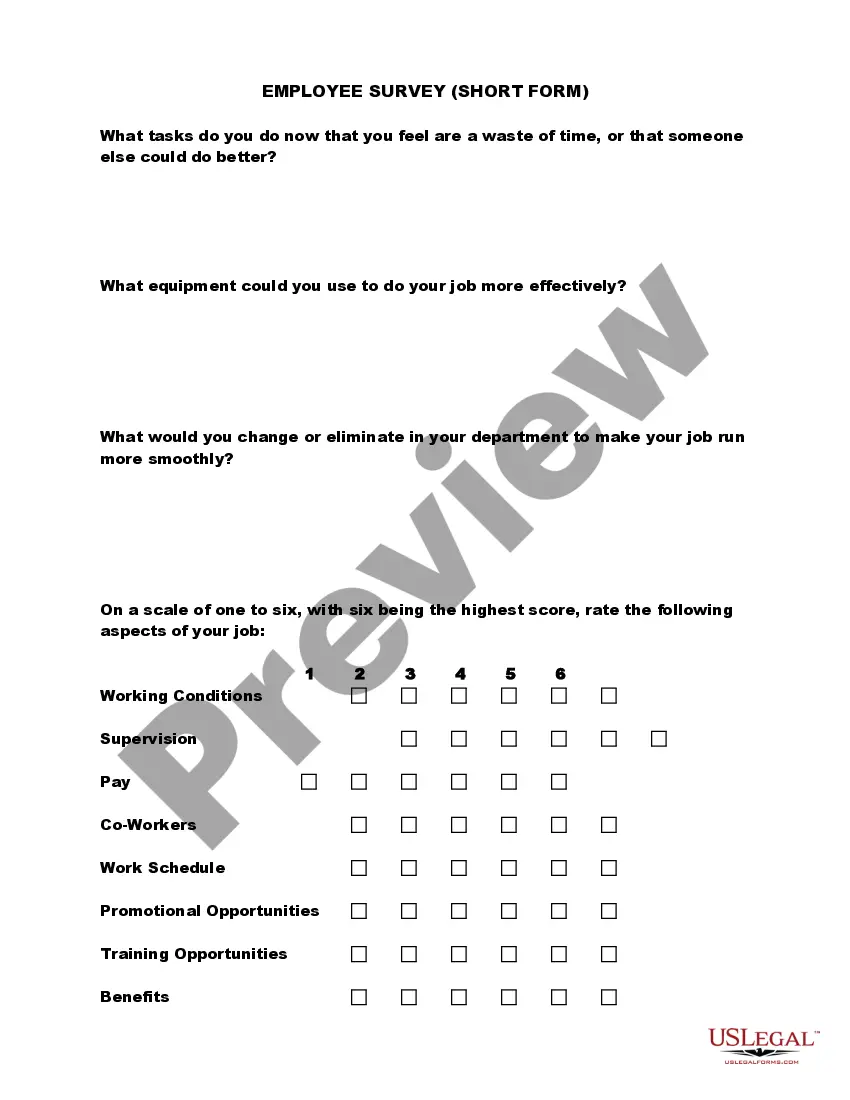

Arizona Employee Survey (Short Form)

