Arizona Proposal to ratify the prior grant of options to each directors to purchase common stock

Description

How to fill out Proposal To Ratify The Prior Grant Of Options To Each Directors To Purchase Common Stock?

Choosing the right authorized papers format can be a battle. Needless to say, there are a lot of templates available on the Internet, but how would you get the authorized develop you will need? Use the US Legal Forms website. The services offers a large number of templates, such as the Arizona Proposal to ratify the prior grant of options to each directors to purchase common stock, that you can use for company and private requirements. Each of the forms are checked by pros and meet federal and state requirements.

When you are currently authorized, log in in your bank account and click the Obtain key to have the Arizona Proposal to ratify the prior grant of options to each directors to purchase common stock. Utilize your bank account to check through the authorized forms you may have ordered earlier. Check out the My Forms tab of your respective bank account and have yet another duplicate of your papers you will need.

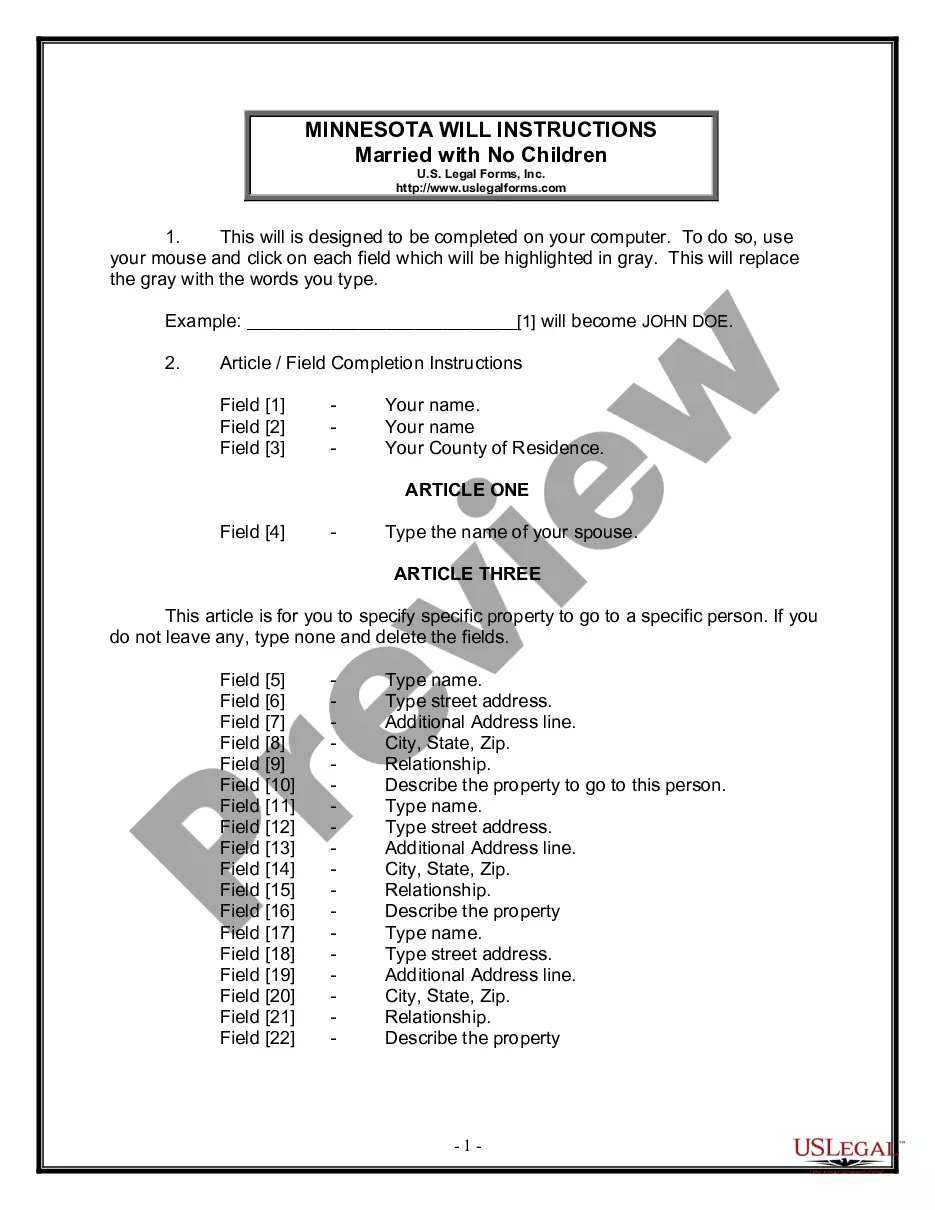

When you are a new customer of US Legal Forms, listed below are basic instructions for you to stick to:

- First, be sure you have chosen the proper develop for the town/region. You may examine the shape using the Review key and read the shape information to ensure this is the best for you.

- When the develop does not meet your needs, use the Seach discipline to obtain the proper develop.

- Once you are positive that the shape is proper, select the Get now key to have the develop.

- Pick the rates program you desire and type in the necessary details. Design your bank account and buy an order utilizing your PayPal bank account or credit card.

- Select the document file format and obtain the authorized papers format in your device.

- Comprehensive, change and produce and signal the received Arizona Proposal to ratify the prior grant of options to each directors to purchase common stock.

US Legal Forms will be the biggest collection of authorized forms in which you will find various papers templates. Use the service to obtain professionally-produced papers that stick to state requirements.

Form popularity

FAQ

For instance, exchange-traded stock options can be purchased via the open market, while ESOs cannot. As such, it's difficult to value ESOs, and lack standard specifications that may apply to listed or exchange-traded stock options. What Are Employee Stock Options? | TIME Stamped time.com ? personal-finance ? article ? what-are-e... time.com ? personal-finance ? article ? what-are-e...

A transfer of employee stock options out of the employee's estate (i.e., to a family member or to a family trust) offers two main estate planning benefits: first, the employee is able to remove a potentially high growth asset from his or her estate; second, a lifetime transfer may also save estate taxes by removing ...

The shareholders could gift their shares back to the company, for no payment or consideration. Since these shares are a gift, the company need not comply with the formalities required to purchase its own shares. All that is necessary is a stock transfer form to transfer legal title.