The purpose of the non-employee director stock option plan is to attract and retain highly qualified people who are not employees of the company or any of its subsidiaries to serve as non-employee directors of the company, and to encourage non-employee directors to own shares of the company's common stock.

Washington Nonemployee Director Stock Option Plan

Description

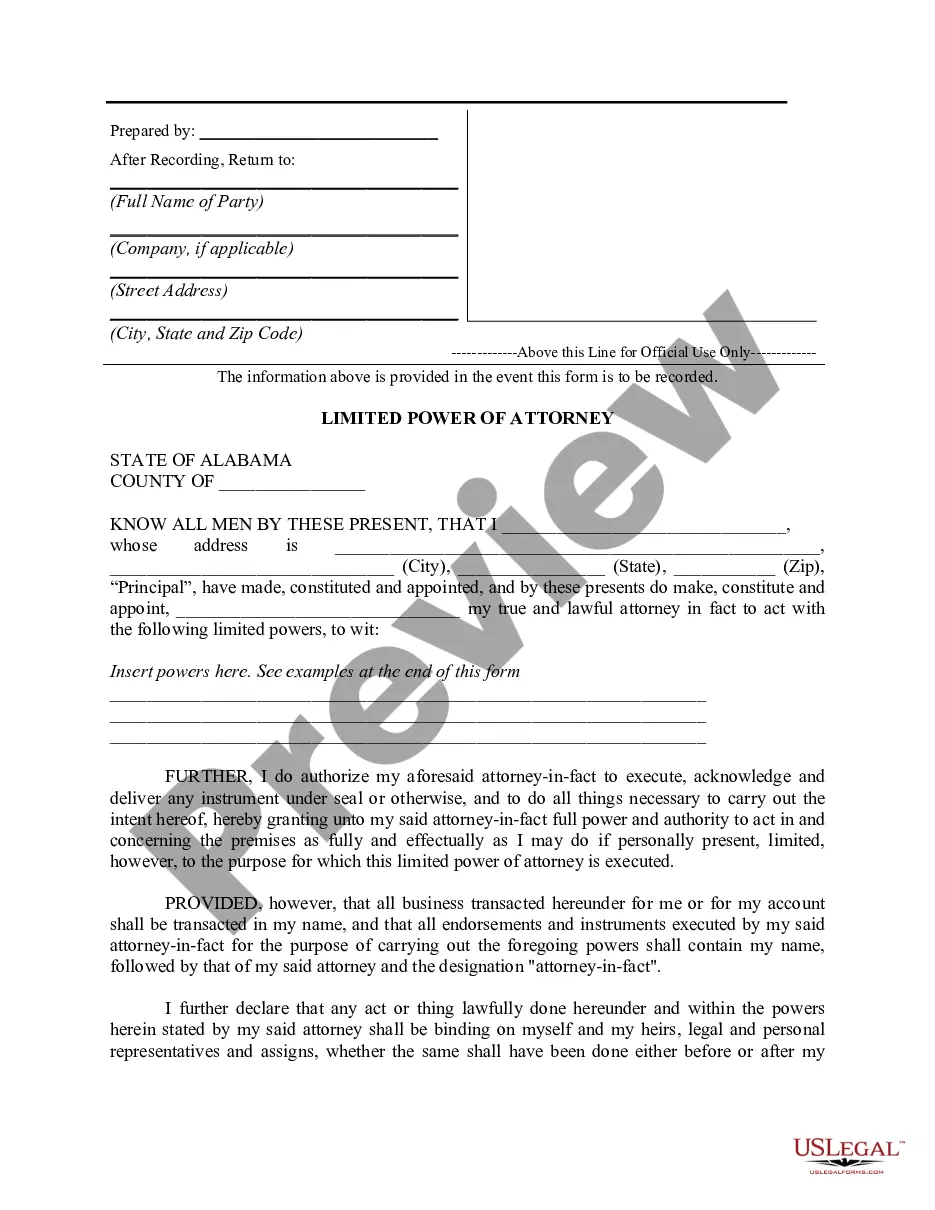

How to fill out Nonemployee Director Stock Option Plan?

You are able to invest several hours online looking for the legitimate document template that fits the federal and state requirements you want. US Legal Forms offers 1000s of legitimate kinds which can be reviewed by professionals. It is possible to download or printing the Washington Nonemployee Director Stock Option Plan from the service.

If you already have a US Legal Forms accounts, it is possible to log in and click the Acquire button. After that, it is possible to full, revise, printing, or signal the Washington Nonemployee Director Stock Option Plan. Each and every legitimate document template you get is your own property permanently. To get one more version for any obtained kind, visit the My Forms tab and click the related button.

If you use the US Legal Forms web site the first time, keep to the basic recommendations below:

- Very first, make sure that you have chosen the right document template to the area/area of your liking. Look at the kind outline to make sure you have chosen the appropriate kind. If available, utilize the Review button to search from the document template too.

- If you wish to find one more edition in the kind, utilize the Look for area to obtain the template that meets your requirements and requirements.

- After you have discovered the template you would like, simply click Acquire now to continue.

- Choose the pricing prepare you would like, enter your credentials, and sign up for an account on US Legal Forms.

- Total the deal. You should use your charge card or PayPal accounts to cover the legitimate kind.

- Choose the formatting in the document and download it for your product.

- Make adjustments for your document if necessary. You are able to full, revise and signal and printing Washington Nonemployee Director Stock Option Plan.

Acquire and printing 1000s of document web templates making use of the US Legal Forms website, which offers the biggest assortment of legitimate kinds. Use expert and status-distinct web templates to deal with your business or specific requirements.

Form popularity

FAQ

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

Many startups, private companies, and corporations will include them as part of a compensation plan for prospective employees. Companies often offer stock options as part of your compensation package so you can share in the company's success.

Qualified stock options, also known as incentive stock options, can only be granted to employees. Non-qualified stock options can be granted to employees, directors, contractors and others. This gives you greater flexibility to recognize the contributions of non-employees.

With stock-based compensation, employees in an early-stage business are offered stock options in addition to their salaries. The percentage of a company's shares reserved for stock options will typically vary from 5% to 15% and sometimes go up as high as 20%, depending on the development stage of the company.

For example, Directors of Sales at companies that have raised Over 30M typically get between 0 and 250K+ shares. However, smaller companies that have raised Under 1M are more generous with their stock compensation as it ranges between . 1 and 1%+ for Directors of Sales.

Non-qualified stock options offer workers, whether independent contractors or regular employees, the right to obtain a certain amount of the company shares for a set price. Employers tend to offer NSOs as an alternative type of compensation, to make sure they remain loyal and work for the company's best interests.

Yes, companies can absolutely offer stock options to their contractors, but contractors need to consider how the vesting, taxation, financial planning, and investment management related to the stock options fit into their personal financial plan.

The income related to the option exercise should be included in the Form W-2 you receive from your employer or 1099-NEC from the company if you are a non-employee. Any capital gain or loss amount may also be reportable on your US Individual Income Tax Return (Form 1040), Schedule D and Form 8949 in the year of sale.