Massachusetts Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders

Description

How to fill out Investors' Rights Agreement Between Telocity, Inc., Existing Holders, And Founders?

You are able to devote hrs online trying to find the authorized papers web template which fits the state and federal needs you need. US Legal Forms supplies thousands of authorized types that are reviewed by experts. You can easily obtain or produce the Massachusetts Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders from your assistance.

If you have a US Legal Forms profile, you may log in and then click the Download option. Following that, you may full, revise, produce, or signal the Massachusetts Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders. Every single authorized papers web template you get is yours eternally. To have an additional version of the bought kind, go to the My Forms tab and then click the corresponding option.

If you use the US Legal Forms web site the first time, adhere to the straightforward directions below:

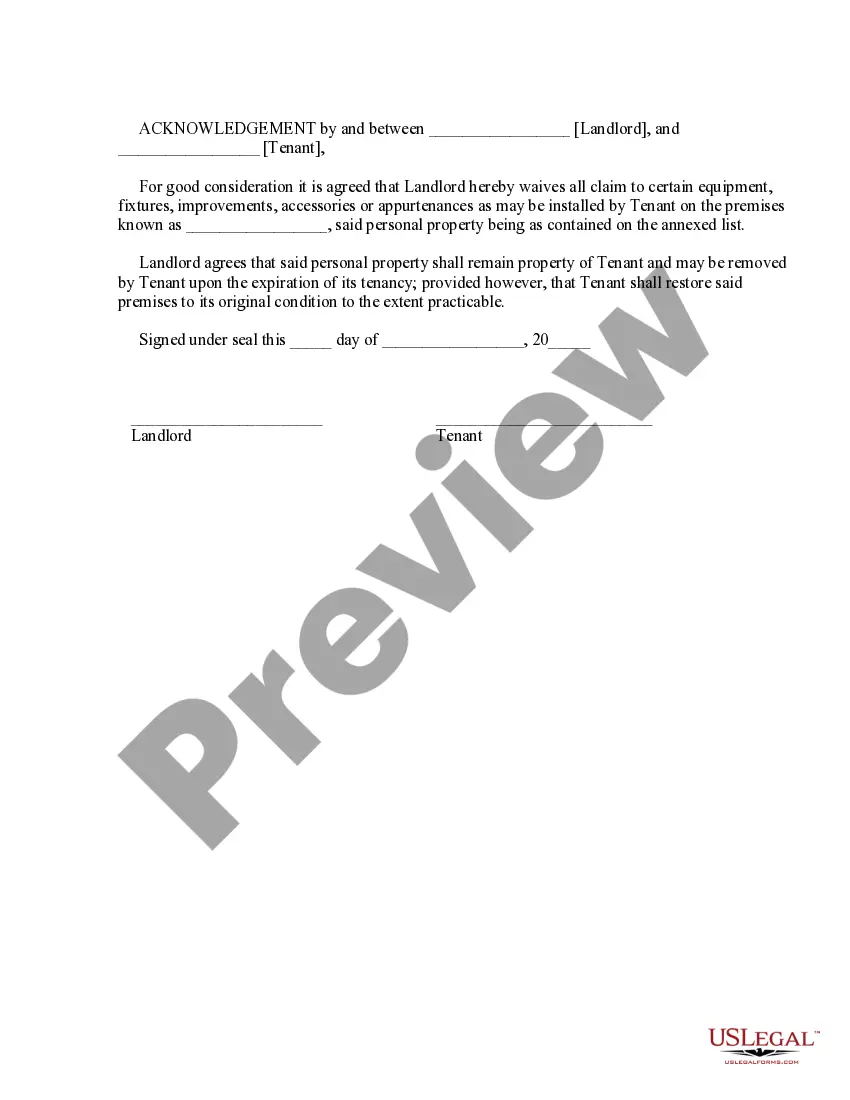

- Very first, ensure that you have selected the right papers web template for that area/metropolis of your choosing. Browse the kind information to ensure you have picked out the correct kind. If offered, utilize the Review option to look through the papers web template at the same time.

- If you wish to discover an additional variation of the kind, utilize the Look for field to discover the web template that meets your requirements and needs.

- After you have discovered the web template you need, simply click Acquire now to continue.

- Pick the costs plan you need, type your credentials, and register for a merchant account on US Legal Forms.

- Comprehensive the transaction. You can use your Visa or Mastercard or PayPal profile to pay for the authorized kind.

- Pick the file format of the papers and obtain it for your gadget.

- Make adjustments for your papers if needed. You are able to full, revise and signal and produce Massachusetts Investors' Rights Agreement between Telocity, Inc., Existing Holders, and Founders.

Download and produce thousands of papers themes while using US Legal Forms web site, that provides the biggest selection of authorized types. Use expert and express-certain themes to tackle your company or individual needs.

Form popularity

FAQ

The major investor clause matters because, if included, the company can reserve rights and provisions for major investors only. Typical terms that the company will reserve for major investors include information rights, pro rata rights, co-sale rights, and the right of first refusal.

DPA Triggering Rights means (i) ?control? (as defined in the DPA); (ii) access to any ?material non-public technical information? (as defined in the DPA) in the possession of the Company; (iii) membership or observer rights on the Board of Directors or equivalent governing body of the Company or the right to nominate ...

A registration right is a right entitling an investor who owns restricted stock to require that a company list the shares publicly so that the investor can sell them. Registration rights, if exercised, can force a privately-held company to become a publicly-traded company.

An Investor Rights Agreement (IRA) is an agreement between an investor and a company that contractually guarantees the investor certain rights including, but not limited to, voting rights, inspection rights, rights of first refusal, and observer rights.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.

Common shareholders are granted six rights: voting power, ownership, the right to transfer ownership, a claim to dividends, the right to inspect corporate documents, and the right to sue for wrongful acts. Investors should thoroughly research the corporate governance policies of the companies they invest in.