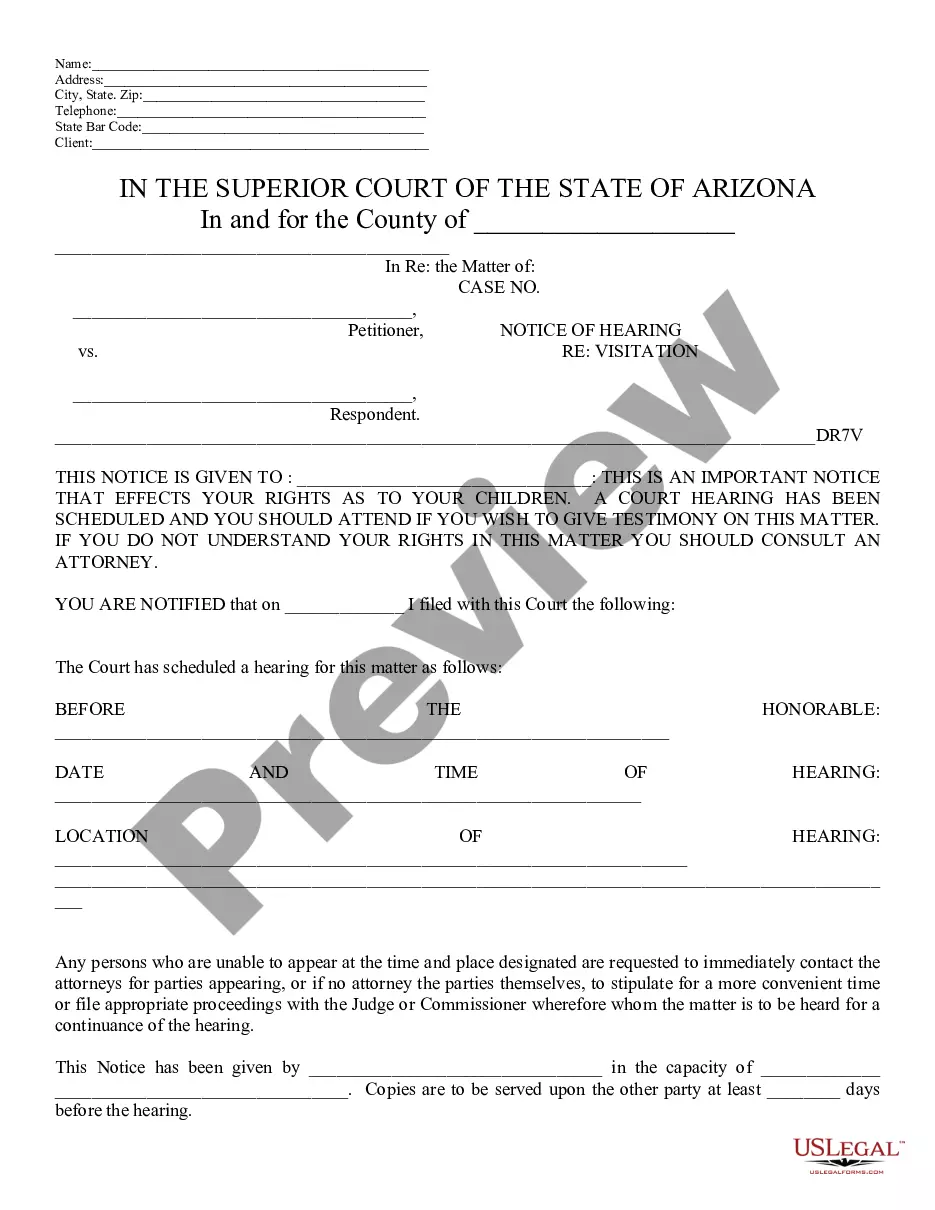

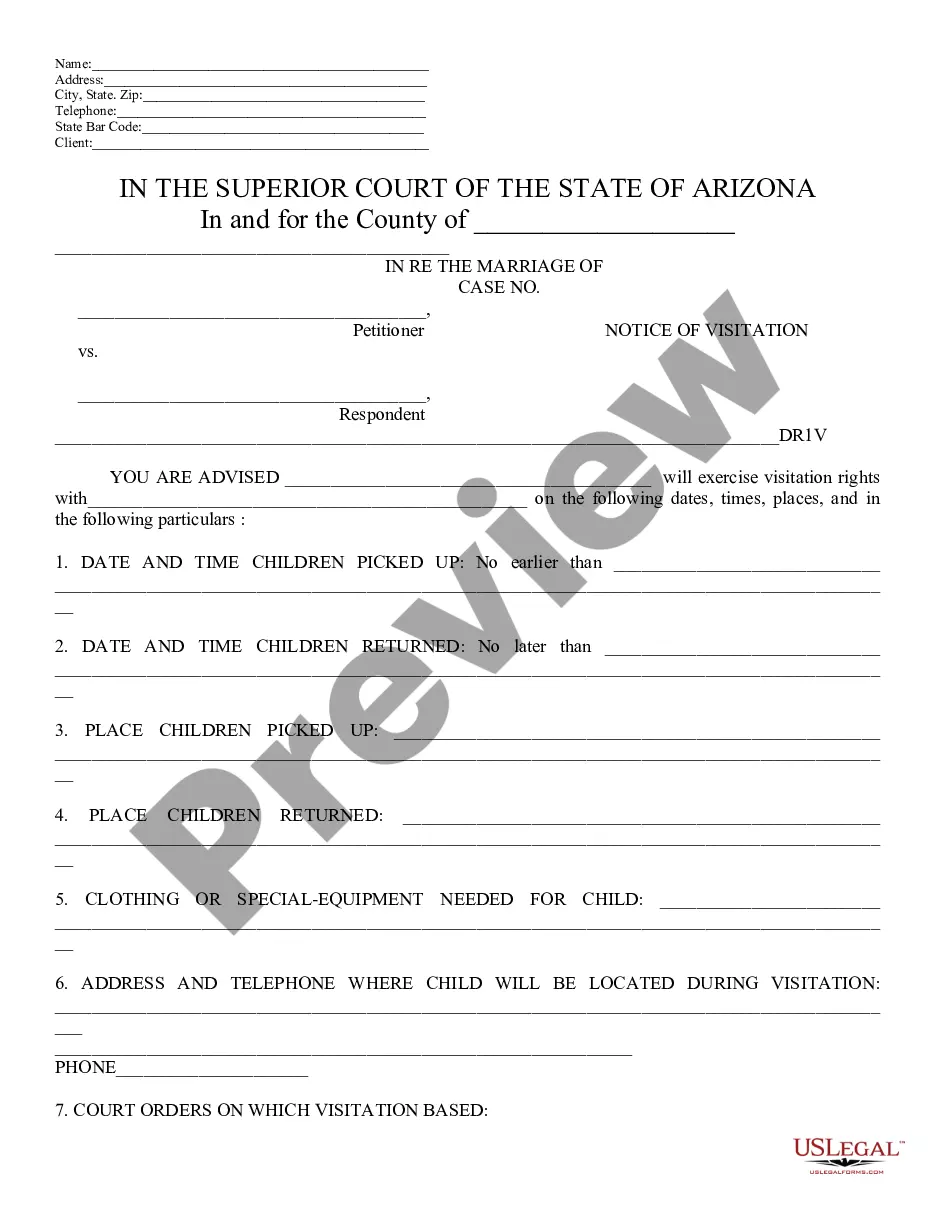

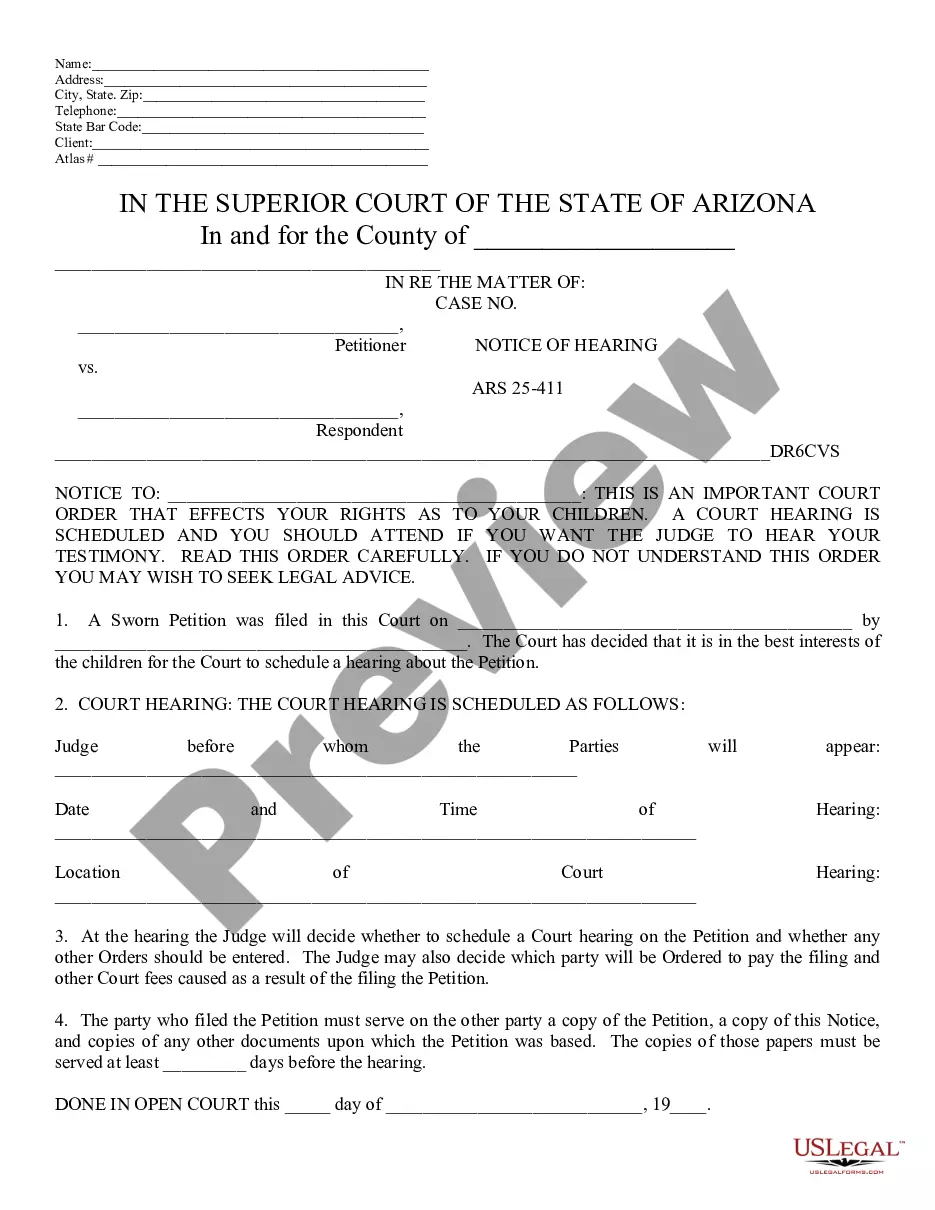

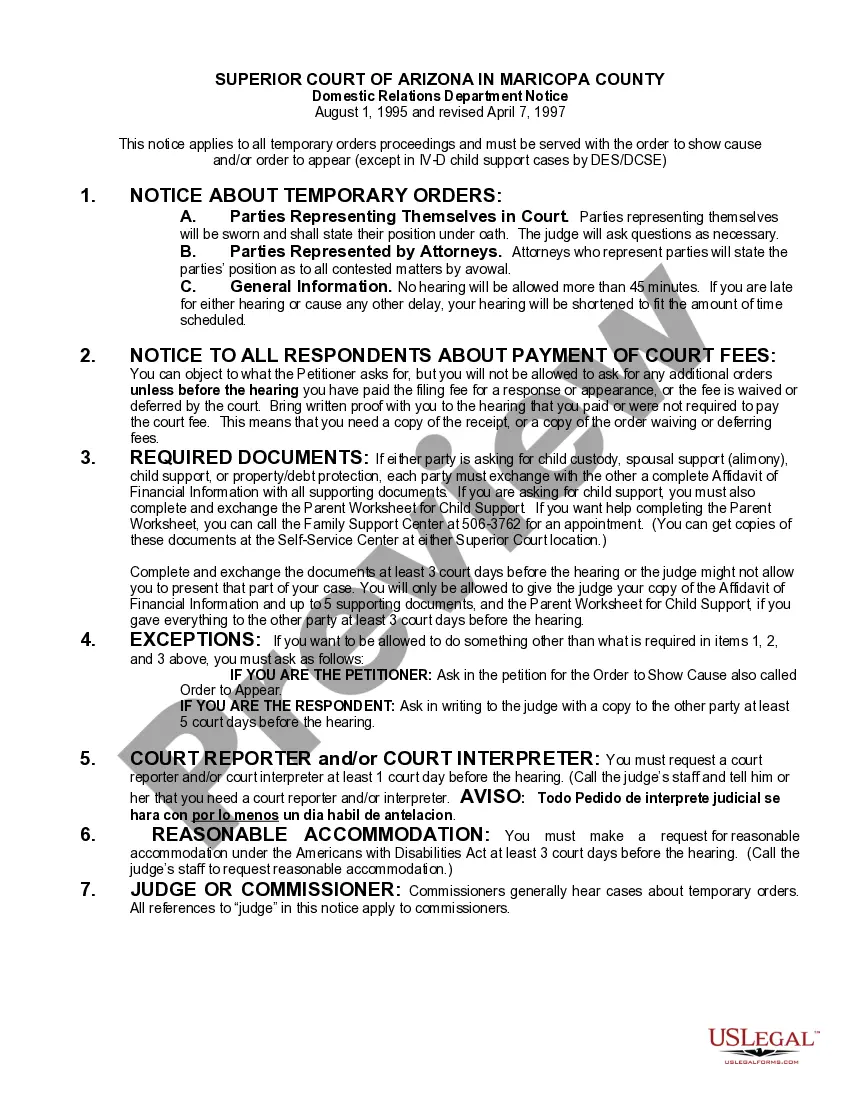

