Arizona Unrestricted Charitable Contribution of Cash

Description

How to fill out Unrestricted Charitable Contribution Of Cash?

Are you presently in a situation where you require documents for either business or personal reasons almost all the time.

There are numerous authentic document templates accessible online, but finding ones you can rely on is challenging.

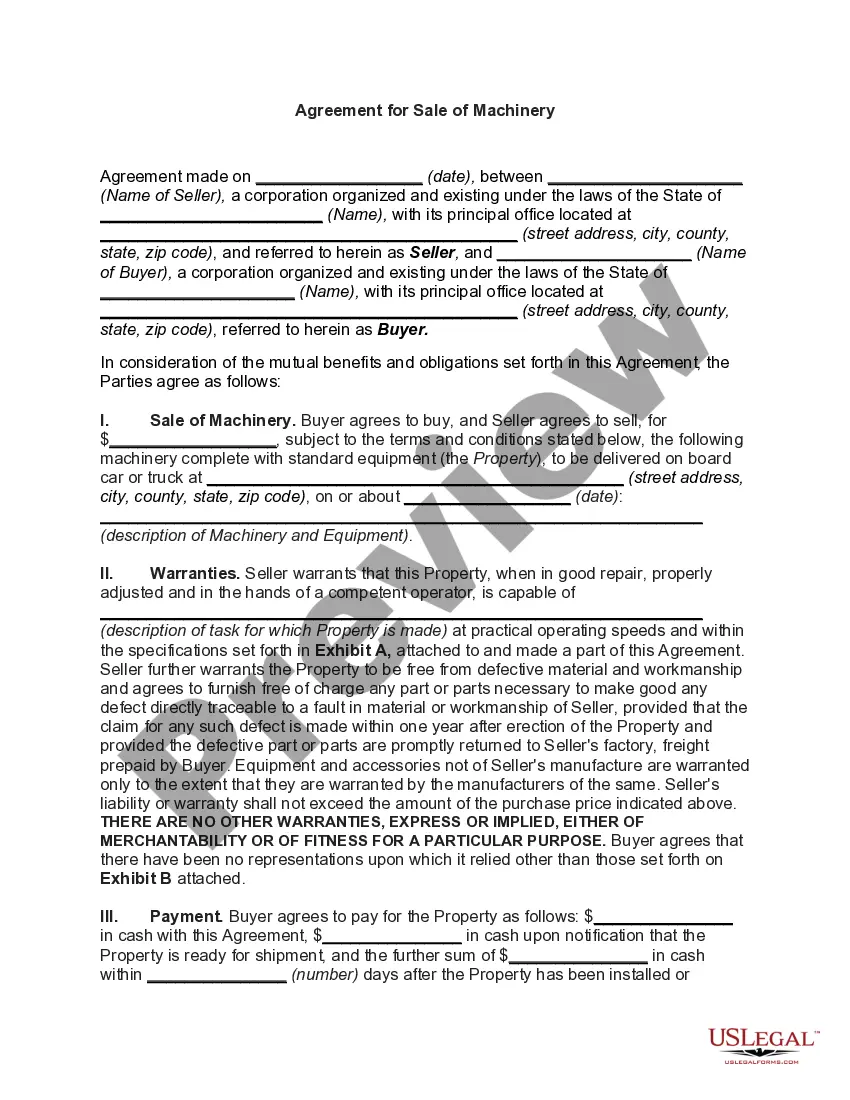

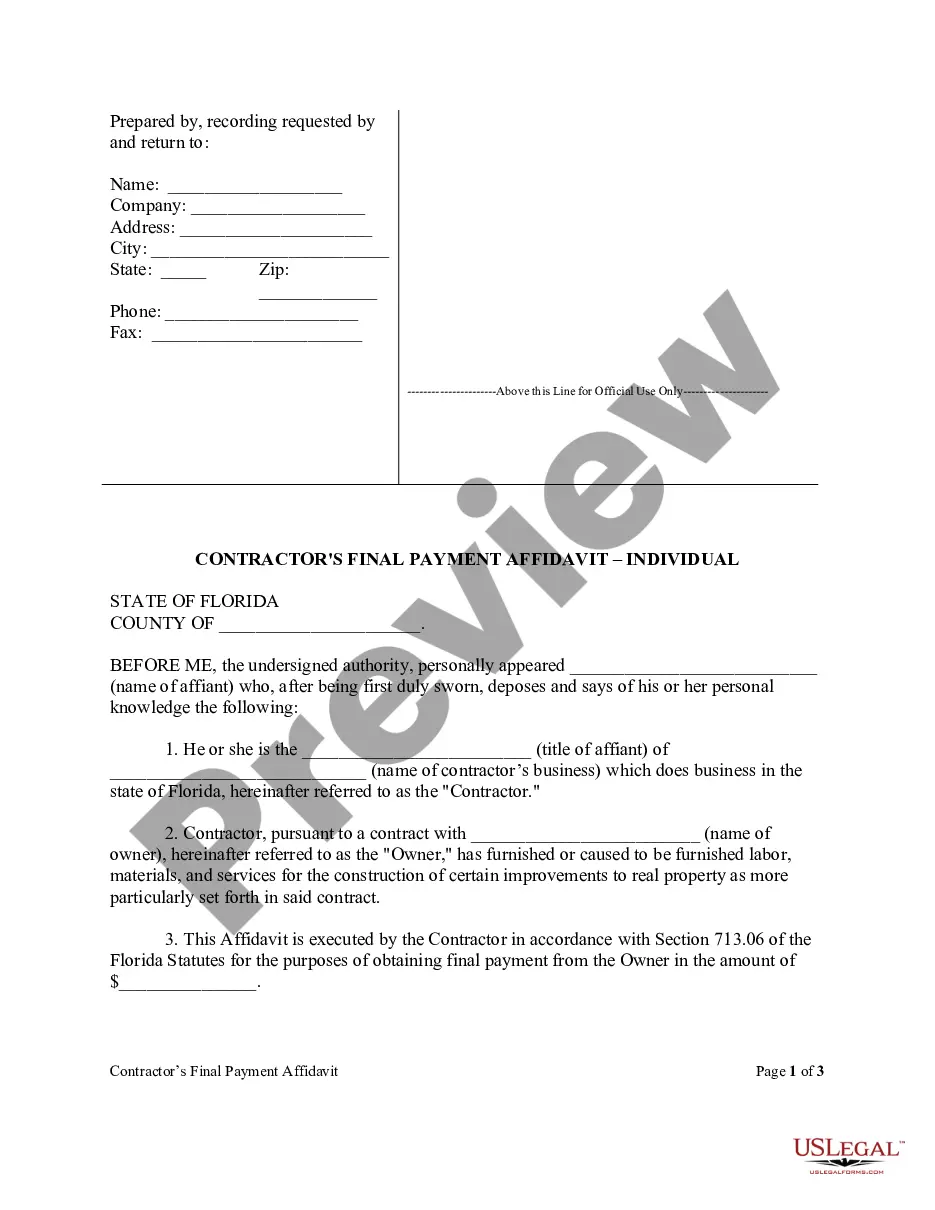

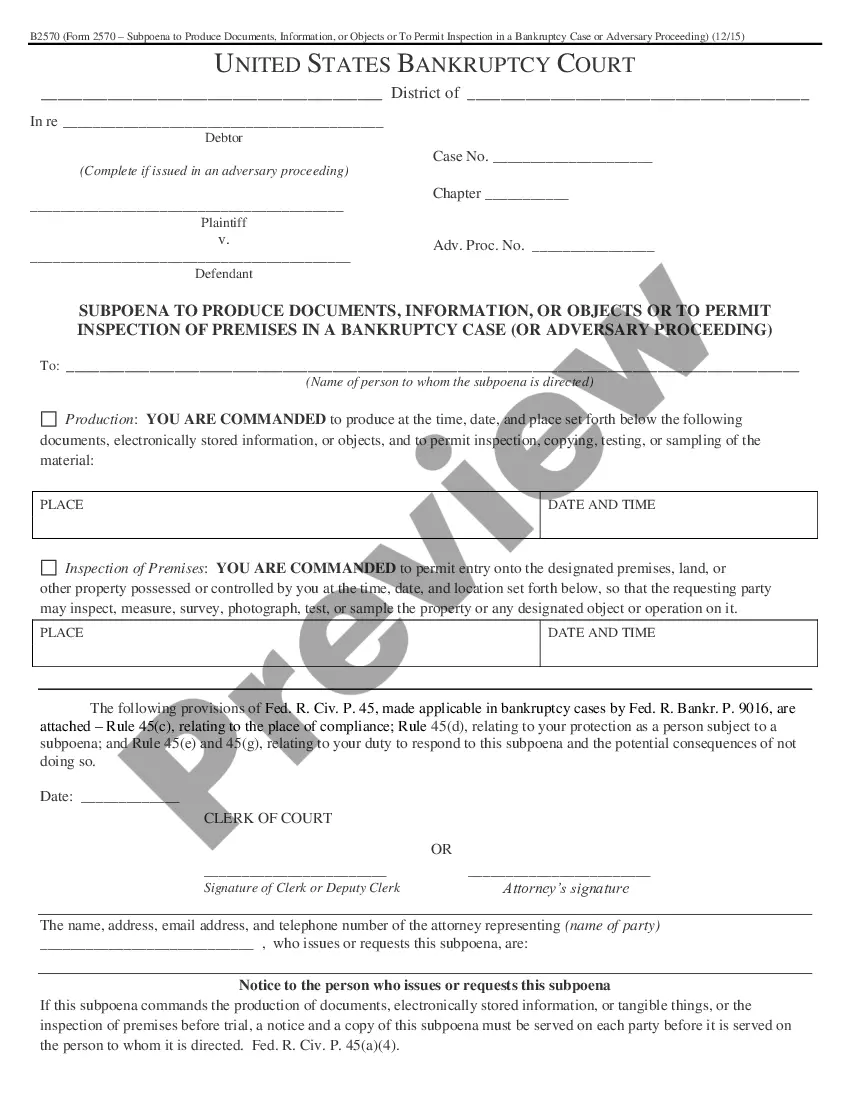

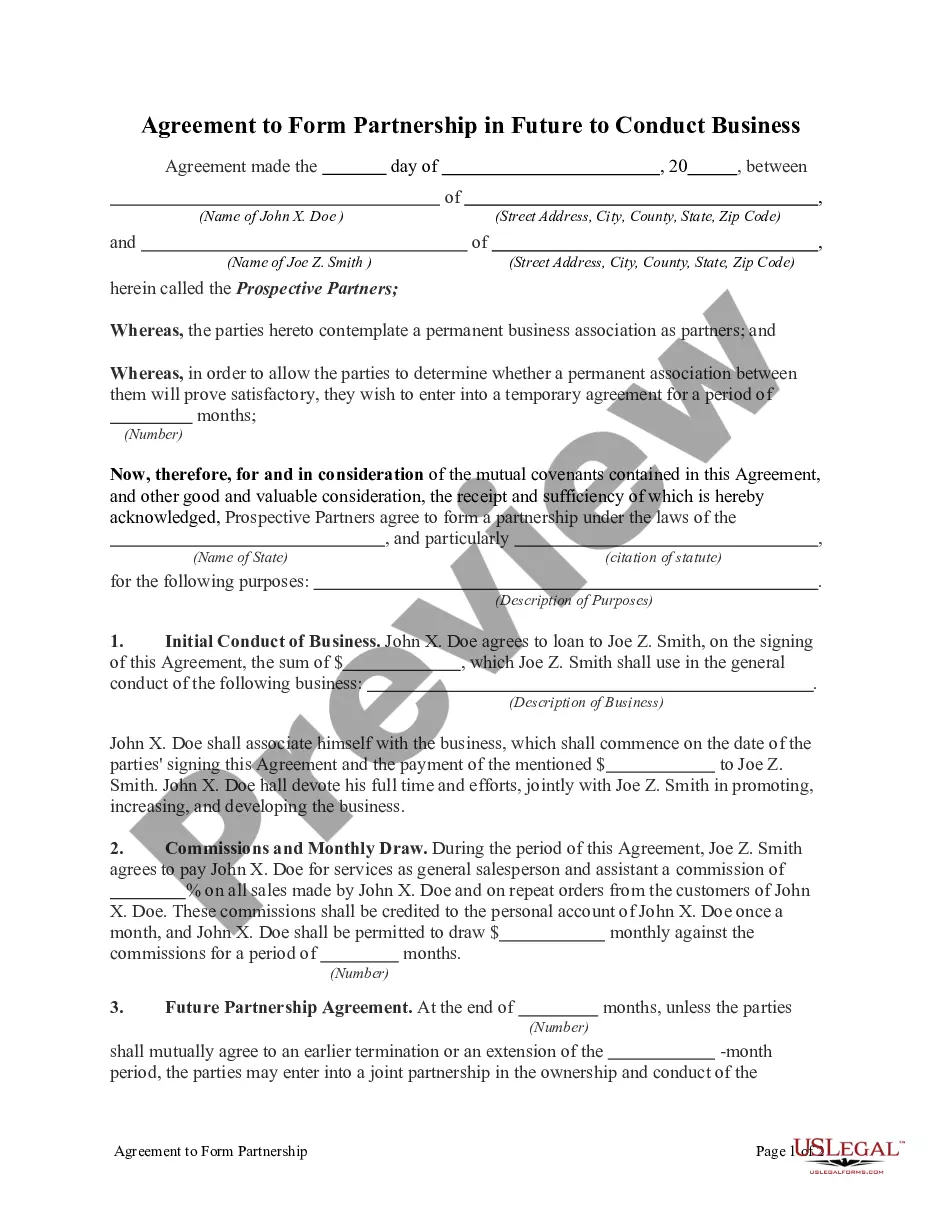

US Legal Forms offers a vast array of form templates, such as the Arizona Unrestricted Charitable Contribution of Cash, that are designed to comply with federal and state regulations.

If you identify the correct form, simply click Purchase now.

Choose the pricing plan you wish, complete the necessary information to create your account, and pay for the order using your PayPal or Visa/Mastercard.

