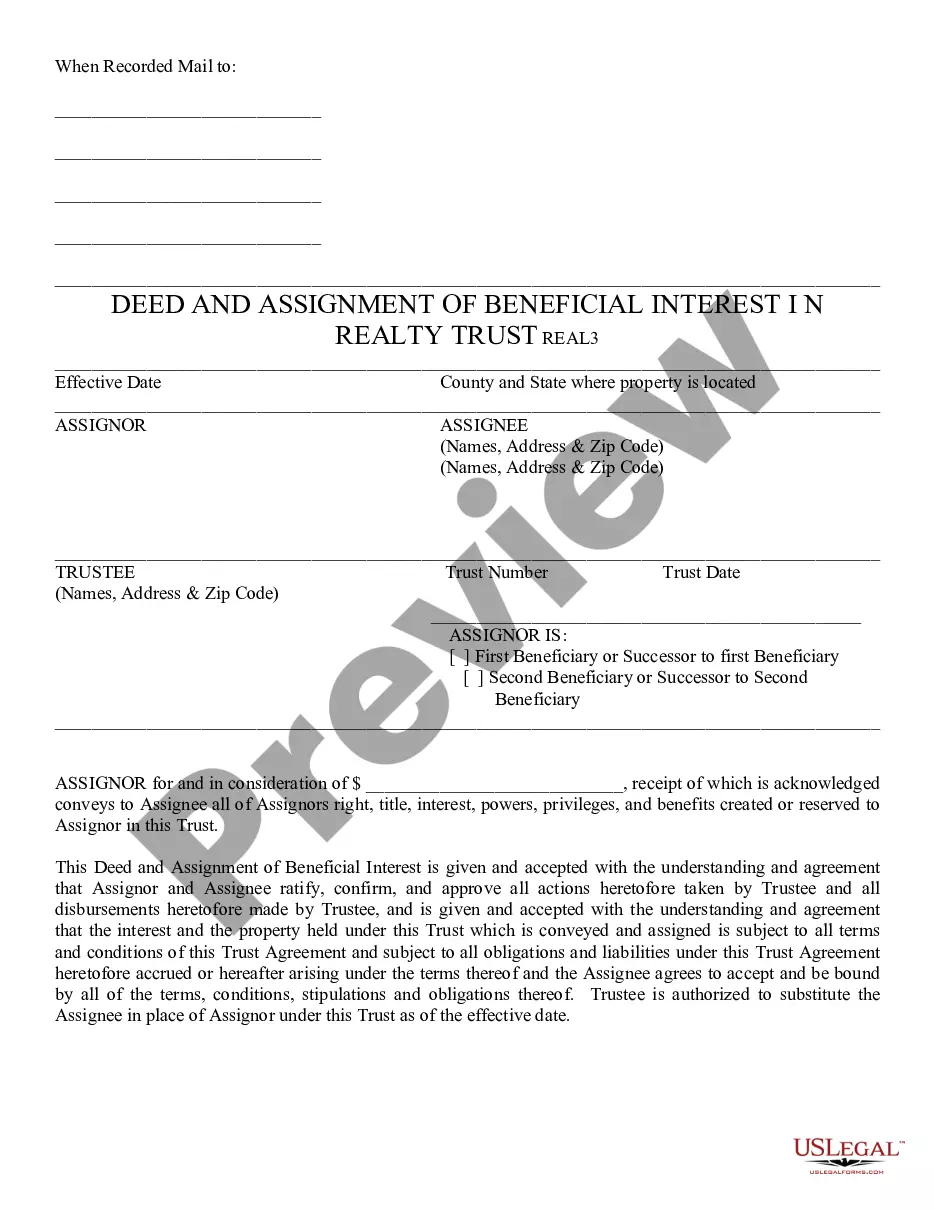

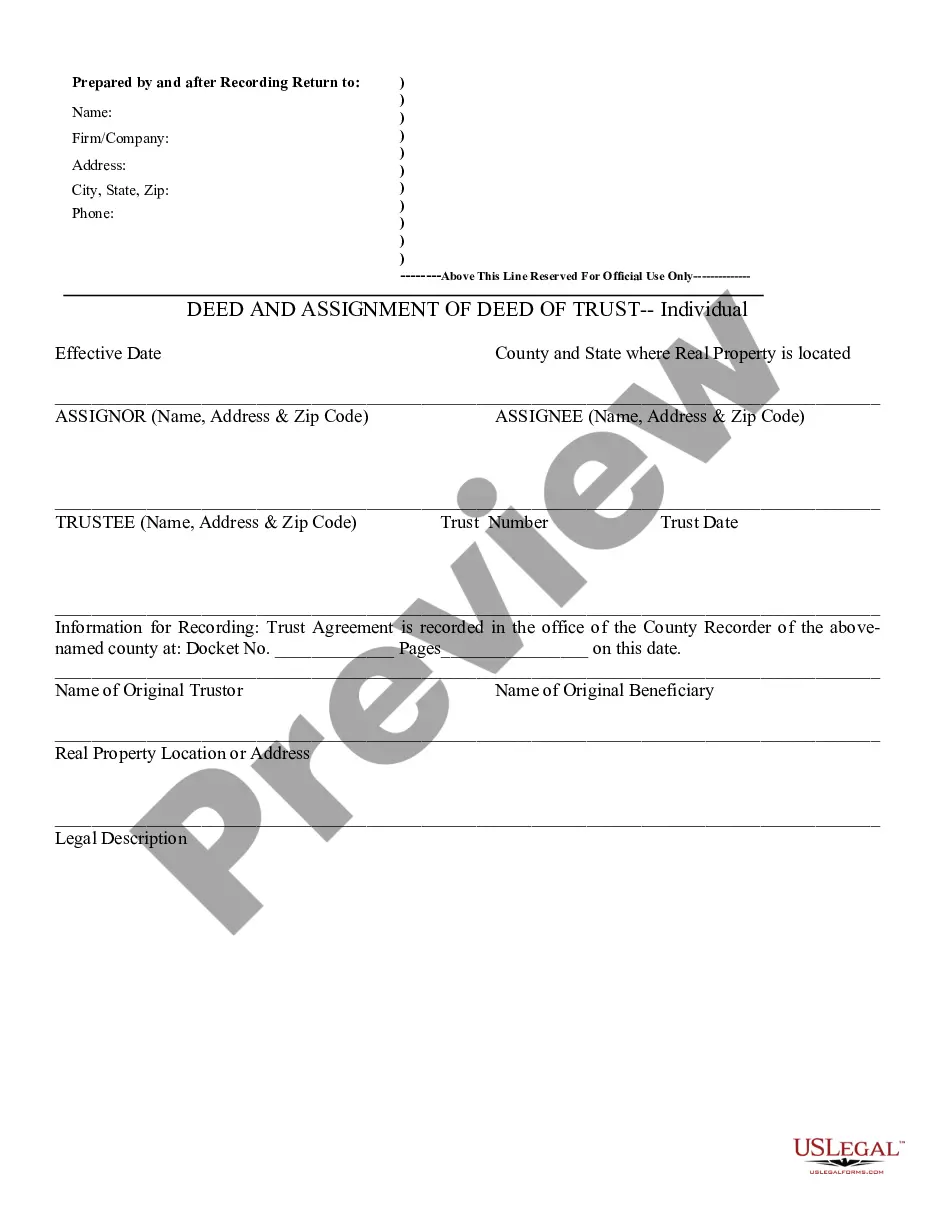

This deed, or deed-related form, is for use in property transactions in the designated state. This document, a sample Deed & Assignment of Beneficial Interest in Realty Trust, can be used in the transfer process or related task. Adapt the language to fit your circumstances. Available for download now in standard format(s).

Arizona Deed and Assignment of Beneficial Interest in Realty Trust

Description

How to fill out Arizona Deed And Assignment Of Beneficial Interest In Realty Trust?

If you are looking for accurate Arizona Deed and Assignment of Beneficial Interest in Realty Trust forms, US Legal Forms is precisely what you require; discover documents created and verified by state-certified legal experts.

Using US Legal Forms not only saves you from complications related to legal documentation; but also saves you time, effort, and money! Downloading, printing, and filling out a professional document is significantly less expensive than hiring an attorney to do it for you.

And that’s it! With just a few simple clicks, you have an editable Arizona Deed and Assignment of Beneficial Interest in Realty Trust. After setting up your account, all subsequent orders will be processed even more easily. Once you secure a US Legal Forms subscription, simply Log In to your account and click the Download button visible on the form’s page. Then, whenever you need to access this template again, you will be able to find it in the My documents section. Don’t waste time searching through numerous forms on various websites. Purchase accurate documents from one reliable service!

- To begin, complete your registration process by entering your email and creating a secure password.

- Follow the instructions below to set up your account and locate the Arizona Deed and Assignment of Beneficial Interest in Realty Trust template to address your needs.

- Utilize the Preview feature or review the document details (if available) to confirm that the form is the one you desire.

- Verify its legality in your state.

- Click on Buy Now to place an order.

- Choose a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Select an appropriate file format and save the document.

