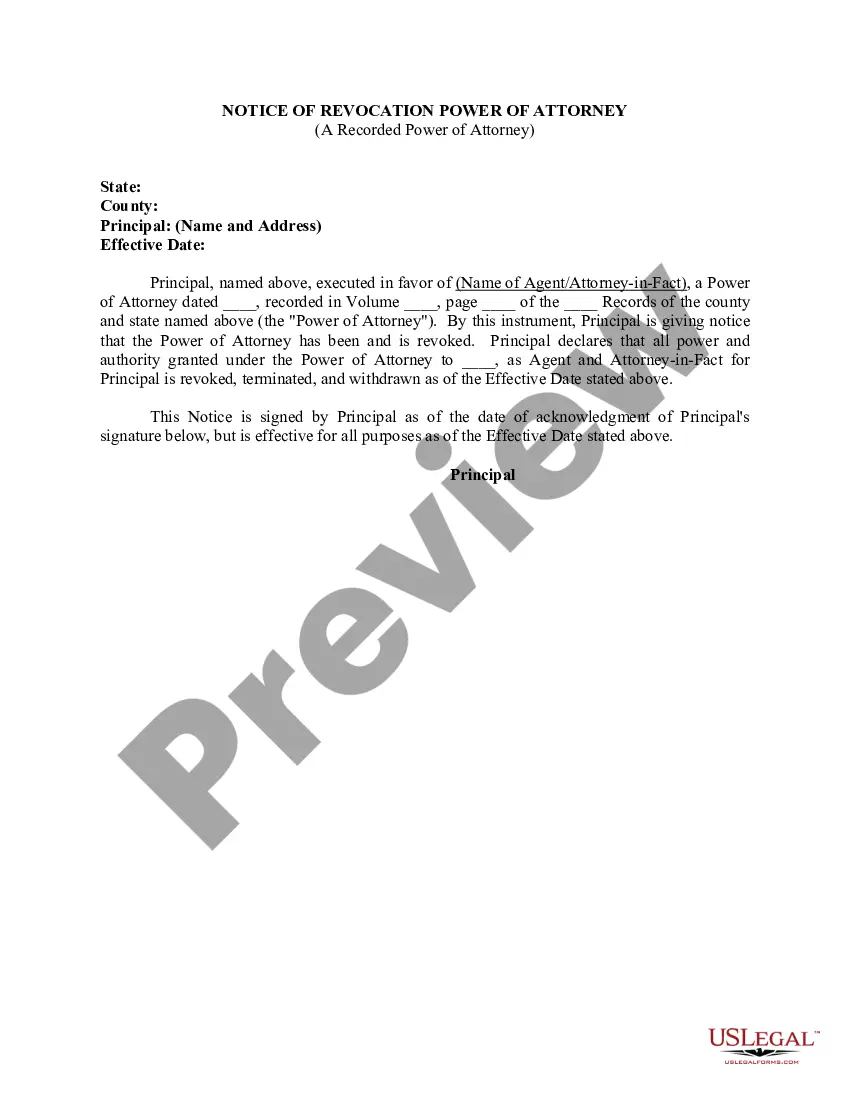

An agreement modifying a loan agreement and mortgage should be signed by both parties to the transaction and recorded in the office of the register of deeds and mortgages where the original mortgage was recorded. This form is a generic example that may be referred to when preparing such a form for your particular state. It is for illustrative purposes only. Local laws should be consulted to determine any specific requirements for such a form in a particular jurisdiction.

Arizona Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage

Description

How to fill out Agreement To Modify Interest Rate, Maturity Date, And Payment Schedule Of Promissory Note Secured By A Mortgage?

US Legal Forms - one of the biggest libraries of legal types in the USA - offers an array of legal file themes it is possible to download or print out. Utilizing the website, you can get a huge number of types for organization and individual reasons, sorted by types, claims, or keywords.You can get the latest types of types just like the Arizona Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage in seconds.

