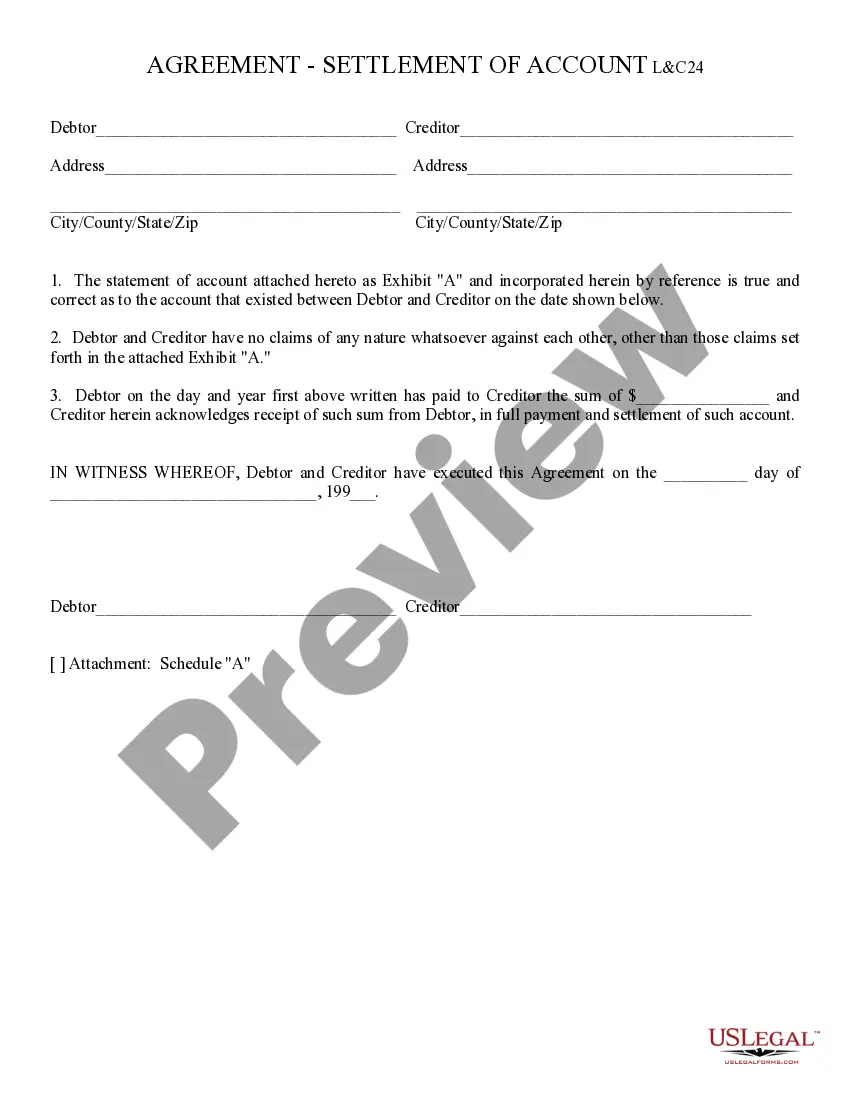

Settlement of Account: A Settlement of Account states that the Buyer and Seller previously had entered into a contract with one another; however, that contract has been fulfilled by both parties. Therefore, this a Statement that the account is settled and no other obligations are to be performed by either party. This form is available for download in both Word and Rich Text formats.

Arizona Settlement of Account

Description

How to fill out Arizona Settlement Of Account?

If you're looking for precise Arizona Settlement of Account duplicates, US Legal Forms is precisely what you require; obtain documents supplied and verified by state-certified legal professionals.

Utilizing US Legal Forms not only alleviates concerns regarding legal paperwork; you also save time, effort, and resources!

And that’s it. In just a few simple steps, you receive an editable Arizona Settlement of Account. Once you create an account, all future orders will be processed even more easily. When you have a US Legal Forms subscription, just Log In and then click the Download button you see on the form’s page. Later, when you need to use this template again, you'll always be able to find it in the My documents section. Don't waste your time and effort comparing numerous forms across various sites. Purchase accurate documents from a single secure service!

- To start, finalize your registration process by providing your email and creating a password.

- Follow the instructions below to establish your account and acquire the Arizona Settlement of Account template to fulfill your requirements.

- Utilize the Preview option or review the file description (if available) to confirm that the form is the one you need.

- Verify its validity in your jurisdiction.

- Click Buy Now to place an order.

- Choose a preferred pricing plan.

- Set up an account and complete payment with a credit card or PayPal.

- Select an appropriate file format and save the document.

Form popularity

FAQ

Residents and non-residents required to file a return generally include individuals whose income meets specific thresholds defined by Arizona tax laws. Additionally, those with earned income from Arizona must file, regardless of residency. Understanding these requirements is essential for maintaining a clear Arizona Settlement of Account and remaining compliant with state tax regulations.

Yes, Arizona allows taxpayers to file amended returns electronically through the Arizona Department of Revenue's online platform. Filing electronically can speed up the processing time and provide immediate confirmation. This efficient method helps ensure a proper Arizona Settlement of Account by keeping your tax records accurate.

Corporations doing business in Arizona or earning income from Arizona sources must file Arizona's Corporation tax return. This includes both domestic and foreign corporations. Filing accurately is key to achieving a correct Arizona Settlement of Account, ensuring all tax obligations are met.

To file a claim against the state of Arizona, you should first identify the grounds for your claim, such as negligence or wrongful action. Then, follow the specific procedures set by the Arizona State Government, which include completing necessary forms. Utilizing the resources available at USLegalForms can simplify the process and guide you in achieving a successful Arizona Settlement of Account.

Individuals must file an Arizona tax return if they are residents and their income exceeds certain levels based on filing status. Additionally, non-residents who earn income in Arizona also need to file. Understanding who must file helps to ensure a smooth Arizona Settlement of Account, enabling compliance with the state's tax requirements.

Yes, as a non-resident, you may need to file an Arizona tax return if you earned income from Arizona sources. Non-residents are taxed on income generated in Arizona, and you should file to comply with state tax laws. This process is part of maintaining a clear Arizona Settlement of Account, helping you fulfill your tax obligations.

Individuals who live or work in Arizona generally need to file a state tax return if they meet certain income thresholds. Even if you are not a resident, if you earned income in Arizona, you may need to file an Arizona tax return. It is crucial to understand your filing obligations to ensure proper Arizona Settlement of Account and avoid penalties.

The final settlement of account represents the conclusion of a financial agreement where no further debts exist. This status confirms that all parties have fulfilled their obligations and that the account balance is zero. Properly achieving this status is essential for a successful Arizona Settlement of Account.

The 7 in 7 rule refers to a strategy where a collector should attempt to reach out to a debtor within seven days of defaulting on payments. This rule aims to prompt quick communication to resolve outstanding debts before they escalate. Implementing this rule can help facilitate an effective Arizona Settlement of Account.

In accounting, settlement refers to the process of resolving outstanding balances between parties. It involves determining the exact amount owed and finalizing the payment terms. Grasping the concept of settlement is key when managing your Arizona Settlement of Account to ensure accurate financial records.