Form popularity

FAQ

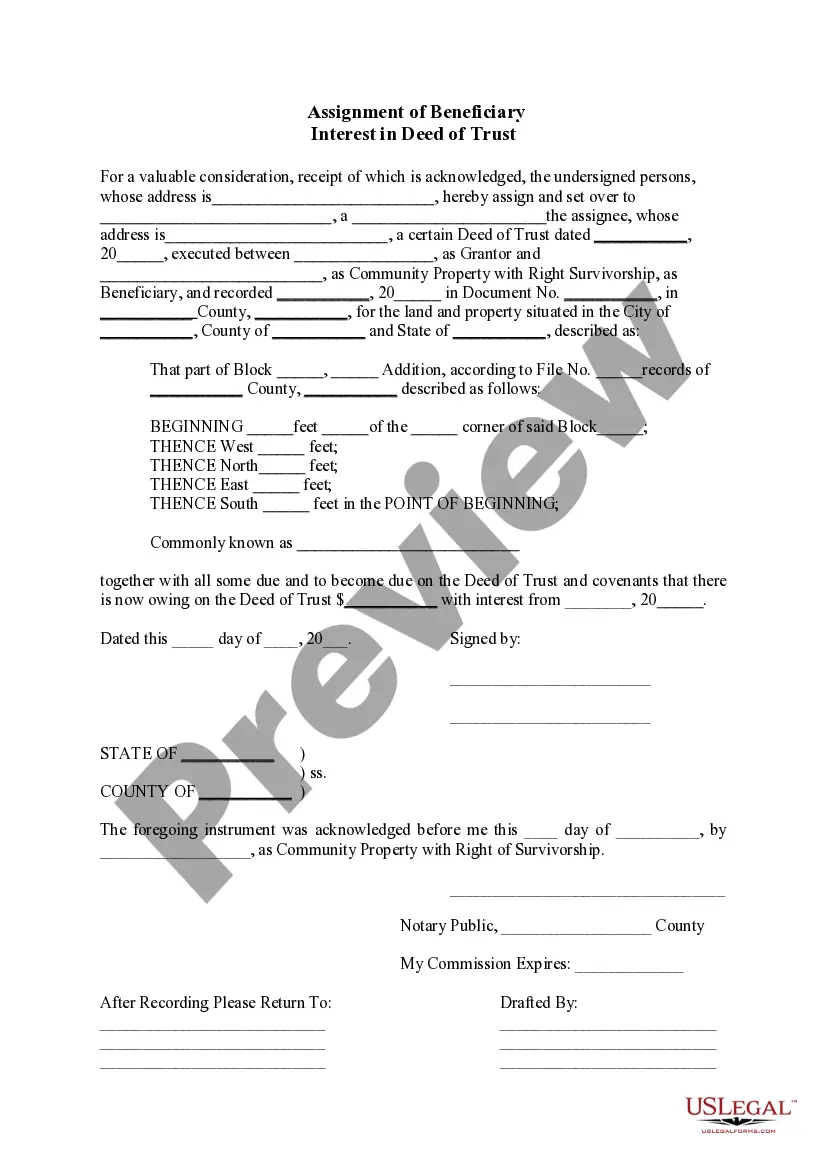

The deed of Assignment of beneficial interest transfers rights in a realty trust from one party to another. This document enables individuals to assign their interest in a property held in a trust, allowing for flexibility in managing assets. Understanding this deed is vital for anyone dealing with an Arizona Deed and Assignment of Beneficial Interest in Realty Trust, as it plays a crucial role in the transfer process. For additional assistance, US Legal Forms offers resources to simplify your experience with these legal documents.

Yes, Arizona allows for the use of a beneficiary deed. This deed helps property owners transfer real estate to their beneficiaries upon their death, avoiding probate. It is a useful tool for estate planning, ensuring that your assets transition smoothly. When considering an Arizona Deed and Assignment of Beneficial Interest in Realty Trust, knowing about beneficiary deeds can enhance your estate planning strategy.