If you already possess a subscription, log in and download Arizona Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage from the US Legal Forms library. The Acquire key will appear on each kind you perspective. You have access to all previously acquired types in the My Forms tab of your own bank account.

In order to use US Legal Forms the first time, listed here are straightforward recommendations to help you get started out:

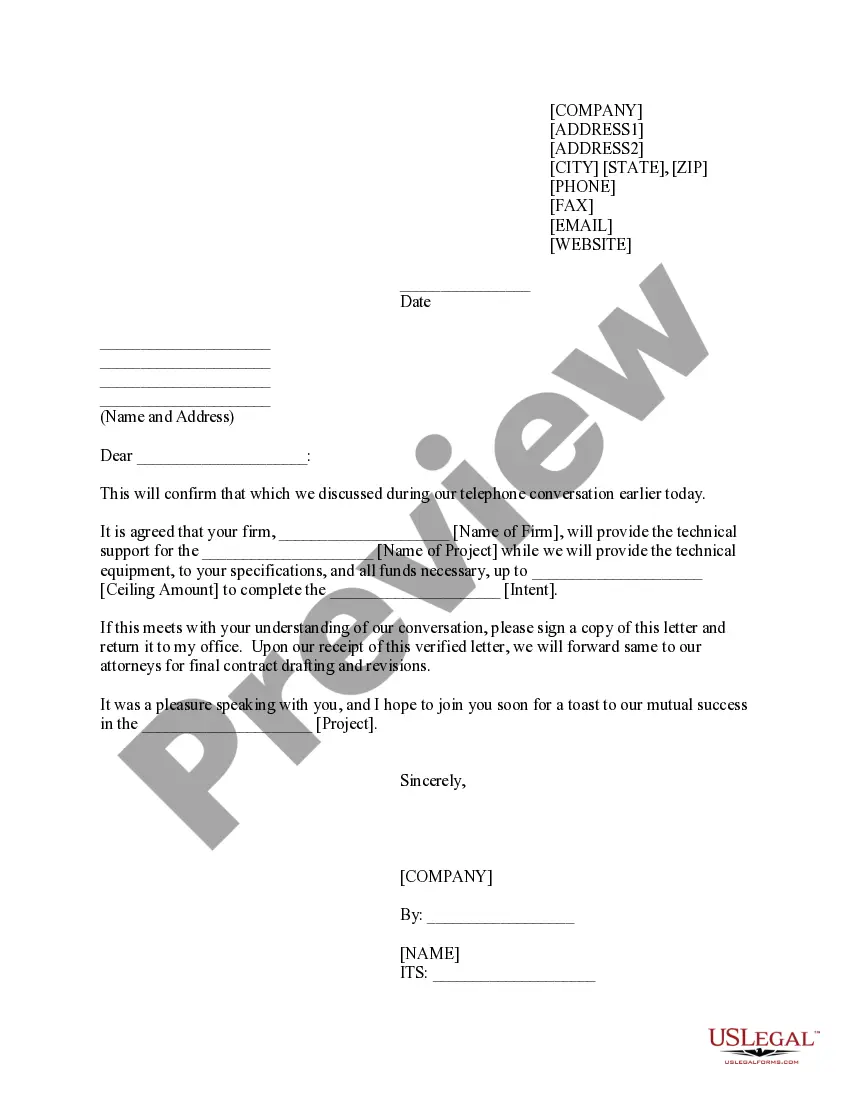

- Be sure to have selected the correct kind for your metropolis/area. Click the Preview key to review the form`s content. See the kind information to ensure that you have selected the correct kind.

- In the event the kind doesn`t match your requirements, make use of the Search field on top of the display to get the one which does.

- In case you are satisfied with the shape, confirm your option by clicking on the Acquire now key. Then, select the prices strategy you want and offer your qualifications to register for the bank account.

- Method the financial transaction. Utilize your credit card or PayPal bank account to finish the financial transaction.

- Find the file format and download the shape on the product.

- Make changes. Fill out, modify and print out and indication the acquired Arizona Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage.

