Arizona Proposal to Approve Adoption of Employees' Stock Option Plan

Description

How to fill out Proposal To Approve Adoption Of Employees' Stock Option Plan?

Are you currently in a place the place you need paperwork for possibly company or individual purposes just about every day? There are a variety of lawful record layouts available on the net, but discovering versions you can depend on isn`t easy. US Legal Forms gives 1000s of kind layouts, much like the Arizona Proposal to Approve Adoption of Employees' Stock Option Plan, that happen to be created to satisfy federal and state requirements.

When you are presently familiar with US Legal Forms internet site and have an account, basically log in. Next, you are able to down load the Arizona Proposal to Approve Adoption of Employees' Stock Option Plan web template.

Unless you provide an accounts and need to begin using US Legal Forms, abide by these steps:

- Get the kind you require and make sure it is for that right city/region.

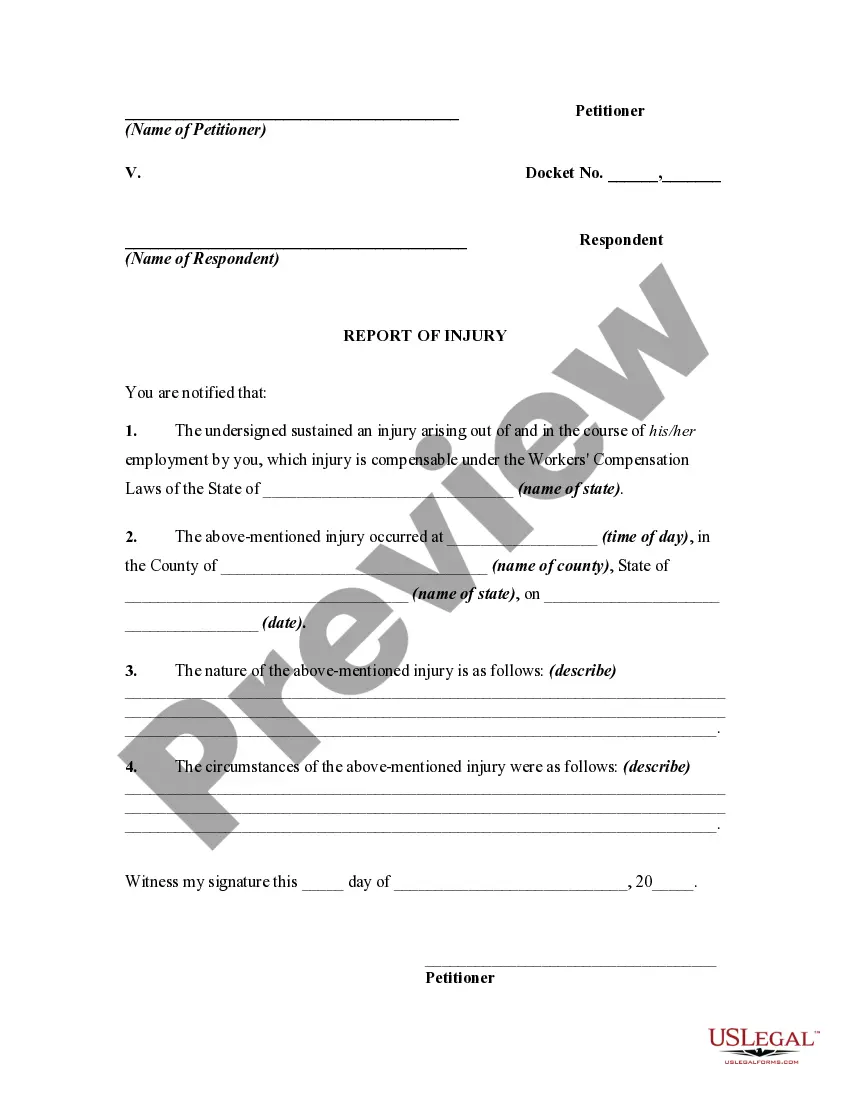

- Utilize the Review switch to analyze the form.

- Read the description to actually have selected the proper kind.

- In the event the kind isn`t what you are looking for, utilize the Look for area to discover the kind that suits you and requirements.

- Whenever you get the right kind, click on Acquire now.

- Choose the rates plan you need, fill in the specified details to make your bank account, and buy an order making use of your PayPal or Visa or Mastercard.

- Decide on a convenient data file format and down load your backup.

Discover all of the record layouts you have purchased in the My Forms menu. You can obtain a additional backup of Arizona Proposal to Approve Adoption of Employees' Stock Option Plan whenever, if needed. Just click on the necessary kind to down load or print the record web template.

Use US Legal Forms, probably the most considerable selection of lawful types, to save some time and avoid blunders. The service gives professionally produced lawful record layouts that you can use for a variety of purposes. Create an account on US Legal Forms and commence creating your lifestyle easier.

Form popularity

FAQ

A stock grant provides the recipient with value?the corporate stock. By contrast, stock options only offer employees the opportunity to purchase something of value. They can acquire the corporate stock at a set price, but the employees receiving stock options still have to pay for those stocks if they want them.

When you're granted stock options, you have the option to purchase company stock at a specific price before a certain date. Whether you actually purchase the stock is entirely up to you. RSUs, on the other hand, grant you the stock itself once the vesting period is complete. You don't have to purchase it.

What Is an Example of an ESOP? Consider an employee who has worked at a large tech firm for five years. Under the company's ESOP, they have the right to receive 20 shares after the first year, and 100 shares total after five years. When the employee retires, they will receive the share value in cash.

A stock option is the right to buy a specific number of shares of company stock at a pre-set price, known as the ?exercise? or ?strike price.? You take actual ownership of granted options over a fixed period of time called the ?vesting period.? When options vest, it means you've ?earned? them, though you still need to ...

What is a stock option grant? Stock option grants are how your company awards stock options. This document usually includes details about: The type of stock options you'll receive (ISOs or NSOs) The number of shares you can purchase.

If the stock value increases, you could make significant financial gains?but only if you've exercised (purchased) your options. And you can only do that if you've accepted your grant. The earlier you understand your options and the financial implications of exercising, the sooner you can make smart financial decisions.

Identification. An ESOP qualifies as a retirement plan, such as a 401 (k) or individual retirement account, while corporations use stock options as an employee benefit, like health insurance. In an ESOP, the company contributes to employee retirement plans with its own stock.

So start off right: Plan ahead. Your first step is planning. ... Manage your equity. ... Set some guidelines for stock options. ... Get a 409A valuation. ... Use the 409A to set the strike price. ... Adopt your vesting and cliff schedule. ... Set an expiration timeline. ... Create an ESO agreement and get your board's approval.