Arkansas Investment Transfer Affidavit and Agreement

Description

How to fill out Investment Transfer Affidavit And Agreement?

Finding the right authorized file template could be a have difficulties. Obviously, there are tons of layouts accessible on the Internet, but how can you obtain the authorized type you require? Take advantage of the US Legal Forms web site. The support provides 1000s of layouts, such as the Arkansas Investment Transfer Affidavit and Agreement, which can be used for enterprise and personal needs. Every one of the forms are examined by specialists and meet up with state and federal specifications.

When you are already authorized, log in for your accounts and click the Down load button to find the Arkansas Investment Transfer Affidavit and Agreement. Make use of your accounts to appear through the authorized forms you possess ordered in the past. Proceed to the My Forms tab of the accounts and get yet another backup of the file you require.

When you are a fresh user of US Legal Forms, here are simple instructions so that you can adhere to:

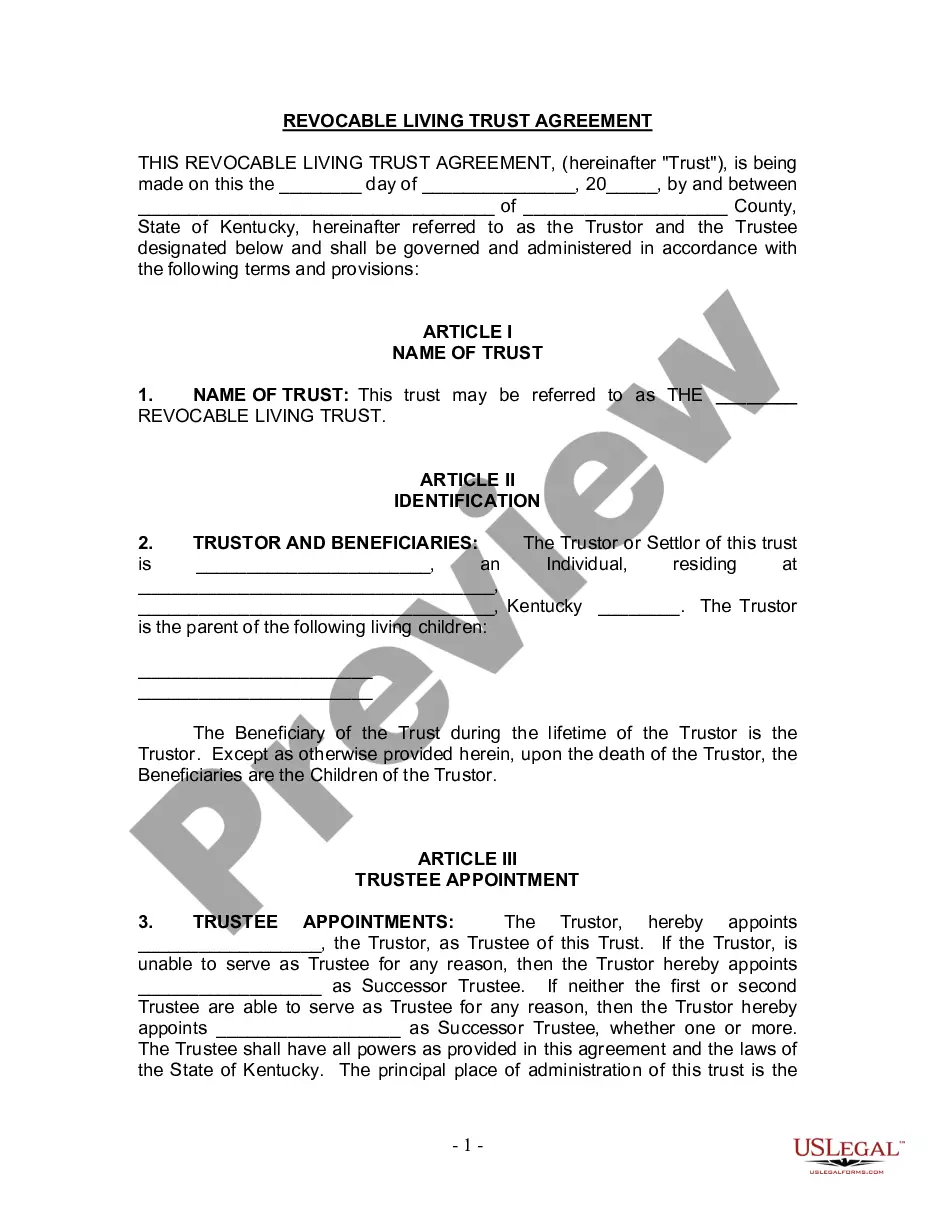

- Initial, be sure you have chosen the correct type to your city/state. You are able to check out the form using the Review button and read the form explanation to ensure it is the best for you.

- In case the type fails to meet up with your requirements, utilize the Seach area to obtain the appropriate type.

- Once you are sure that the form is suitable, go through the Purchase now button to find the type.

- Pick the rates program you would like and enter in the required information. Create your accounts and pay for your order with your PayPal accounts or charge card.

- Pick the file structure and acquire the authorized file template for your gadget.

- Complete, modify and print out and indication the acquired Arkansas Investment Transfer Affidavit and Agreement.

US Legal Forms may be the most significant collection of authorized forms that you can see various file layouts. Take advantage of the company to acquire professionally-created documents that adhere to state specifications.

Form popularity

FAQ

