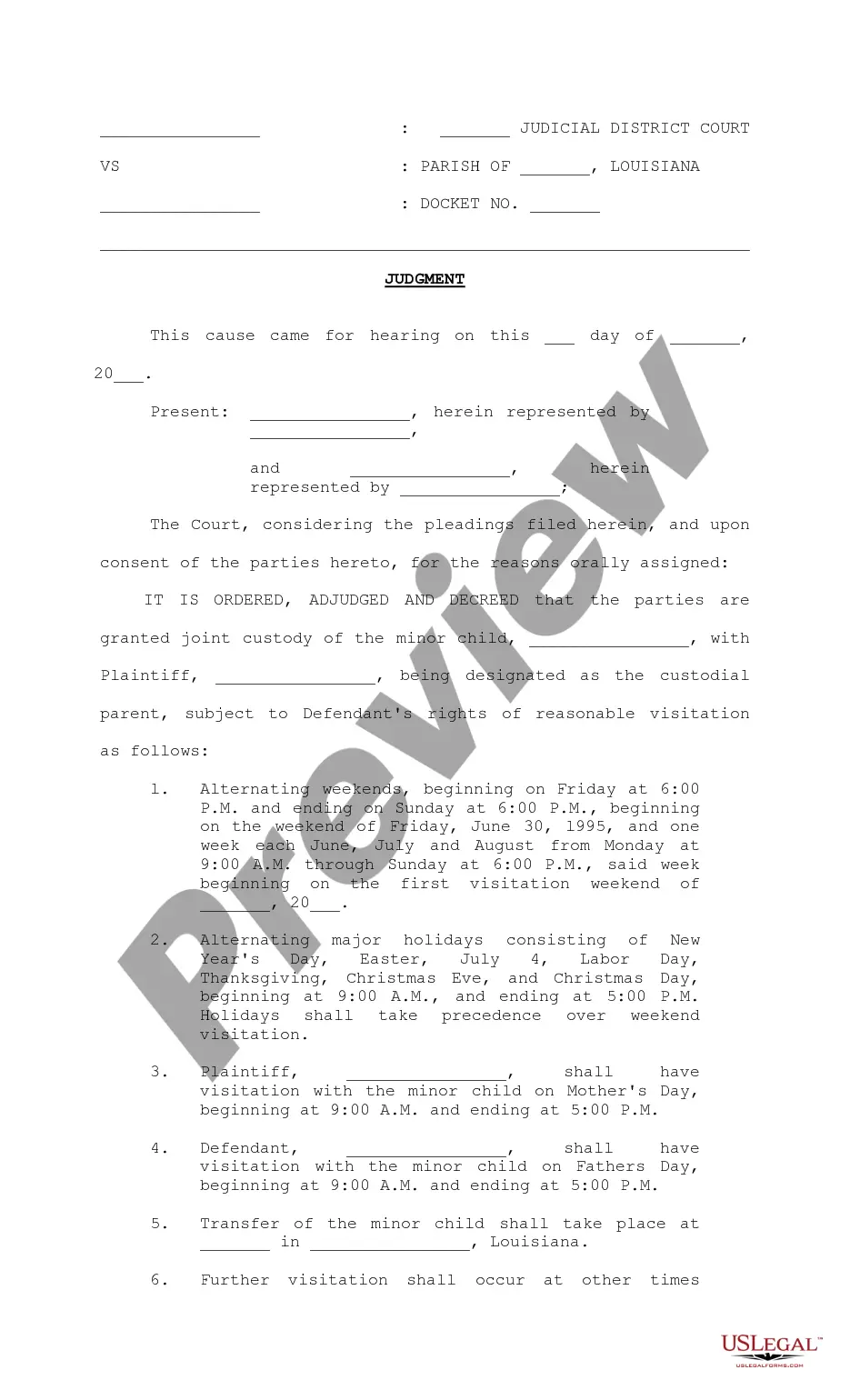

Statutory Guidelines [Appendix A(6) Revenue Procedure 93-34] regarding rules under which a designated settlement fund described in section 468B(d)(2) of the Internal Revenue Code or a qualified settlement fund described in section 1.468B-1 of the Income Tax Regulations will be considered "a party to the suit or agreement" for purposes of section 130.

Arizona Revenue Procedure 93-34

Description

How to fill out Revenue Procedure 93-34?

Have you been inside a place that you need papers for both company or specific uses almost every day? There are a lot of authorized record layouts available on the net, but discovering kinds you can rely isn`t effortless. US Legal Forms gives a huge number of kind layouts, just like the Arizona Revenue Procedure 93-34, that are created in order to meet federal and state needs.

When you are already acquainted with US Legal Forms site and also have an account, merely log in. Following that, you are able to obtain the Arizona Revenue Procedure 93-34 format.

Unless you have an profile and want to begin using US Legal Forms, adopt these measures:

- Find the kind you require and ensure it is for your proper area/region.

- Utilize the Review key to check the form.

- Browse the description to ensure that you have selected the correct kind.

- In the event the kind isn`t what you are searching for, take advantage of the Research field to discover the kind that fits your needs and needs.

- If you discover the proper kind, simply click Purchase now.

- Choose the costs prepare you want, fill out the required info to make your account, and pay for an order with your PayPal or charge card.

- Decide on a hassle-free data file format and obtain your backup.

Get each of the record layouts you possess purchased in the My Forms menu. You can obtain a further backup of Arizona Revenue Procedure 93-34 at any time, if necessary. Just click on the needed kind to obtain or printing the record format.

Use US Legal Forms, one of the most comprehensive variety of authorized varieties, in order to save time as well as steer clear of faults. The services gives expertly manufactured authorized record layouts that can be used for an array of uses. Make an account on US Legal Forms and start creating your way of life a little easier.

Form popularity

FAQ

The Arizona Department of Revenue's (ADOR) Education & Outreach District serves as a liaison between the department and the state's cities, towns and municipalities. Our division consists of three areas: City Services Team, Education Unit, Compliance Programs and Specialty Tax Program Teams.

Rob Woods | Arizona Department of Revenue.

The mission of the Arizona Department of Revenue is to Serve Taxpayers! Vision: Funding Arizona's priorities through excellence in innovation, exceptional customer experience, and public servant-led continuous improvement.

"The Arizona Department of Revenue does not call to demand immediate payment or call about taxes owed without having initial communication with them through the mail." Arizonans with tax-related ID theft questions should contact the ADOR's identity theft call center or the Internal Revenue Service.

PTE ELECTION How do I make the PTE election? Businesses that are treated as partnerships or S Corporations at the federal level may make the PTE election on a timely filed, original Arizona Income Tax Return (Arizona Form 165 ? partnerships; Arizona Form 120S ? S Corporations), including extensions.

The mission of the Arizona Department of Revenue is to serve taxpayers. The Department administers and enforces collection of individual and corporate income tax, transaction privilege (sales), use, luxury, withholding, property, estate, fiduciary, bingo, and severance taxes.