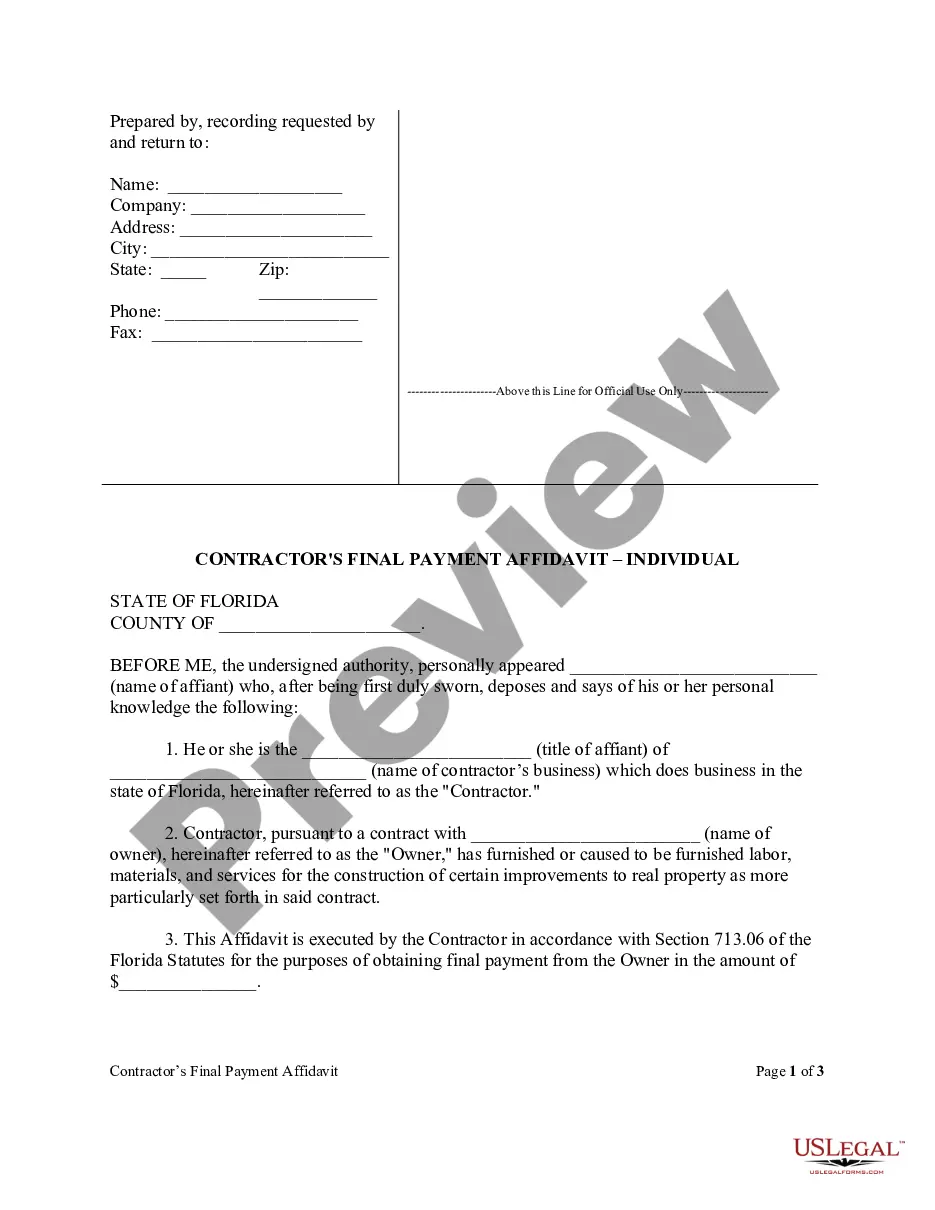

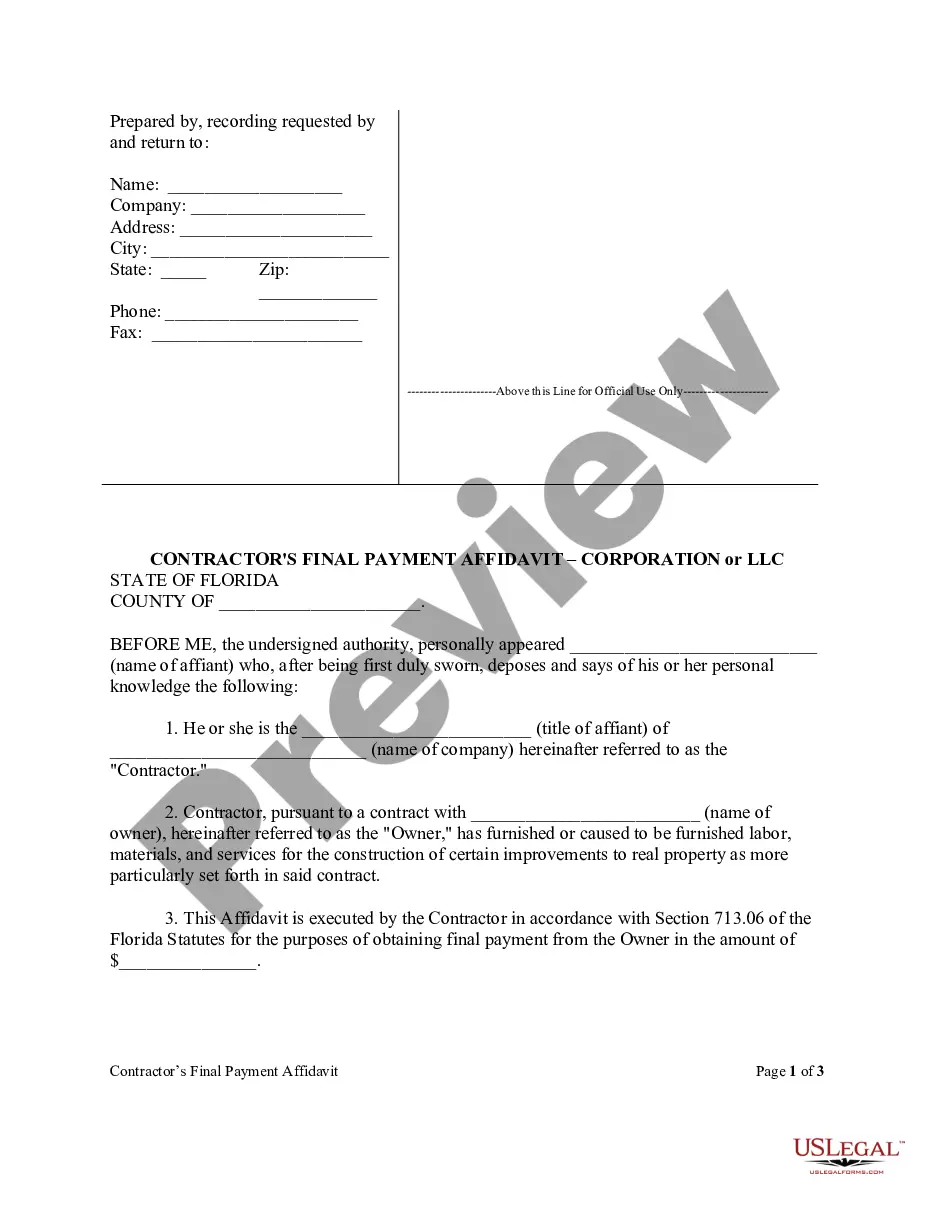

Florida Contractor's Final Affidavit Form - Construction - Mechanic Liens - Individual

