Arizona Dividend Policy - Resolution Form - Corporate Resolutions

Description

How to fill out Dividend Policy - Resolution Form - Corporate Resolutions?

If you aim to aggregate, acquire, or print authentic document templates, utilize US Legal Forms, the largest repository of legal forms available online.

Take advantage of the website's straightforward and user-friendly search feature to find the documents you require.

Various templates for business and personal purposes are categorized by type and region, or keywords.

Step 4. Once you have located the form you need, click the Get now button. Choose the payment plan you prefer and enter your details to register for an account.

Step 5. Process the payment. You can use your Visa, Mastercard, or PayPal account to complete the transaction.

- Employ US Legal Forms to obtain the Arizona Dividend Policy - Resolution Form - Corporate Resolutions with just a few clicks.

- If you are already a US Legal Forms member, Log In to your account and select the Obtain option to access the Arizona Dividend Policy - Resolution Form - Corporate Resolutions.

- You can also find forms you have previously downloaded in the My documents section of your account.

- If you are using US Legal Forms for the first time, follow the instructions outlined below.

- Step 1. Ensure you have chosen the form for the correct city/state.

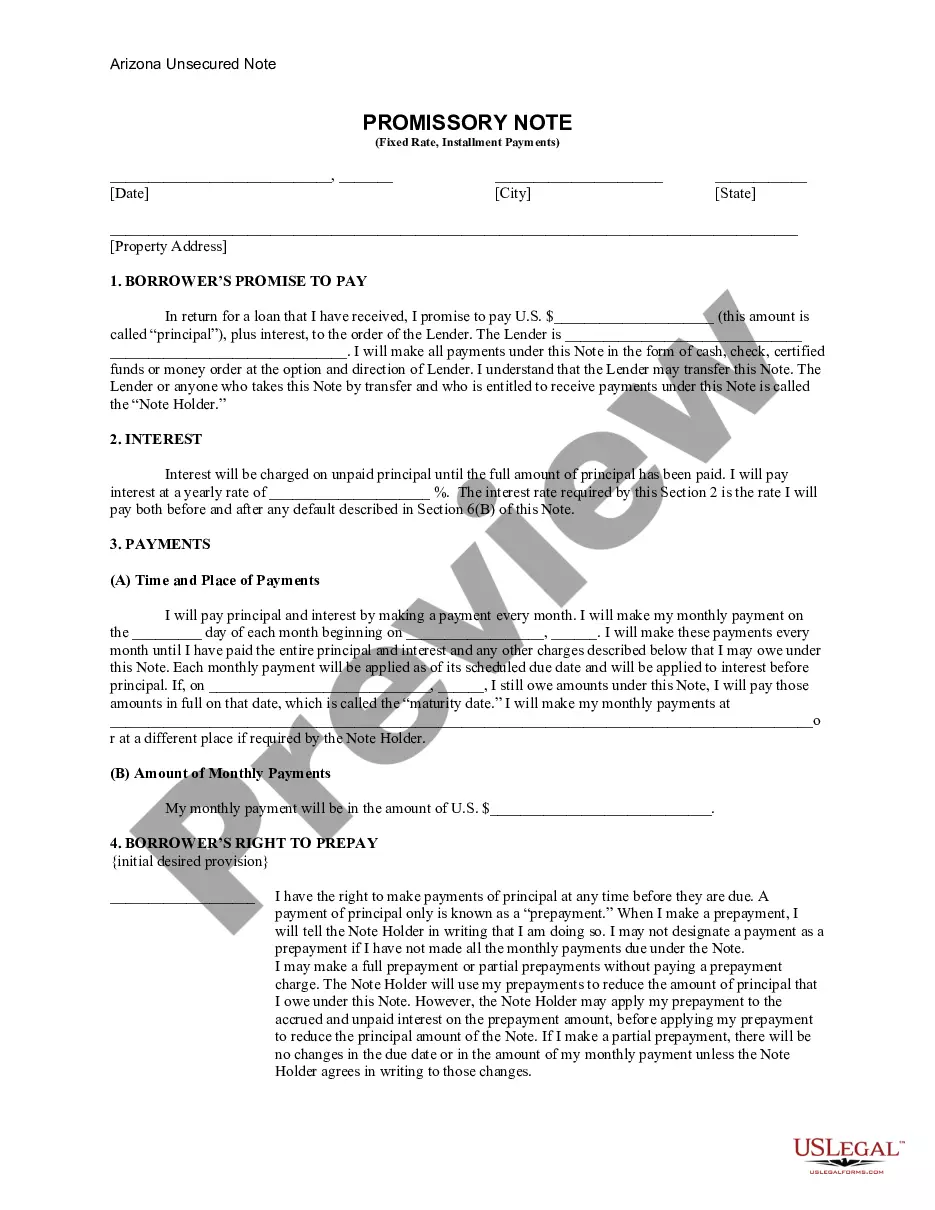

- Step 2. Use the Review option to evaluate the form's contents. Be sure to read the summary.

- Step 3. If you are not satisfied with the form, utilize the Search field at the top of the screen to find other forms within the legal template category.

Form popularity

FAQ

A corporate consent resolution is a written agreement that signifies unanimous consent from the board of directors or shareholders regarding specific actions without a formal meeting. This type of resolution helps streamline decision-making and often covers urgent matters requiring immediate attention. The 'Arizona Dividend Policy - Resolution Form - Corporate Resolutions' can be included in this process, providing a reliable structure for consent documentation.

An example of a resolution is one that approves a dividend payout to shareholders, outlining the amount and the schedule for distribution. This type of resolution is critical for financial transparency and compliance within a corporation. You can find a suitable format in the 'Arizona Dividend Policy - Resolution Form - Corporate Resolutions,' which can assist in your drafting process.

The format of a resolution typically includes a title, a statement of purpose, and the resolutions being proposed. Start with the organization's name and the date, followed by 'Resolved' statements to outline decisions or actions. Utilizing the 'Arizona Dividend Policy - Resolution Form - Corporate Resolutions' can guide you in structuring your resolution effectively and professionally.

