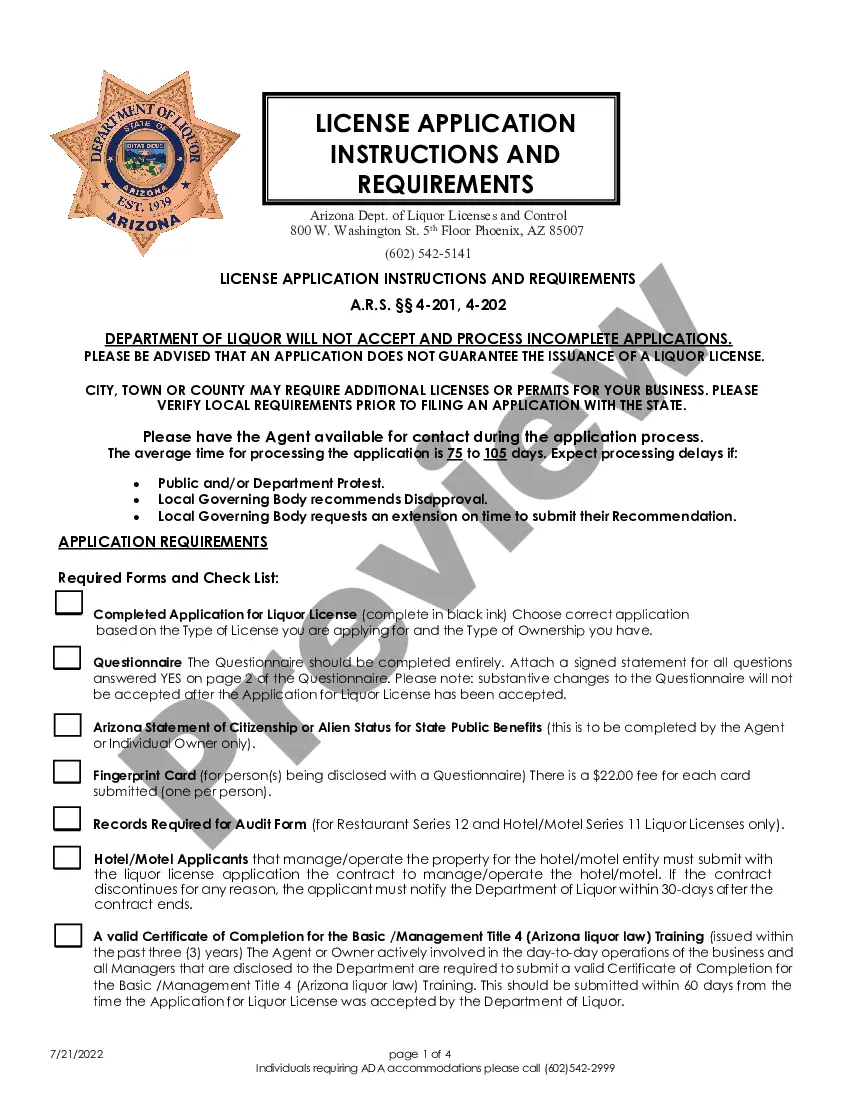

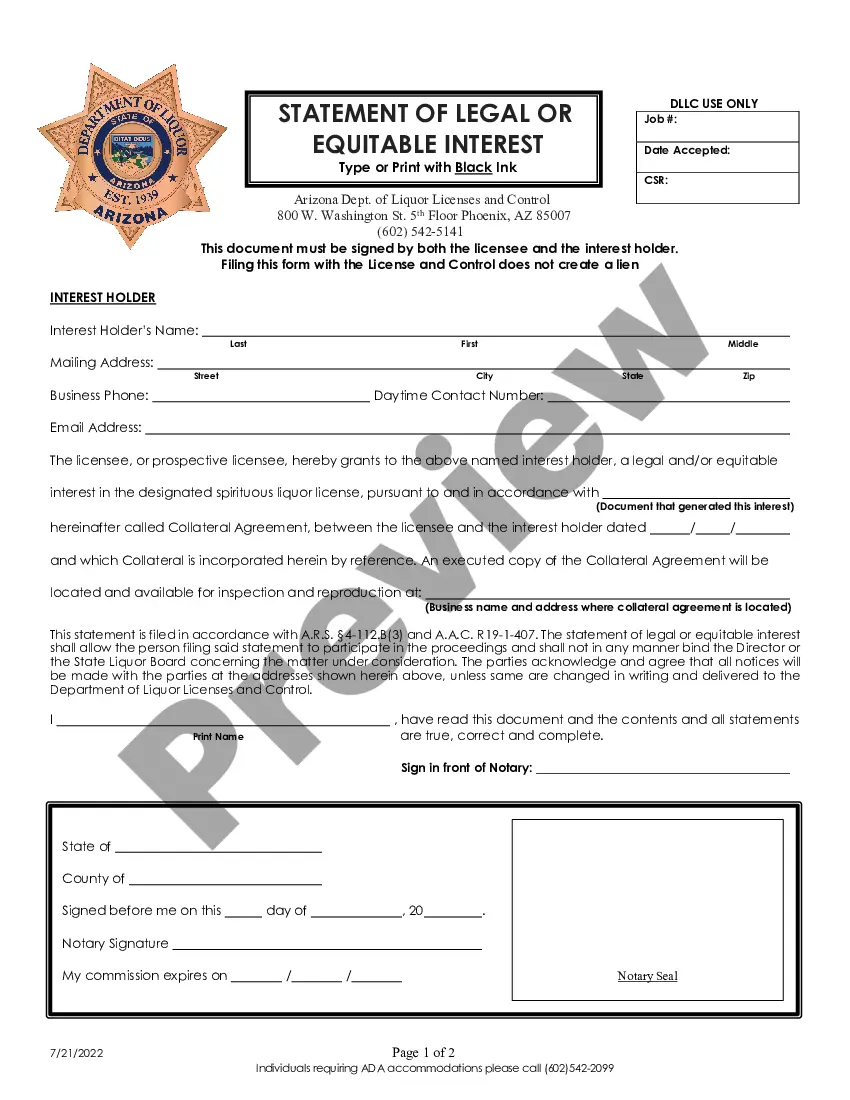

Arizona Non-Judicial Foreclosure Affidavit is a document used by lenders to initiate foreclosure proceedings against borrowers in the state of Arizona. It is typically filed with the county recorder's office in the county where the property is located. The affidavit outlines the lender's rights to foreclose and sets out the timeline for the process. It also includes a description of the property, the borrower's name, and a statement that the borrower has defaulted on the loan. There are two main types of Arizona Non-Judicial Foreclosure Affidavit: a Notice of Sale and a Power of Sale. A Notice of Sale includes information about the property, the borrower, and the foreclosure process, and is typically filed with the county recorder's office. A Power of Sale includes a description of the property, the borrower's name, and a statement that the borrower has defaulted on the loan, and is typically filed with the court.

Arizona Non Judicial Foreclosure Affidavit

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Non Judicial Foreclosure Affidavit?

US Legal Forms is the most straightforward and affordable method to find suitable legal templates.

It’s the most comprehensive online collection of business and personal legal documents created and verified by attorneys.

Here, you can discover printable and editable templates that adhere to national and local regulations - just like your Arizona Non Judicial Foreclosure Affidavit.

Examine the form description or preview the document to ensure you’ve identified the one that satisfies your needs, or search for another using the search option above.

Hit Buy now when you’re certain about its suitability with all the criteria, and select the subscription plan you prefer the most.

- Acquiring your template involves just a few easy steps.

- Users who already possess an account with a valid subscription only need to Log In to the site and download the form onto their device.

- Afterward, they can locate it in their profile in the My documents section.

- And here’s how you can secure a professionally prepared Arizona Non Judicial Foreclosure Affidavit if you are utilizing US Legal Forms for the first time.

Form popularity

FAQ

Arizona is primarily a non-judicial foreclosure state, which means that lenders can proceed with foreclosure without court intervention. The process starts with the filing of the Arizona Non Judicial Foreclosure Affidavit, allowing for a more efficient timeline. While judicial foreclosure can occur in certain circumstances, most foreclosures in Arizona follow the non-judicial route. Understanding this distinction helps homeowners prepare appropriately for any potential foreclosure proceedings.

Arizona permits non-judicial foreclosure, which allows lenders to recover properties without going through the court system. This process is initiated with the Arizona Non Judicial Foreclosure Affidavit, facilitating a speedier resolution than judicial foreclosure. Non-judicial foreclosures follow a defined timeline and set of rules, making them a common choice for lenders. Homeowners facing foreclosure should be aware of this process and consult legal resources for guidance.