About this form

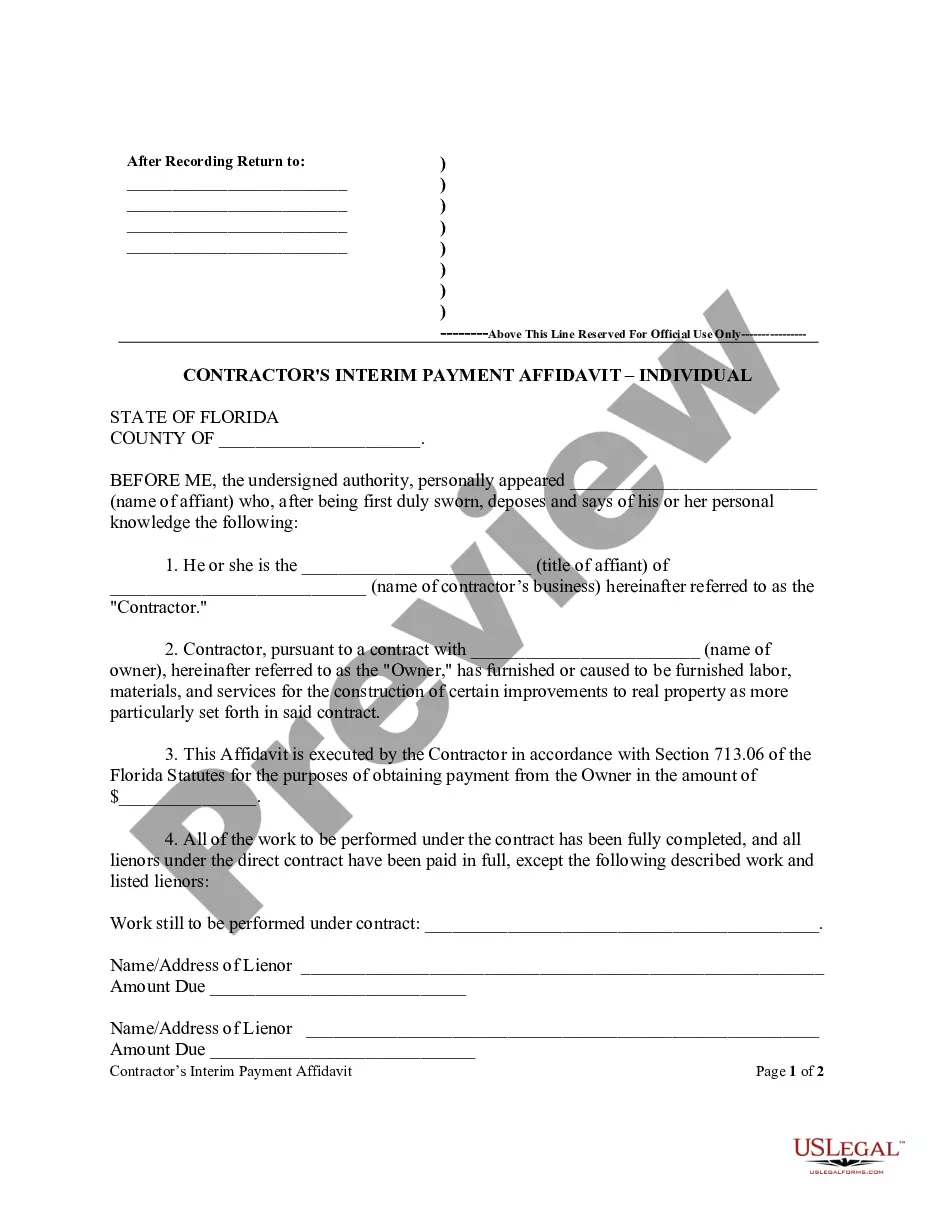

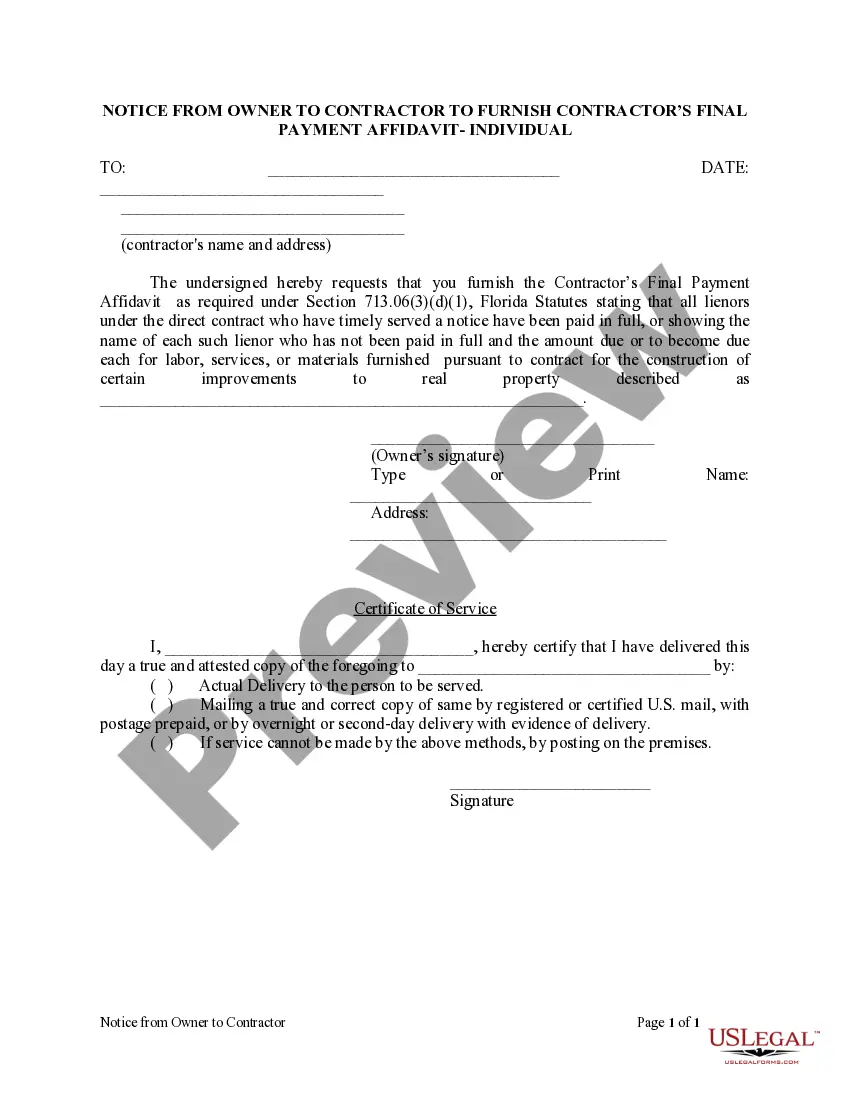

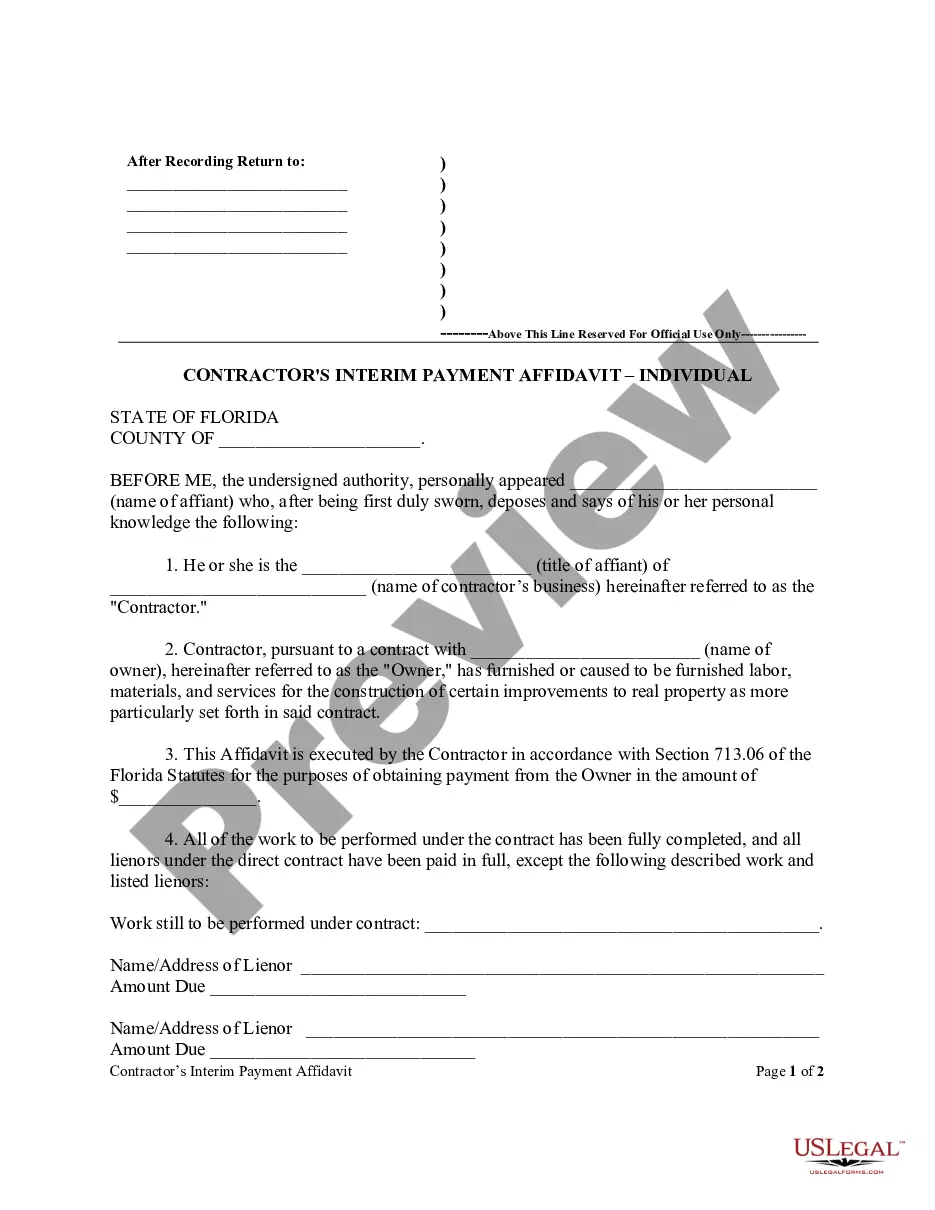

The Contractor's Final Affidavit Form is a legal document used in Florida to confirm that a contractor has completed their work and has paid all subcontractors and suppliers on a construction project. This affidavit serves as a formal declaration to the property owner that the contractor is entitled to receive final payment for their services. Unlike other forms, this affidavit is specifically tailored for individual contractors and focuses on the completion of work and settlement with all lienors under the contract.

Key components of this form

- Name and contact information of the contractor.

- Affidavit declaration attesting to the completion of work.

- Details of the property owner and the contract.

