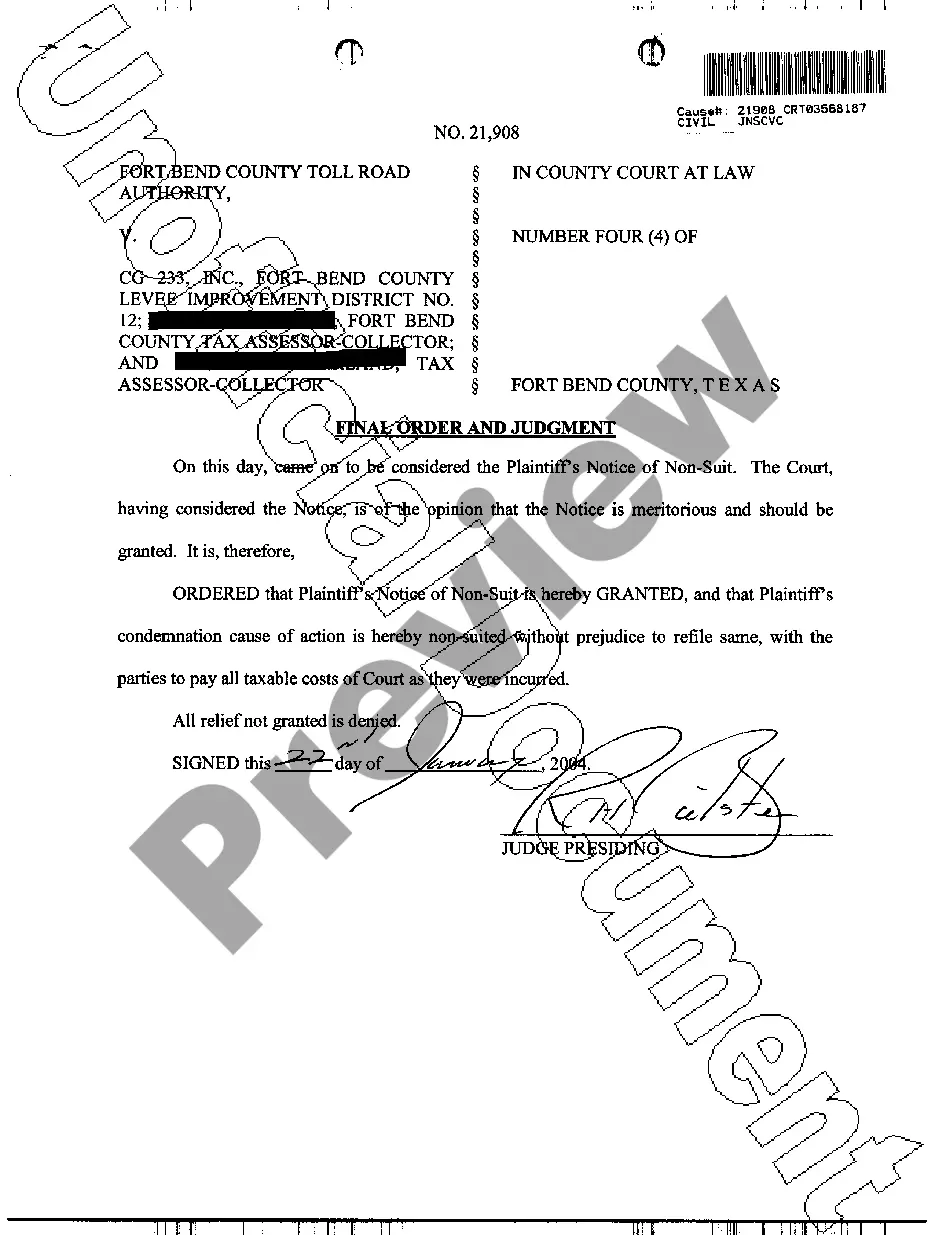

Texas Final Order and Judgment

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Texas Final Order And Judgment?

Access to top quality Texas Final Order and Judgment forms online with US Legal Forms. Prevent days of lost time looking the internet and lost money on forms that aren’t up-to-date. US Legal Forms gives you a solution to just that. Get over 85,000 state-specific authorized and tax forms you can save and submit in clicks in the Forms library.

To find the sample, log in to your account and click on Download button. The document will be saved in two places: on the device and in the My Forms folder.