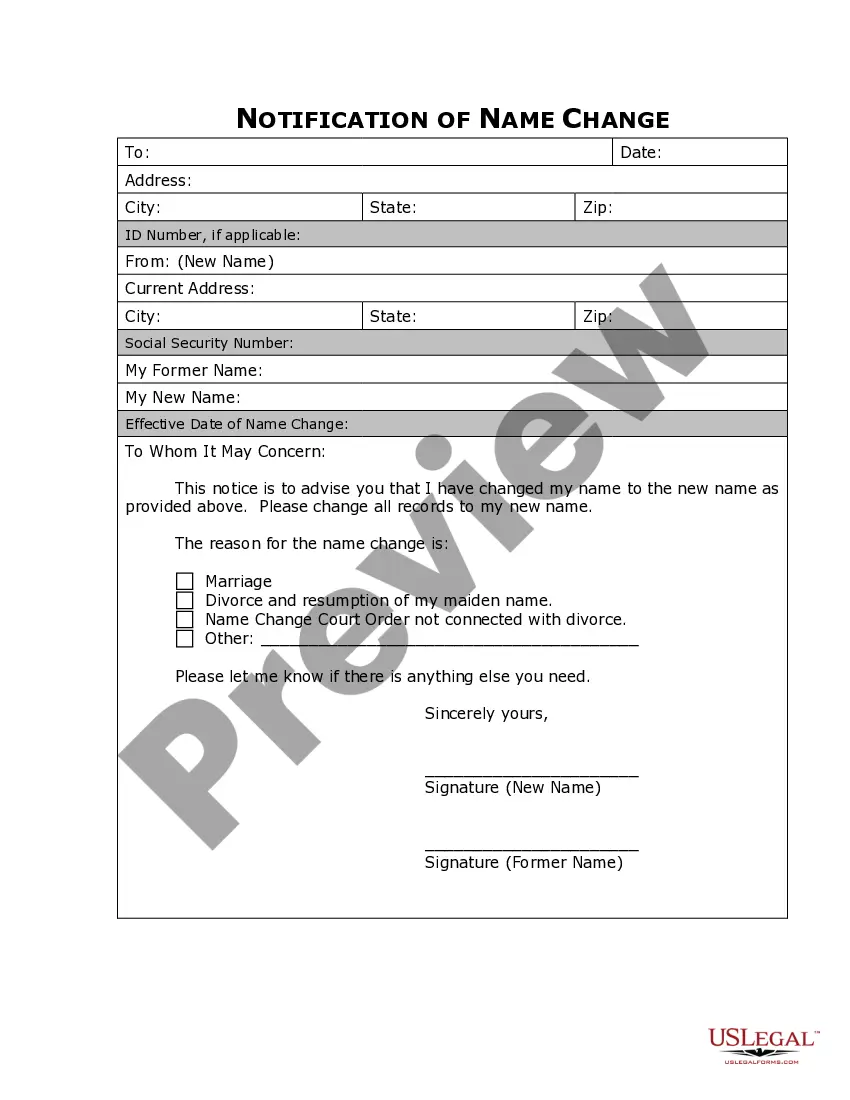

A Notice form provides legal notification to a party of an important aspect of a legal matter. Failure to provide proper notice is often the cause of delays in the progress of lawsuits and other legal matters. This model form, a Notice 411, provides notice of the stated matter. Because each case is unique, you will need to adapt the form to fit your specific facts and circumstances. Available for download now.

