Arkansas Short Form Limited Liability Company LLC Agreement

Description

How to fill out Short Form Limited Liability Company LLC Agreement?

US Legal Forms - one of several greatest libraries of legitimate kinds in America - provides a wide array of legitimate document layouts you can acquire or printing. Using the web site, you may get a huge number of kinds for organization and individual purposes, sorted by types, says, or key phrases.You will discover the most recent versions of kinds such as the Arkansas Short Form Limited Liability Company LLC Agreement within minutes.

If you currently have a membership, log in and acquire Arkansas Short Form Limited Liability Company LLC Agreement through the US Legal Forms local library. The Down load button will appear on each and every type you view. You have accessibility to all previously downloaded kinds in the My Forms tab of the accounts.

If you want to use US Legal Forms the very first time, allow me to share simple recommendations to obtain started out:

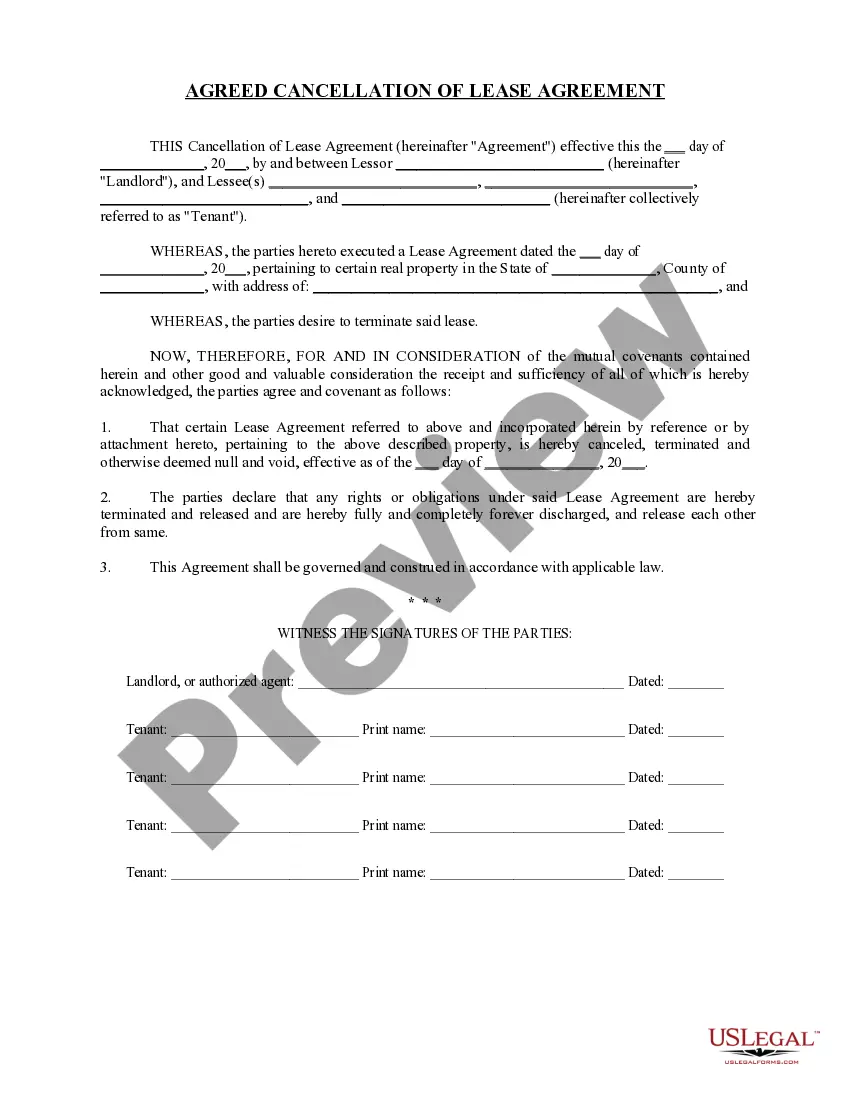

- Make sure you have chosen the best type to your metropolis/area. Click the Preview button to analyze the form`s articles. See the type outline to actually have selected the proper type.

- In case the type doesn`t fit your needs, use the Research area towards the top of the display to get the one which does.

- Should you be satisfied with the shape, verify your option by clicking the Purchase now button. Then, opt for the rates strategy you want and give your qualifications to sign up to have an accounts.

- Method the deal. Make use of your credit card or PayPal accounts to complete the deal.

- Find the structure and acquire the shape on the product.

- Make modifications. Fill out, edit and printing and sign the downloaded Arkansas Short Form Limited Liability Company LLC Agreement.

Each format you included with your money lacks an expiration time which is yours for a long time. So, if you want to acquire or printing another backup, just go to the My Forms segment and click on around the type you need.

Get access to the Arkansas Short Form Limited Liability Company LLC Agreement with US Legal Forms, the most extensive local library of legitimate document layouts. Use a huge number of professional and express-certain layouts that meet your organization or individual requires and needs.

Form popularity

FAQ

Arkansas LLC Cost. Arkansas charges a $45 state fee to form an LLC ($50 by mail). You'll also need to pay $150 every year to file a franchise tax report, and you may have to pay for additional services for your LLC?such as filing a DBA or hiring a professional registered agent.

LLC stands for limited liability company, which means its members are not personally liable for the company's debts. LLCs are taxed on a ?pass-through? basis ? all profits and losses are filed through the member's personal tax return. Generally, LLCs are required to pay a one-time filing fee as well as an annual fee.

Arkansas does not legally require LLC owners to submit an operating agreement to the Secretary of State when filing the Articles of Organization (the formal paperwork needed to form an LLC officially).

Two Ways to Start A New Business in Arkansas Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Arkansas Secretary of State. Get your business licenses. Set up a business bank account.

Limited Liability Company Must file Articles of Organization with the Arkansas Secretary of State. Allow members to manage a company themselves or to elect managers.

Benefits of starting an Arkansas LLC: Easily file your taxes and discover potential advantages for tax treatment. Create, manage, regulate, administer and stay in compliance easily. Protect your personal assets from your business liability and debts. Low cost to file ($45)

Yes, you can be your own registered agent in Arkansas. With that said, however, after considering the registered agent requirements most business owners elect to hire a registered agent service instead.