Arkansas Merger Agreement for Type A Reorganization

Description

How to fill out Merger Agreement For Type A Reorganization?

Are you in a place that you need to have paperwork for both company or specific purposes nearly every time? There are plenty of legitimate record layouts accessible on the Internet, but locating types you can depend on isn`t effortless. US Legal Forms delivers 1000s of kind layouts, much like the Arkansas Merger Agreement for Type A Reorganization, that are created to meet state and federal requirements.

Should you be currently familiar with US Legal Forms internet site and get an account, merely log in. After that, it is possible to down load the Arkansas Merger Agreement for Type A Reorganization template.

Unless you come with an profile and need to start using US Legal Forms, follow these steps:

- Discover the kind you require and ensure it is for your correct town/area.

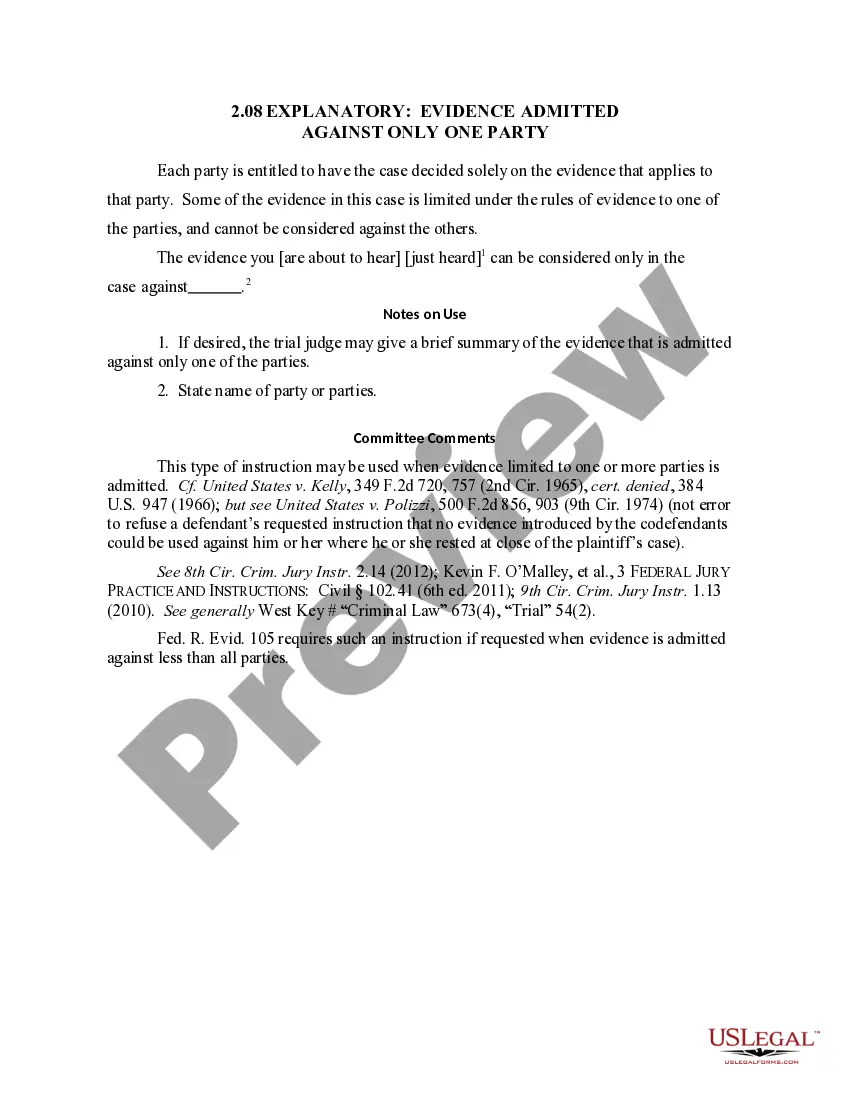

- Make use of the Preview option to analyze the form.

- Read the explanation to actually have chosen the proper kind.

- If the kind isn`t what you`re searching for, take advantage of the Search field to find the kind that meets your needs and requirements.

- Once you get the correct kind, click on Acquire now.

- Pick the pricing prepare you need, fill out the necessary information and facts to produce your money, and purchase your order making use of your PayPal or Visa or Mastercard.

