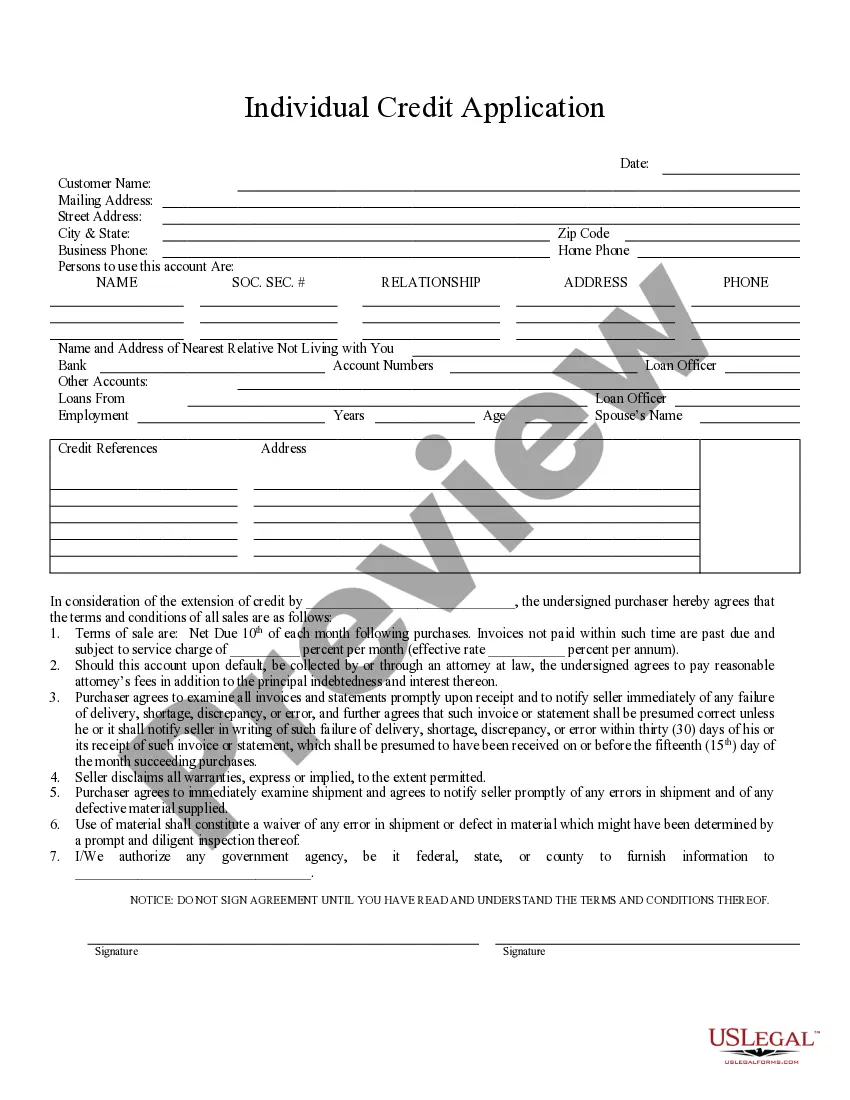

Michigan Individual Credit Application

Description

How to fill out Michigan Individual Credit Application?

Obtain any version from 85,000 legal records such as Michigan Individual Credit Application online with US Legal Forms.

Each template is organized and revised by state-approved legal experts.

If you possess a subscription, Log In. Once you are on the form’s page, click the Download button and proceed to My documents to access it.

With US Legal Forms, you will always have immediate access to the suitable downloadable template. The service will provide you with access to documents and categorizes them to ease your search. Utilize US Legal Forms to obtain your Michigan Individual Credit Application quickly and effortlessly.

- Verify the state-specific criteria for the Michigan Individual Credit Application you intend to use.

- Review the description and look at the sample.

- Once you are sure that the template meets your requirements, simply click Buy Now.

- Select a subscription plan that fits your financial situation.

- Establish a personal account.

- Make payment in one of two convenient methods: by card or via PayPal.

- Choose a format to download the file in; two options are available (PDF or Word).

- Download the document to the My documents section.

- After your reusable form is downloaded, print it out or save it to your device.

Form popularity

FAQ

If you worked at any time during 2019, these are the income guidelines and credit amounts to claim the Earned Income Tax Credit and Child Tax Credit when you file your taxes in 2020. The Child Tax Credit is worth a maximum of $2,000 per qualifying child. Up to $1,400 is refundable.

Visit the Michigan Department of Treasury website at michigan.gov/treasury and enter Home Heating Credit in the search box. Pick up a paper copy at a public library, post office, Michigan Department of Health and Human Services (MDHHS) office or other locations where income tax forms are available.

2020 Child Tax Credit For 2020 tax returns, which are due by April 15 of this year, the child tax credit is worth $2,000 per kid under the age of 17 claimed as a dependent on your return. The child must be related to you and generally live with you for at least six months during the year.

Biden's expansion of the child tax credit will significantly increase the amount from $2,000 to $3,600 for children under age 6 and to $3,000 for children ages 6 to 17. Kids that were 17 at the end of the 2020 tax year also now qualify (they were previously excluded).

We will send a letter/notice if: You are due a larger or smaller refund. We have a question about your tax return. We need to verify your identity.

The child tax credit got a boost from the American Rescue Plan, signed into law by President Joe Biden in March. The new enhanced credit increases the annual benefit per child 17 and younger to $3,000 from $2,000 for 2021. It also gives an additional $600 benefit for children under the age of 6 for the 2021 tax year.

In 2020. For 2020, eligible taxpayers can claim a tax credit of $2,000 per qualifying dependent child under age 17. 5 If the amount of the credit exceeds the tax owed, the taxpayer generally is entitled to a refund of the excess credit amount up to $1,400 per qualifying child.

You may qualify for a home heating credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead. You were NOT a full-time student who was claimed as a dependent on another person's return. You did NOT live in college or university operated housing for the entire year.

You may qualify for a home heating credit if all of the following apply: You own or were contracted to pay rent and occupied a Michigan homestead. You were NOT a full-time student who was claimed as a dependent on another person's return. You did NOT live in college or university operated housing for the entire year.