Arkansas Joint Filing Agreement

Description

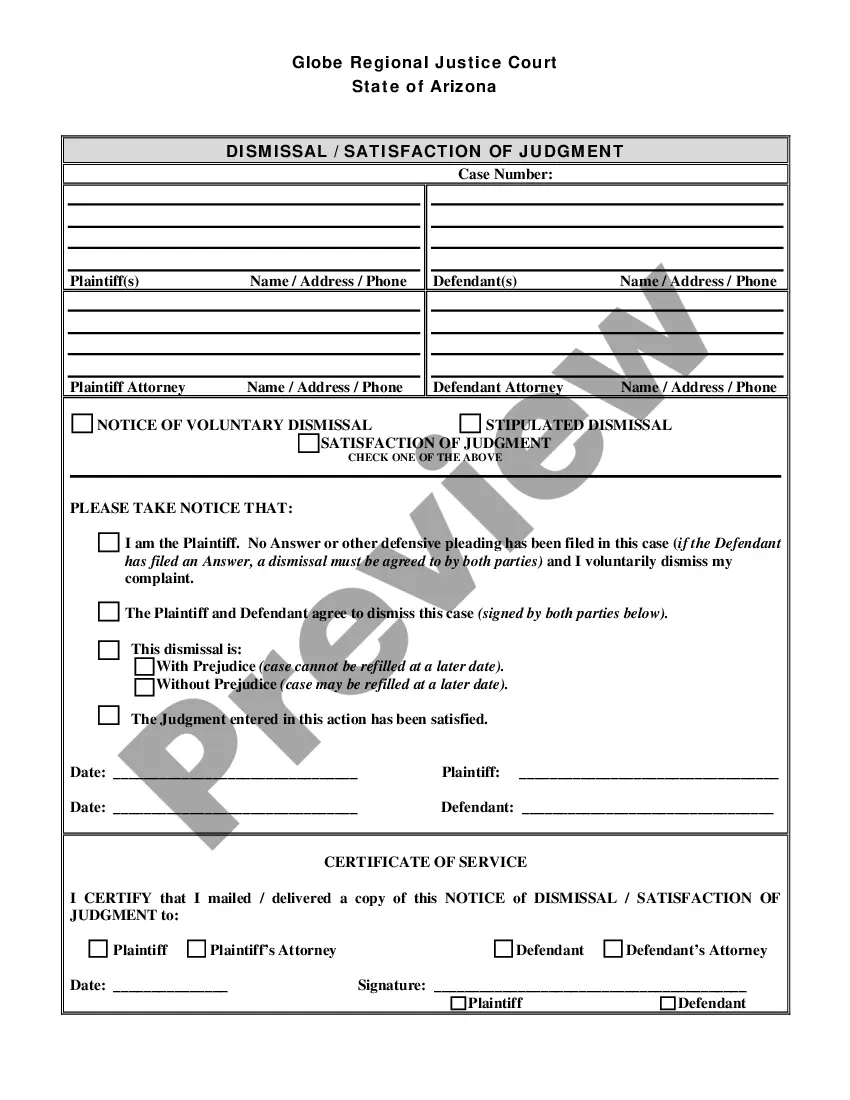

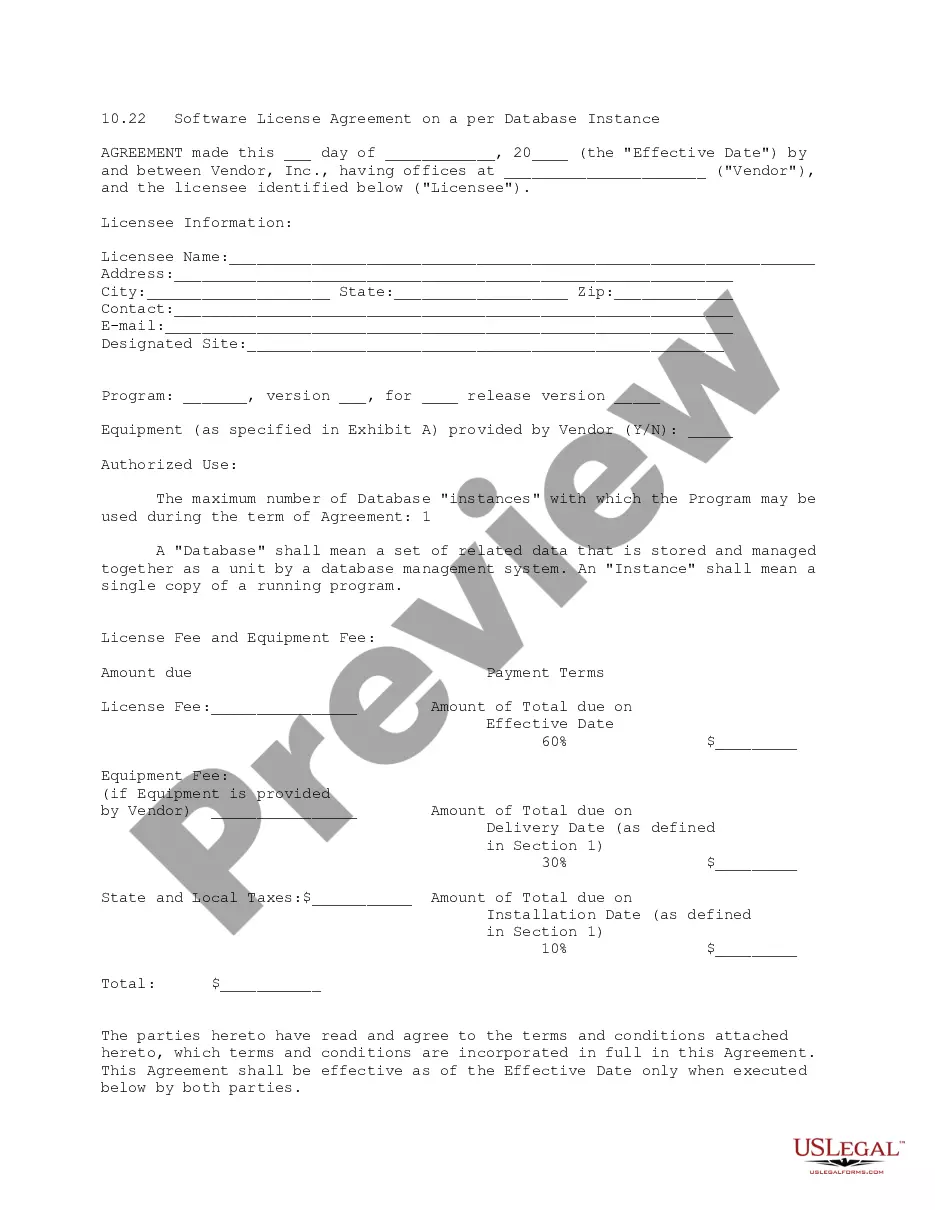

How to fill out Joint Filing Agreement?

US Legal Forms - one of the most significant libraries of lawful forms in America - gives a wide array of lawful papers templates it is possible to download or print. Utilizing the website, you will get a large number of forms for company and specific uses, categorized by groups, says, or key phrases.You can get the latest types of forms just like the Arkansas Joint Filing Agreement in seconds.

If you currently have a monthly subscription, log in and download Arkansas Joint Filing Agreement from your US Legal Forms collection. The Down load option will show up on every single develop you see. You have accessibility to all earlier saved forms in the My Forms tab of your own accounts.

If you want to use US Legal Forms the first time, listed here are basic directions to obtain started:

- Be sure you have picked the correct develop for your city/state. Click on the Preview option to analyze the form`s content. Read the develop description to actually have chosen the appropriate develop.

- In case the develop does not suit your needs, make use of the Look for discipline towards the top of the screen to find the the one that does.

- When you are content with the form, validate your decision by clicking on the Acquire now option. Then, pick the pricing prepare you prefer and give your references to register for the accounts.

- Method the purchase. Make use of your credit card or PayPal accounts to accomplish the purchase.

- Find the structure and download the form on your system.

- Make modifications. Load, revise and print and sign the saved Arkansas Joint Filing Agreement.