- Decide on a hassle-free paper file format and down load your copy.

Locate all the record layouts you possess purchased in the My Forms menus. You may get a extra copy of Arkansas Merger Agreement for Type A Reorganization anytime, if required. Just click on the needed kind to down load or produce the record template.

Use US Legal Forms, by far the most substantial collection of legitimate varieties, to conserve time as well as prevent mistakes. The assistance delivers skillfully produced legitimate record layouts that you can use for a variety of purposes. Generate an account on US Legal Forms and commence generating your way of life a little easier.

Form popularity

FAQ

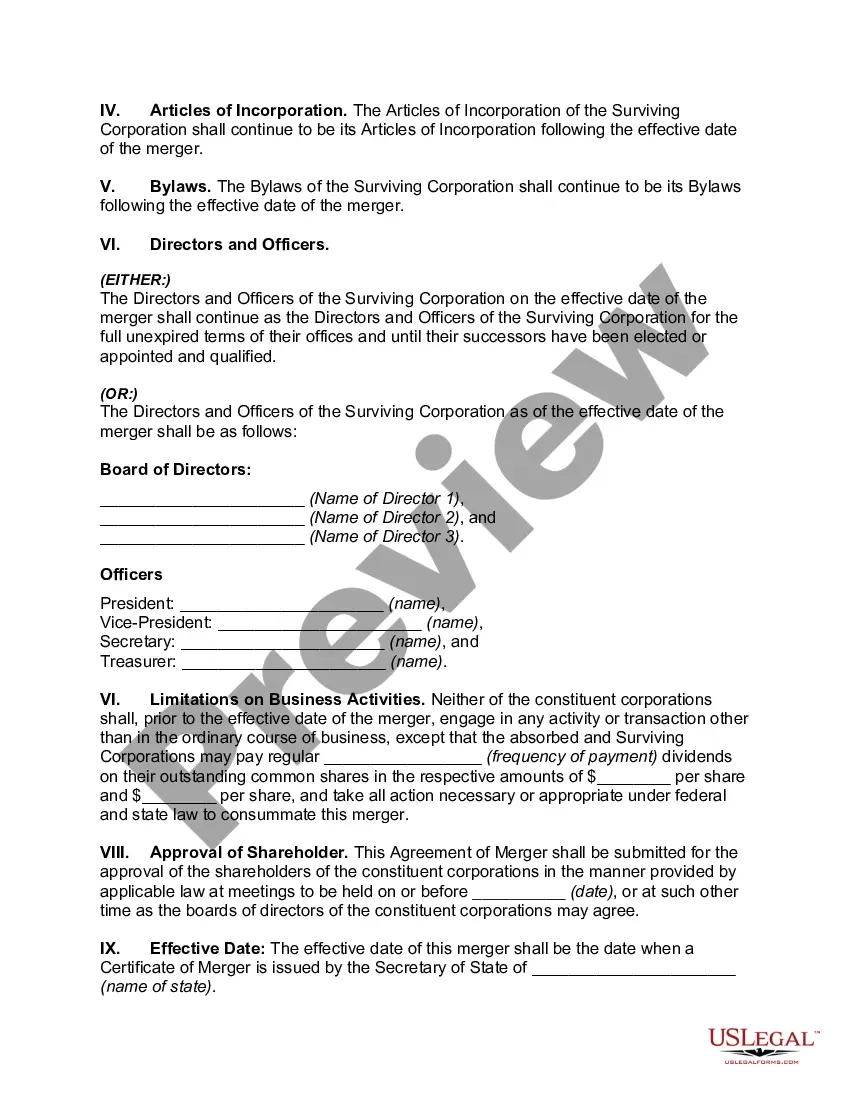

The principal tax advantage of an "A" reorganization is the freedom allowed in choosing the consideration which may be used in the merger. The stock issued by the surviving corporation, or by its parent if a subsidiary is used, can be preferred or common, voting or nonvoting.

Overview. In a D reorganization, one corporation transfers all or part of its assets to another corporation. Immediately after the transfer, the transferring corporation or one or more of its shareholders must be in control of the corporation that acquired the assets.

