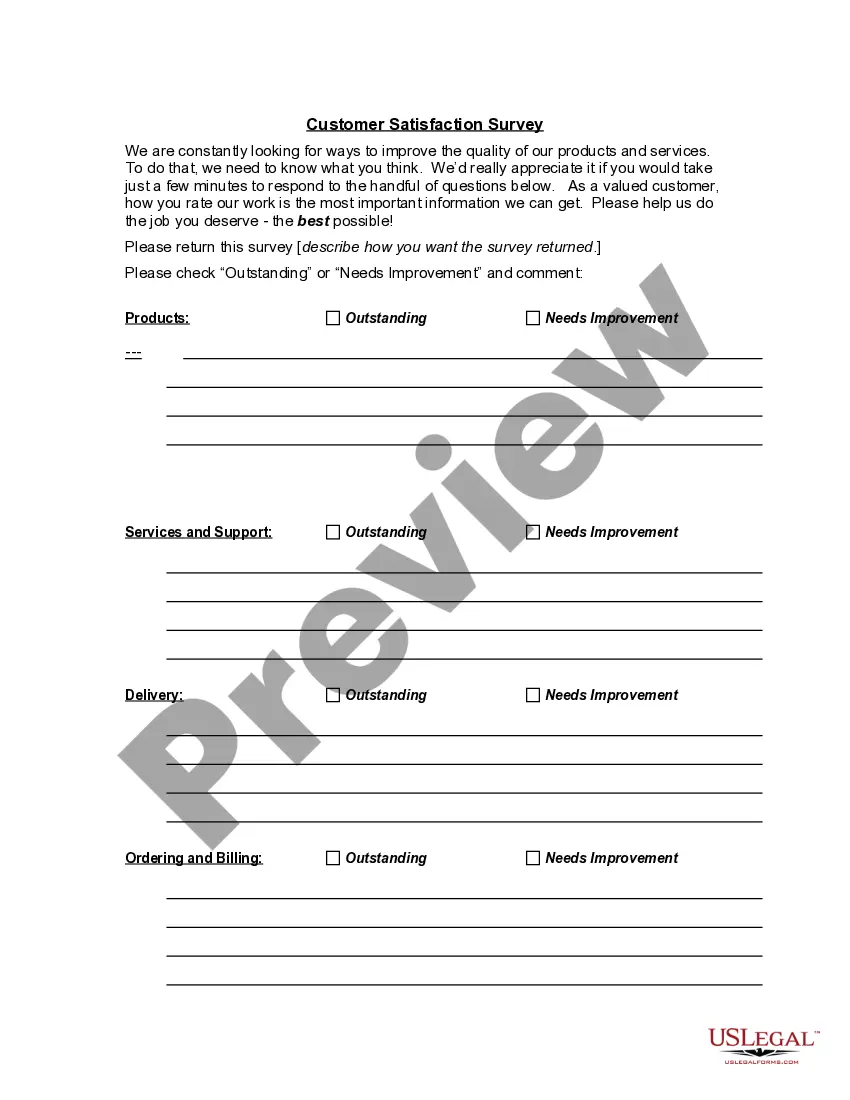

Arizona Customer Satisfaction Survey Instructions

Description

How to fill out Customer Satisfaction Survey Instructions?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal document templates that can be downloaded or printed. By utilizing the website, you can discover a vast number of forms for business and personal purposes, categorized by types, states, or keywords.

You can quickly find the most recent versions of forms such as the Arizona Customer Satisfaction Survey Instructions. If you have a subscription, Log In and obtain the Arizona Customer Satisfaction Survey Instructions from the US Legal Forms catalog. The Acquire option will be present on every document you view.

You can access all previously obtained forms from the My documents tab in your account. If you are using US Legal Forms for the first time, here are simple instructions to help you get started: Ensure that you have selected the correct form for your city/state. Review the Review option to check the content of the form. Read the form details to confirm that you have selected the right document.

Every template you add to your account has no expiration date and belongs to you forever. Therefore, if you wish to download or print another copy, simply visit the My documents section and click on the form you need.

Access the Arizona Customer Satisfaction Survey Instructions with US Legal Forms, the most extensive collection of legal document templates. Take advantage of a vast number of professional and state-specific templates that meet your business or personal requirements.

- If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Buy now button.

- Then, choose your preferred pricing plan and provide your information to register for an account.

- Process the transaction. Use your credit card or PayPal account to finalize the transaction.

- Select the format and download the form to your device.

- Make modifications. Complete, edit, print, and sign the downloaded Arizona Customer Satisfaction Survey Instructions.

Form popularity

FAQ

You can calculate the customer satisfaction index by analyzing the responses collected from your survey. Essentially, you will need to categorize feedback based on satisfaction levels and derive an average score. By following the Arizona Customer Satisfaction Survey Instructions, you ensure that your methodology for calculating the index is reliable and reflects your customers' true sentiments.

Arizona will hold unclaimed money and property for up to 35 years; after 35 years the property escheats to the state.

The State of Arizona holds unclaimed property as a custodian for the rightful owner. The state will return property to owners who provide proof showing their right to claim the property.

For assistance with reporting and payment, contact the Holder Compliance Section at (602) 716-6031 or (602) 716-6032. You can also e-mail us at ReportingUnclaimedProperty@azdor.gov.

Electronically File Your Arizona 2021 Income Tax Returns for Free. Free File Alliance is a nonprofit coalition of industry-leading tax software companies partnered with ADOR and the IRS to provide free electronic tax services. Free File is the fast, safe and free way to do your tax return online.

Description:You can not eFile a AZ Tax Amendment anywhere, except mail it in. However, you can prepare it here on eFile.com. This Form can be used to file an: Income Tax Return, Tax Amendment, Change of Address.

Electronic payments can be made using AZTaxes.gov under the Make a Payment link. Taxpayers who filed an extension with the Internal Revenue Service do not have to do so with the state, but they must check the Filing Under Extension box 82F on the Arizona tax returns when they file.

You have two options for filing and paying your Arizona sales tax: File online File online at the Arizona Department of Revenue. You can remit your payment through their online system.

To accomplish this, here are some tips:Start with a headline. After conducting a survey, it's easy to get wrapped up in data sets and percentages.Present insights, not data.Get visual.Keep it short.Start with a structured plan.Prioritize and visualize.Provide actionable intel for each department.Proofread and tighten.

Beginning January 1, 2021, employers will have the ability to electronically submit Arizona Form A1-R or Arizona Form A1-QRT and federal Forms W-2, W-2c, W-2G, and supported federal Forms 1099. For the 2020 taxable year, the department will accept the following Forms 1099 electronically: 1099-DIV, 1099-R and 1099-MISC.