Arizona Notice to Creditors and Other Parties in Interest is a legal notice that is sent to any creditors of a deceased person or estate. It informs them of the death and provides them with the information they need to file a claim against the estate. The notice serves to protect the estate from any potential claims that may arise after the deceased’s death. There are three main types of Arizona Notice to Creditors and Other Parties in Interest: formal notice, informal notice, and summary notice. Formal notices are the most detailed and are typically used when a deceased individual has significant assets or debts. In contrast, informal notices are simpler and are used in cases where the deceased has only small assets or debts. Summary notices are the most basic type of notice and are used when the deceased has no assets or debts.

Arizona Notice to Creditors and Other Parties in Interest

Description

How to fill out Arizona Notice To Creditors And Other Parties In Interest?

How much time and resources do you typically invest in creating formal documentation.

There’s a better option to procure such forms than engaging legal professionals or squandering hours looking online for a suitable template. US Legal Forms is the leading online repository that provides expertly crafted and validated state-specific legal documents for any purpose, including the Arizona Notice to Creditors and Other Parties in Interest.

Another benefit of our service is that you can access previously acquired documents that you securely store in your profile in the My documents tab. Retrieve them anytime and redo your paperwork as often as necessary.

Save time and energy preparing official documentation with US Legal Forms, one of the most reliable online solutions. Register with us now!

- Review the form content to verify it complies with your state regulations. For this, check the form description or utilize the Preview option.

- If your legal template doesn’t satisfy your needs, find a different one using the search bar at the top of the page.

- If you are already registered with our service, Log In and download the Arizona Notice to Creditors and Other Parties in Interest. If not, continue to the next steps.

- Click Buy now once you locate the correct template. Select the subscription plan that suits you best to access the full features of our library.

- Create an account and pay for your subscription. You can process payment with your credit card or via PayPal - our service is completely secure for that.

- Download your Arizona Notice to Creditors and Other Parties in Interest onto your device and complete it on a printed hard copy or electronically.

Form popularity

FAQ

Publishing a notice to creditors in Arizona involves a few clear steps. First, get your notice prepared, detailing the necessary information as stipulated in the Arizona Notice to Creditors and Other Parties in Interest guidelines. Next, select an appropriate newspaper for publication; it must be one that meets the circulation requirements outlined by Arizona law. Once the notice is published, you should keep a copy of the publication as part of your probate records to demonstrate compliance with the notification requirement.

To post a notice to creditors as part of the Arizona Notice to Creditors and Other Parties in Interest process, you need to draft a formal notice that includes essential details such as the decedent's name and the probate case number. You must then publish this notice in a newspaper that is widely circulated in the county where the estate is being probated. It's crucial to complete this as part of your legal obligations to inform creditors and other interested parties, ensuring they have the opportunity to make claims against the estate.

When addressing creditors after a death, you should send a formal letter that acknowledges their claims against the estate. This letter typically includes information about the deceased, the probate process, and instructions on how to submit their claims for consideration. It is crucial that this communication aligns with the Arizona Notice to Creditors and Other Parties in Interest guidelines. By using US Legal Forms, you can access templates that simplify this communication and ensure you do not overlook any important details.

In Arizona, an estate must generally be worth over $75,000 to require probate. However, certain assets, such as those held in joint tenancy or those with designated beneficiaries, may not be included in this total. Initiating the Arizona Notice to Creditors and Other Parties in Interest process will clarify these matters. To navigate this efficiently, consider utilizing the resources from US Legal Forms to ensure you meet all legal requirements.

A notice to creditors in a deceased estate serves as a formal announcement for all potential creditors to present their claims against the estate. In the Arizona Notice to Creditors and Other Parties in Interest process, this notice acts as a safeguard, ensuring that all debts are settled before the estate distribution occurs. It typically provides critical details like the deadline for claim submission and contact information for the personal representative. Understanding this notice can help streamline estate settlement.

While this FAQ focuses on Arizona, it can be helpful to know that in Florida, the notice to creditors typically runs for three months from the date of publication. This time frame allows creditors to come forward with claims against the deceased's estate. It's essential to understand the specific timelines in your state, as they can impact the Arizona Notice to Creditors and Other Parties in Interest process. Always consult with a legal expert to ensure compliance with state laws.