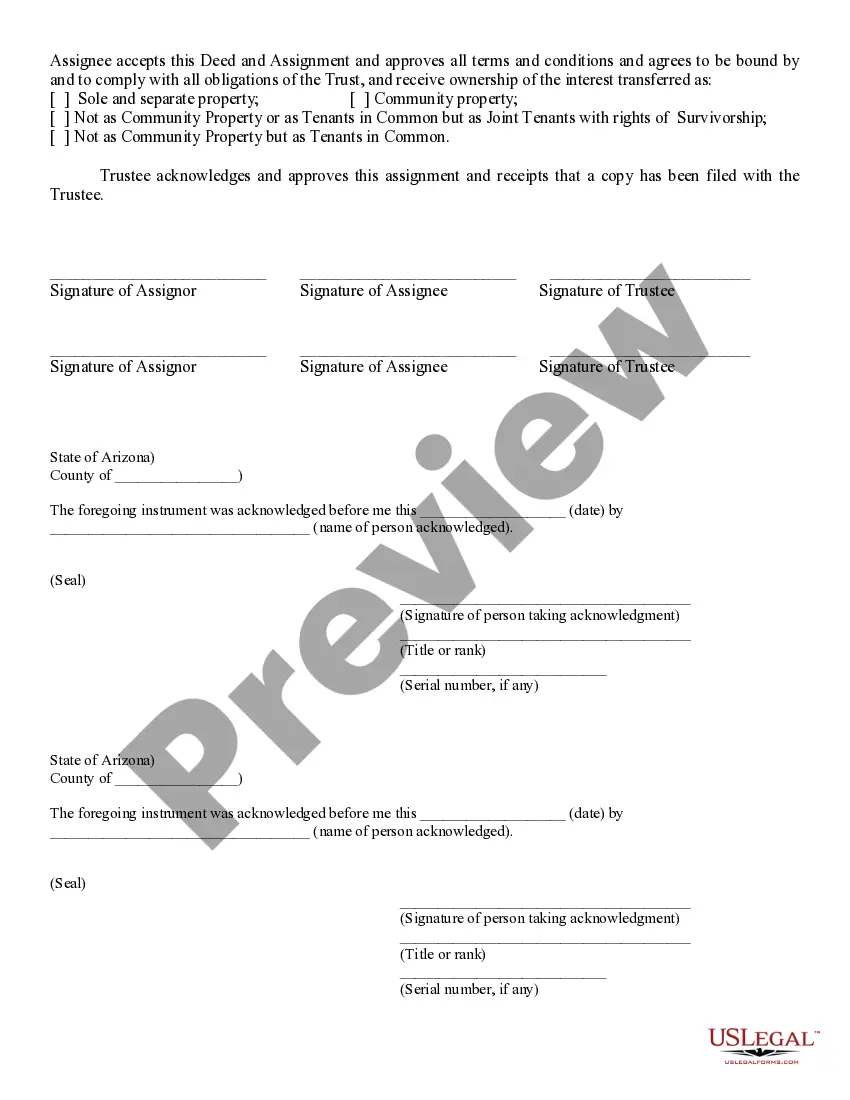

To record a beneficiary deed in Arizona, you need to fill out the form correctly, including details about the property and the beneficiaries. Next, take the completed Arizona Deed and Assignment of Beneficial Interest in Realty Trust to the county recorder's office in the county where the property is located. By filing this form, you ensure that your beneficiaries will receive the property automatically upon your death, simplifying the inheritance process.

In Arizona, while a deed does not have to be recorded to be valid between parties, recording it is crucial for public notice. An Arizona Deed and Assignment of Beneficial Interest in Realty Trust must be recorded to protect against claims by third parties and to establish your rights as the property owner. Therefore, it is advisable to record any deed you wish to enforce.

In Arizona, a properly executed beneficiary deed takes priority over a will regarding the property it covers. This means that if you have an Arizona Deed and Assignment of Beneficial Interest in Realty Trust, it will transfer the property directly to the named beneficiary, bypassing the will's provisions. This can simplify the transfer process and help avoid potential conflicts among heirs.

Yes, in Arizona, a beneficiary deed should be recorded with the county recorder's office to ensure its validity. Recording the Arizona Deed and Assignment of Beneficial Interest in Realty Trust protects the beneficiary's rights and prevents potential disputes over the property after the owner's death. It is essential to file this deed before the owner's passing to secure its effectiveness.

To transfer a property deed from a deceased relative in Arizona, you first need to determine if the property is part of a trust or if it is subject to probate. If there is a beneficiary designated, such as in a beneficiary deed or an Arizona Deed and Assignment of Beneficial Interest in Realty Trust, you can directly transfer ownership to that beneficiary. If not, you may need to file for probate, allowing the court to approve the transfer of the property according to the deceased's wishes.

To put your home in a trust in Arizona, you need to create a trust document that specifies the trust's terms and beneficiaries. After creating the trust, you must transfer the property into the trust by executing a new deed and recording it with the local county recorder's office. Utilizing resources such as US Legal Forms can simplify this procedure and ensure that your home is effectively managed under the Arizona Deed and Assignment of Beneficial Interest in Realty Trust.

Filing a beneficiary deed in Arizona involves completing the appropriate forms and then recording them with your county recorder’s office. This deed must be executed while you are alive and can help avoid probate after your death. Always check the specifics related to the Arizona Deed and Assignment of Beneficial Interest in Realty Trust to ensure that all requirements are met for a smooth filing process.

To transfer a deed to a trust in Arizona, you must execute a new deed that conveys the property into the trust. This deed needs to be signed, notarized, and recorded with the county recorder's office. It is wise to consult legal resources like US Legal Forms to ensure compliance with all steps for an efficient transfer process, especially when dealing with the Arizona Deed and Assignment of Beneficial Interest in Realty Trust.