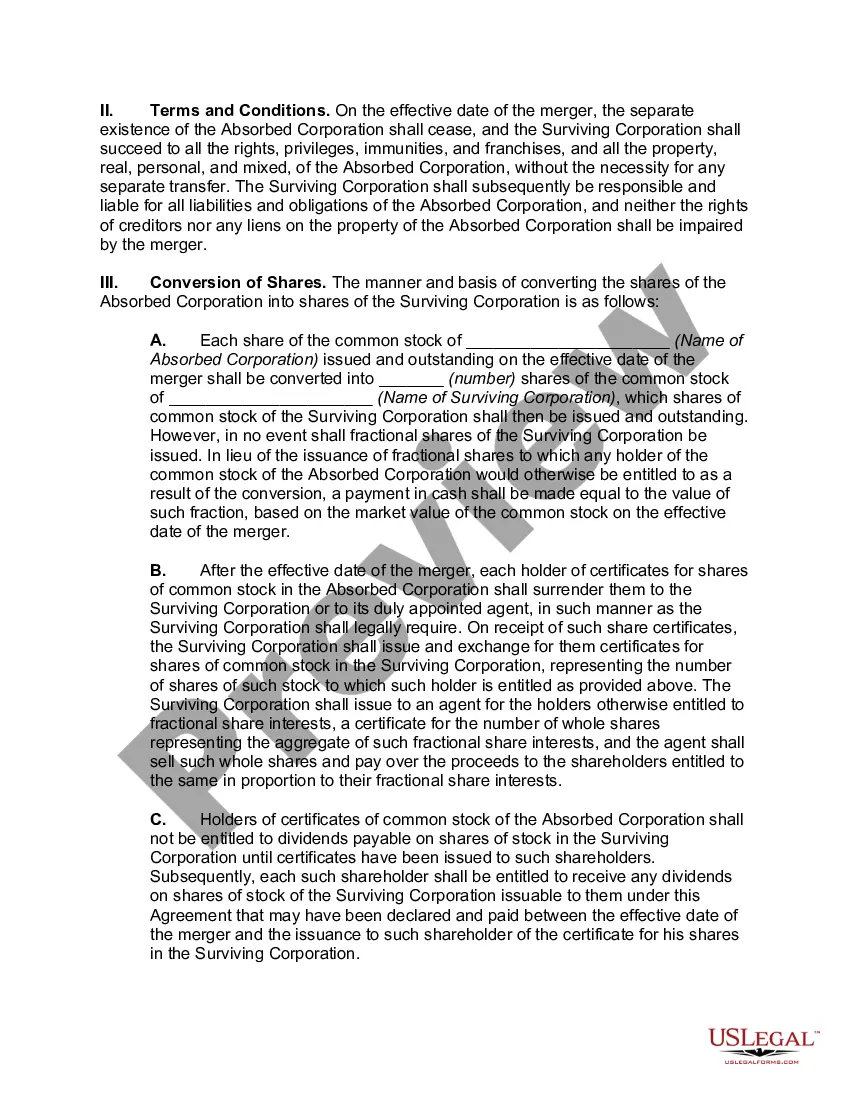

Under IRC § 368(a)(1)(A), a Type A reorganization is a ?statutory merger or consolidation.? An ?A? reorganization must meet the requirements of applicable state corporate law or the merger laws of a foreign jurisdiction, as well as regulatory requirements in Treas.

A Type A reorganization must fulfill the continuity of interests requirement. That is, the shareholders in the acquired company must receive enough stock in the acquiring firm that they have a continuing financial interest in the buyer.

While other consideration besides stock can be paid under a type A reorganization, the price paid under a type B reorganization must be solely in stock. And while the target is dissolved in a type A reorganization, it can be retained in a type B reorganization.

In a typical merger, the assets and liabilities of T are transferred to P, and T dissolves by operation of law. The consideration received by T's shareholders is determined by a merger agreement. A consolidation is a transfer of assets and liabilities of two or more existing corporations to a newly created corporation.

A type A Reorganization is a tax-free merger or consolidation. Generally, in a merger, one corporation (the acquiring corporation) acquires the assets and assumes the liabilities of another corporation (the target corporation) in exchange for its stock.

The seven main types of company reorganization are mergers and consolidations, acquisitions, practical mergers, transfer spinoffs and split-offs, recapitalization, identity changes and transfers of assets.