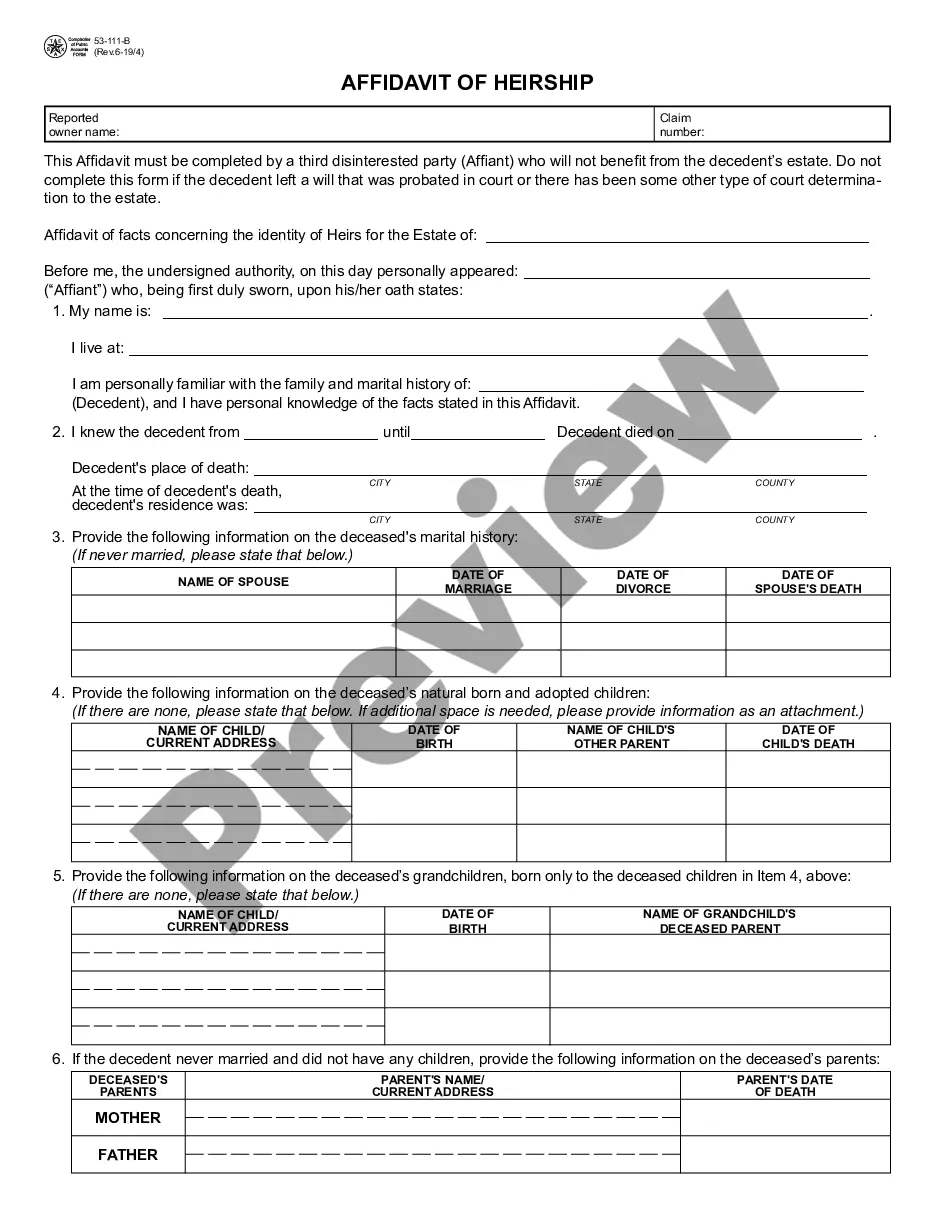

In the context of Arizona Notice to Creditors and Other Parties in Interest, creditors generally fall into three categories: secured creditors, unsecured creditors, and priority creditors. Secured creditors hold collateral against the debt, while unsecured creditors do not have any collateral backing their claims. Priority creditors receive payment before others, often due to the nature of their claims, such as taxes owed or child support. Understanding these types can help you navigate the notice process effectively.

Probate rules in Arizona include requirements for validating the will, notifying creditors, and settling debts before distributing assets. The Arizona Notice to Creditors and Other Parties in Interest helps creditors understand how they can present their claims within a certain period. Key among these rules is the need for transparency and compliance with state laws. Our platform is designed to help you navigate these regulations efficiently and confidently.

The timeline for probate in Arizona can vary, but it typically takes several months to over a year to complete, depending on the complexity of the estate. Crucially, the Arizona Notice to Creditors and Other Parties in Interest allows creditors to make their claims timely. During this process, you may need to deal with appraisals and potential disputes among beneficiaries. Our services can help streamline this timeline to minimize stress.

Yes, Arizona imposes a time limit for filing probate, which is generally 2 years from the date of death. The Arizona Notice to Creditors and Other Parties in Interest plays a key role in ensuring individuals are informed of their rights during this limited time frame. Missing this deadline could lead to forfeiting your right to manage or inherit from the estate. For tailored guidance, take advantage of our platform's resources.