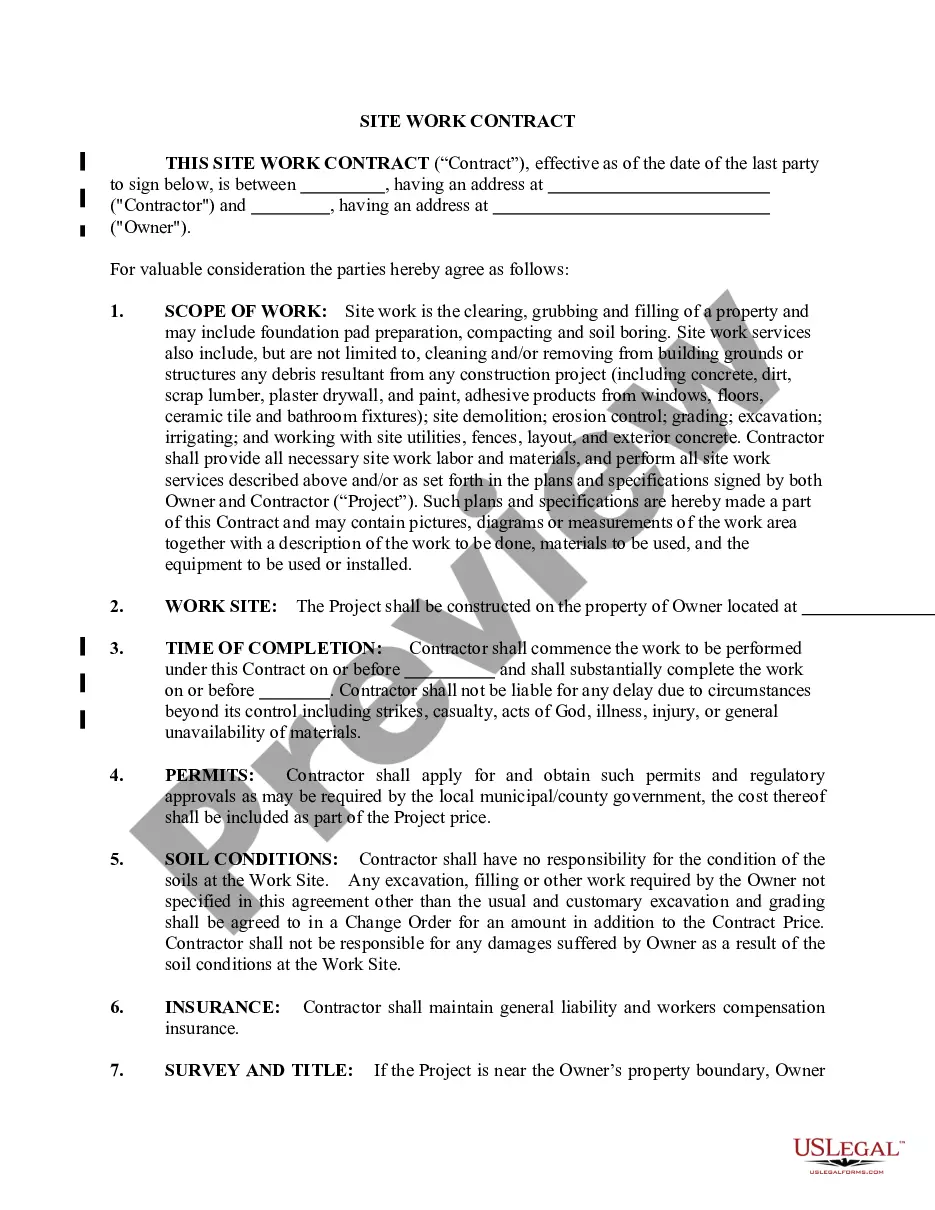

Arkansas Proposal to amend certificate of incorporation with copy of proposed article of bylaws

Description

How to fill out Proposal To Amend Certificate Of Incorporation With Copy Of Proposed Article Of Bylaws?

Are you currently in the place that you will need papers for both organization or person reasons just about every day time? There are a lot of legal file web templates accessible on the Internet, but discovering types you can rely is not effortless. US Legal Forms provides thousands of type web templates, such as the Arkansas Proposal to amend certificate of incorporation with copy of proposed article of bylaws, which are published to fulfill federal and state requirements.

Should you be previously informed about US Legal Forms site and possess a free account, merely log in. Afterward, you are able to download the Arkansas Proposal to amend certificate of incorporation with copy of proposed article of bylaws web template.

Unless you have an profile and need to begin using US Legal Forms, abide by these steps:

- Obtain the type you need and make sure it is to the correct metropolis/county.

- Take advantage of the Review option to review the form.

- Look at the description to actually have selected the right type.

- When the type is not what you are trying to find, utilize the Look for industry to obtain the type that suits you and requirements.

- If you find the correct type, click Purchase now.

- Choose the rates prepare you would like, fill out the necessary details to generate your bank account, and pay money for your order with your PayPal or bank card.

- Choose a hassle-free document structure and download your version.

Discover all of the file web templates you may have bought in the My Forms food selection. You can obtain a extra version of Arkansas Proposal to amend certificate of incorporation with copy of proposed article of bylaws anytime, if possible. Just click on the necessary type to download or printing the file web template.

Use US Legal Forms, one of the most considerable variety of legal forms, to conserve some time and prevent errors. The support provides professionally produced legal file web templates that you can use for an array of reasons. Make a free account on US Legal Forms and start producing your lifestyle a little easier.

Form popularity

FAQ

The Division completes most filings such as articles of incorporation, amendments, mergers or dissolutions within two business days of receipt.

Two Ways to Start A New Business in Arkansas Define your business concept. Draft a business plan. Choose a business name. Fund your startup costs. Choose a business structure. Register your business with the Arkansas Secretary of State. Get your business licenses. Set up a business bank account.

The Arkansas Nonprofit Corporation Act of 19931 (hereinafter the "Act") creates a comprehensive corporate code which applies to all Arkansas nonprofit corporations incorporated after 1993.2 Nonprofits chartered before 1994 may elect to become subject to the provisions of the Act by amending their articles of ...

Arkansas Business License and Permit Requirements As a business owner, it's your responsibility to make sure you have the proper state, federal or local business licenses to operate your Arkansas LLC. Some of the associated fees only need to be paid once, while others are ongoing charges.

(Small Businesses) 1. The business must be registered with the Arkansas Secretary of State. 2. The business must elect Subchapter S treatment for federal income tax purposes by filing an Election by Small Business (Form 2553) with the IRS.

SALES AND USE TAX A completed application for a sales tax permit and a fifty dollar ($50) non- refundable fee is required to register new businesses. It will take approximately eight to ten working days to process the application.

While an Arkansas seller's permit is necessary to collect sales tax on retail transactions, a resale certificate allows a business to purchase items on a tax-free basis if these goods are intended to be resold later.