Arkansas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement

Description

How to fill out Approval Of Transfer Of Outstanding Stock With Copy Of Liquidating Trust Agreement?

You are able to invest hours on-line attempting to find the authorized file design that suits the federal and state demands you require. US Legal Forms gives a huge number of authorized varieties that happen to be evaluated by experts. It is possible to down load or print out the Arkansas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement from the service.

If you currently have a US Legal Forms account, you are able to log in and click on the Download key. Afterward, you are able to complete, edit, print out, or indication the Arkansas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement. Every authorized file design you acquire is yours permanently. To get another backup of any acquired kind, go to the My Forms tab and click on the related key.

If you work with the US Legal Forms website initially, adhere to the easy recommendations below:

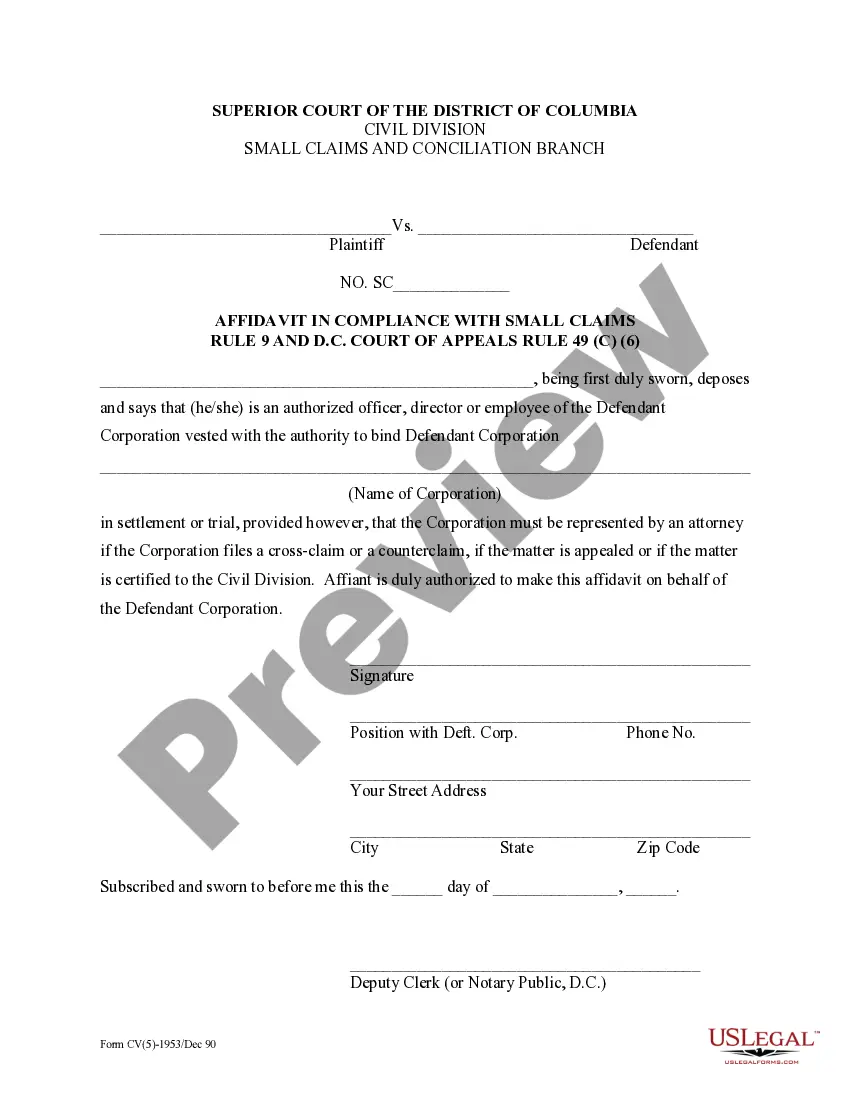

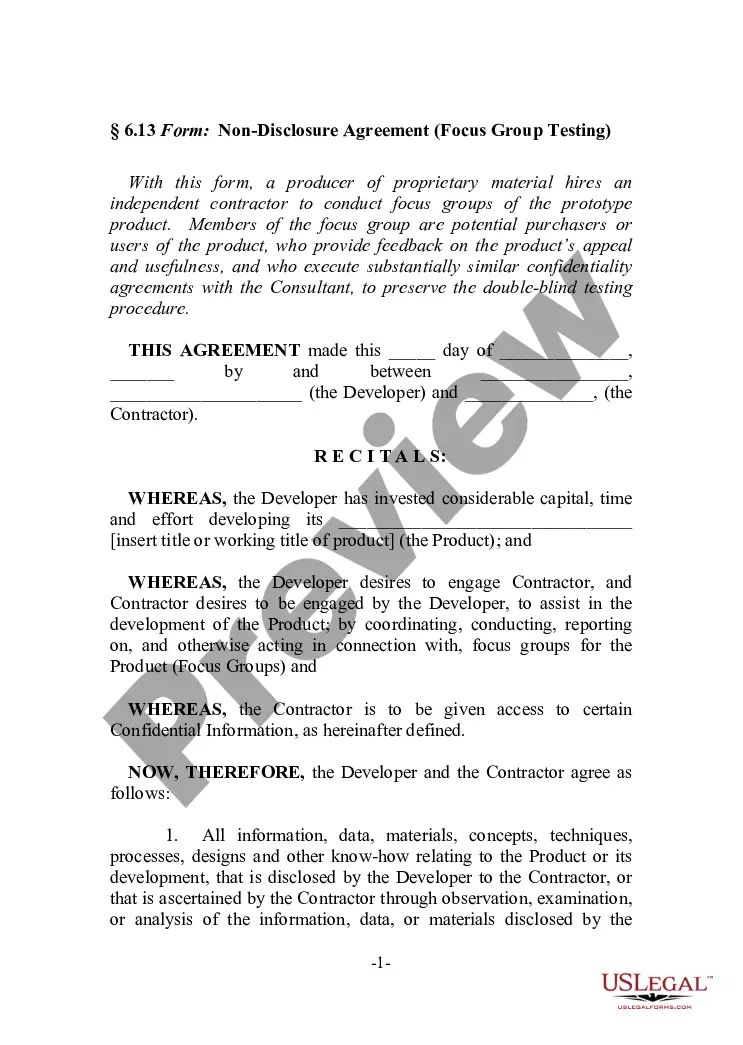

- Very first, be sure that you have selected the correct file design to the region/town of your choice. See the kind information to make sure you have chosen the proper kind. If available, utilize the Review key to check through the file design also.

- If you want to find another edition of the kind, utilize the Research field to obtain the design that fits your needs and demands.

- After you have identified the design you need, simply click Acquire now to proceed.

- Find the pricing plan you need, type your accreditations, and register for an account on US Legal Forms.

- Comprehensive the purchase. You can use your Visa or Mastercard or PayPal account to pay for the authorized kind.

- Find the format of the file and down load it in your gadget.

