Arkansas Lab Worker Employment Contract - Self-Employed

Description

How to fill out Lab Worker Employment Contract - Self-Employed?

Are you situated in an environment where you require documentation for potential business or personal purposes regularly.

There are numerous valid document templates accessible online, but locating templates you can trust is not easy.

US Legal Forms offers a vast array of document templates, such as the Arkansas Lab Worker Employment Agreement - Self-Employed, which are designed to comply with federal and state regulations.

Once you find the correct document, click Purchase now.

Select the pricing plan you prefer, fill in the required information to create your account, and complete the payment with your PayPal or Visa or Mastercard. Choose a convenient file format and download your copy. Access all the document templates you have purchased in the My documents section. You can retrieve an additional copy of the Arkansas Lab Worker Employment Agreement - Self-Employed at any time, simply select the necessary document to download or print the document template. Utilize US Legal Forms, the most comprehensive collection of legitimate forms, to save time and avoid mistakes. The service offers professionally crafted legal document templates that you can use for various purposes. Create your account on US Legal Forms and start making your life a bit easier.

- If you are already familiar with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Lab Worker Employment Agreement - Self-Employed template.

- If you do not have an account and wish to start using US Legal Forms, follow these steps.

- Obtain the document you need and ensure it is for your correct city/state.

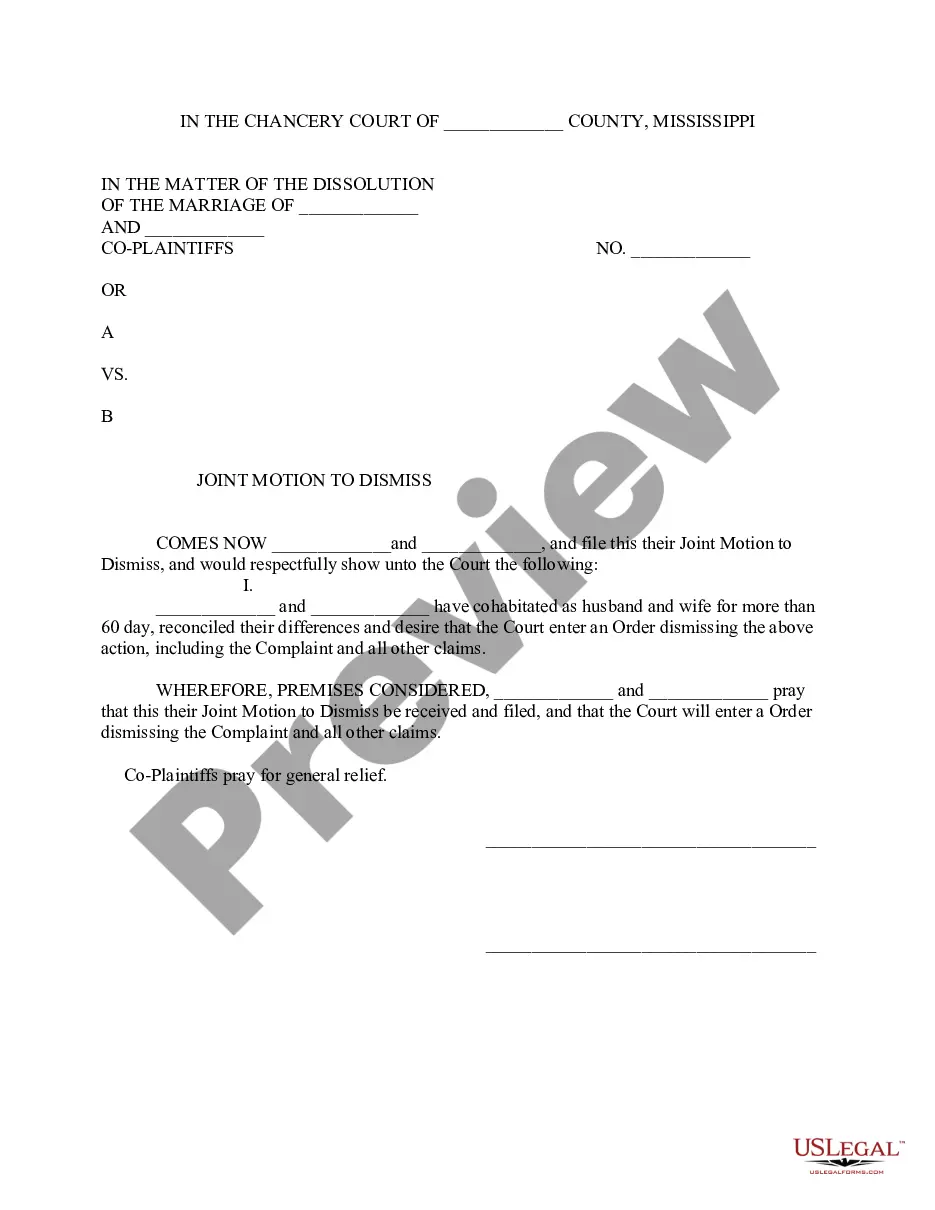

- Use the Review button to examine the document.

- Check the description to confirm that you have selected the correct document.

- If the document is not what you are looking for, use the Search field to find the document that meets your requirements.

Form popularity

FAQ

Yes, contract work typically counts as self-employment. If you are working under an Arkansas Lab Worker Employment Contract - Self-Employed, you are likely considered self-employed. This means you manage your own business and have the freedom to choose your clients, while also being responsible for your taxes. Understanding this distinction will help you benefit from the flexibility of contracting.

Recent regulations have updated the landscape for self-employed individuals. These rules often affect tax filing and benefit eligibility. It's crucial to review the guidelines regarding your Arkansas Lab Worker Employment Contract - Self-Employed to ensure you comply. Staying informed will help you navigate any legal or financial considerations effectively.

