Arizona Increase Dividend - Resolution Form - Corporate Resolutions

Description

How to fill out Increase Dividend - Resolution Form - Corporate Resolutions?

Are you currently in the location where you require documents for either business or personal purposes almost every day? There are many legitimate document templates available online, but finding ones you can depend on is not easy.

US Legal Forms provides a vast selection of form templates, such as the Arizona Increase Dividend - Resolution Form - Corporate Resolutions, which are designed to meet federal and state requirements.

If you are already familiar with the US Legal Forms website and have an account, simply Log In. After that, you can download the Arizona Increase Dividend - Resolution Form - Corporate Resolutions template.

Locate all of the document templates you have purchased in the My documents menu. You can download an additional copy of the Arizona Increase Dividend - Resolution Form - Corporate Resolutions anytime, if desired. Just click on the needed form to download or print the document template.

Utilize US Legal Forms, one of the largest collections of legitimate forms, to save time and prevent mistakes. The service offers well-crafted legal document templates that can be used for a variety of purposes. Create your account on US Legal Forms and begin simplifying your life.

- Obtain the form you want and ensure it is for the correct city/state.

- Use the Preview button to review the form.

- Read the description to confirm you have selected the correct form.

- If the form is not what you're looking for, use the Search field to find the form that meets your needs and requirements.

- Once you find the appropriate form, click Get now.

- Choose the pricing plan you prefer, fill in the required information to create your account, and pay for the order using your PayPal or credit card.

- Select a convenient document format and download your version.

