New Jersey Employer Training Memo - Payroll Deductions

Description

How to fill out Employer Training Memo - Payroll Deductions?

Are you within a placement where you require files for both organization or personal purposes just about every day? There are a lot of legal file web templates available on the net, but discovering ones you can trust is not easy. US Legal Forms offers thousands of develop web templates, much like the New Jersey Employer Training Memo - Payroll Deductions, that are published to satisfy state and federal needs.

In case you are already informed about US Legal Forms internet site and get a merchant account, simply log in. Following that, you are able to download the New Jersey Employer Training Memo - Payroll Deductions design.

Unless you provide an bank account and would like to begin to use US Legal Forms, adopt these measures:

- Discover the develop you will need and ensure it is for your right area/county.

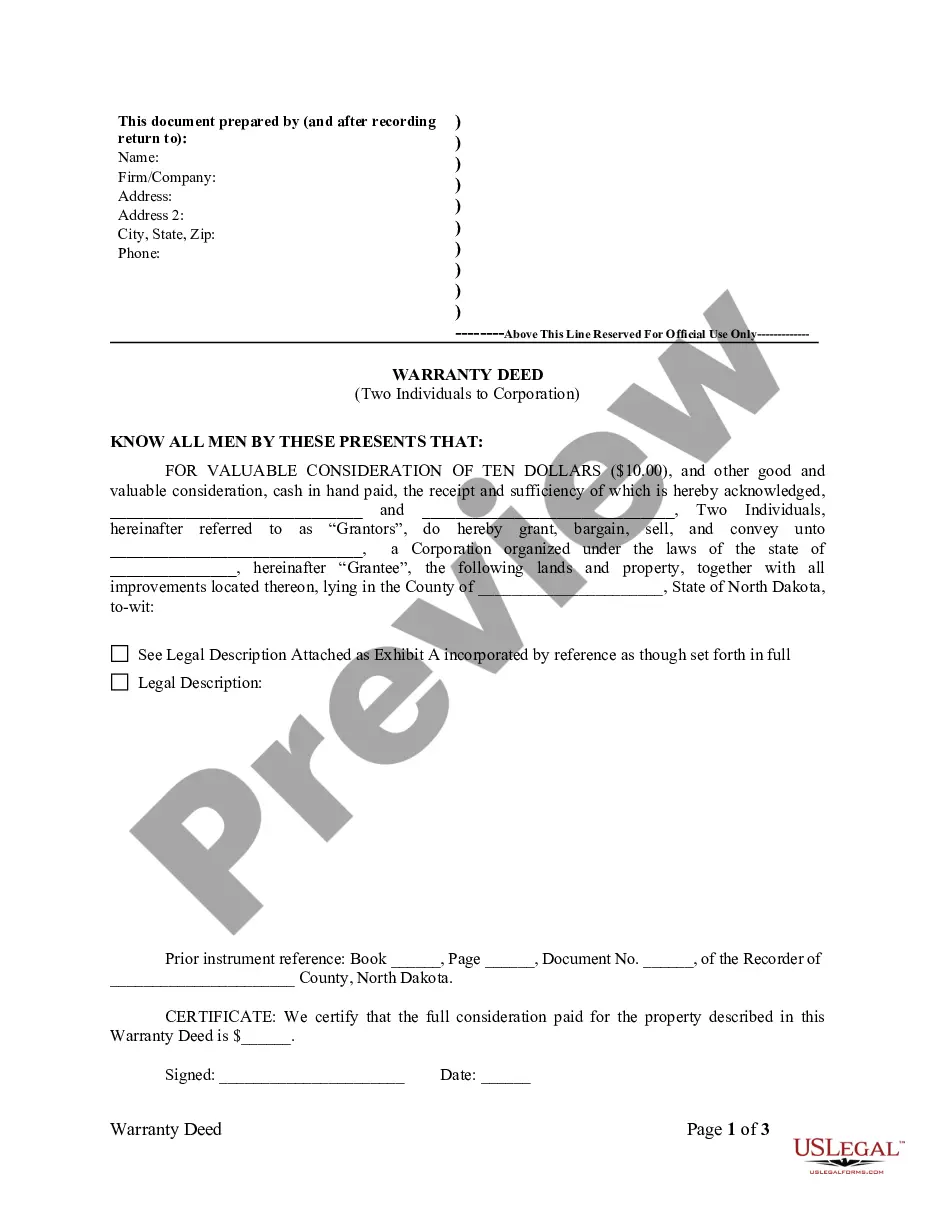

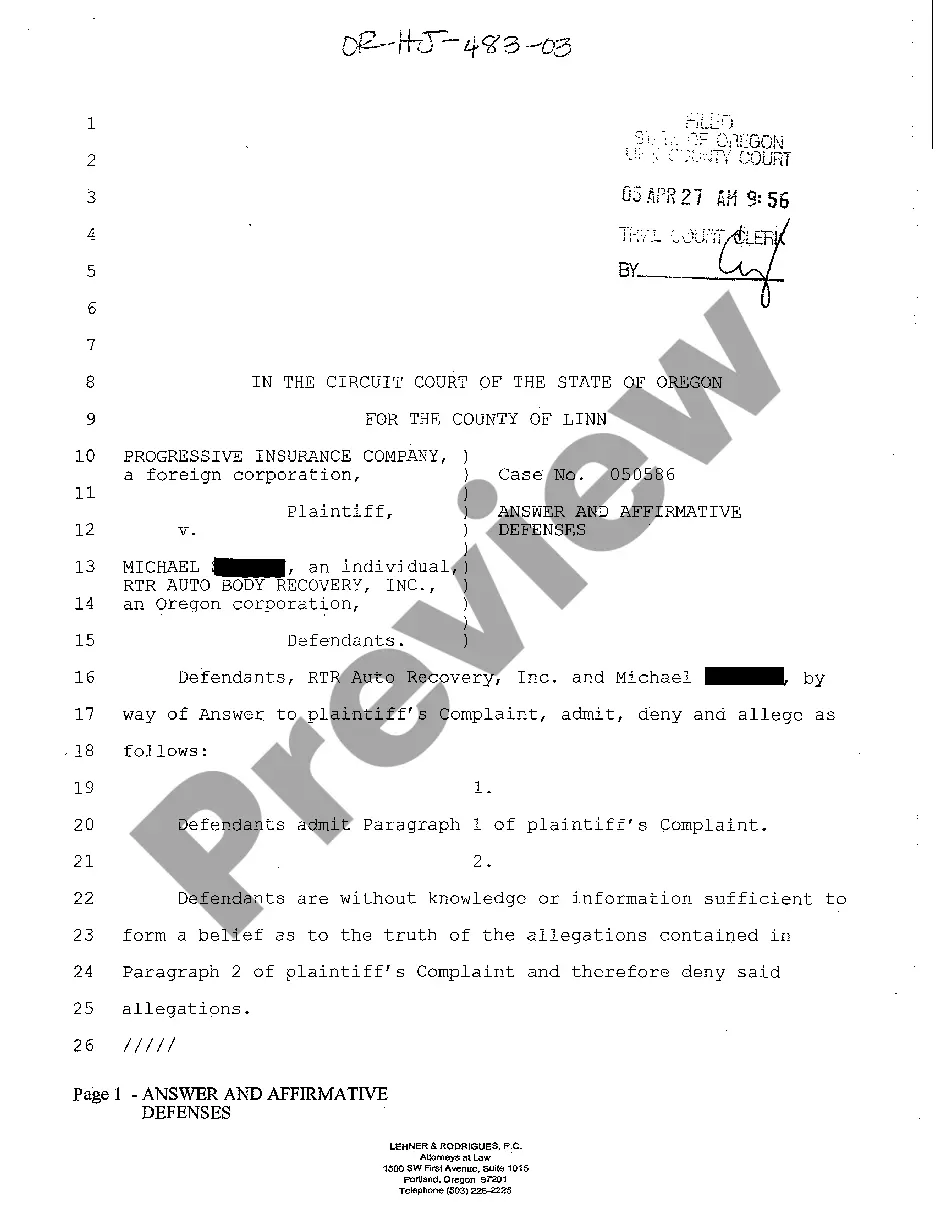

- Take advantage of the Review button to examine the shape.

- Browse the information to ensure that you have selected the proper develop.

- When the develop is not what you are looking for, take advantage of the Look for area to obtain the develop that fits your needs and needs.

- Once you discover the right develop, click on Buy now.

- Select the pricing strategy you need, fill in the necessary information to create your account, and pay for the order making use of your PayPal or Visa or Mastercard.

- Choose a handy paper file format and download your duplicate.

Get all the file web templates you have bought in the My Forms menus. You can obtain a more duplicate of New Jersey Employer Training Memo - Payroll Deductions any time, if needed. Just go through the necessary develop to download or print out the file design.

Use US Legal Forms, probably the most comprehensive assortment of legal forms, in order to save time and avoid blunders. The services offers expertly created legal file web templates that you can use for a variety of purposes. Make a merchant account on US Legal Forms and initiate making your way of life easier.

Form popularity

FAQ

Some of the types of deductions which are authorized under federal and state law include: meals, housing and transportation, debts owed the employer, debts owed to third parties (through the process of garnishment); debts owed to the government (such as back taxes and federally-subsidized student loans), child support

