New Jersey Payroll Deduction Authorization Form

Description

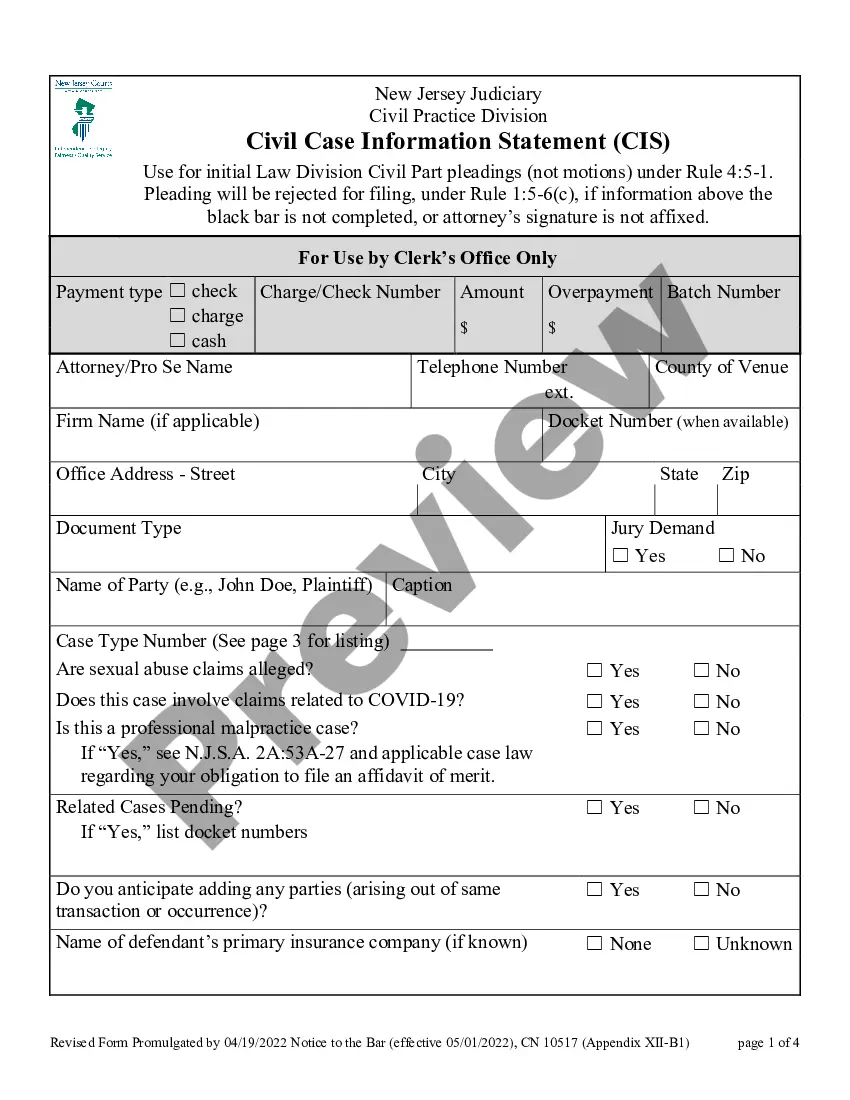

How to fill out Payroll Deduction Authorization Form?

Finding the appropriate legal document format can be challenging.

Of course, there are numerous templates available on the internet, but how do you find the legal form you require.

Visit the US Legal Forms website. This service offers thousands of templates, including the New Jersey Payroll Deduction Authorization Form, available for both business and personal use. All forms are verified by professionals and comply with federal and state regulations.

If the form does not fulfill your requirements, utilize the Search area to locate the correct form. Once you are confident that the form is appropriate, click the Acquire now button to obtain it. Select the pricing plan you prefer and enter the necessary information. Create your account and complete your purchase using your PayPal account or credit card. Choose the file format and download the legal document format to your device. Complete, modify, print, and sign the retrieved New Jersey Payroll Deduction Authorization Form. US Legal Forms is the largest repository of legal forms where you can find various document templates. Use their service to acquire professionally crafted documents that meet state standards.

- If you are already registered, Log In to your account and click the Acquire button to obtain the New Jersey Payroll Deduction Authorization Form.

- Use your account to search through the legal forms you have purchased previously.

- Go to the My documents tab in your account to retrieve another copy of the document you need.

- If you are a new user of US Legal Forms, here are simple steps for you to follow.

- First, ensure you have chosen the correct form for your city/state.

- You can preview the form using the Preview button and review the form description to confirm it’s the correct one for you.

Form popularity

FAQ

(WPL) requires every employer to pay the full amount of wages due its employees at least twice during the calendar month on regular paydays designated in advance. Each regular payday must be no more than 10 working days after the end of the pay period for which payment is made.

Certificate of Voluntary Withholding of Gross Income Tax from Pension and Annuity Payments. NJ-927-H.

-4.4 Withholding or diverting wagesNo employer may withhold or divert any portion of an employee's wages unless: a. The employer is required or empowered to do so by New Jersey or United States law; or b.

To stop the withholding of New Jersey Income Tax, complete an Employee's Certificate of Nonresidence in New Jersey (Form NJ-165) and give it to your employer.

If the employee has breached their employment contract, the employer is legally allowed to withhold payment. This includes going on strike, choosing to work to rule, or deducting overpayment.

Form NJ-927-H filers must file Form NJ-W-3 by the last day of February following the close of the calendar year that payment of wages ended; 4. Submit a Request for Change of Registration Information (Form REG-C-L) online or by mail to notify the State of the date that operations (and payment of wages) ended.

The final paycheck should contain the employee's regular wages from the most recent pay period, plus other types of compensation such as commissions, bonuses, and accrued sick and vacation pay. Employers can withhold money from the employee's last paycheck if the employee owes your organization.

How to Submit a WR-30. You must file all completed WR-30 forms via the Divison of Taxation website. You will need your New Jersey taxpayer identification number and PIN) which would have been included on the letter you received after registering your business.

The WR-30 form is a report of all of the people who were employed or paid wages by an employer in the state of New Jersey. Employers are required to file a WR-30 form on a quarterly basis.

Under the New Jersey Security and Financial Empowerment Act ("NJ SAFE Act"), employees have the right to take up to 20 days of unpaid time off necessary because they, or a member of their immediate family, has been a victim of domestic violence or sexual assault.