Arkansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets

Description

How to fill out Agreement To Dissolve And Wind Up Partnership With Sale To Partner And Disproportionate Distribution Of Assets?

US Legal Forms - one of the largest collections of legal documents in the USA - provides a variety of legal paperwork templates that you can download or print.

By using the website, you will find hundreds of forms for business and personal purposes, sorted by categories, states, or keywords.

You can locate the latest versions of forms such as the Arkansas Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets in just a few minutes.

If the form does not meet your requirements, use the Search field at the top of the screen to find one that does.

Once you are satisfied with the form, confirm your choice by clicking the Purchase now button. Then, select your preferred payment plan and provide your credentials to register for an account.

- If you already have a monthly subscription, Log In and download the Arkansas Agreement to Dissolve and Wind Up Partnership with Sale to Partner and Disproportionate Distribution of Assets from the US Legal Forms library.

- The Download button will appear on every form you view.

- You have access to all previously downloaded forms in the My documents section of your account.

- If you are new to US Legal Forms, here are simple steps to help you get started.

- Make sure you have chosen the right form for your city/state.

- Click the Review button to check the content of the form.

Form popularity

FAQ

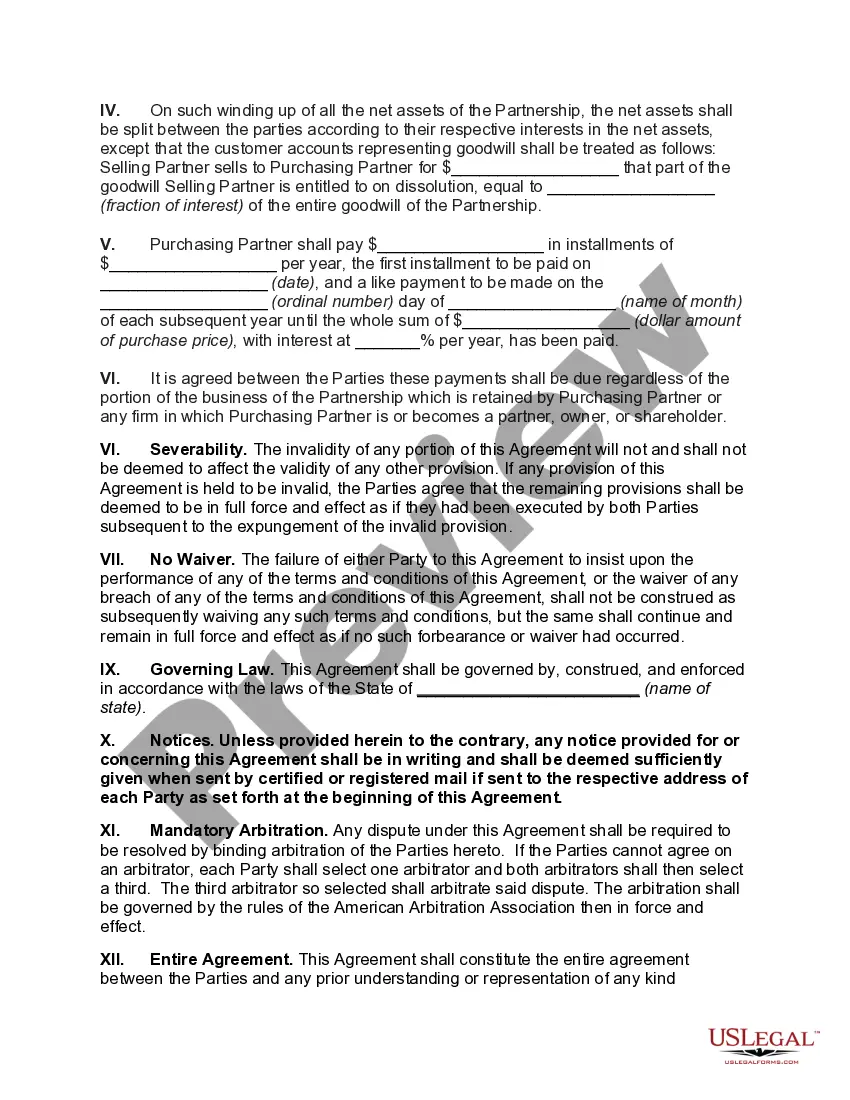

The correct order for distributing assets upon dissolution typically involves paying off liabilities first, followed by distributing any remaining assets among partners. The Arkansas Agreement to Dissolve and Wind up Partnership with Sale to Partner and Disproportionate Distribution of Assets should guide this process, ensuring fair treatment among partners based on their contributions.

To dissolve your Arkansas LLC, you submit the completed form Articles of Dissolution for Limited Liability Company to the Arkansas Secretary of State, Business and Commercial Services (BCS) by mail or in person. You cannot file articles of dissolution online. Make checks payable to Arkansas Secretary of State.

Once the debts owed to all creditors are satisfied, the partnership property will be distributed to each partner according to their ownership interest in the partnership. If there was a partnership agreement, then that document controls the distribution.

A distribution is disproportionate if a partner receives more or less than his pro rata share of IRC 751(b) hot assets. Partnership distributes money and/or property to a partner.

Do partnership distributions have to be equal? Partner equity does not typically equate to equivalent investment contributions from all business partners. Instead, partners can make equal contributions to the company and possess equal ownership rights, but make contributions in a variety of different forms.

Typically, state law provides that the partnership must first pay partners according to their share of capital contributions (the investments in the partnership), and then distribute any remaining assets equally.

If dissolution is not covered in the partnership agreement, the partners can later create a separate dissolution agreement for that purpose. However, the default rule is that any remaining money or property will be distributed to each partner according to their ownership interest in the partnership.

A disproportionate distribution is a payout of corporate profits whereby some shareholders receive cash or other assets and others receive an increased interest in the company.

Can Partners Take Unequal Distributions? You may be entitled to unequal distribution of partnership profits regardless of the partners' share of capital under a partnership agreement. An S Corporation cannot take advantage of this tax break because it cannot adjust its tax bill in this way.

LLCs are not required to periodically distribute profits to members. If profits are distributed, a member still has an equal claim for future distributions.