Allowable Paycheck DeductionsPersonal loans (cash advances, 401(k) or retirement loan payment, bail or bond payments, etc.)Personal purchases of a business's goods or services such as: Food purchases from the cafeteria.Employee's health, dental, vision, and other insurance payments or co-payments.

The WR-30 form is a report of all of the people who were employed or paid wages by an employer in the state of New Jersey. Employers are required to file a WR-30 form on a quarterly basis.

You can take credit on your New Jersey tax return for any excess unemployment insurance (UI)/workforce development partnership fund (WF)/supplemental workforce fund (SWF) contributions, disability insurance (DI) contributions, and/or family leave insurance (FLI) contributions withheld by two or more employers.

By law, your employer is permitted to deduct wages for taxes for state and federal income, social security, and state disability insurance obligations. You can control how much is deducted by claiming allowances on a W4.

What Can Be Deducted From Employee Wages?Payroll taxes;Retirement plan contributions;Social security contributions;Benefit plan contributions, such as the employee portion of health insurance premiums;Other items for the employee's benefit or for which the employee gives written consent, such as union dues;More items...?

Family Leave Insurance benefits are subject to federal income tax and to federal rules on reporting income and paying taxes. Family Leave Insurance benefits are not subject to New Jersey state income tax.

Mandatory Payroll Tax DeductionsFederal income tax withholding.Social Security & Medicare taxes also known as FICA taxes.State income tax withholding.Local tax withholdings such as city or county taxes, state disability or unemployment insurance.Court ordered child support payments.

Form NJ-927-H filers must file Form NJ-W-3 by the last day of February following the close of the calendar year that payment of wages ended; 4. Submit a Request for Change of Registration Information (Form REG-C-L) online or by mail to notify the State of the date that operations (and payment of wages) ended.

Certificate of Voluntary Withholding of Gross Income Tax from Pension and Annuity Payments. NJ-927-H.