Writing a company resolution involves summarizing the discussions and decisions made by the board or shareholders. Specify the action to be taken, the parties involved, and any relevant dates. Using a template such as the 'Arizona Dividend Policy - Resolution Form - Corporate Resolutions' can streamline this process, making it easier to ensure compliance and clarity.

To write a corporate resolution, start by clearly stating the purpose of the resolution, including relevant details such as the date and location of the meeting. Follow this with a formal declaration that specifies the decisions or actions taken by the corporation's board. Incorporate the 'Arizona Dividend Policy - Resolution Form - Corporate Resolutions' if it is applicable to your situation, ensuring that all necessary details are properly documented.

A shareholder resolution is necessary for involving shareholders in important company decisions. It promotes transparency and allows shareholders to voice their opinions on key issues. By properly utilizing the Arizona Dividend Policy - Resolution Form - Corporate Resolutions, you can ensure that shareholder resolutions follow legal requirements and support your corporate objectives.

A corporate resolution is a document that represents decisions made by a company's board of directors or shareholders. These resolutions are a vital part of corporate governance, ensuring that official actions are documented and legally binding. Following the Arizona Dividend Policy - Resolution Form - Corporate Resolutions strengthens your organization's lawful standing.

A shareholder resolution for the sale of shares is a formal proposal made by shareholders concerning the rights to sell their shares. This resolution often outlines the reasons for the sale and seeks the consent of other shareholders. Adhering to the Arizona Dividend Policy - Resolution Form - Corporate Resolutions can facilitate this process and clarify corporate intent.

A corporate resolution for share transfer is a document that authorizes the transfer of ownership of shares within a corporation. This resolution is essential for maintaining accurate records and ensuring that all transfers comply with legal requirements. Utilizing the Arizona Dividend Policy - Resolution Form - Corporate Resolutions can help your organization handle share transfers efficiently.

Writing a corporate resolution involves several key steps. First, you need to identify the purpose of the resolution and gather relevant details like dates and names. Draft the resolution clearly, stating the decisions being made and ensuring it follows the Arizona Dividend Policy - Resolution Form - Corporate Resolutions guidelines. Remember to have it signed by the appropriate parties for it to be valid.