Arizona Job Expense Record

Description

How to fill out Job Expense Record?

US Legal Forms - one of the largest collections of legal templates in the United States - offers a variety of lawful document templates available for download or printing.

By using the website, you can find thousands of templates for business and personal needs, organized by categories, states, or keywords. You can quickly find the latest versions of forms like the Arizona Job Expense Record.

If you have a subscription, Log In to download the Arizona Job Expense Record from the US Legal Forms library. The Download button will appear on every form you review. You can access all previously saved forms in the My documents section of your account.

Process the payment. Use your Visa or Mastercard or PayPal account to complete the transaction.

Select the format and download the form to your device. Make modifications. Fill, edit, and print and sign the saved Arizona Job Expense Record. Each template you add to your account does not expire and is yours indefinitely. Therefore, if you wish to download or print another copy, simply navigate to the My documents section and click on the form you need. Access the Arizona Job Expense Record with US Legal Forms, the most extensive library of legal document templates. Utilize thousands of professional and state-specific templates that meet your business or personal needs and requirements.

- Ensure you have selected the correct form for your region/source.

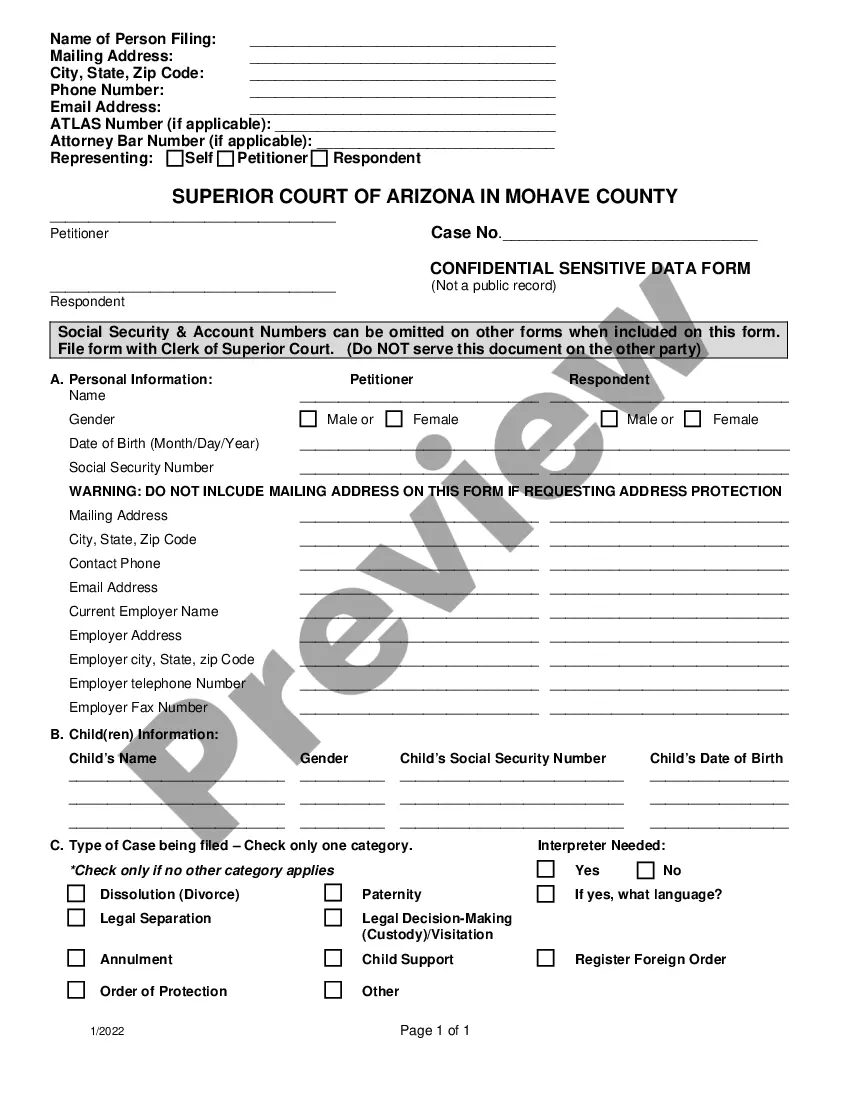

- Click on the Review button to examine the content of the form.

- Read the form description to confirm that you have selected the right form.

- If the form does not meet your needs, use the Search field at the top of the page to find one that does.

- Once you are satisfied with the form, confirm your choice by clicking on the Buy now button.

- Then, choose your preferred pricing plan and provide your information to create an account.

Form popularity

FAQ

Employers must give all their employees and workers payslips, by law (Employment Rights Act 1996).

The employer should retain the records in question for three years after termination of employment. A wage and attendance register. The forms are to be retained for the stipulated three years from the date of the last entry.

Arizona law requires all employers, whether or not they have been determined liable to pay unemployment taxes, to keep the following records for the most recent four calendar years.

Yes. Arizona law requires all employers to use E-Verify for new workers hired after December 31, 2007. In addition, after September 30, 2008, an employer will not be eligible to receive an economic development incentive or a government contract or subcontract unless the employer uses the E-Verify program.

Note: A minimum of four work search activity entries on four different days of the week is required in order to receive compensation for a benefit week. If you applied for jobs, follow the prompts and complete the work search requirement.

States that require employers to give employees access to pay stubs: Alaska. Arizona. Idaho.

Arizona employers must obtain a Arizona Employee's Withholding Election, Form A-4, and a federal Form W-4 from each new Arizona employee. See Employee Withholding Form. Arizona's minimum wage law requires notice to new hires.

If you're operating in a state like Georgia and Florida, who don't have their own requirements, you don't have to provide any kind of paycheck stub. States like New York and Illinois require you to provide some type of stub, either electronic or paper. Finally, there are access/print states, like California and Texas.

All Personnel Files and Training Records: 6 years from the end of employment. Redundancy Records: 6 years. Sickness Absence Records: A minimum of 3 months but potentially up to 6 years after employment ends.

Arizona has no laws that prohibit an employer from requiring an employee to pay for a uniform, tools, or other items necessary for employment for the employer. However, an employee must consent in writing to any deduction from wages to pay for the uniform.