Each template you put into your account does not have an expiration particular date and is also yours forever. So, if you want to download or print an additional version, just proceed to the My Forms section and click in the develop you will need.

Gain access to the Arkansas Joint Filing Agreement with US Legal Forms, the most comprehensive collection of lawful papers templates. Use a large number of specialist and status-certain templates that fulfill your business or specific needs and needs.

Form popularity

FAQ

Form AR1050 is used to file the income of a partnership. Every domestic or foreign partnership doing business within the State of Arkansas or in receipt of income from Arkansas sources, regardless of amount, must file an AR1050.

If you are married, you and your spouse may file a joint return, separately on the same return, or separately on different returns.

A partnership (including REMICs classified as partnerships) that engages in a trade or business in California or has income from a California source must file Form 565.

The state of Arkansas requires you to pay taxes if you're a resident or nonresident that receives income from an Arkansas source. The state income tax rates range up to 5.9%, and the sales tax rate is 6.5%.

Only one Form 1065 is required per partnership or LLC, but each member of the entity must complete their own Schedule K-1 to file with the 1065 tax form, as well as their personal tax returns.

A partnership return must be signed by any one of the partners (IRC § 6063; Reg. §1.6063-1). ing to the Instructions for Form 1065, U.S. Partnership Return of Income, any partner or any member of a limited liability company (LLC) may sign the return.

Part year residents who received any gross income while an Arkansas resident must file a return (regardless of marital status, filing status, or amount). *Gross income is all income (before deductions) other than income specifically described as exempt on pages 9 and 10 ?Exempt From Income Tax.?