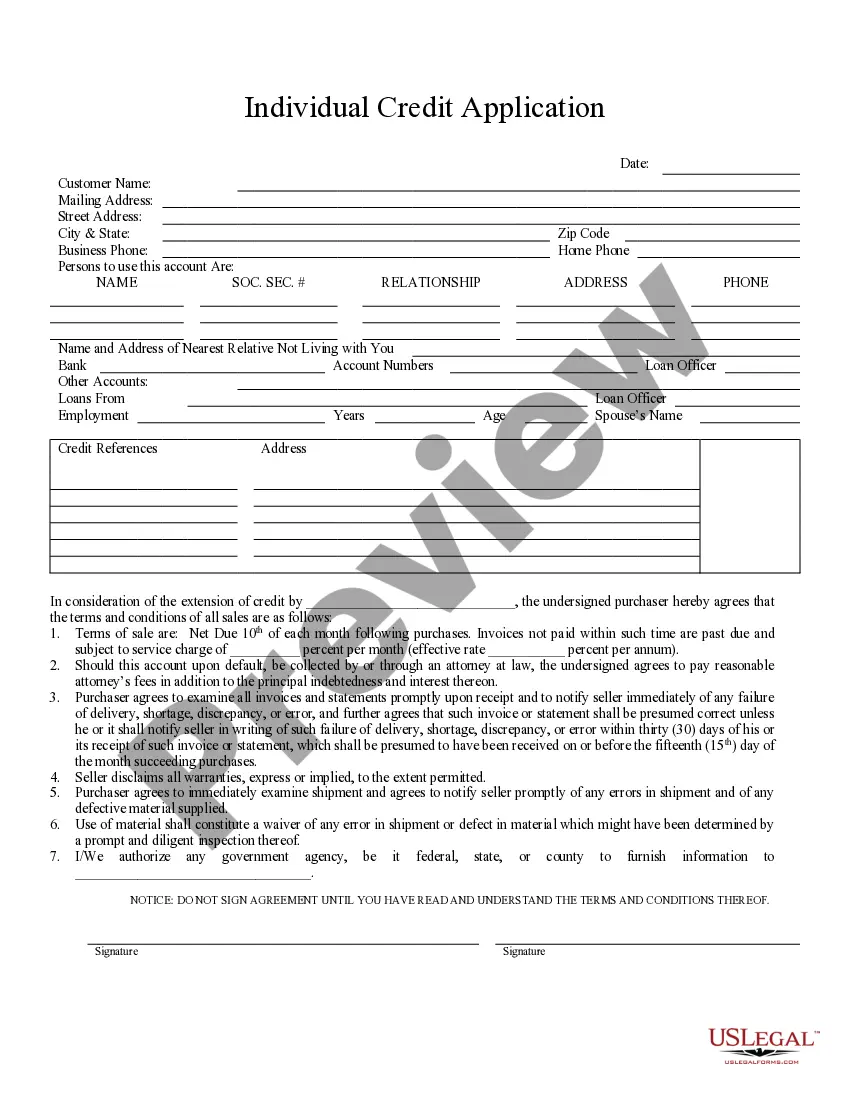

This is an Individal Credit Application for an individual seeking to obtain credit for a purchase. It includes provisions for re-payment with interest, default provisions, disclaimer of warranties by the Seller and permission for Seller to obtain personal information about purchaser from government agencies, if necessary.

Arizona Individual Credit Application

Description

Get your form ready online

Our built-in tools help you complete, sign, share, and store your documents in one place.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Make edits, fill in missing information, and update formatting in US Legal Forms—just like you would in MS Word.

Download a copy, print it, send it by email, or mail it via USPS—whatever works best for your next step.

Sign and collect signatures with our SignNow integration. Send to multiple recipients, set reminders, and more. Go Premium to unlock E-Sign.

If this form requires notarization, complete it online through a secure video call—no need to meet a notary in person or wait for an appointment.

