Arkansas Proposal to approve material terms of stock appreciation right plan

Description

How to fill out Proposal To Approve Material Terms Of Stock Appreciation Right Plan?

You are able to devote hrs on the Internet looking for the lawful record template that suits the state and federal specifications you will need. US Legal Forms offers a huge number of lawful types that are analyzed by experts. You can easily obtain or produce the Arkansas Proposal to approve material terms of stock appreciation right plan from the services.

If you already have a US Legal Forms profile, you may log in and click on the Acquire switch. After that, you may total, change, produce, or signal the Arkansas Proposal to approve material terms of stock appreciation right plan. Every single lawful record template you acquire is the one you have for a long time. To acquire yet another backup associated with a acquired form, go to the My Forms tab and click on the related switch.

Should you use the US Legal Forms internet site the very first time, keep to the simple directions listed below:

- Initially, make certain you have selected the best record template for your county/town that you pick. Read the form outline to ensure you have selected the right form. If available, take advantage of the Preview switch to appear through the record template as well.

- In order to discover yet another edition in the form, take advantage of the Search discipline to discover the template that meets your needs and specifications.

- Upon having located the template you need, click Acquire now to proceed.

- Pick the prices program you need, type your credentials, and register for your account on US Legal Forms.

- Total the deal. You can utilize your Visa or Mastercard or PayPal profile to cover the lawful form.

- Pick the format in the record and obtain it for your device.

- Make modifications for your record if needed. You are able to total, change and signal and produce Arkansas Proposal to approve material terms of stock appreciation right plan.

Acquire and produce a huge number of record web templates making use of the US Legal Forms Internet site, that provides the biggest selection of lawful types. Use skilled and state-particular web templates to tackle your small business or person requirements.

Form popularity

FAQ

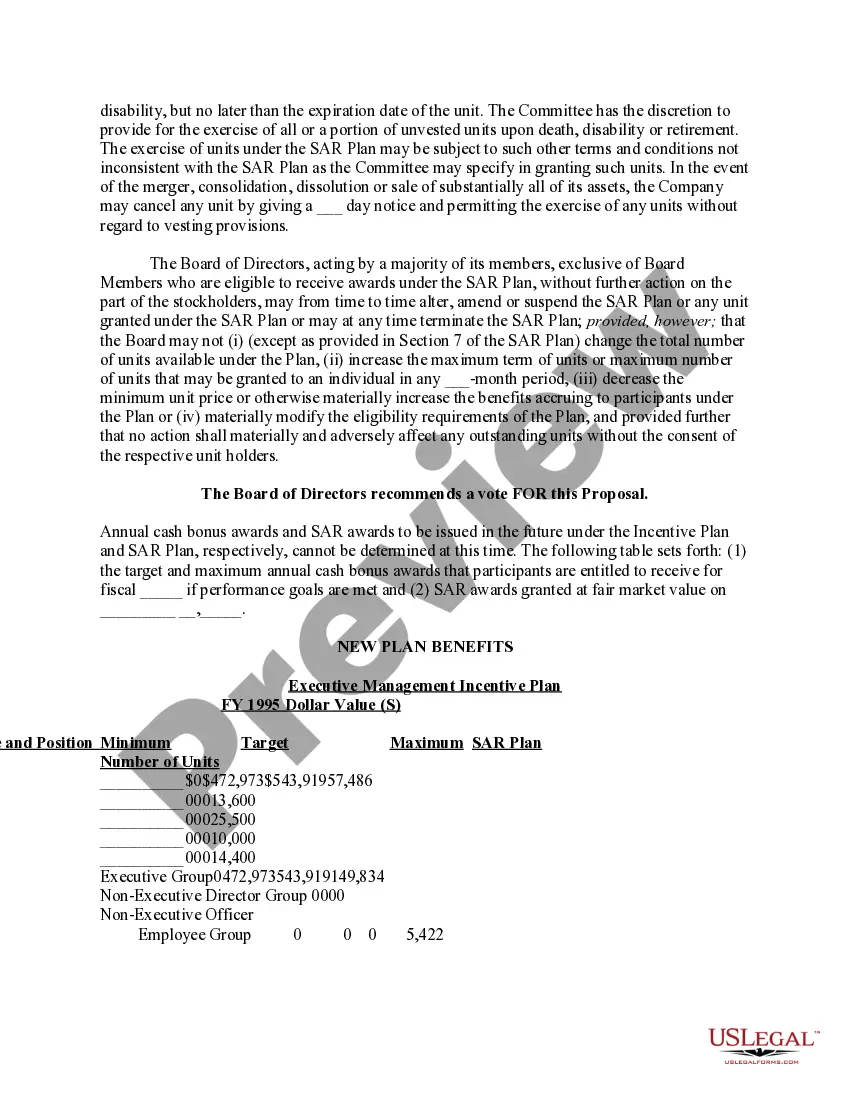

A Stock Appreciation Right (SAR) refers to the right to be paid compensation equivalent to an increase in the company's common stock price over a base or the value of appreciation of the equity shares currently being traded on the public market.

In accounting, the process that the company uses to record SAR agreements is to accrue a liability and recognize expense over the term of service. At the end of the service period, the liability is settled in cash or stock (or both).

A stock appreciation right (SAR) entitles an employee to the appreciation in value of a specified number of shares of employer stock over an ?exercise price? or ?grant price? over a specified period of time. The base price generally is equal to the underlying stock's fair market value on the date of grant.

The part of the change in the value of the stocks held by a business over any period which is due to price changes.

For example, let's say you were granted stock appreciation rights on 10 shares of your company ABC's stock, valued at $10 per share. Over time, the share price increases from $10 to $12. This means you'd receive $2 per share since that was the increased value.

For purposes of financial disclosure, you may value a stock appreciation right based on the difference between the current market value and the grant price. This formula is: (current market value ? grant price) x number of shares = value.

Stock Appreciation Rights (SARs) SARs differ from ESOPs in that they do not grant direct ownership to employees, but rather give them the right to receive a cash payout equal to the value of the stock appreciation.

A stock appreciation right is a form of incentive or deferred compensation that ties part of your income to the performance of your company's stock. It gives you the right to the monetary equivalent of the appreciation in the value of a specified number of shares over a specified period of time.