Missouri Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

US Legal Forms - one of the largest collections of official forms in the United States - offers a wide selection of official document templates that you can download or print.

By using the website, you can access numerous forms for business and personal purposes, organized by categories, states, or keywords. You can find the latest versions of forms such as the Missouri Employer Training Memo - Payroll Deductions in just minutes.

If you hold a membership, Log In and obtain the Missouri Employer Training Memo - Payroll Deductions from the US Legal Forms archive. The Download button will appear on every form you view. You can access all previously downloaded forms from the My documents section of your account.

Complete the transaction. Use your credit card or PayPal account to finalize the purchase.

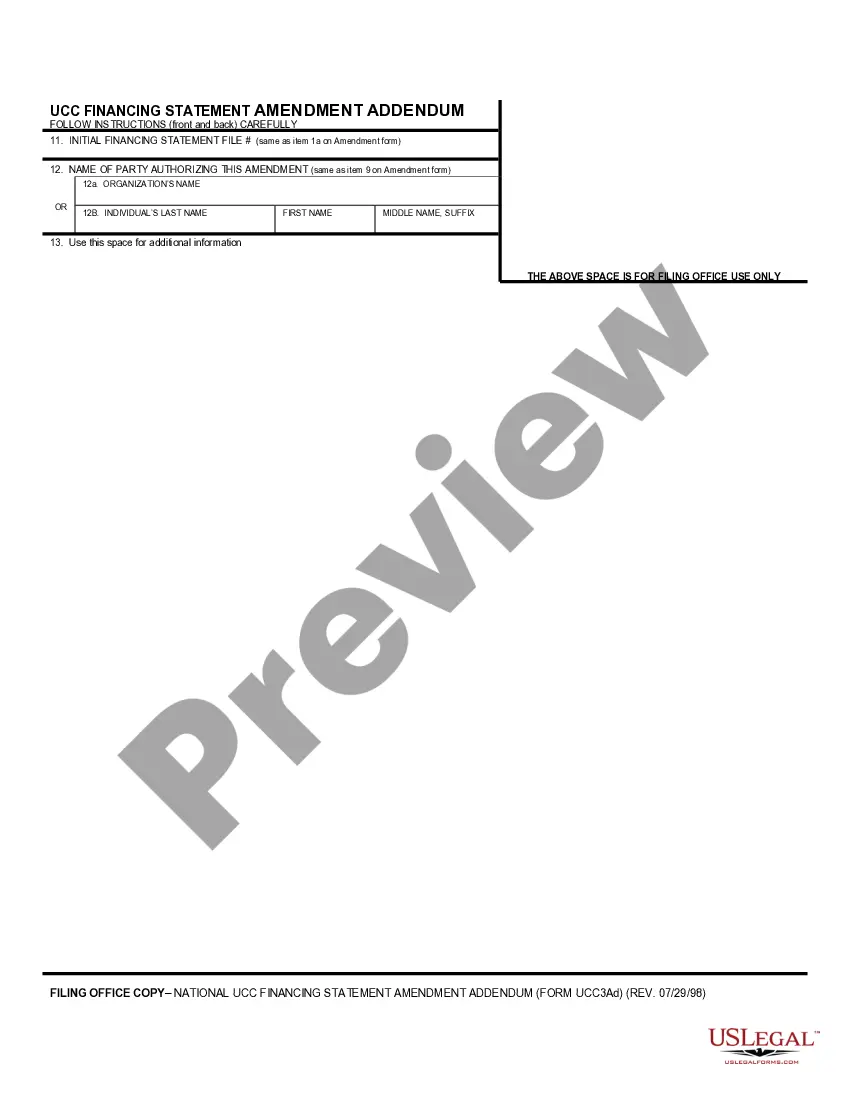

Select the format and download the form onto your device. Edit. Fill in, modify, and print and sign the downloaded Missouri Employer Training Memo - Payroll Deductions. Each template you add to your account has no expiration date and is yours permanently. Therefore, if you wish to download or print another copy, just navigate to the My documents section and click on the form you require.

- Ensure you have selected the appropriate form for your city/state.

