Arizona Notice to Employees of Scheduled Authorization Expiration

Description

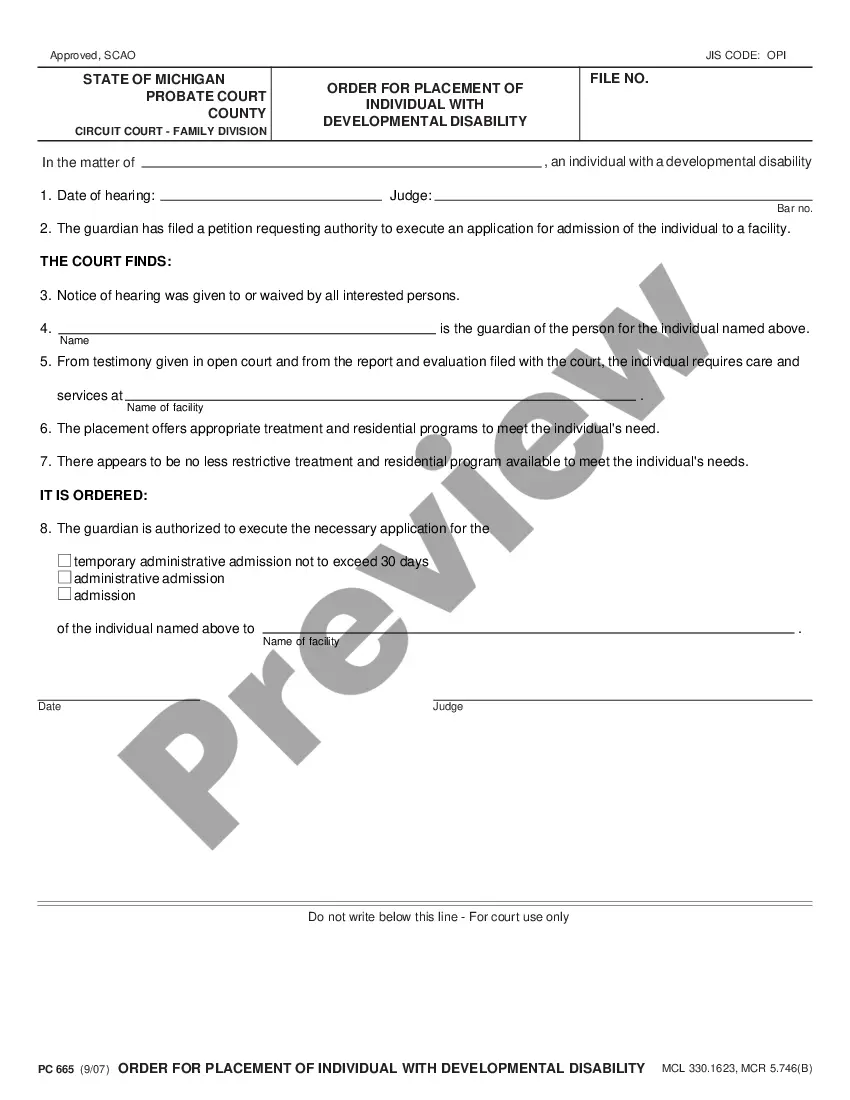

How to fill out Notice To Employees Of Scheduled Authorization Expiration?

If you need to compile, save, or produce authorized document templates, utilize US Legal Forms, the largest assortment of legal forms available online.

Employ the site’s simple and user-friendly search feature to find the documents you require.

Numerous templates for business and personal use are organized by categories and regions, or keywords.

Step 4. Once you have found the form you need, click the Get now button. Choose your desired pricing plan and enter your credentials to register for an account.

Step 5. Process the transaction. You can use your credit card or PayPal account to complete the transaction.

- Use US Legal Forms to obtain the Arizona Notice to Employees of Scheduled Authorization Expiration with just a few clicks.

- If you are presently a US Legal Forms member, Log In to your account and then click the Download button to get the Arizona Notice to Employees of Scheduled Authorization Expiration.

- You can also access forms you have previously downloaded within the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Ensure that you have chosen the form for the correct city/region.

- Step 2. Utilize the Review option to inspect the form's details. Be sure to read the information.

- Step 3. If you are not satisfied with the form, take advantage of the Lookup area at the top of the screen to find other types in the legal form template.

Form popularity

FAQ

The Arizona A-4 form is the Employee's Arizona Withholding Certificate, which employees use to determine their state income tax withholding. Each new employee should complete this form to ensure proper tax deductions from their paychecks. Remember to accompany this with the Arizona Notice to Employees of Scheduled Authorization Expiration to cover important aspects of employment eligibility.

Arizona statute 23-372 addresses employer responsibilities regarding employee work authorization. This law stipulates that employers must verify and maintain records of their employees' eligibility to work, particularly when it pertains to work authorization expiration. Utilizing the Arizona Notice to Employees of Scheduled Authorization Expiration can help ensure that you adhere to this statute by providing timely reminders to employees.

The Fair Labor Standards Act (FLSA) requires employers to pay an employee who performs work, even if the employee is found to be unauthorized to work in the U.S. or quits employment prior to completing the I-9 form.

Penalties: First-time offenders with knowing violations are subject to a $500 company penalty as well as a $500 fine for each employee and non-employee the company failed to verify. For repeat offenders, the penalties may rise to as high as a $2,500 company fine plus and additional $2,500 for each employee.

To continue to employ an individual whose employment authorization has expired, the employee must present to the employer a document from either List A or List C that shows either an extension of his or her initial employment authorization or new employment authorization.

The employer must complete Section 2 of Form I-9 by the end of the third business day, or within 72 hours after employment commences, even if the employee is not scheduled to work for some or all of that period.

Failing to timely complete an I-9 for employee or doing a really bad job of it can result in fines of $110 to over $1000 per employee for the first infraction. These fines impact large and small business alike.

Failing to timely complete an I-9 for employee or doing a really bad job of it can result in fines of $110 to over $1000 per employee for the first infraction. These fines impact large and small business alike.

Do we have to pay an employee who terminated employment before completing Form I-9? Yes. An incomplete I-9 form does not affect an employer's ability or obligation to pay an employee. The I-9 form is used to verify eligibility to work in the U.S. and does not affect payroll.

A. If an employee is unable to present the required document or documents within 3 business days of the date employment begins, the employee must produce a receipt showing that he or she has applied for the document. In addition, the employee must present the actual document to you within 90 days of the hire.