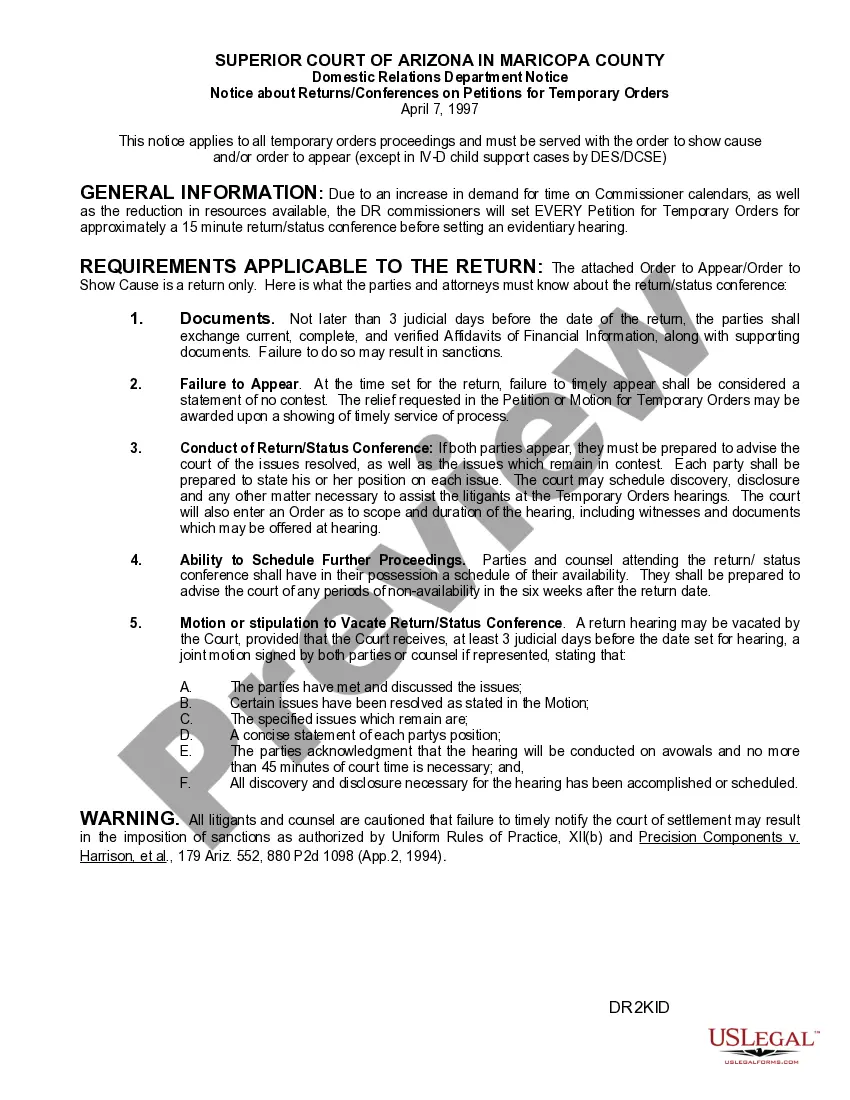

Return Conference: This is an instructional guide on the basics of a Return Conference. This document states that Return Conferences are only used when either the Plaintiff or Defendant files a Motion for a Temporary Order. The guide goes into further detail on all the rules and regulations surrounding this special type of conference. This form is available in both Word and Rich Text formats.

Arizona Return Conference

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Return Conference?

If you're searching for suitable Arizona Return Conference samples, US Legal Forms is precisely what you require; access documents crafted and reviewed by state-licensed legal professionals.

Using US Legal Forms not only spares you from frustrations related to legal documentation; additionally, you conserve time, effort, and money!

And that's it. In just a few easy clicks, you possess an editable Arizona Return Conference. When you set up an account, all subsequent requests will be handled even more effortlessly. Once you have a US Legal Forms subscription, just Log In to your profile and click the Download button visible on the form's page. Then, when you need to use this template again, you'll always find it in the My documents section. Don't waste your time comparing countless forms across multiple websites. Purchase accurate templates from just one reliable source!

- To initiate, complete your registration by providing your email address and creating a password.

- Follow the instructions below to establish your account and obtain the Arizona Return Conference form to meet your requirements.

- Utilize the Preview feature or review the document details (if available) to confirm that the template is appropriate for you.

- Verify its relevance in your residing state.

- Click Buy Now to place an order.

- Select a preferred pricing plan.

- Create your account and pay using your credit card or PayPal.

- Choose a preferred file format and save the document.

Form popularity

FAQ

ASU is set to transition to a new conference in 2025, a topic of great interest that will likely be highlighted at the Arizona Return Conference. This shift represents a significant moment for ASU as it seeks to enhance its competitive standing and expand its reach. The conference will delve into the implications of this move and how it aligns with the university’s broader goals. It's essential to stay tuned for more details as the date approaches.

Arizona's upcoming participation in the Arizona Return Conference marks an important shift in its sports and academic affiliations. This conference will serve as a pivotal moment for the state as it navigates changes in its league standings. Attendees will gain insights about Arizona's future trajectories in various sectors, showcasing opportunities that await. Don’t miss out on the information presented at this influential gathering.

Arizona anticipates joining a new league, which will be discussed at the Arizona Return Conference. This gathering will attract sports enthusiasts and stakeholders, providing a platform for discussions on the future of sports in Arizona. You can learn about potential alignments and how they may enhance Arizona's athletic programs and community engagement. Keep an eye out for announcements during the event.

There has been significant discussion regarding the idea of eliminating state income tax in Arizona. Proponents argue that removing this tax could boost economic growth and attract more businesses to the state. However, as of now, there are no confirmed plans for such a change. Stay informed about updates, as the Arizona Return Conference will likely address taxation and fiscal policy changes.

Arizona is set to participate in the upcoming Arizona Return Conference. This event will focus on strategic discussions and developments within the state. Attendees can expect insights on various topics that impact the legal and business landscapes in Arizona. This conference aims to foster collaboration and innovation among participants.

A salary of $100,000 is generally considered a strong income in Arizona, providing a comfortable lifestyle. However, the perception of 'good' income can depend on personal circumstances, such as family size and housing costs. Exploring financial planning options at an Arizona Return Conference can help clarify your financial goals.

If you earn $120,000 annually in Arizona, your after-tax income typically falls between $84,000 and $90,000. This calculation includes both federal and state taxes, along with potential deductions. To better understand these figures, consider engaging with the experts at an Arizona Return Conference.

For a $100,000 income in Arizona, you can expect your after-tax earnings to be around $70,000 to $75,000. This figure varies with your tax code and potential deductions. Accurate calculations can prevent any surprises during tax season, and assistance is often available at the Arizona Return Conference.

Yes, if you earn income sourced from Arizona as a non-resident, you are required to file a tax return. This applies to income earned from jobs, sources, or property in Arizona. Ensuring compliance can be complex, so attending an Arizona Return Conference can provide clarity on filing requirements for non-residents.

If you earn $200,000 in Arizona, your after-tax income will be approximately $140,000 to $150,000. This estimate varies based on your specific tax situation, including the deductions you claim. Always stay updated on tax rates and regulations, which can often be discussed in detail at an Arizona Return Conference.