- Make modifications in your file if required. You are able to complete, edit and indication and print out Arkansas Approval of transfer of outstanding stock with copy of Liquidating Trust Agreement.

Download and print out a huge number of file templates utilizing the US Legal Forms Internet site, which provides the biggest collection of authorized varieties. Use expert and condition-particular templates to handle your organization or personal needs.

Form popularity

FAQ

Liquidating trusts are commonly used to help shorten and conclude Chapter 11 cases by saving litigation for after plan confirmation. This can help save time and resources so the debtor can focus on conducting a sale or reorganization rather than being mired in creditor disputes while trying to do so.

Liquidating trusts are funded with assets held for the benefit of creditors who may have a claim against the debtor. These trusts can exist from several months to several years, depending on how long it takes to liquidate the assets and work through various claims and settlements.

Proceeds from a cash liquidation distribution can be either a non-taxable return of principal or a taxable distribution, depending upon whether or not the amount is more than the investors' cost basis in the stock. The proceeds can be paid in a lump sum or through a series of installments.

This chapter of the Bankruptcy Code generally provides for reorganization, usually involving a corporation or partnership. A chapter 11 debtor usually proposes a plan of reorganization to keep its business alive and pay creditors over time. People in business or individuals can also seek relief in chapter 11.

Wind-Down Trust means the trust (if any) established on the Effective Date for the ratable benefit of the holders of the Wind-Down Trust Interests in ance with the Plan and pursuant to the Wind-Down Trust Agreement.