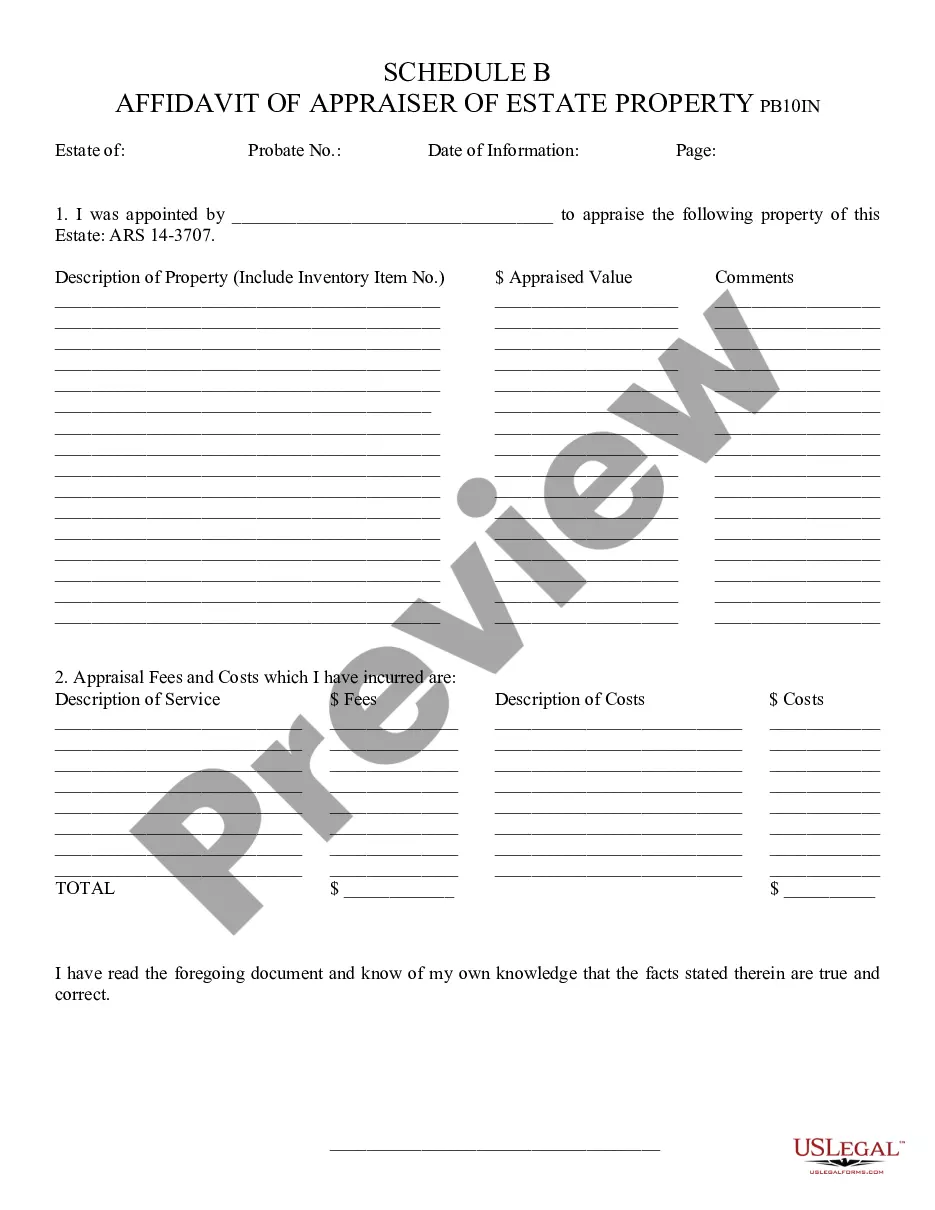

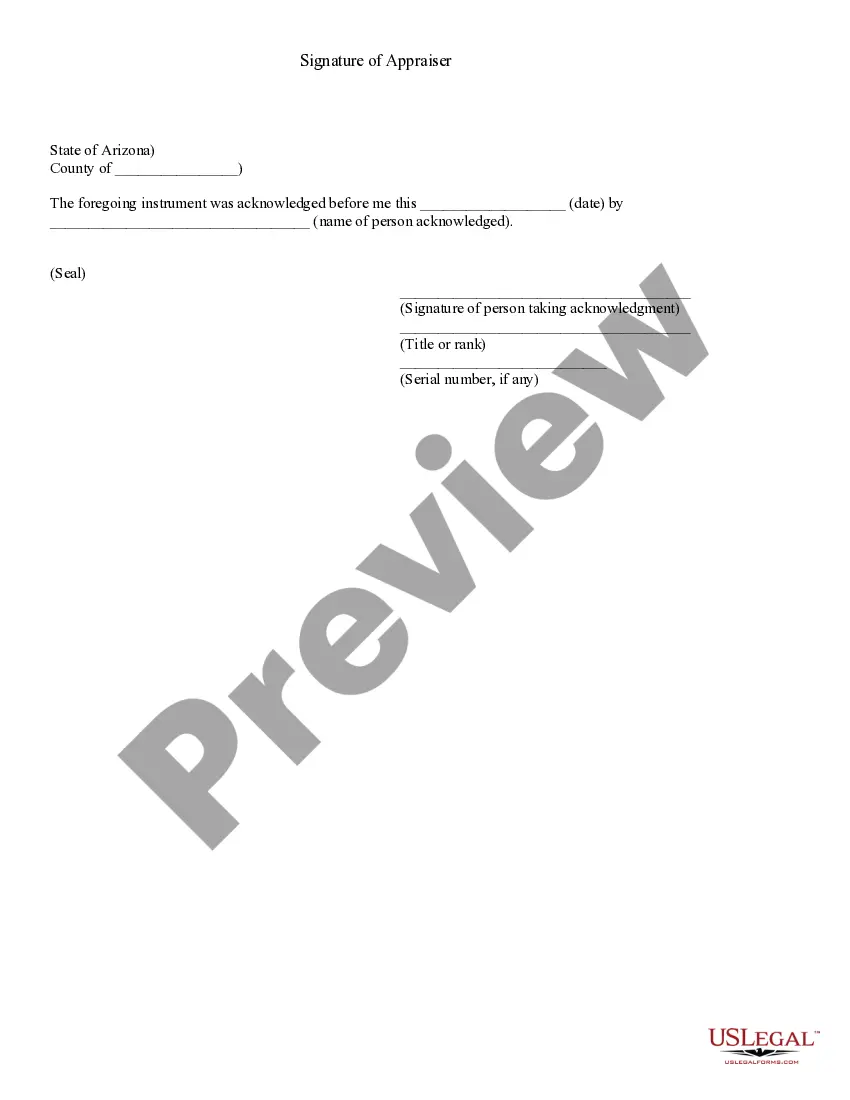

Affidavit of Appraiser of Estate Property, Schedule B - Arizona: This affidavit details the appraisal of an estate's property. The appraiser lists all the property and then gives an estimate as to its value. He/She then signs the form in front of a Notary Public. It is available for download in both Word and Rich Text formats.

Arizona Schedule B

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Schedule B?

If you are looking for accurate Arizona Schedule B forms, US Legal Forms is exactly what you need; find documents created and reviewed by state-licensed attorneys.

Utilizing US Legal Forms not only protects you from issues related to legal documents; additionally, you conserve time and effort, as well as financial resources! Downloading, printing, and filling out a professional form is significantly cheaper than hiring a lawyer to do it for you.

And that’s it. In just a few simple steps, you possess an editable Arizona Schedule B. After creating an account, all future purchases will be processed even more effortlessly. Once you have a US Legal Forms subscription, just Log In to your account and click the Download button available on the form’s page. Then, whenever you need to use this template again, you will always be able to find it in the My documents section. Do not waste your time comparing many forms on various websites. Purchase professional templates from a single trustworthy source!

- To start, complete your registration process by entering your email and creating a secure password.

- Follow the steps below to establish an account and obtain the Arizona Schedule B template to address your needs.

- Utilize the Preview feature or review the document details (if available) to ensure that the sample meets your requirements.

- Verify its legality in your state.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create your account and pay using a credit card or PayPal.

- Choose a suitable format and save the form.

Form popularity

FAQ

Yes, Arizona does have state income tax for retirees, but certain exemptions and deductions may apply. Income from pensions and Social Security may be partially or fully excluded depending on the circumstances. To fully understand your situation, review your earnings in relation to the Arizona Schedule B.