Description

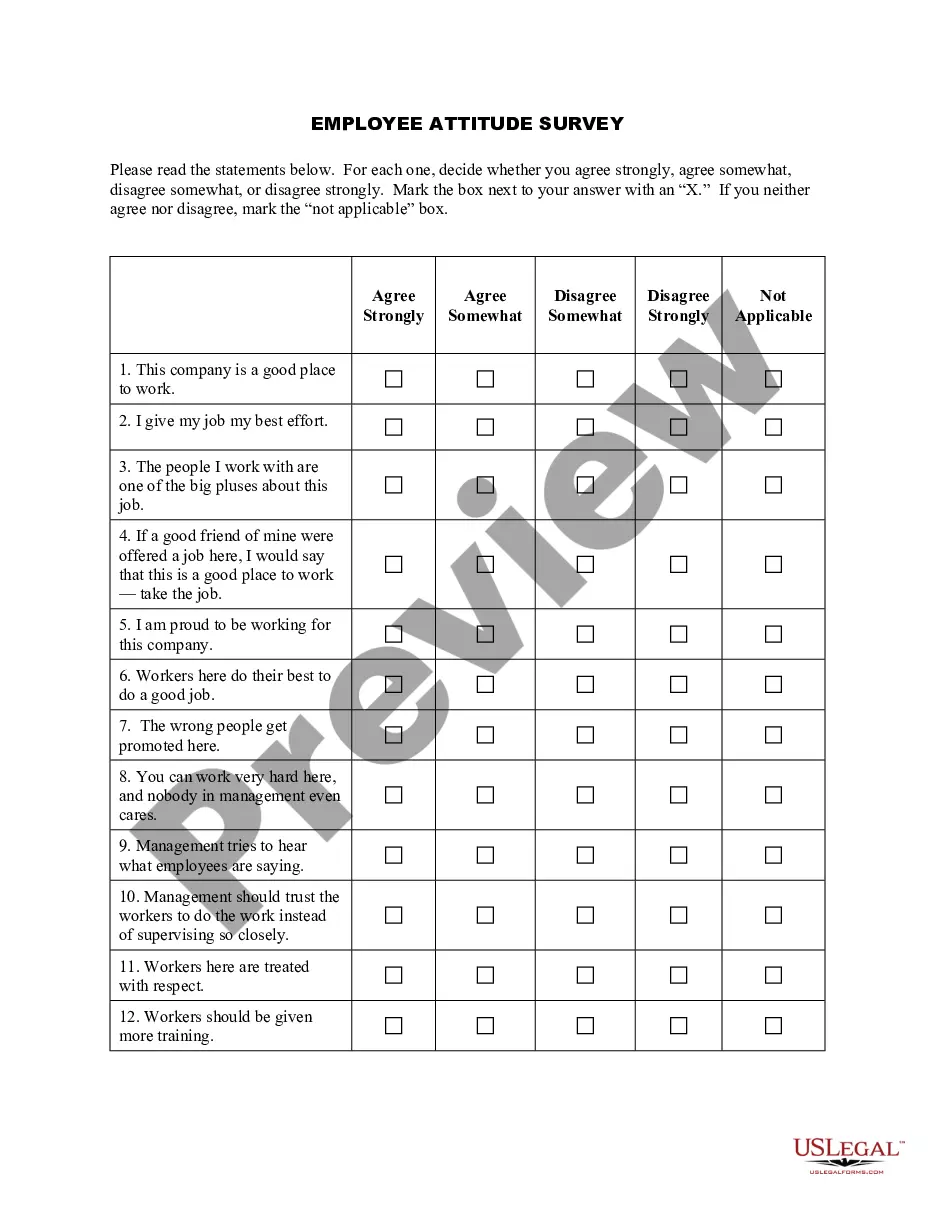

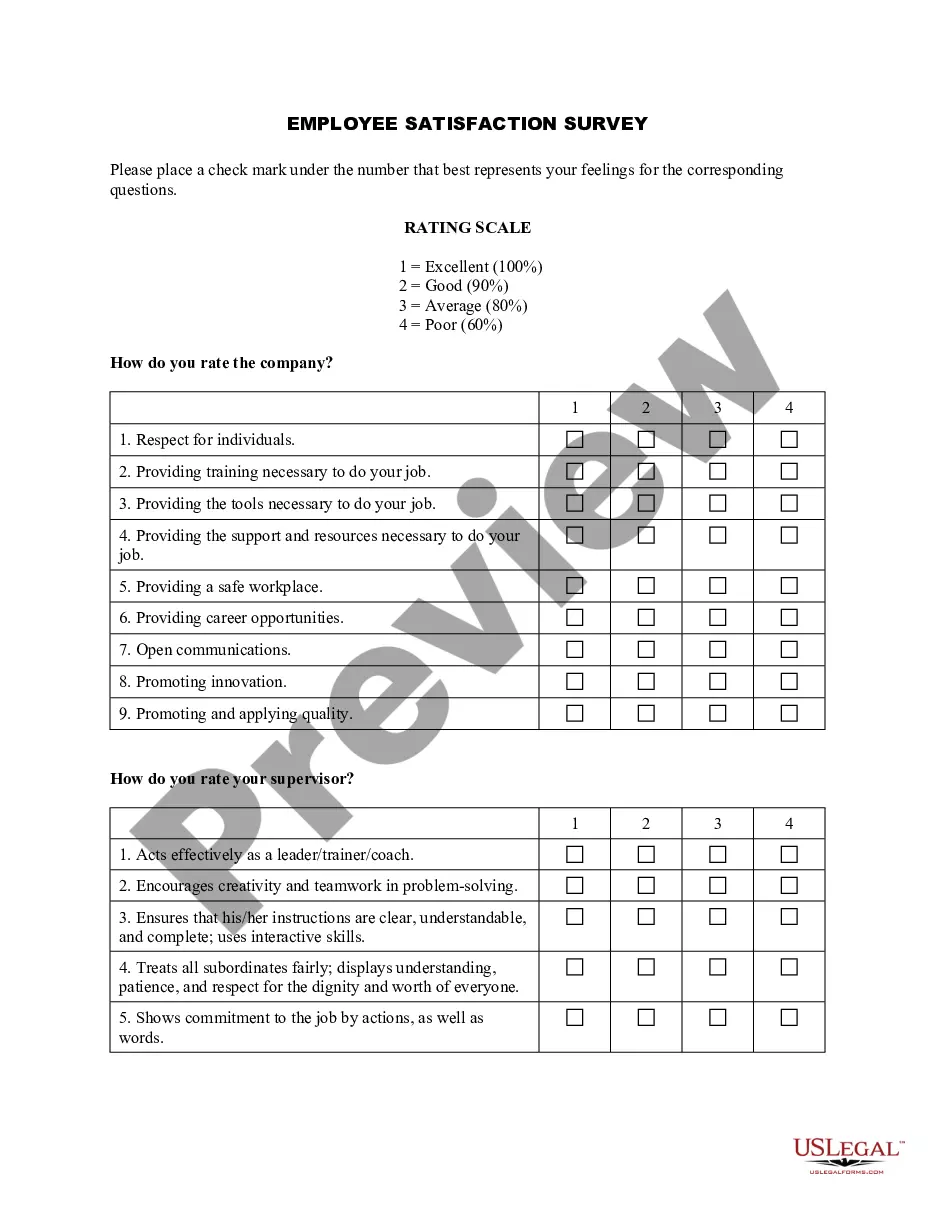

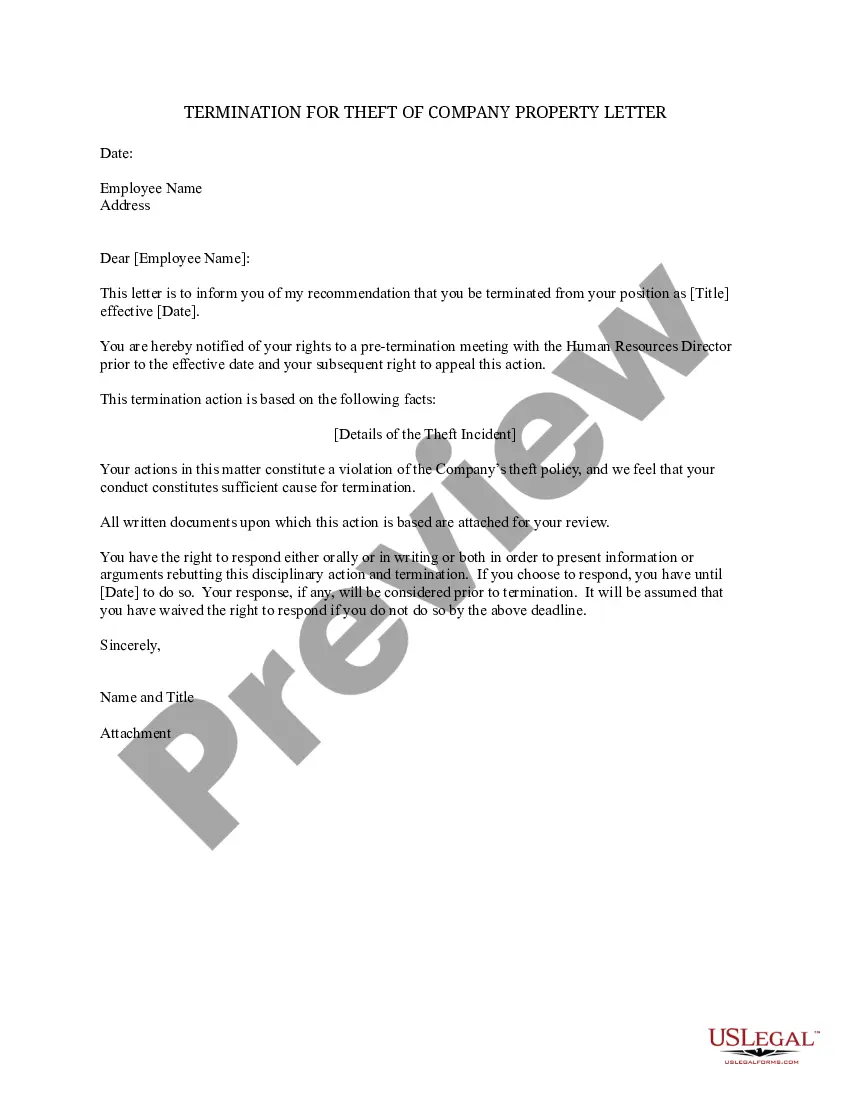

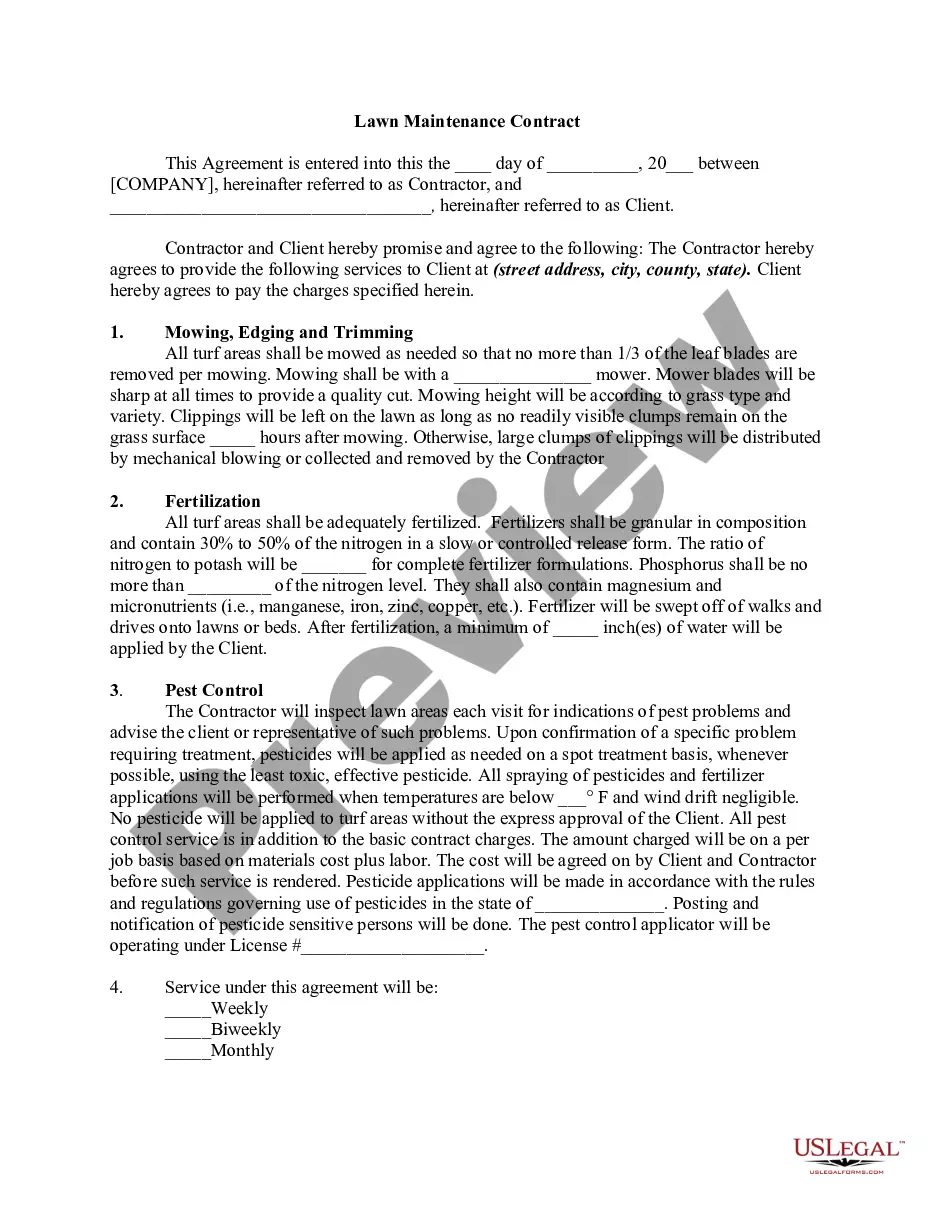

How to fill out Employee Survey (Short Form)?

You might spend numerous hours online searching for the valid document template that aligns with the federal and state standards you require.

US Legal Forms provides thousands of valid forms that are reviewed by experts.

It is easy to obtain or print the Arizona Employee Survey (Short Form) from our services.

If available, use the Review button to browse through the document template as well.

- If you already have a US Legal Forms account, you can Log In and click on the Download button.

- Then, you can fill out, modify, print, or sign the Arizona Employee Survey (Short Form).

- Each valid document template you obtain is yours indefinitely.

- To get another copy of a purchased form, visit the My documents tab and click on the corresponding button.