For people who don’t have a subscription yet, take a look at our how-guide below to make getting started simpler:

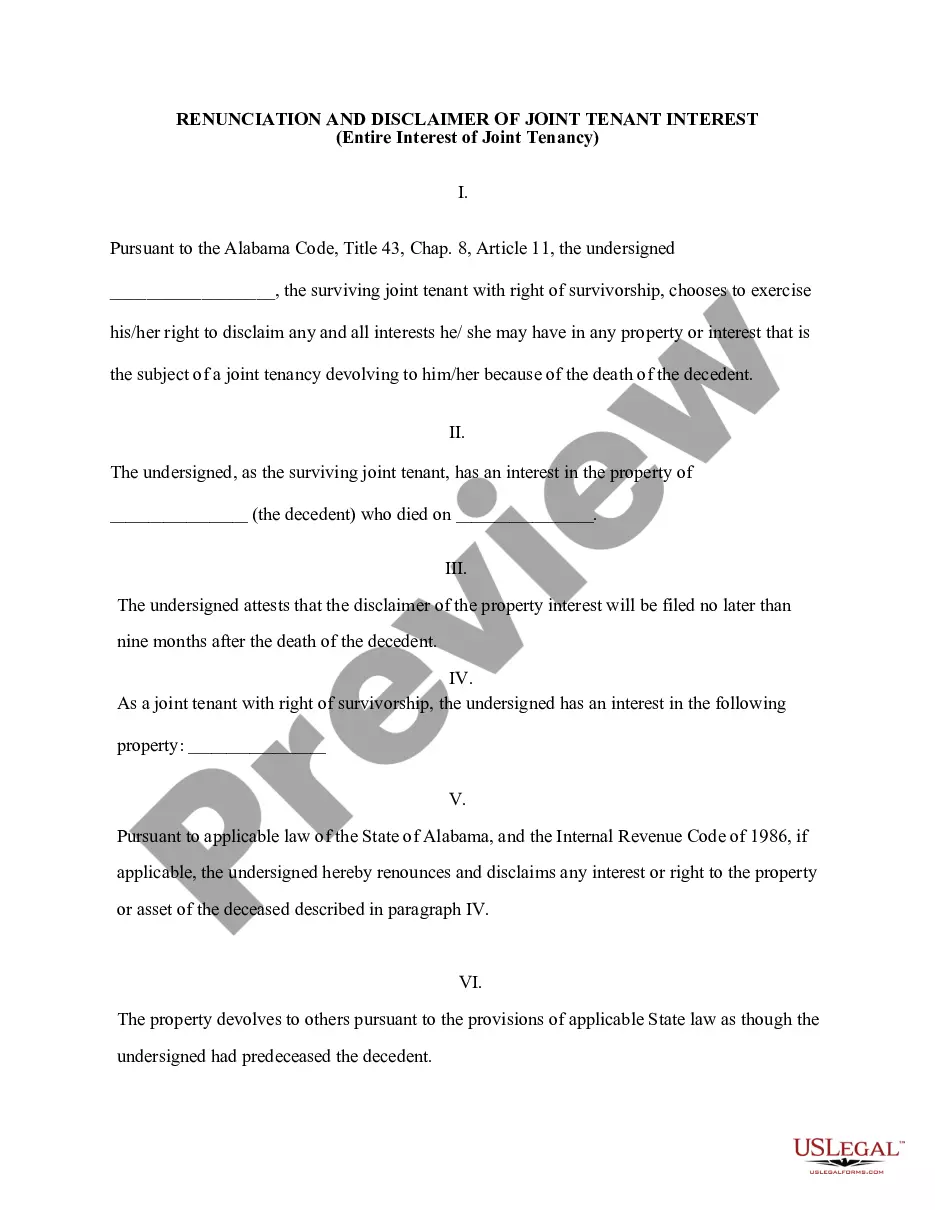

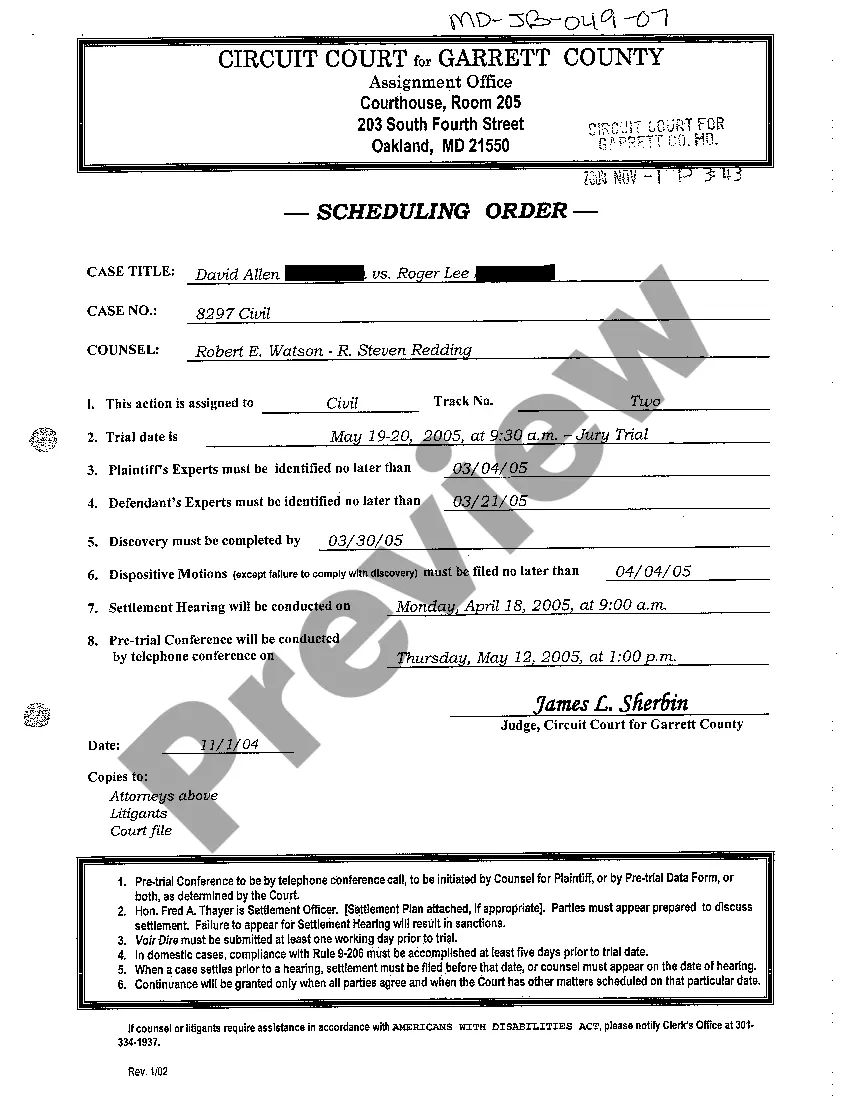

- Verify that the Texas Final Order and Judgment you’re considering is suitable for your state.

- See the sample making use of the Preview function and read its description.

- Go to the subscription page by clicking Buy Now.

- Select the subscription plan to go on to register.

- Pay out by credit card or PayPal to complete creating an account.

- Choose a preferred file format to save the file (.pdf or .docx).

Now you can open the Texas Final Order and Judgment template and fill it out online or print it and do it by hand. Think about mailing the document to your legal counsel to be certain everything is completed appropriately. If you make a mistake, print out and fill application once again (once you’ve created an account all documents you save is reusable). Make your US Legal Forms account now and access more samples.

Form popularity

FAQ

Fill out the appropriate mechanics lien form. (Lien form for Original Contractors Lien form for Subcontractors & Suppliers) Deliver your lien form to the county recorder office. Serve your lien on the property owner.

First, you can ask the court to set aside the default judgment and give you an opportunity to contest it. Next, you can settle the debt with the debt buyer for an amount less than what the default judgment is for. And finally you can eliminate the default judgment completely by filing for bankruptcy.

Do Judgments Expire in Texas? Judgments issued in Texas with a non-government creditor are generally valid for ten years but they can be renewed for longer.

