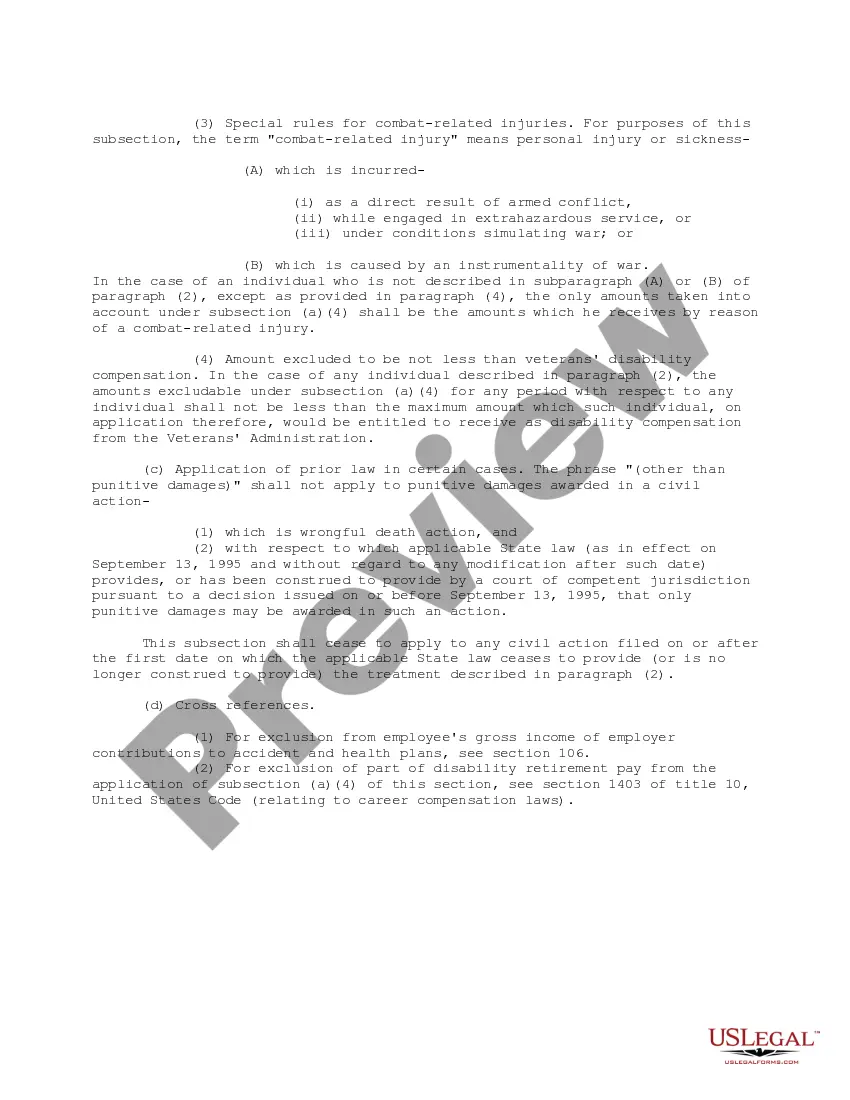

Statutory Guidelines [Appendix A(1) IRC 104] regarding compensation for injuries or sickness under workmen's compensation acts, damages (other than punitive damages), accident or health insurance, etc. as stated in the guidelines.

Arizona Compensation for Injuries or Sickness IRS Code 104

Description

How to fill out Compensation For Injuries Or Sickness IRS Code 104?

You are able to invest time online searching for the authorized papers template that suits the state and federal requirements you need. US Legal Forms supplies thousands of authorized varieties which are analyzed by specialists. It is simple to obtain or produce the Arizona Compensation for Injuries or Sickness IRS Code 104 from your assistance.

If you have a US Legal Forms account, it is possible to log in and then click the Obtain key. After that, it is possible to comprehensive, edit, produce, or indicator the Arizona Compensation for Injuries or Sickness IRS Code 104. Each and every authorized papers template you acquire is the one you have eternally. To get yet another version for any bought kind, proceed to the My Forms tab and then click the corresponding key.

Should you use the US Legal Forms internet site the very first time, stick to the basic instructions below:

- Very first, make certain you have selected the proper papers template for your state/area of your liking. Look at the kind description to make sure you have selected the appropriate kind. If offered, take advantage of the Preview key to check with the papers template at the same time.

- If you want to get yet another model in the kind, take advantage of the Research field to find the template that meets your requirements and requirements.

- When you have found the template you need, simply click Get now to carry on.

- Choose the prices prepare you need, type in your qualifications, and register for an account on US Legal Forms.

- Complete the deal. You should use your charge card or PayPal account to fund the authorized kind.

- Choose the file format in the papers and obtain it to the system.

- Make adjustments to the papers if required. You are able to comprehensive, edit and indicator and produce Arizona Compensation for Injuries or Sickness IRS Code 104.

Obtain and produce thousands of papers web templates using the US Legal Forms web site, which provides the most important variety of authorized varieties. Use specialist and state-distinct web templates to tackle your organization or individual demands.

Form popularity

FAQ

Camp Lejeune settlements paid out for medical expenses or pain and suffering are not taxable. However, any compensation awarded for lost wages or punitive damages (additional money to punish defendants) may be subjected to taxes.

The general rule regarding taxability of amounts received from settlement of lawsuits and other legal remedies is Internal Revenue Code (IRC) Section 61. This section states all income is taxable from whatever source derived, unless exempted by another section of the code.

If you receive a settlement for personal physical injuries or physical sickness and did not itemize deductions for medical expenses related to the injury or sickness in the previous years, the full amount is non-taxable.

Are Personal Injury Settlements Taxable in Arizona? In most personal injury cases, compensation received from a settlement is not considered taxable income under federal or state laws. ing to federal law, gross income does not include damages received as a result of personal injuries or physical sickness.

Allocate damages to reduce taxes: During settlement negotiations, you can negotiate to allocate a larger portion of the settlement to non-taxable award categories. For example, increase the award related to physical injuries and illness and decrease amounts related to emotional distress.

The result of a settlement agreement involves the responsible party paying a certain amount to compensate for the damages caused to the victim.

Texas does not have personal income taxes and does not tax personal injury settlements or verdicts. As with all federal tax laws, there are exceptions to the rule. Settlements or verdict awards from breach of contract lawsuits that involve personal injuries are subject to taxation by the IRS.

Ing to the California Franchise Tax Board (FTB), compensation received as a result of a lemon law settlement is considered income and must be reported on a FORM 1099-MISC state tax return. This includes any cash payments, credits towards other purchases, or refunds that are part of the agreement.