Arkansas Disclaimer of Testamentary Bequests

Description

How to fill out Arkansas Disclaimer Of Testamentary Bequests?

Among numerous paid and complimentary templates that you find online, you cannot guarantee their trustworthiness.

For instance, who created them or whether they have the expertise to fulfill your needs.

Remain composed and utilize US Legal Forms!

When you have registered and paid for your subscription, you can utilize your Arkansas Disclaimer of Testamentary Bequests as many times as necessary or for as long as it remains valid in your state. Modify it in your preferred offline or online editor, fill it in, sign it, and print it. Achieve more for less with US Legal Forms!

- Locate Arkansas Disclaimer of Testamentary Bequests templates crafted by experienced attorneys and evade the expensive and time-consuming process of seeking an attorney and then compensating them to draft a document for you that you could easily find.

- If you possess a subscription, Log In to your account and locate the Download button adjacent to the file you're after.

- You will also gain access to all your previously obtained documents in the My documents section.

- If you're using our website for the first time, follow the steps outlined below to obtain your Arkansas Disclaimer of Testamentary Bequests swiftly.

- Ensure that the file you view is legitimate in your location.

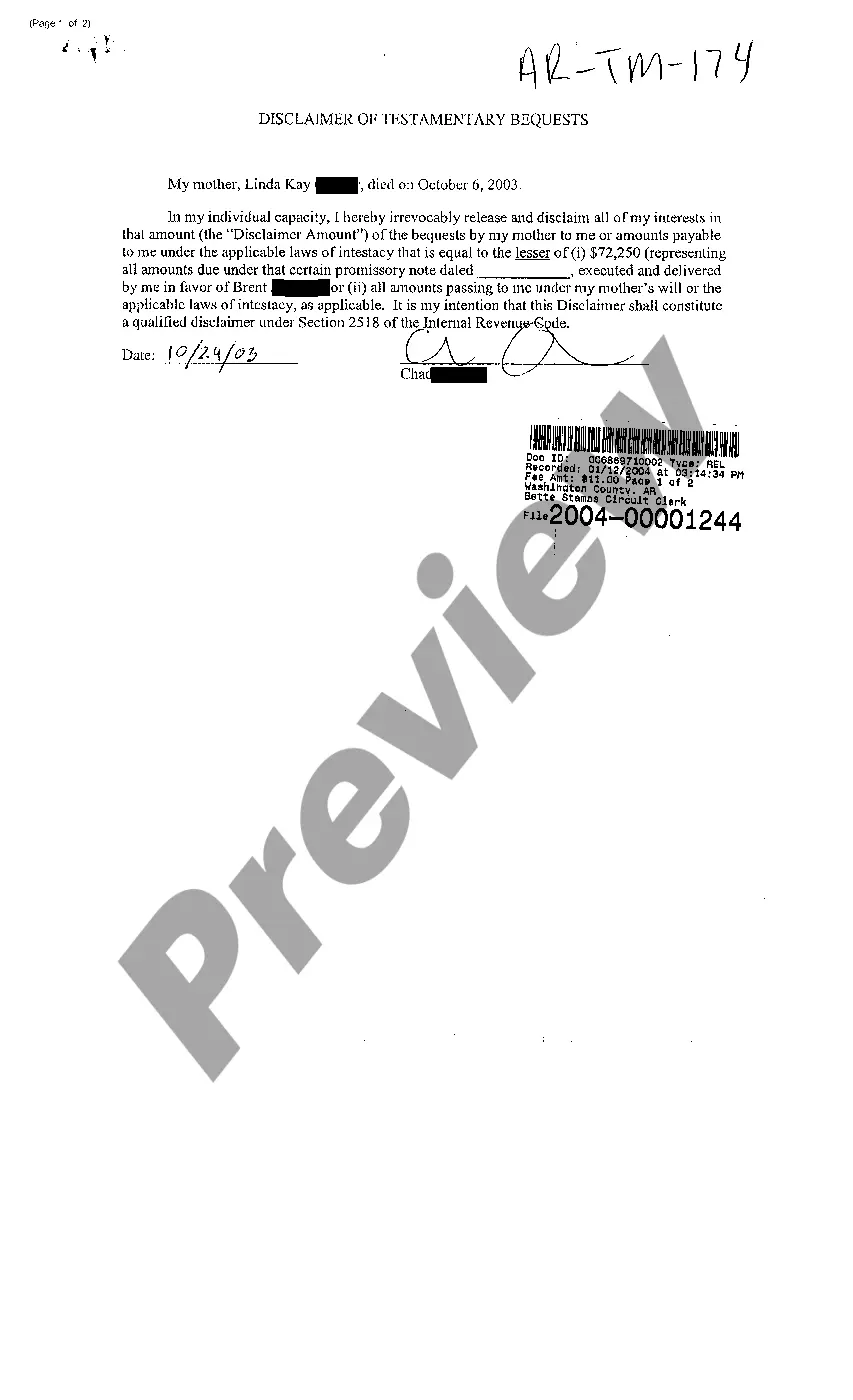

- Review the file by checking the information using the Preview feature.

Form popularity

FAQ

In Arkansas, a handwritten will does not necessarily need to be notarized if it is validly executed. However, having it notarized can help prove its authenticity and mitigate disputes. Including an Arkansas Disclaimer of Testamentary Bequests can further clarify your intentions, ensuring your wishes are honored.

Disclaiming part of an inheritance involves formally rejecting the assets you do not wish to accept. You must file a disclaimer document that outlines your intent, following Arkansas laws. An Arkansas Disclaimer of Testamentary Bequests can be essential in this process, so consider using platforms like uslegalforms to assist with the necessary paperwork.

Online wills are indeed legal in Arkansas, provided they meet the state's legal requirements. Using trusted online services, such as uslegalforms, can help you prepare a compliant document. Make sure to include any relevant information related to Arkansas Disclaimer of Testamentary Bequests to ensure clarity.