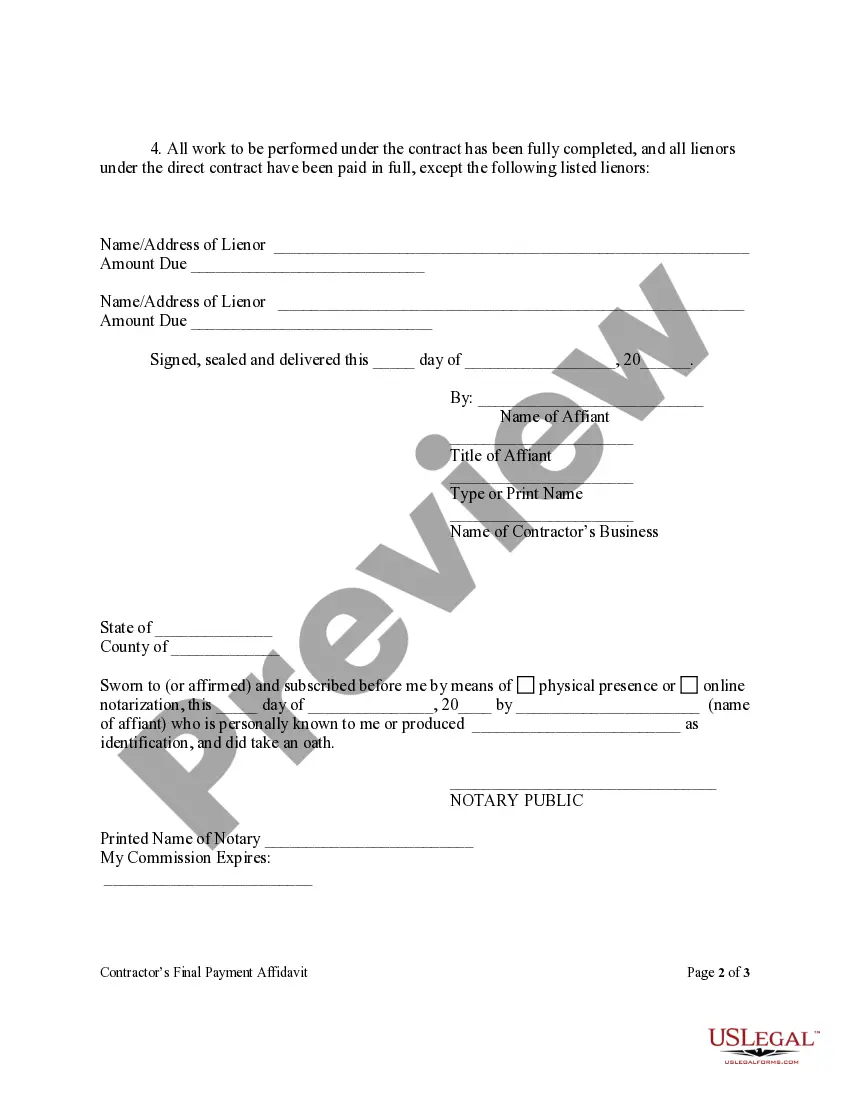

- Statement of payment owed and confirmation of payment to lienors.

- Notary section for verification.

When this form is needed

This form should be used when a contractor has completed all work on a construction project and is seeking final payment from the property owner. It is essential when all parties involved have settled accounts, and the contractor needs to formally confirm the completion of the project in order to protect their rights and facilitate the payment process.

Who this form is for

- Individual contractors in Florida seeking final payment from property owners.

- Contractors who have ensured that all subcontractors and suppliers have been paid.

- Property owners who require a formal declaration before releasing final payment.

How to prepare this document

- Enter the contractor's name, company, address, and contact information at the top of the form.

- Provide details about the owner and specify the amount due for final payment.

- List any unpaid lienors, including their names and addresses, and the amounts owed.

- Have the contractor sign the affidavit and include their title and the name of their business.

- Complete the notary section, having a notary public witness the signature.

Notarization requirements for this form

This document requires notarization to meet legal standards. US Legal Forms provides secure online notarization powered by Notarize, allowing you to complete the process through a verified video call, available 24/7.

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Common mistakes to avoid

- Failing to list all unpaid lienors can lead to potential legal issues.

- Not having the affidavit notarized, which is essential for its validity.

- Leaving out important contact information or details about the construction project.

Why use this form online

- Convenience of immediate access to the form for quick completion.

- Editability allows for easy customization to fit specific project details.

- Reliable access to legal templates drafted by licensed attorneys.

Looking for another form?

Form popularity

FAQ

Form FL-150 is your Income and Expense Declaration where you detail everything you earn and spend, and it is completed by both petitioner and respondent.

No, you don't have to file the FL-150. You do, however, have to serve it (along with the FL-140 Declaration of disclosure and FL-142 Schedule of Assets and Debts) on your spouse.

Tip 1: Include everything. Tip 2: Who does the Income and Expense Declaration cover? Tip 3: Be accurate. Tip 4: Make sure you average everything in! Tip 5: Differentiate changes in the budget due to your divorce. Tip 6: List your one-time expenses.

The Income and Expense Declaration is one of the most misunderstood forms required by the Court when setting child and/or spousal support.At the beginning of Page 3, the form requests the names of any persons living with you, their age, and whether they contribute to your living expenses.

If you are going through divorce in California and have children, you will have to file an income and expense declaration with the court. But, you only have to file the FL-150 if your case is what we call a default with agreement or true default.

The Declarations of Disclosure are financial disclosures that each party to a divorce case must provide to the other side, and they consist of an Income & Expense Declaration as well as a Schedule of Assets and Debts. Those documents are exactly like they sound, they list out all income, expenses, assets and debts.

Form FL-300, Request for Order, is the basic form you need to file with the court. Depending on your request, you may need these additional forms: When specific Judicial Council forms must be used to ask the court for orders.

No, you don't have to file the FL-150. You do, however, have to serve it (along with the FL-140 Declaration of disclosure and FL-142 Schedule of Assets and Debts) on your spouse.

You need to have your written agreement notarized. Make sure, when you sign the agreement, that you understand everything you are agreeing to. This type of agreement is often called a marital settlement agreement or MSA.