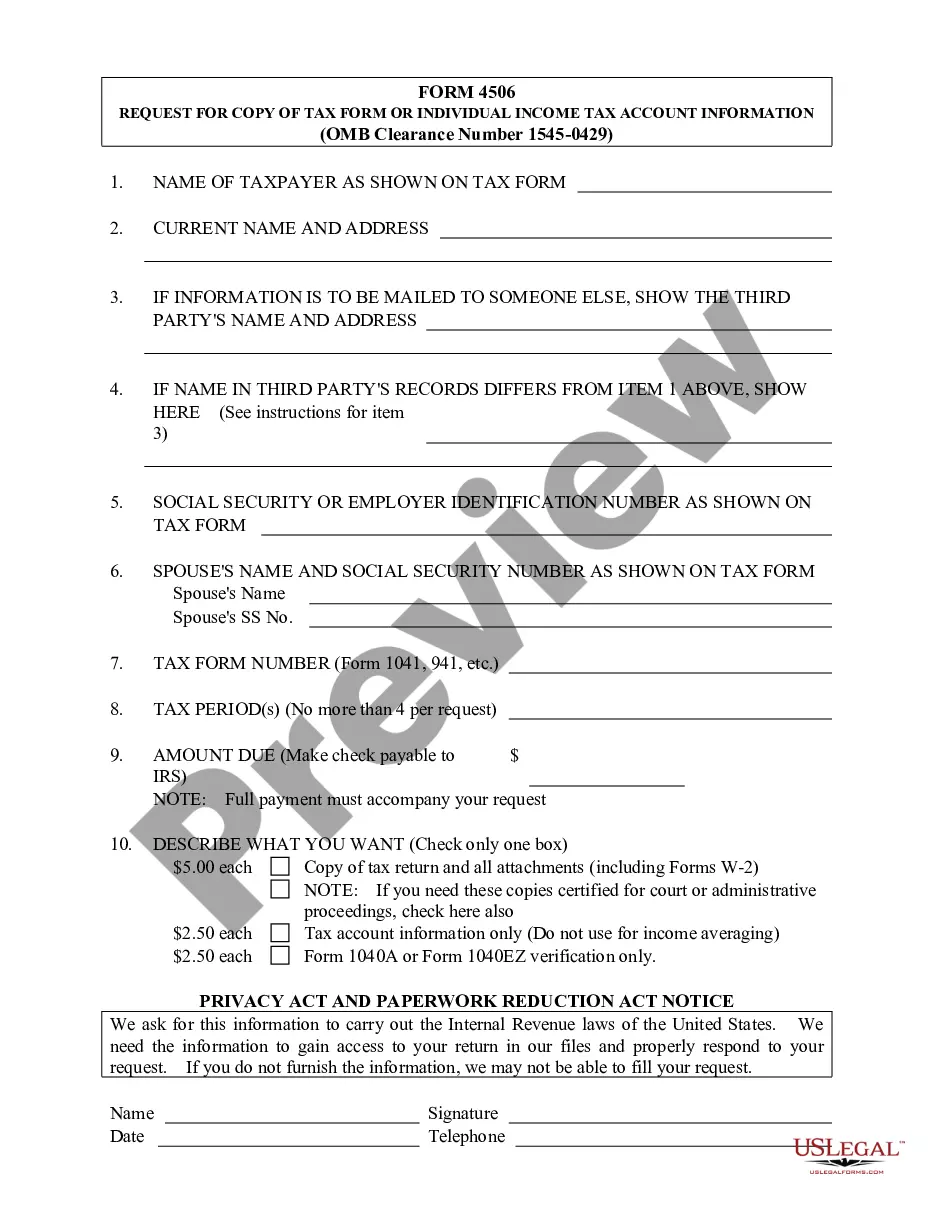

Arkansas Request for Copy of Tax Form or Individual Income Tax Account Information

Description

How to fill out Request For Copy Of Tax Form Or Individual Income Tax Account Information?

US Legal Forms - one of many greatest libraries of legal types in the United States - offers an array of legal record themes it is possible to down load or produce. Utilizing the web site, you can find thousands of types for organization and person uses, categorized by groups, claims, or keywords.You will discover the most up-to-date models of types just like the Arkansas Request for Copy of Tax Form or Individual Income Tax Account Information in seconds.

If you currently have a membership, log in and down load Arkansas Request for Copy of Tax Form or Individual Income Tax Account Information from the US Legal Forms library. The Acquire key can look on each develop you look at. You have access to all formerly acquired types in the My Forms tab of the account.

If you wish to use US Legal Forms for the first time, allow me to share basic recommendations to obtain started out:

- Be sure to have picked out the proper develop for your personal town/region. Click the Preview key to analyze the form`s content. Browse the develop outline to actually have chosen the right develop.

- When the develop doesn`t fit your specifications, utilize the Search field near the top of the display to discover the one that does.

- If you are content with the form, affirm your option by simply clicking the Buy now key. Then, pick the rates strategy you prefer and give your references to register for the account.

- Procedure the transaction. Utilize your bank card or PayPal account to finish the transaction.

- Find the format and down load the form on your own gadget.

- Make changes. Complete, edit and produce and signal the acquired Arkansas Request for Copy of Tax Form or Individual Income Tax Account Information.

Every template you included in your bank account does not have an expiration particular date and is also your own permanently. So, if you would like down load or produce yet another backup, just proceed to the My Forms section and click around the develop you require.

Obtain access to the Arkansas Request for Copy of Tax Form or Individual Income Tax Account Information with US Legal Forms, the most comprehensive library of legal record themes. Use thousands of specialist and express-certain themes that meet your small business or person requirements and specifications.

Form popularity

FAQ

You may be able to obtain a free copy of your California tax return. Go to MyFTB for information on how to register for your account. You may also request a copy of your tax return by submitting a Request for Copy of Tax Return (Form FTB 3516 ) or written request.

You can request copies of previously filed Arkansas individual income tax returns by completing form AR4506 and returning it to our office with a check or money order (copies are $2.00 per year). Please allow 4 to 6 weeks to receive your copies.

Get federal tax forms Download them from IRS.gov. Order online and have them delivered by U.S. mail. Order by phone at 1-800-TAX-FORM (1-800-829-3676)

State Tax Forms The Arkansas Department of Finance and Administration distributes Arkansas tax forms and instructions in the following ways: In Person: Arkansas Revenue Office, 206 Southwest Drive, Jonesboro, AR. Phone: Arkansas Revenue Office, 870-932-2716 (Jonesboro) 1-800-882-9275 (Little Rock)

Order a free tax return transcript over the phone by calling the automated Internal Revenue Service Transcript Order Line at 1-800-908-9946. Description:Here's an overview of how to obtain a tax return copy. Complete Form 4506 now and download, print, and mail it to the address on the form.

Requesting an IRS tax transcript online If you have an online IRS account, you can simply log in to your account and navigate to the "Tax Records" tab. There you'll be able to select, view or download the tax transcript you need.

You can do this by going to: manage tax return. select view details of the tax return you want to view. bottom of the page is the option for the print friendly version.

Telephone Numbers NamePhone NumberIndividual Income Tax Hotline - Little Rock501-682-1100Individual Income Tax Hotline - Toll Free800-882-9275IRS - Federal Tax Forms800-829-3676IRS - Taxpayer Assistance/Refund Information800-829-10409 more rows