Form popularity

FAQ

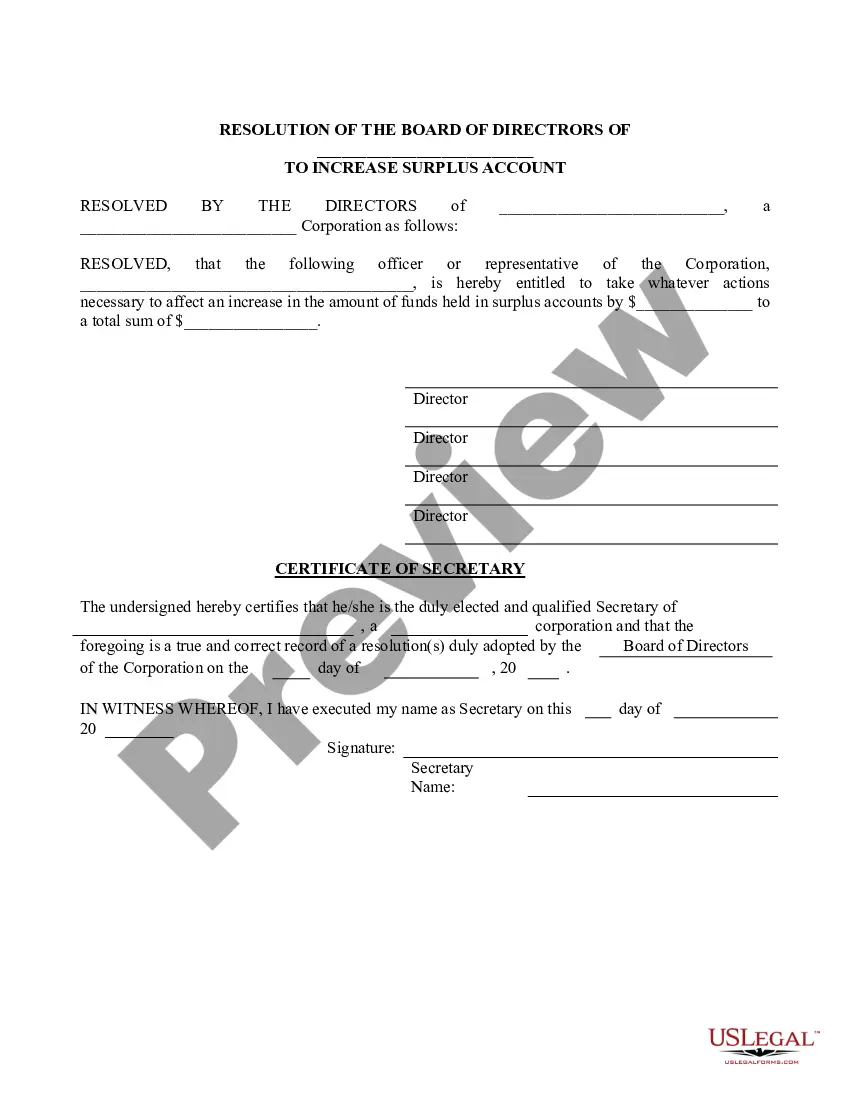

A corporate resolution form is an official document that captures the decisions made by a corporation’s board of directors or shareholders. It typically addresses significant matters like transferring shares or approving major expenses. The Arizona Increase Dividend - Resolution Form - Corporate Resolutions streamlines this process, offering a clear template that helps ensure all legal requirements are met. This form can simplify company operations and enhance transparency.