- If you are using the US Legal Forms website for the first time, follow the simple instructions below.

- First, make sure you have chosen the correct document template for the area/city of your preference.

- Review the form description to ensure you have selected the right form.

Form popularity

FAQ

To keep your withholding the same as last year, choose a withholding percentage of 1.8% (40,000 x . 018 = 720) and withhold an additional $10.77 per biweekly pay period (1,000 - 720 = 280 / 26 = 10.77). Be sure to take into account any amount already withheld for this year.

6 Forms Employers Need to Collect for Each New Hire in ArizonaForm I-9. All new employees are required to complete section one of the I-9 Form by the end of their first day of work.New Hire Reporting.Form W-4.Form A-4.Notice of Coverage Options.E-Verify.

Common Arizona Income Tax Forms & Instructions The most common Arizona income tax form is the Arizona form 140. This form is used by residents who file an individual income tax return. This form should be completed after filing your federal taxes, using Form 1040.

If you have an Arizona tax liability when you file your return or if at any time during the current year conditions change so that you expect to have a tax liability, you should promptly file a new Form A-4 and choose a withholding percentage that applies to you.

You can use Form 140A to file if all of the following apply to you: You (and your spouse if married filing a joint return) are both full year residents of Arizona. Your Arizona taxable income is less than $50,000, regardless of your filing status. You are a calendar filer.

Information for Employers, Employees, and Individuals To elect an Arizona withholding percentage, an employee must complete Arizona Form A-4, Arizona Withholding Percentage Election, and submit it to his/her employer. Employees may request to have an additional amount withheld by their employer.

It is your gross wages less any pretax deductions, such as your share of health insurance premiums. New Employees. Complete this form within the first five days of your employment to select an Arizona withholding percentage. You may also have your employer withhold an extra amount from each paycheck.

Employees fill out a W-4 form to inform employers how much tax to withhold from their paycheck based on filing status, dependents, anticipated tax credits, and deductions. If the form is filled out incorrectly, you may end up owing taxes when you file your return.

The following states opted to create their own state W-4 forms: Delaware, Idaho, Nebraska, Oregon, South Carolina, and Wisconsin whereas Colorado, New Mexico, North Dakota, and Utah will adopt the new inputs that the 2020 Federal W-4 put forth.

The best way to determine your liability is to talk with your tax advisor. If you don't have a tax advisor, you can look at your last year's return. Your liability can be found on Line 48 of your Arizona Form 140 and Line 58 for both your Arizona 140PY (Part Year Resident) and Arizona 140NR (Non-Resident) forms.