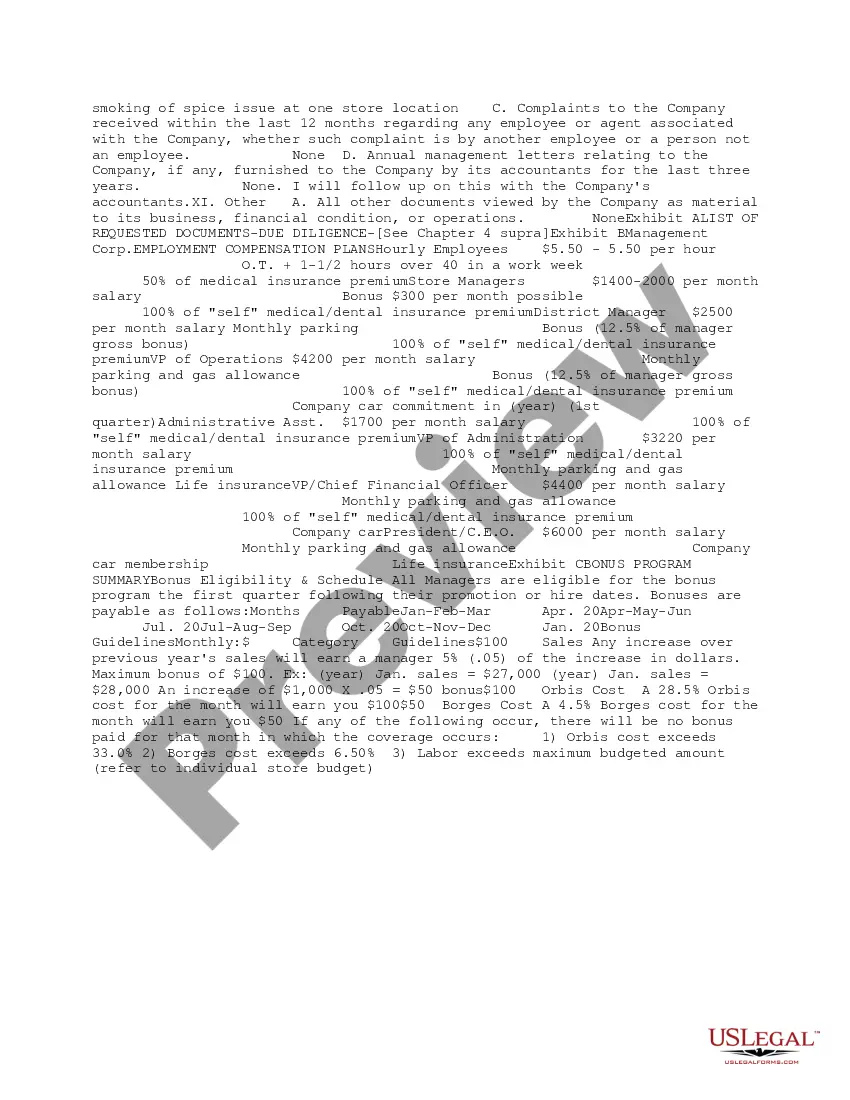

This due diligence form is a memorandum that summarizes the review of documents and the formation produced by a company in response to a list of requested materials.

Arkansas Summary Initial Review of Response to Due Diligence Request

Description

How to fill out Summary Initial Review Of Response To Due Diligence Request?

You can invest hours online searching for the valid document template that complies with the federal and state regulations you require.

US Legal Forms offers a vast selection of legal documents that are evaluated by professionals.

It's easy to download or print the Arkansas Summary Initial Review of Response to Due Diligence Request from the service.

To locate another version of the form, use the Search section to find the template that fits your needs and requirements.

- If you already possess a US Legal Forms account, you can Log In and click on the Obtain button.

- After that, you can complete, edit, print, or sign the Arkansas Summary Initial Review of Response to Due Diligence Request.

- Every legal document template you acquire is yours permanently.

- To obtain an additional copy of a purchased form, visit the My documents tab and click the corresponding button.

- If you are using the US Legal Forms site for the first time, follow the simple instructions below.

- First, ensure you have chosen the correct document template for the region/city you select.

- Review the document description to confirm you have selected the right template.

Form popularity

FAQ

The dormancy period for unclaimed property in Arkansas ranges from three to five years, depending on the asset type. After this period, the property is turned over to the state, and the owners lose their claim unless they take action. When preparing an Arkansas Summary Initial Review of Response to Due Diligence Request, be aware of these time limits. Tools like USLegalForms provide useful resources and guidance to help you track and reclaim your unclaimed property efficiently.

In Arkansas, property is generally considered abandoned after a dormancy period of three to five years. This duration depends on the type of property involved. Knowing this timeframe can guide you when submitting an Arkansas Summary Initial Review of Response to Due Diligence Request to reclaim lost assets. It's often beneficial to consult a knowledgeable platform like USLegalForms to navigate these timelines effectively.

The dormancy period refers to the length of time that an asset remains unclaimed before it is presumed abandoned. In Arkansas, this period varies depending on the type of property or account. Understanding this period is vital when dealing with an Arkansas Summary Initial Review of Response to Due Diligence Request, as it impacts when property will be turned over to the state. You can rely on services like USLegalForms to understand the specific dormancy periods for various properties.

Yes, you can claim your deceased father's unclaimed funds. In Arkansas, you will need to provide documentation proving your relationship to him, as well as his death certificate. With the appropriate paperwork, you can initiate an Arkansas Summary Initial Review of Response to Due Diligence Request. This ensures you follow the right process to access any funds that may legally belong to you.

The state auditor for Arkansas taxes is a key figure responsible for managing the audit processes related to tax collection and expenditure. This individual ensures compliance with tax laws and helps identify and mitigate any financial discrepancies. Understanding who holds this position is essential for anyone involved in the Arkansas Summary Initial Review of Response to Due Diligence Request. The current state auditor can provide guidance and resources relevant to tax-related inquiries.

The Arkansas state auditor plays a crucial role in overseeing the financial operations of the state. This official ensures that public funds are managed correctly and that state agencies comply with financial regulations. By conducting audits and reviews, the auditor supports transparency and accountability in state finances. As part of the Arkansas Summary Initial Review of Response to Due Diligence Request, the auditor's work helps maintain trust in government operations.

Yes, you can claim your deceased father's unclaimed property if you provide appropriate documentation proving your relationship and legal right to the assets. The process involves following the guidelines in the Arkansas Summary Initial Review of Response to Due Diligence Request. Ensure you have the necessary legal paperwork, such as a death certificate and proof of inheritance. This can facilitate a smoother claim process.

Yes, Arkansas does require negative unclaimed property reporting. This means that if a business has no unclaimed property to report, it must notify the state. This aligns with the Arkansas Summary Initial Review of Response to Due Diligence Request, ensuring transparency among businesses handling unclaimed funds. A clear understanding of this requirement reinforces compliance and can prevent penalties.

To submit unclaimed property in Arkansas, you need to follow guidelines set by the state treasurer’s office. First, gather necessary information, including documentation that proves your claim. This process is often streamlined through the Arkansas Summary Initial Review of Response to Due Diligence Request. For assistance, consider using uslegalforms to ensure you fill out all forms accurately and efficiently.

The due diligence requirements for unclaimed property in Arkansas involve contacting the owner before the property is reported to the state. This process aligns with the Arkansas Summary Initial Review of Response to Due Diligence Request, ensuring that businesses attempt to locate owners. Compliance with these regulations is essential for organizations managing unclaimed funds. If you suspect you might have unclaimed property, checking these requirements can guide you on how to proceed.