Every single format you included in your account does not have an expiry date which is your own property eternally. So, if you want to download or print out an additional duplicate, just go to the My Forms portion and click around the kind you require.

Get access to the Arizona Agreement to Modify Interest Rate, Maturity Date, and Payment Schedule of Promissory Note Secured by a Mortgage with US Legal Forms, by far the most comprehensive library of legal file themes. Use a huge number of skilled and state-specific themes that satisfy your small business or individual needs and requirements.

Form popularity

FAQ

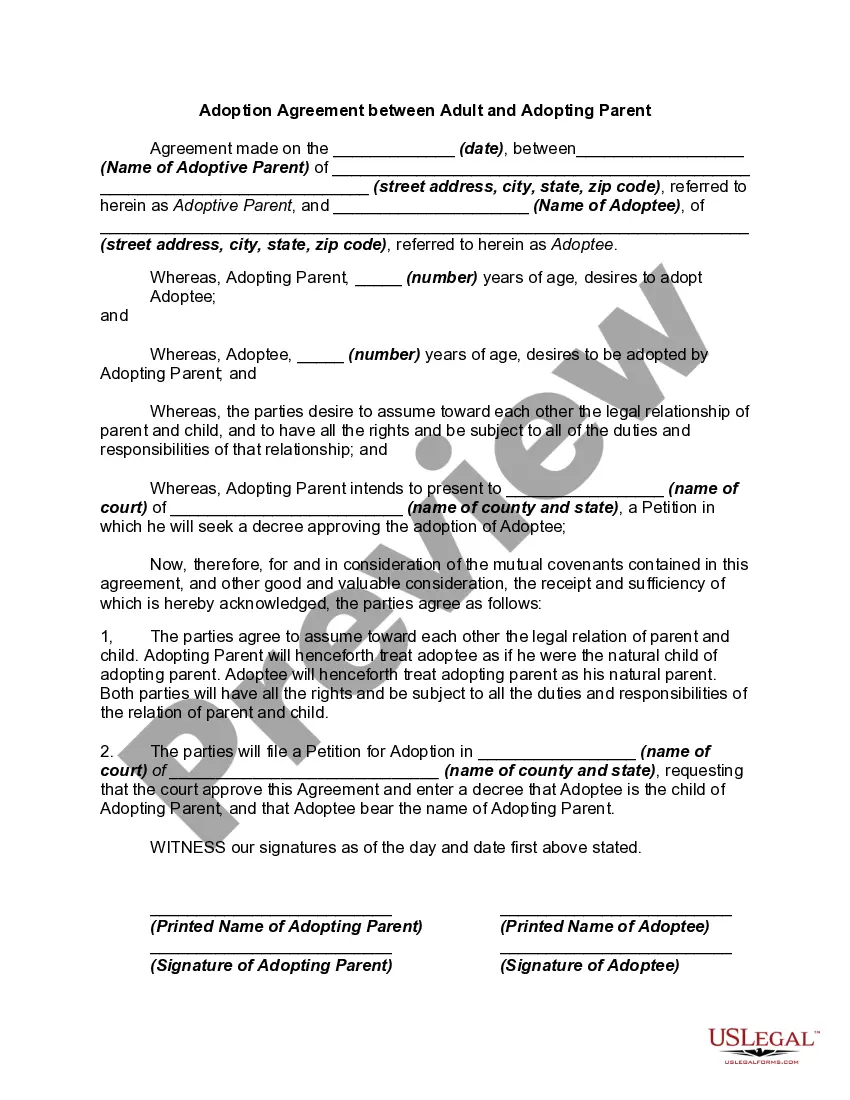

For example, you might agree to change the interest rate or the length of the loan. Always put promissory note changes in writing and have the borrower sign off on them, as oral changes can't be enforced in court. Changing a note without the borrower's written agreement makes a promissory note invalid.