We protect your documents and personal data by following strict security and privacy standards.

Looking for another form?

How to fill out Arizona Individual Credit Application?

If you're looking for precise Arizona Individual Credit Application examples, US Legal Forms is what you require; obtain documents created and verified by state-certified legal experts.

Using US Legal Forms not only alleviates your concerns regarding legal documents; it also saves you time, effort, and money! Downloading, printing, and completing a professional form is significantly less expensive than hiring a lawyer to do it for you.

And there you have it. In just a few easy steps, you obtain an editable Arizona Individual Credit Application. When you create an account, all future requests will be processed even more smoothly. If you possess a US Legal Forms subscription, just Log In to your account and click the Download option displayed on the form's page. Then, whenever you need to use this template again, you'll always be able to find it in the My documents menu. Don't waste your time and energy sifting through countless forms on various websites. Order accurate copies from a single secure platform!

- To begin, complete your registration process by providing your email and creating a secure password.

- Follow the instructions below to set up an account and find the Arizona Individual Credit Application example to address your needs.

- Utilize the Preview option or review the document description (if available) to confirm that the template is what you're looking for.

- Verify its legality in the state where you reside.

- Click on Buy Now to place your order.

- Select a preferred pricing plan.

- Create an account and pay with your credit card or PayPal.

- Choose a convenient format and save the document.

Form popularity

FAQ

The AZ tax credit is available to Arizona residents who meet specific income requirements. Typically, individuals and families with lower incomes can benefit from this credit. Submitting the Arizona Individual Credit Application can help clarify your eligibility and guide you through the claiming process.

The Arizona school tax credit allows you to contribute directly to public schools while also receiving a tax credit on your state tax return. This program enables you to support extracurricular activities and character education programs. Filling out the Arizona Individual Credit Application can make the process simple and ensure you contribute effectively.

Arizona Form 301 is an essential document used to apply for the Arizona property tax credit. It allows residents to report their income and claim the credit to reduce their property tax burden. Completing the Arizona Individual Credit Application with Form 301 facilitates the credit process, ensuring you take advantage of potential savings.

Eligibility for the property tax credit in Arizona generally includes seniors, low-income households, and disabled individuals. You need to be a resident of Arizona and submit proof of income to show that you meet the criteria. The Arizona Individual Credit Application assists you in gathering all necessary documentation for your application.

Arizona property tax credit is designed for low-income individuals, seniors, and certain disabled individuals. To qualify, you must have a valid Arizona residency and meet financial guidelines. Using the Arizona Individual Credit Application can help determine your eligibility for this beneficial program.

To qualify for the Arizona rebate, applicants must meet specific income thresholds set by the state. Generally, individuals and families who have a primary residence in Arizona and earn below a certain limit can apply. It is recommended to utilize the Arizona Individual Credit Application to streamline the process and ensure eligibility.

In Arizona, property tax is assessed based on the value of your property, which is determined by the county assessor. Each year, property owners receive a notice indicating the assessed value and the corresponding tax rate. Understanding how these assessments work can benefit those applying for an Arizona Individual Credit Application, as it may affect your financial responsibilities. For more detailed information, consider using US Legal Forms to navigate property tax applications and related documents.

Filing requirements in Arizona depend on your residency status and income level. Generally, if you earn income in Arizona, you must file a state tax return, even as a nonresident. Understanding these requirements can simplify your process when filling out the Arizona Individual Credit Application.

The deadline for claiming an Arizona tax credit usually aligns with the state tax return filing deadline, which is typically April 15. However, it’s essential to keep an eye on announcements from the state as deadlines can shift. Submitting your Arizona Individual Credit Application on time ensures you receive any credits you qualify for.

Individuals, couples, and businesses are required to file an Arizona tax return if their income exceeds certain thresholds. It is essential to review these thresholds closely, as they determine your filing obligation. Filing accurately can help unlock advantages from the Arizona Individual Credit Application.