Writing a testamentary typically involves clearly stating your wishes regarding the distribution of your estate after your death. Begin with your personal information, followed by a declaration of your intent. Always consider incorporating an Arkansas Disclaimer of Testamentary Bequests to address any specific bequests and conditions.

Yes, you can write your own will in Arkansas. Once you complete your document, you can have it notarized to strengthen its validity. However, remember that including an Arkansas Disclaimer of Testamentary Bequests can clarify any conditions about your bequests.

A letter of testamentary is a legal document issued by the probate court, granting an executor the authority to administer a deceased person's estate. This document authorizes the executor to manage tasks such as paying bills and distributing assets. Understanding its importance is crucial, especially when dealing with Arkansas Disclaimer of Testamentary Bequests, as it helps streamline the estate process.

Failing to file probate in Arkansas can lead to complications for the deceased's assets. The estate may become tangled in legal issues, potentially delaying asset distribution. Additionally, heirs might miss out on properly claiming their rights, especially relevant in cases involving Arkansas Disclaimer of Testamentary Bequests.

Probate is typically triggered when an individual dies with assets solely in their name. If there is a will, probate ensures that the will is validated, while the estate's debts are settled. Furthermore, understanding how an Arkansas Disclaimer of Testamentary Bequests factors into the process can provide clarity on which assets need to be probated.

In Arkansas, you have a maximum of three years to file for probate after someone's death. Nonetheless, initiating probate sooner can benefit heirs by expediting the distribution of assets. If the estate includes an Arkansas Disclaimer of Testamentary Bequests, it may further impact how quickly you need to act.

In Arkansas, estates that fall below a certain threshold often do not require probate. Currently, assets valued at $100,000 or less may qualify for a simplified process that bypasses the full probate procedure. If you're unsure about how your estate's value fits in with Arkansas Disclaimer of Testamentary Bequests, seeking guidance can help clarify your options.