Statutory Guidelines [Appendix A(3) IRC 130] regarding certain personal injury liability assignments.

Arizona Certain Personal Injury Liability Assignments IRS Code 130

Description

How to fill out Certain Personal Injury Liability Assignments IRS Code 130?

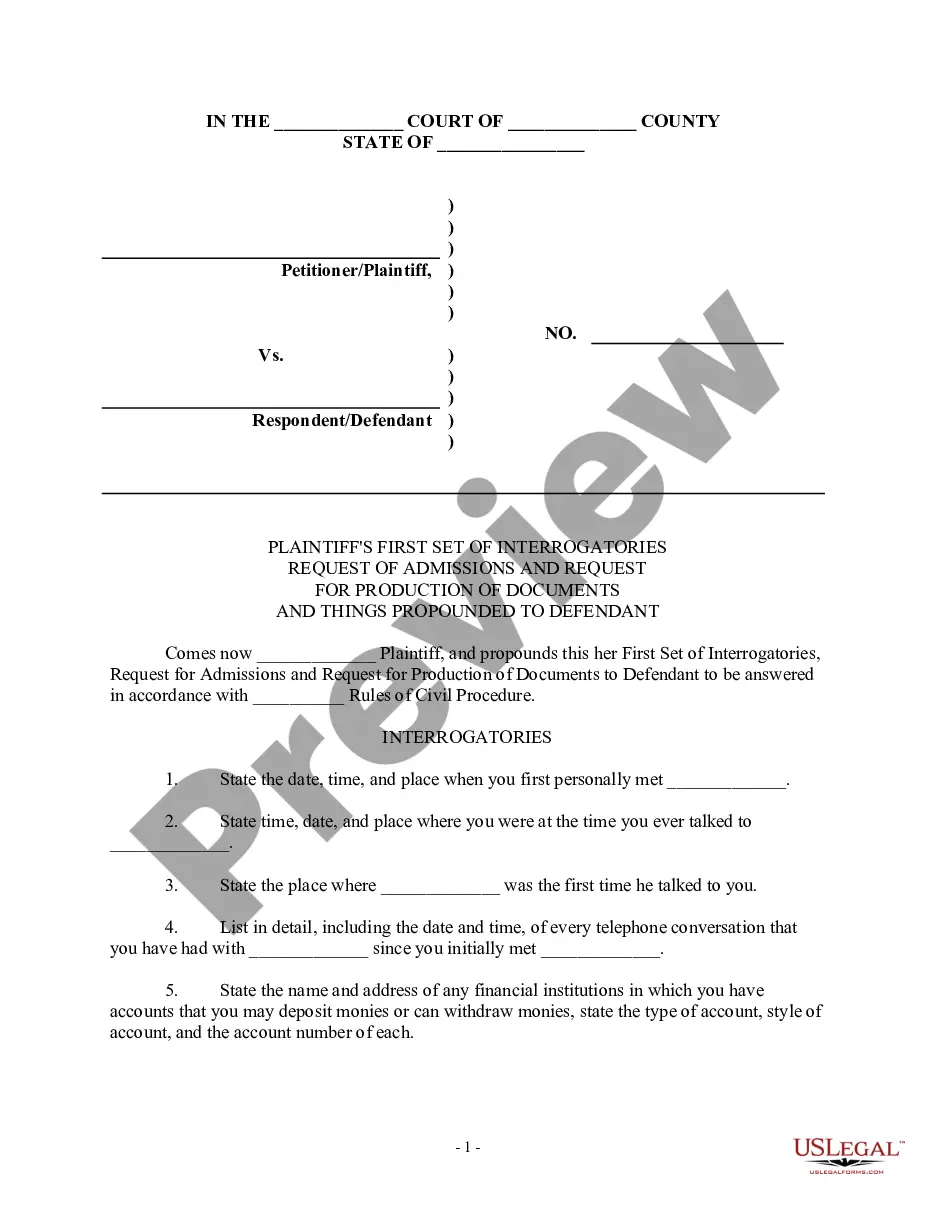

Discovering the right authorized record format can be a have a problem. Obviously, there are a lot of web templates accessible on the Internet, but how can you obtain the authorized form you need? Take advantage of the US Legal Forms internet site. The service delivers 1000s of web templates, like the Arizona Certain Personal Injury Liability Assignments IRS Code 130, that can be used for enterprise and personal needs. All of the kinds are examined by specialists and satisfy state and federal needs.

In case you are previously authorized, log in to the bank account and then click the Obtain switch to find the Arizona Certain Personal Injury Liability Assignments IRS Code 130. Make use of bank account to check throughout the authorized kinds you may have acquired earlier. Check out the My Forms tab of your own bank account and get yet another duplicate in the record you need.

In case you are a brand new customer of US Legal Forms, here are basic recommendations that you should stick to:

- Initial, ensure you have selected the appropriate form to your metropolis/area. You are able to look through the shape making use of the Preview switch and study the shape description to make certain this is the best for you.