To qualify as an independent contractor, you must generally demonstrate control over how you perform your work. Your Arkansas Lab Worker Employment Contract - Self-Employed can help clarify your work parameters. Key factors include your ability to set your schedule, manage your tools, and make independent business decisions. Additionally, understanding tax obligations and business licenses may be necessary.

You can obtain your employment contract by creating one tailored to your needs. A platform like US Legal Forms offers templates for an Arkansas Lab Worker Employment Contract - Self-Employed, which can be personalized to fit your specific requirements. Simply choose a relevant template, fill in your details, and ensure both parties sign it. This will solidify your agreement and protect your rights.

Both terms are often used interchangeably, but they can imply different things. An Arkansas Lab Worker Employment Contract - Self-Employed typically focuses on self-employment, while 'independent contractor' may refer to contractual work for various clients. Depending on your business structure and how you want to market yourself, you might choose one term over the other. Either way, a clear contract is essential.

Yes, you can have a contract if you're self-employed. In fact, having an Arkansas Lab Worker Employment Contract - Self-Employed can provide clarity on your responsibilities and payment terms. A well-drafted contract can protect both you and your clients by outlining the terms of your engagement. It's a wise step to formalize your working relationship.

To show proof of self-employment, you can present documents such as tax returns, invoices, or a business registration certificate. Additionally, contracts like the Arkansas Lab Worker Employment Contract - Self-Employed can serve as supporting evidence of your self-employed status. Maintaining thorough records is essential for documentation.

Writing a self-employed contract involves detailing the work to be done, payment terms, and any specific conditions. You should also include clauses about confidentiality and dispute resolution. Using an established resource like the Arkansas Lab Worker Employment Contract - Self-Employed can simplify the drafting process.

Absolutely, a self-employed person can and should have a contract. A formal agreement helps protect both parties and clarifies expectations. The Arkansas Lab Worker Employment Contract - Self-Employed specifically accommodates the needs of individuals in this category, providing necessary legal foundations.

When writing a contract for a 1099 employee, outline the services they will provide and the payment terms. Include any milestones or deliverables, and be clear about the independent nature of the work. A structured template, such as the Arkansas Lab Worker Employment Contract - Self-Employed, can help you include all essential information.