Arkansas Accounting Procedures

Description

How to fill out Accounting Procedures?

You are able to commit hours on the Internet trying to find the legitimate file design which fits the state and federal needs you need. US Legal Forms provides a huge number of legitimate kinds that are reviewed by pros. You can actually obtain or print out the Arkansas Accounting Procedures from the support.

If you have a US Legal Forms profile, you may log in and click on the Down load option. Next, you may complete, change, print out, or indicator the Arkansas Accounting Procedures. Every single legitimate file design you acquire is yours forever. To have an additional backup associated with a acquired type, visit the My Forms tab and click on the related option.

If you are using the US Legal Forms web site the first time, follow the simple recommendations beneath:

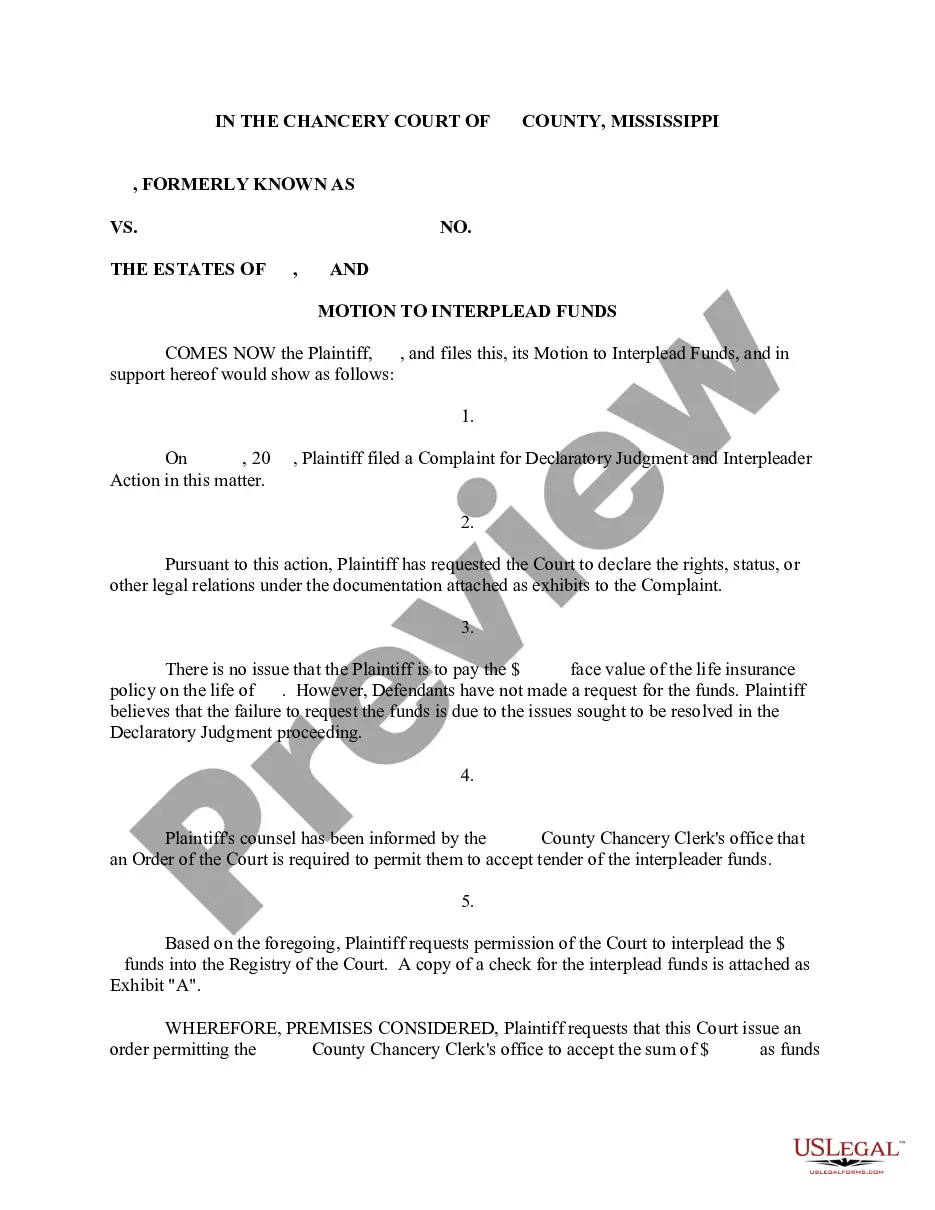

- Initial, make sure that you have chosen the right file design for that county/city of your liking. Browse the type outline to make sure you have picked out the appropriate type. If accessible, make use of the Review option to look through the file design also.

- If you would like discover an additional version of your type, make use of the Research industry to obtain the design that meets your requirements and needs.

- Upon having found the design you want, click on Acquire now to proceed.

- Choose the costs prepare you want, enter your references, and sign up for a merchant account on US Legal Forms.

- Comprehensive the financial transaction. You can utilize your credit card or PayPal profile to purchase the legitimate type.

- Choose the file format of your file and obtain it in your gadget.

- Make alterations in your file if needed. You are able to complete, change and indicator and print out Arkansas Accounting Procedures.

Down load and print out a huge number of file layouts using the US Legal Forms Internet site, which provides the largest assortment of legitimate kinds. Use professional and express-specific layouts to tackle your business or individual needs.

Form popularity

FAQ

When filing state copies of forms 1099 with Arkansas department of revenue, the agency contact information is: Department of Finance & Administration , Withholding Tax, PO Box 8055, Little Rock, AR 72203.

Know the Different Copies of a 1099 Form For many employers, all five copies of the 1099 form are essential: Copy A?Goes to the IRS. Copy 1?Goes to the state tax agency. Copy 2?Goes to the recipient.

The ATAP service allows taxpayers to file and pay taxes online, view their tax account information, and communicate with the department.

NEC FILING REQUIRED Forms filed to the IRS are automatically forwarded to the state, eliminating separate reporting to the participating states.

You'll mail one copy to the payee and submit a copy of each one to the IRS with Form 1096. Software companies and online websites also provide filing and mailing services, generally for a small fee per form. If you will be filing 250 or more 1099-NEC returns, you're required to submit them electronically to the IRS.

You can find your Tax ID Number on any previous payment voucher you have received from the AR Department of Finance and Administration. If you're unsure, contact the agency at (501) 682-7290.

It is much easier to file these forms electronically in the first instance. If you have opted to send these forms in the mail, read on to find out where to send them. Send your forms to: Internal Revenue Service, Austin, Submission Processing Center, P.O Box 149213, Austin, TX 78714.