- In case the form is not going to satisfy your expectations, make use of the Seach discipline to find the correct form.

- Once you are certain that the shape is suitable, go through the Acquire now switch to find the form.

- Select the costs program you desire and enter in the required info. Design your bank account and purchase the transaction with your PayPal bank account or charge card.

- Select the data file file format and acquire the authorized record format to the product.

- Total, modify and produce and indicator the attained Arizona Certain Personal Injury Liability Assignments IRS Code 130.

US Legal Forms will be the biggest collection of authorized kinds in which you can see various record web templates. Take advantage of the company to acquire expertly-created paperwork that stick to condition needs.

Form popularity

FAQ

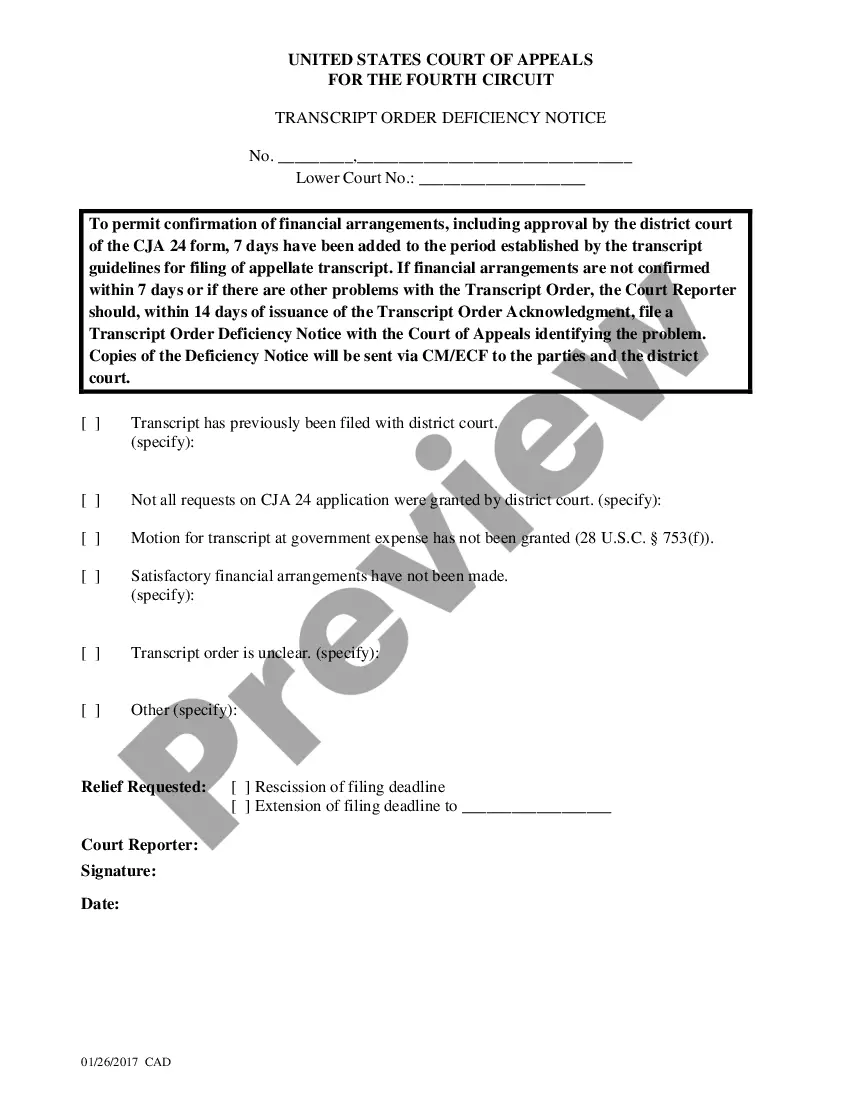

Any amount received for agreeing to a qualified assignment shall not be included in gross income to the extent that such amount does not exceed the aggregate cost of any qualified funding assets.

For purposes of this section, the term ?qualified funding asset? means any annuity contract issued by a company licensed to do business as an insurance company under the laws of any State, or any obligation of the United States, if? 130(d)(1)

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

A qualified assignment is a formal arrangement wherein a defendant or its insurance company or other representative agrees to transfer their obligation to make future periodic payments to a third party (?an assignment company?). This is generally done using a uniform qualified assignment (?UQA?) document.

How do I report settlement income on my taxes? In many cases, a personal injury settlement is not taxed. If you do receive a taxable court settlement, you will likely receive a Form 1099-MISC. You report the information from this form on your tax returns in the Other Income box on your tax forms.

Section 130(c) defines a qualified assignment as any assignment of liability to make periodic payments as damages (whether by suit or agreement) on account of personal injury or sickness (in a case involving physical injury or sickness) provided, among other conditions, the periodic payments are fixed and determinable ...

Income tax exemption: Structured settlement payments?including growth?are 100% income tax-free. While lump sum cash settlements are income tax-free for physical injury cases, growth on funds placed in a traditional investment may be taxable.