- If you are already familiar with the US Legal Forms website and possess an account, simply Log In.

- After that, you can download the Arizona Unrestricted Charitable Contribution of Cash template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Find the form you need and ensure it is for the correct city/state.

- Utilize the Review option to examine the form.

- Check the description to confirm that you have selected the correct form.

- If the form is not what you require, use the Search box to find the form that meets your needs and specifications.

Form popularity

FAQ

For the 2021 tax year, you can deduct up to $300 per person rather than per tax return, meaning a married couple filing jointly could deduct up to $600 of donations without having to itemize. The CARES Act eliminated the 60% limit for cash donations to public charities.

For 2020, the charitable limit was $300 per tax unit meaning that those who are married and filing jointly can only get a $300 deduction. For the 2021 tax year, however, those who are married and filing jointly can each take a $300 deduction, for a total of $600.

Usually, individual itemizers are allowed to deduct up to 60% of their adjusted gross incomes (AGI) for cash donations to qualified charities. However, in 2021, they generally can deduct cash contributions equal to 100% of their AGI.

Arizona provides two separate tax credits for individuals who make contributions to charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and the second for donations to Qualifying Foster Care Charitable Organizations (QFCO).

The Arizona Charitable Tax Credit is a set of two nonrefundable individual income tax credits for charitable contributions to Qualifying Charitable Organizations (QCOs) and Qualifying Foster Care Charitable Organizations (QFCOs).

When you don't itemize your tax deductions, you typically won't get any additional tax savings from donating to charity. However, in 2021, U.S. taxpayers can deduct up to $300 in charitable donations made this year, even if they choose to take the standard deduction.

In Arizona, there are two tax credits for individuals who make contributions to qualified charitable organizations: one for donations to Qualifying Charitable Organizations (QCO) and another for donations to Qualifying Foster Care Charitable Organizations (QFCO).

Expanded tax benefits help individuals and businesses give to charity during 2021; deductions up to $600 available for cash donations by non-itemizers.

Individuals may deduct qualified contributions of up to 100 percent of their adjusted gross income. A corporation may deduct qualified contributions of up to 25 percent of its taxable income. Contributions that exceed that amount can carry over to the next tax year.