First, the creditor must obtain a judgment in court that requires the debtor to pay the amount owed and any interest due on that amount. The creditor must then request and receive an Abstract of Judgment that can be filed with the County Clerk in the areas in which the debtor maintains property.

Aim to Pay 50% or Less of Your Unsecured Debt If you decide to try to settle your unsecured debts, aim to pay 50% or less. It might take some time to get to this point, but most unsecured creditors will agree to take around 30% to 50% of the debt. So, start with a lower offerabout 15%and negotiate from there.

Talk to a lawyer if you have questions or need help.File (turn in) your completed answer form with the court. To file online, go to E-File Texas and follow the instructions. To file in person, take your answer (and copies) to the district clerk's office in the county where the plaintiff filed the case.

Even after a judgment is entered against you, it is still possible to settle a debt for less than the court-approved amount.However, you may be able to negotiate a discount to the debt, in return for a lump sum payment.

Vacate the Judgment. If a judgment has been entered against a debtor in Texas, a motion for new trial is the best way to vacate that judgment. Discharge Through Bankruptcy. If all else fails, most judgments can be discharged in bankruptcy. Claim Your Property as Exempt. Settle Your Judgment for Less.

Find the judgment creditor. Create a hardship letter. Negotiate. Write a Release of Judgment (RoJ) Transfer Money and Get Release of Judgment (RoJ) Signed. File Release of judgment (RoJ) in the correct county.