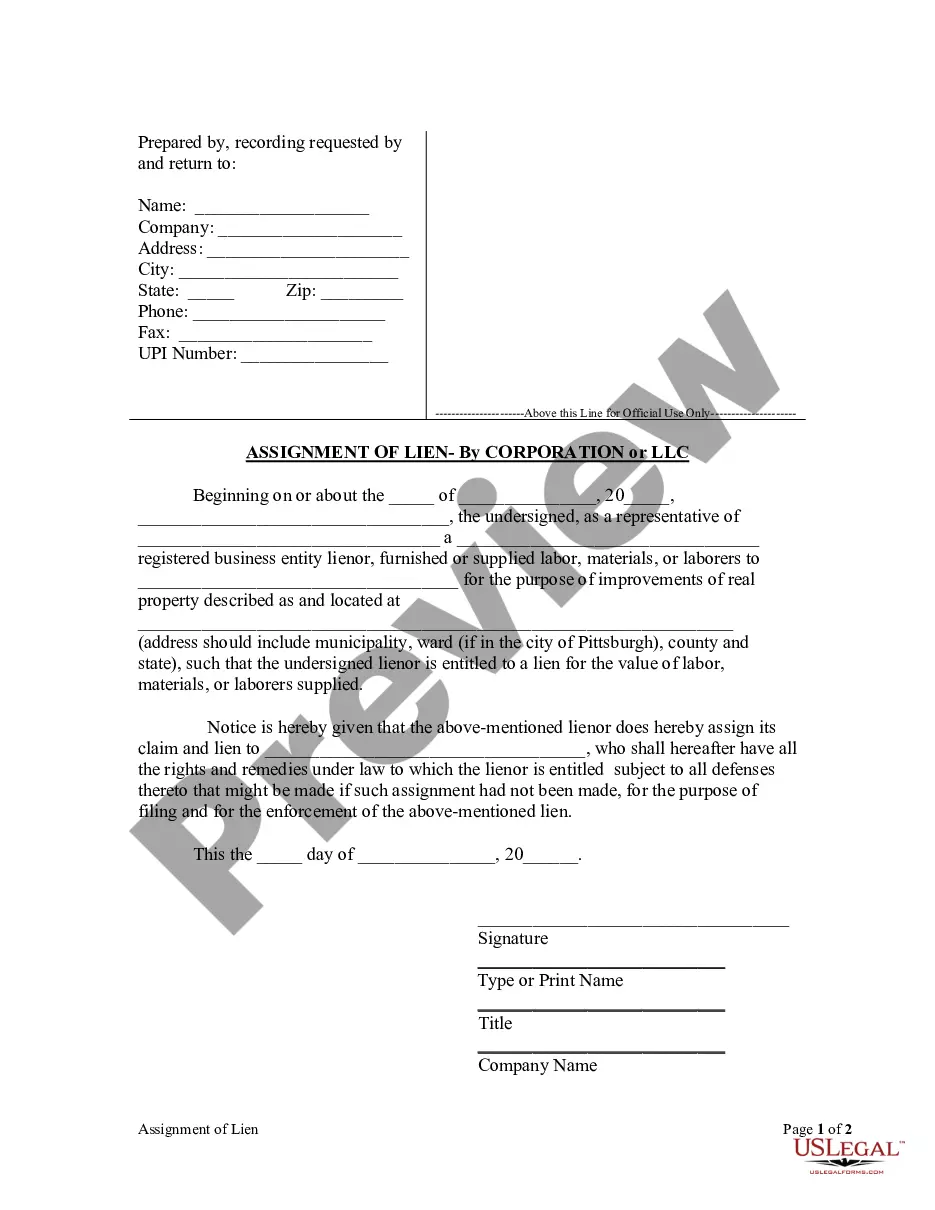

How to fill out Proposals To Approve Employees' Stock Deferral Plan And Directors' Stock Deferral Plan With Copy Of Plans?

Discovering the right authorized record format can be quite a struggle. Naturally, there are plenty of layouts available on the net, but how would you find the authorized form you will need? Make use of the US Legal Forms site. The support delivers a large number of layouts, for example the Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans, that can be used for organization and private needs. Each of the varieties are examined by specialists and meet up with federal and state specifications.

If you are previously listed, log in in your accounts and click on the Download switch to have the Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans. Utilize your accounts to check from the authorized varieties you may have acquired formerly. Go to the My Forms tab of the accounts and have one more backup of your record you will need.

If you are a brand new user of US Legal Forms, listed below are straightforward directions so that you can comply with:

- Initial, make sure you have selected the proper form to your metropolis/county. You are able to examine the form while using Review switch and read the form outline to guarantee it will be the right one for you.

- In the event the form is not going to meet up with your needs, use the Seach discipline to find the proper form.

- When you are certain the form is suitable, select the Purchase now switch to have the form.

- Opt for the costs plan you need and enter in the needed info. Design your accounts and buy the order utilizing your PayPal accounts or charge card.

- Pick the document structure and download the authorized record format in your product.

- Complete, edit and print and indicator the obtained Arizona Proposals to Approve Employees' Stock Deferral Plan and Directors' Stock Deferral Plan with Copy of Plans.

US Legal Forms is the largest collection of authorized varieties where you can see a variety of record layouts. Make use of the service to download expertly-manufactured paperwork that comply with status specifications.