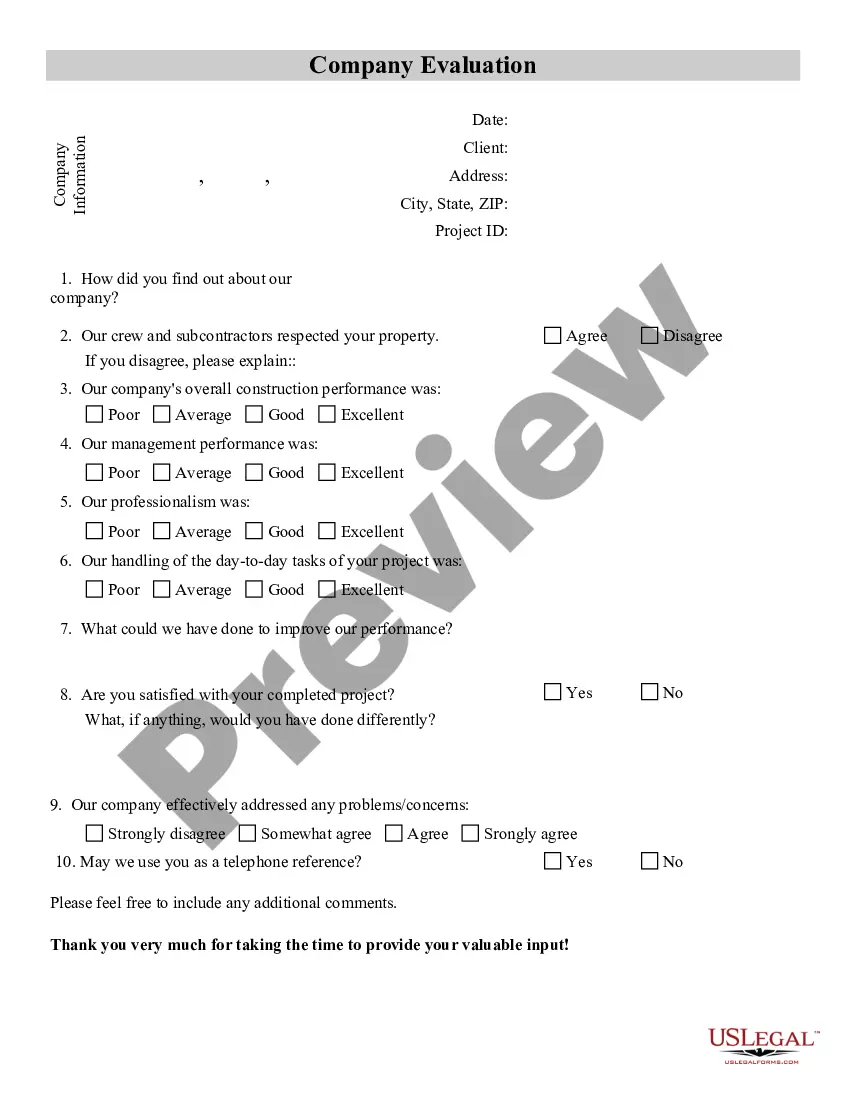

- Click the Review button to examine the content of the form.

- Check the form details to confirm that you have selected the right one.

- If the form doesn’t suit your needs, use the Search field at the top of the screen to find one that does.

- If you are satisfied with the form, confirm your choice by clicking the Purchase now button.

- Then, choose your preferred pricing plan and provide your details to create an account.

Form popularity

FAQ

Setting up payroll in Missouri involves several important steps. First, you need to obtain your Employer Identification Number (EIN) from the IRS for tax purposes. Next, ensure you comply with state-specific regulations, including understanding the rules around Missouri Employer Training Memo - Payroll Deductions. You might consider utilizing platforms like US Legal Forms, which provide templates and resources to simplify and streamline the payroll setup process for your business.

There are specific deductions that Missouri recognizes that the federal government does not. For instance, certain medical expenses or state-specific deductions may apply only at the state level. The Missouri Employer Training Memo - Payroll Deductions will clarify these specific items for you. Knowing the differences can help ensure that you do not miss out on potential savings.

The new $6000 tax deduction introduced in Missouri applies to taxpayers filing their state income taxes. This deduction can reduce your taxable income significantly, thus lowering your tax liability. It’s essential to review how this deduction fits into the Missouri Employer Training Memo - Payroll Deductions, as understanding it can help you make the most of your tax return. Always consider consulting with a tax professional if you have questions.

In Missouri, you do not need to itemize deductions to claim a deduction for state taxes. Standard deductions are available, and you can choose the method that benefits you most. It's important to know that the Missouri Employer Training Memo - Payroll Deductions provides crucial information on these options. You may find that standard deductions work better for your financial situation.

Yes, Missouri allows taxpayers to claim itemized deductions when filing their state taxes. These deductions can help reduce your taxable income, making tax preparation easier and possibly leading to a lower tax bill. The Missouri Employer Training Memo - Payroll Deductions can offer guidance on how to approach itemizing if you're unfamiliar with the process. Understanding what qualifies can help you maximize your deductions.

To speak with a representative at the Missouri Department of Revenue, you can call their customer service hotline during business hours. Be sure to have your questions ready, as the representatives are there to assist with inquiries related to the Missouri Employer Training Memo - Payroll Deductions. If you prefer written communication, you can also reach out via email. They typically respond within a few business days.

An employer deduction refers to any amount that an employer can subtract from their taxable income related to business expenses, including payroll costs. This helps reduce the taxable income reported to the state, potentially resulting in tax savings. For clarity on managing these deductions, the Missouri Employer Training Memo - Payroll Deductions offers comprehensive insights that can guide your payroll strategies.

The Missouri employer compensation deduction refers to the deduction available to employers for certain compensation costs. This deduction can lower overall payroll tax liability, making it beneficial for business planning. By understanding this deduction, which is detailed in the Missouri Employer Training Memo - Payroll Deductions, employers can strategically manage payroll to enhance financial outcomes.

To avoid penalties for underpayment in Missouri, ensure that you are withholding enough taxes from employee wages and making timely payments. Monitoring payroll deductions carefully can help you stay compliant with state requirements. The Missouri Employer Training Memo - Payroll Deductions can provide strategies to manage withholdings effectively and help you steer clear of unexpected penalties.

The standard deduction for Missouri taxpayers typically varies by filing status, and it can change annually. For many, this deduction reduces taxable income, making it simpler to calculate your tax liability. For specific figures and updates, check the Missouri Employer Training Memo - Payroll Deductions to get insights on how this impacts payroll calculations.