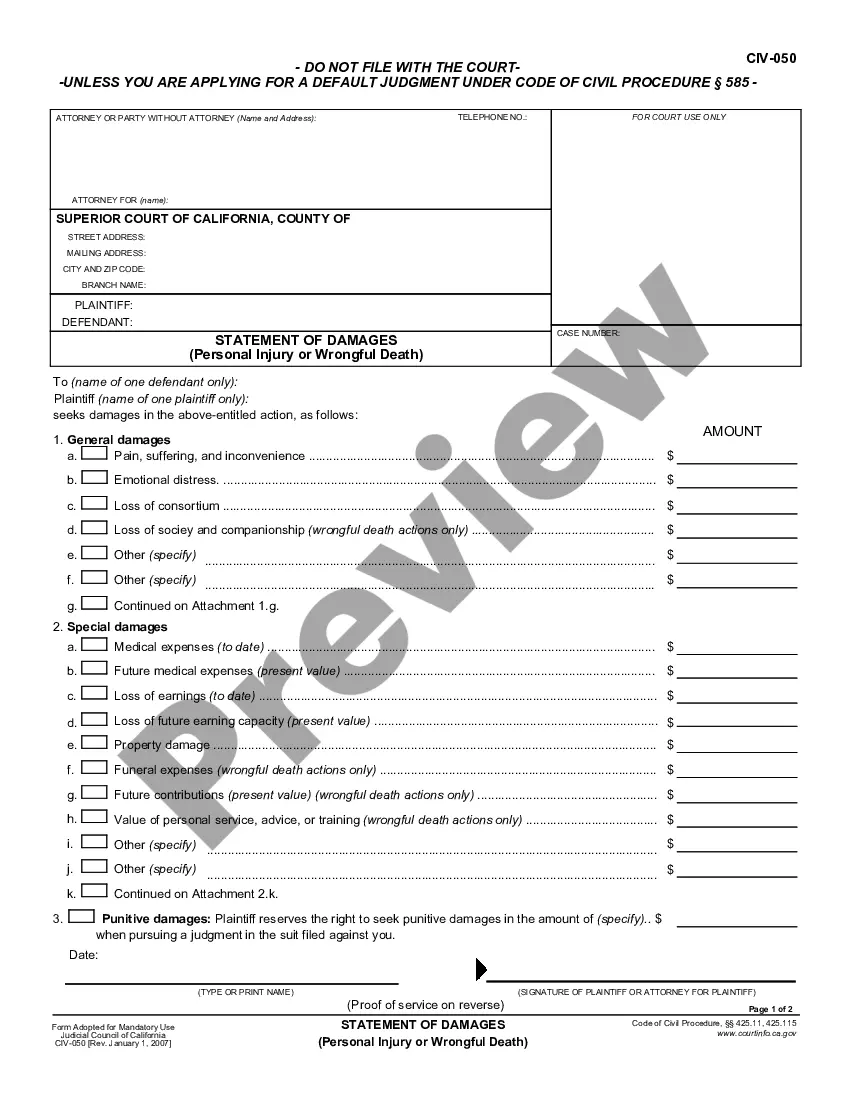

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

By signing a promissory note, a borrower promises to pay back a set amount of money, including interest and fees, to a bank, a person or another lender.

A promissory note must include the date of the loan, the loan amount, the names of both the lender and borrower, the interest rate on the loan, and the timeline for repayment. Once the document is signed by both parties, it becomes a legally binding contract.

The promissory note form should include: The names and addresses of the lender and borrower. The amount of money being borrowed and what, if any, collateral is being used. How often payments will be made in and in what amount. Signatures of both parties, in order for the note to be enforceable.

If you lend money to someone and the borrower later wants more time to pay, or lower monthly payments, you can use this form to make changes to the original promissory note.

A promissory note will include the agreed-upon terms between the two parties, such as the maturity date, principal, interest, and issuer's signature.

A Promissory Note must always be written by hand. It must include all the mandatory elements such as the legal names of the payee and maker's name, amount being loaned / to be repaid, full terms of the agreement and the full amount of liability, beside other elements.