The 2023 standard deduction is $13,850 for single filers, $27,700 for joint filers or $20,800 for heads of household. People 65 or older may be eligible for a higher standard deduction amount.

State Income Tax Filing Requirements To claim any refund due, you must file an Arkansas income tax return. Residents of Ar- kansas must complete Form AR1000. Nonresidents and Part-Year Residents must complete Form AR1000NR. Moving to Arkansas - A Tax Guide for New Residents arkansas.gov ? dfa ? income_tax ? documents arkansas.gov ? dfa ? income_tax ? documents

Arkansas also has a 1.0 to 5.30 percent corporate income tax rate. Arkansas has a 6.50 percent state sales tax rate, a max local sales tax rate of 6.125 percent, and an average combined state and local sales tax rate of 9.46 percent. Arkansas's tax system ranks 38th overall on our 2024 State Business Tax Climate Index.

As previously reported (Tax Alert 2023-0779), on April 10, 2023, Arkansas Governor Sarah Huckabee Sanders signed into law SB 549, which, retroactive to January 1, 2023, lowers the top marginal personal income tax rate from 4.9% to 4.7%.

Arkansas standard deduction for tax year 2021 is $4,400 for married filing jointly and $2,200 for all other filers. Arkansas Income Tax Calculator 2022-2023 - Forbes forbes.com ? advisor ? arkansas forbes.com ? advisor ? arkansas

There are no set rules on whether the buyer or seller pays for the transfer tax in the Natural State. The going rate for real estate transfer tax in Arkansas is $3.30 per $1,000. Guide to Arkansas Closing Costs - NewHomeSource newhomesource.com ? learn ? closing-costs-... newhomesource.com ? learn ? closing-costs-...

Arkansas income taxes Arkansas income tax rates currently max out at 4.7%. The top tax rate will reduce to 4.4% in 2024. The table below shows 2023 Arkansas income tax rates for individuals with net incomes up to $84,500. Taxpayers with net incomes above this amount reach the higher tax brackets sooner.

The notary must be certain that the person appearing before him/her is who that person claims to be. Personal appearance before the notary is required. A notary cannot notarize a document by video or remotely. Notary Public & eNotary Handbook - Arkansas Secretary of State arkansas.gov ? uploads ? bcs ? NotaryH... arkansas.gov ? uploads ? bcs ? NotaryH...