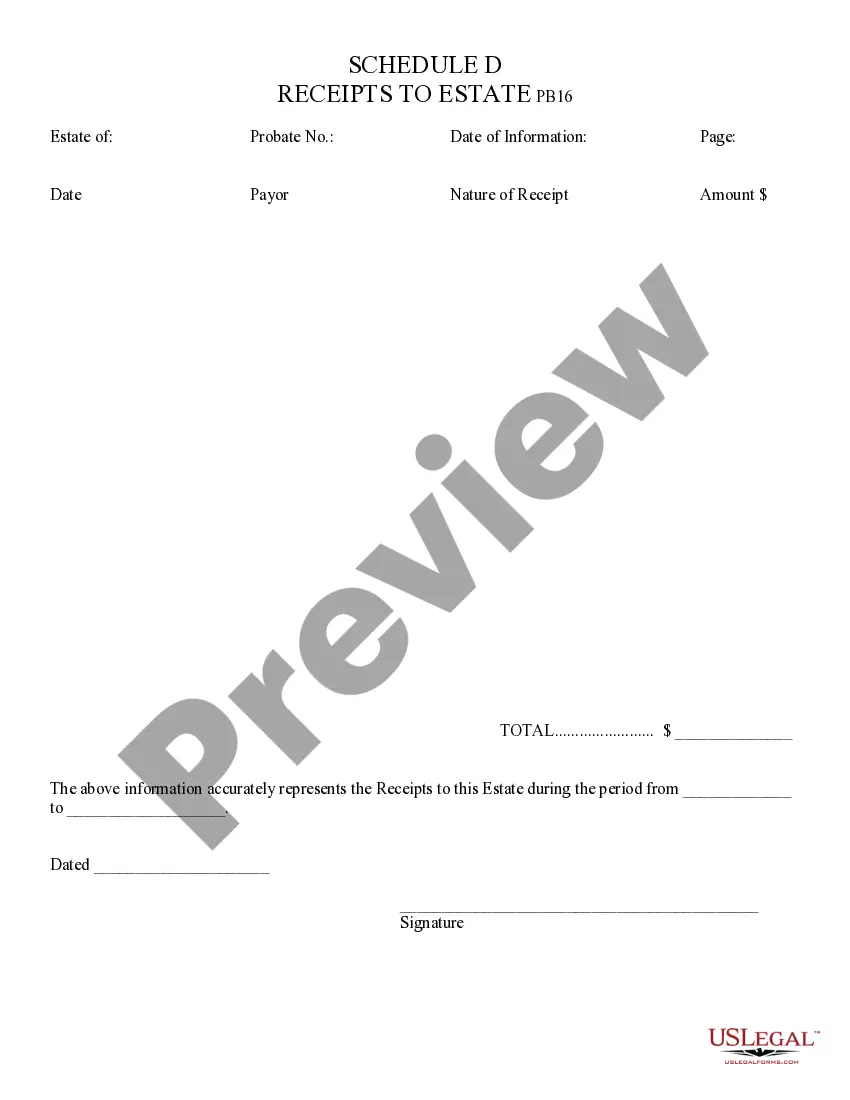

Receipts to Estate - Arizona: This form is used when an administrator of an estate is called upon to list all the receipts of any payments made by the estate. It states the amount of the receipt, as well as the Payor. It is available for download in both Word and Rich Text formats.

Arizona Receipts to Estate

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Receipts To Estate?

If you're in search of suitable Arizona Receipts for Estate samples, US Legal Forms is what you require; obtain files prepared and verified by state-certified legal experts.

Using US Legal Forms not only alleviates concerns regarding legal documents; you also save energy and time, and money!

And that's all. With a few easy clicks, you have an editable Arizona Receipts for Estate. After you establish your account, all future requests will be handled even more effortlessly. Once you have a US Legal Forms subscription, simply Log In to your account and click the Download button available on the form's page. Then, when you need to utilize this blank form again, you can always locate it in the My documents section. Don't waste your time comparing numerous forms on various online platforms. Acquire precise documents from one secure website!

- To begin, finalize your registration process by entering your email and creating a password.

- Follow the steps below to set up your account and acquire the Arizona Receipts for Estate template to address your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the form is the one you need.

- Verify its relevance in the state where you reside.

- Click Buy Now to complete your purchase.

- Choose a suggested payment plan.

- Create an account and settle the payment using your credit card or PayPal.

Form popularity

FAQ

In Arizona, assets such as life insurance policies with named beneficiaries, retirement accounts, and properties held in joint tenancy often bypass probate. These exemptions can simplify the transfer of assets. By strategically managing Arizona receipts to estate and utilizing available exemptions, families can ensure a more efficient inheritance process.

As mentioned earlier, in Arizona, an estate must be valued at over $75,000 in personal property or exceed $100,000 in real estate to necessitate probate. This understanding can be vital for estate planning purposes. Proper attention to Arizona receipts to estate value can streamline the management of assets and alleviate the complexities of probate.

To file a claim against an estate in Arizona, creditors must submit their claims formally to the personal representative. The claim should detail the amount owed and the nature of the debt, following the deadlines in probate notices. Understanding the process around Arizona receipts to estate allows you to approach claims systematically, ensuring that you secure your rightful payments.

Not all estates in Arizona must enter probate, especially if assets are owned jointly, titled in a trust, or have designated beneficiaries. Such arrangements can save time and resources. Familiarity with how Arizona receipts to estate function can empower individuals and families to make the best choices regarding asset management while avoiding probate.

An estate in Arizona must exceed $75,000 in personal assets or $100,000 in real estate value to initiate probate. This threshold can influence estate planning decisions significantly. By addressing Arizona receipts to estate with foresight, individuals can make informed choices about their assets to avoid unnecessary probate complications.

Generally, bank accounts in Arizona can bypass probate if they have a payable-on-death (POD) designation or are joint accounts. This provision allows the transfer of funds directly to the named beneficiary. Knowing how Arizona receipts to estate are affected by account designations can ensure swift access to funds for heirs, minimizing delays after a loved one passes.

To avoid probate in Arizona, individuals can utilize living trusts, joint ownership, and designated beneficiary accounts. Such strategies ensure smooth asset transfer upon death without going through probate. When considering Arizona receipts to estate, implementing these methods can significantly streamline inheritance processes for surviving beneficiaries.

Claims against an estate may include debts owed by the deceased, medical bills, and outstanding loans. Creditors will need to file their claims within the designated period to receive compensation. Navigating these claims effectively is crucial for managing Arizona receipts to estate and ensuring fair distribution among heirs. Timely attention to these matters can prevent disputes later.

Certain assets in Arizona can be exempt from probate, including joint tenancy properties, assets held in trust, and bank accounts with designated beneficiaries. Understanding these exemptions helps streamline the estate settlement process. By focusing on Arizona receipts to estate that qualify for exemptions, individuals can reduce the workload and potentially save on related fees.

Inherited property in Arizona usually benefits from a tax provision known as a step-up in basis, which may exempt it from capital gains tax at the time of inheritance. However, any future sales could incur taxes based on the appreciated value beyond the inherited basis. Knowing how Arizona receipts to estate interplay with tax implications can help beneficiaries make informed decisions about selling inherited assets.