Arizona income tax applies to residents and nonresidents who earn income from Arizona sources. This includes wages, rental income, or any business operations conducted within the state. Reviewing the Arizona Schedule B will help clarify your tax responsibilities based on your earned income.

For a gross income of $120,000, you might take home around $75,000 to $80,000 after taxes in Arizona. Your personal deductions, filing status, and any credits can shift this figure. Analyzing your potential tax burden with the Arizona Schedule B can assist in understanding your net income more clearly.

You can obtain a Schedule B from the IRS website or through tax preparation software. Many tax professionals also have access to the form and can provide you with guidance. Don't forget to look into resources that explain the Arizona Schedule B for state-specific needs.

Earning $500,000 in Arizona may leave you with around $320,000 to $350,000 after both federal and state tax deductions. Your exact amount will depend on your specific situation, tax deductions, and credits. Use the Arizona Schedule B to accurately estimate your tax implications.

Arizona does tax foreign income if that income is reported on your federal tax return. Any income earned outside the U.S. must be accounted for. To navigate these complexities, consult your Arizona Schedule B for clarity on reporting your total income correctly.

Nonresidents must file Arizona state taxes if they earn income sourced from Arizona. This includes freelancers, contractors, and individuals working within the state. Reviewing the Arizona Schedule B will guide you through the necessary forms and requirements for nonresidents.

A salary of $100,000 is generally considered above average in Arizona, providing a comfortable lifestyle in many parts of the state. However, your standard of living may vary based on location and personal expenses. Leveraging resources like the Arizona Schedule B can help you understand your net income after taxes.

When earning $200,000 in Arizona, you can expect around $130,000 after federal and state taxes, depending on your tax deductions and filings. It's crucial to assess your specific tax bracket using the Arizona Schedule B for precise calculations and to maximize your deductions.

Certain groups may be exempt from Arizona state income tax, including low-income individuals and some federal retirees. Additionally, certain income types may not be taxable under Arizona law. Utilizing the Arizona Schedule B can help determine if your income qualifies for any exemptions.