Non-judicial foreclosures are permitted in several states, including Arizona, California, and Nevada. In these states, lenders can foreclose without court involvement by following specific procedures. This process can streamline foreclosures, allowing lenders to reclaim properties more quickly. Familiarity with your state's laws can help homeowners navigate their options more effectively.

The timeframe for foreclosure in Arizona can vary, but generally, it takes about 90 to 120 days when following non-judicial procedures. The process begins once the lender files the Arizona Non Judicial Foreclosure Affidavit, which sets the clock ticking on notifications and auctions. Homeowners should expect a timeline influenced by various factors, including the lender's actions and the borrower's responses. Understanding this timeline is crucial for effective financial planning.

The 120-day rule in Arizona refers to the required waiting period after a notice of default is issued before a property can be sold at auction. This rule aims to provide homeowners adequate time to address outstanding payments and avoid foreclosure. During this period, borrowers have options to resolve their debts, and lenders must be cautious in their actions. An Arizona Non Judicial Foreclosure Affidavit can clarify expectations during these 120 days.

Yes, Arizona is a non-judicial foreclosure state, which means lenders can foreclose without going through the court system. This process simplifies and expedites property sales when borrowers default on their loans. Non-judicial foreclosures in Arizona adhere to specific statutory requirements, including providing proper notices. The Arizona Non Judicial Foreclosure Affidavit plays a crucial role in ensuring these legal requirements are met.

In Arizona, lenders can initiate foreclosure procedures after a borrower misses three consecutive payments. However, the exact timeline can vary depending on lender policies and specific mortgage agreements. It is important for homeowners to communicate with their lenders if they face financial difficulties. The Arizona Non Judicial Foreclosure Affidavit can help outline the situation effectively.

To initiate foreclosure on a property in Arizona, the lender must first issue a notice of default to the homeowner. The homeowner is then given a period, usually about 30 days, to rectify the default by making the required payments. After this period, if the default remains unresolved, the lender can proceed with auctioning the property. Employing an Arizona Non Judicial Foreclosure Affidavit can assist in documenting this process accurately.

To foreclose on a property in Arizona, lenders typically initiate a non-judicial process due to the state's laws. They must provide a notice of the default to the property owner, allowing a specified period to rectify the issue. Following this, the lender can sell the property through a public auction. Using an Arizona Non Judicial Foreclosure Affidavit can streamline this process and provide essential documentation.

In Arizona, a bank can initiate foreclosure proceedings as soon as you default on your mortgage payments. The entire process may take around 90 to 120 days, provided proper notices are given. Understanding the role of the Arizona Non Judicial Foreclosure Affidavit can help you navigate this complex situation. Engaging with professionals can provide clarity and guidance, ensuring that you make informed decisions.