Arizona Notice 411

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Notice 411?

If you're looking for accurate Arizona Notice 411 templates, US Legal Forms is what you require; obtain documents created and verified by state-certified attorneys.

Utilizing US Legal Forms not only alleviates your concerns regarding legal paperwork; additionally, you save effort, time, and money! Downloading, printing, and completing a professional template is far more economical than hiring an attorney to do it for you.

And that’s all. In just a few simple clicks, you will have an editable Arizona Notice 411. Once you create your account, all future requests will be processed even more effortlessly. If you possess a US Legal Forms subscription, simply Log In to your account and then click the Download button you see on the form’s page. The next time you need to use this document again, you'll always be able to find it in the My documents menu. Don’t waste your effort comparing countless forms across different web sources. Acquire precise documents from a single reputable service!

- To start, complete your registration process by entering your email and creating a password.

- Follow the instructions below to establish your account and locate the Arizona Notice 411 template to resolve your issues.

- Utilize the Preview option or review the document description (if available) to ensure the template is what you need.

- Verify its validity in your jurisdiction.

- Click Buy Now to place your order.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

Yes, it is essential to respond to a traffic violation notice in Arizona. Ignoring the notice can lead to additional penalties, including fines or even license suspension. You have options, such as contesting the ticket or paying the fine, both of which require timely responses. For assistance with navigating traffic laws, consider utilizing tools mentioned in Arizona Notice 411.

In Arizona, either party wishing to terminate a month-to-month lease must provide at least 30 days' written notice. This notice period ensures that both landlords and tenants have adequate time to prepare for the transition. If you are unsure about the legal requirements or need templates for such notices, Arizona Notice 411 can lend helpful support.

The 85% law in Arizona states that individuals convicted of certain crimes must serve at least 85% of their sentence before qualifying for parole. This law applies to serious offenses and highlights the state’s approach to criminal justice. It's critical for convicted individuals and families to comprehend how this impacts sentencing and release. For further insights into your legal rights and obligations, consult Arizona Notice 411.

Rule 85 in Arizona family law pertains to how certain aspects of custody and visitation can be affected by parental involvement. This rule emphasizes the importance of a child's best interests when determining arrangements. It provides guidelines for adjustments based on each parent’s degree of engagement. To navigate these legal waters effectively, you can refer to the Arizona Notice 411 for guidance.

In Arizona, individuals typically must serve a minimum of 85% of their imposed sentence before becoming eligible for parole. This rule, often referred to as the 85% law, aims to ensure that inmates serve substantial time for their offenses. Understanding the nuances of this law can be critical for defendants and their families. For specific details personalized to your situation, resources like Arizona Notice 411 can be invaluable.

Eligibility for parole in Arizona generally applies to inmates who have served a significant part of their sentence, displayed good behavior, and meet specific criteria set by the Arizona Board of Executive Clemency. Additionally, inmates convicted of non-violent offenses may qualify sooner. It's essential for inmates to stay informed about their status and options. Resources such as Arizona Notice 411 offer valuable information related to parole eligibility.

The 65% law in Arizona allows certain offenders to be eligible for parole after serving 65% of their sentence. This law applies to non-violent offenders, and it aims to reduce prison overcrowding while promoting rehabilitation. Understanding the implications of this law can help individuals prepare for their parole hearings. For more information on parole laws, consult Arizona Notice 411.

Common conditions of parole in Arizona include regular meetings with a parole officer, maintaining employment, avoiding criminal activity, completing treatment programs, and complying with curfews. These conditions aim to promote rehabilitation and community safety. Failure to adhere to these conditions can result in revocation of parole. Explore Arizona Notice 411 for more details on parole conditions.

Eligibility for parole in place typically applies to certain individuals who have been living in Arizona without legal status but have no criminal history. This option allows qualified applicants to adjust their immigration status. It provides a way for these individuals to seek legal recognition without leaving the country. To learn more about this, check Arizona Notice 411 for comprehensive insights.

In Arizona, the requirements for parole include the completion of a designated portion of the prison sentence, good behavior while incarcerated, and a parole hearing. Offenders must demonstrate that they pose no threat to society. Additionally, they are required to comply with any specific recommendations made by the sentencing judge. For clarity on legal processes like these, refer to Arizona Notice 411.