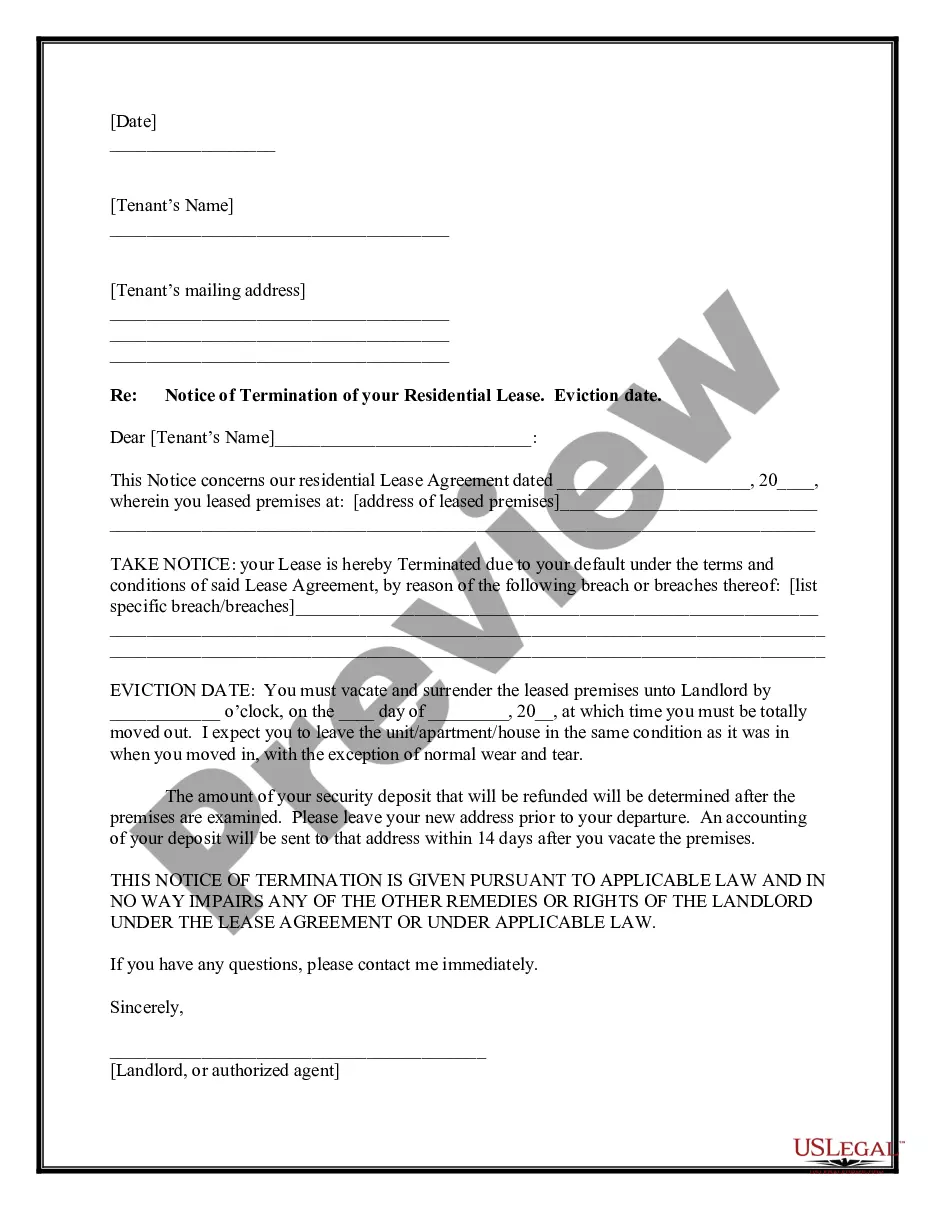

The resolution to sell corporate shares is a formal decision made by a company's board confirming the sale of shares to a buyer. This resolution details the specifics of the transaction, including the number of shares and sale conditions, guided by the Arizona Increase Dividend - Resolution Form - Corporate Resolutions. Implementing this resolution helps maintain proper corporate governance and ensures all shareholders are informed about changes in ownership.

The apportionment method for corporate income tax in Arizona allocates income based on the company's business activities within the state. This method considers factors such as sales, property, and payroll to determine tax liability. Understanding this can help corporations prepare their taxes more effectively. It's advisable to review guidance from the Arizona Increase Dividend - Resolution Form - Corporate Resolutions to ensure compliance.

Yes, a corporate resolution is often required to ensure that significant actions, such as transferring shares or making financial decisions, are documented and approved by the governing body of the company. The Arizona Increase Dividend - Resolution Form - Corporate Resolutions provides a framework for these decisions and reinforces good governance practices. This form is crucial for communicating important changes to shareholders and maintaining regulatory compliance.

A corporate resolution for a stock transfer is a written record stating the board’s decision regarding the transfer of stock ownership. It serves as proof that the transfer was approved in accordance with company bylaws and applicable laws like those outlined in the Arizona Increase Dividend - Resolution Form - Corporate Resolutions. This resolution protects the company legally and helps maintain accurate financial records. Proper documentation also aids in resolving potential disputes.

A company resolution to sell shares is a formal document that indicates the decision to sell ownership interests in the company. This document typically includes the number of shares, their value, and the terms of the sale, guided by the Arizona Increase Dividend - Resolution Form - Corporate Resolutions. This resolution helps maintain transparency and compliance with corporate governance standards. It's essential for keeping clear records of the ownership structure.

To transfer shares, a corporate resolution is necessary to ensure proper authorization and documentation. Specifically, the Arizona Increase Dividend - Resolution Form - Corporate Resolutions outlines the process and details involved in this transfer. Using this form will help protect your company’s interests and formalize the change in ownership. It ensures all parties involved have a clear understanding of the transfer.

To mail your Arizona state tax forms, you must send them to the address indicated on each form. Each document may have a specific mailing address, so it is vital to refer to the instructions provided. For those managing corporate structures, ensuring accuracy in your submissions helps maintain compliance, especially when it comes to your Arizona Increase Dividend - Resolution Form - Corporate Resolutions.

Arizona Form 120 should be filed with the Department of Revenue. You can file electronically through their online platform or submit a paper copy via mail. Proper filing ensures that your Arizona Increase Dividend - Resolution Form - Corporate Resolutions aligns with your tax obligations, facilitating smoother corporate operations and compliance.

The Arizona Income Tax Act of 1978 established a comprehensive state income tax system for individuals and corporations. This legislation outlines the tax obligations and rates applicable within the state. For those managing corporate resolutions, including the Arizona Increase Dividend - Resolution Form - Corporate Resolutions, being aware of this act can help you navigate your tax responsibilities effectively.