Nebraska Final Notice of Past Due Account

Description

How to fill out Final Notice Of Past Due Account?

If you require to access, retrieve, or print legal document templates, utilize US Legal Forms, the largest collection of legal forms available online.

Employ the website's straightforward and user-friendly search feature to find the documents you seek.

Many templates for business and personal purposes are categorized by groups and regions, or keywords. Use US Legal Forms to locate the Nebraska Final Notice of Past Due Account with just a few clicks.

Every legal document template you purchase is yours permanently. You have access to every form you downloaded within your account. Click on the My documents section to select a form to print or download again.

Be proactive and download, and print the Nebraska Final Notice of Past Due Account with US Legal Forms. There are millions of professional and state-specific forms available for your business or personal needs.

- When you are already a US Legal Forms user, Log In to your account and click the Acquire button to obtain the Nebraska Final Notice of Past Due Account.

- You can also retrieve forms you previously downloaded in the My documents tab of your account.

- If you are using US Legal Forms for the first time, follow the instructions below.

- Step 1. Confirm you have selected the form for the correct area/region.

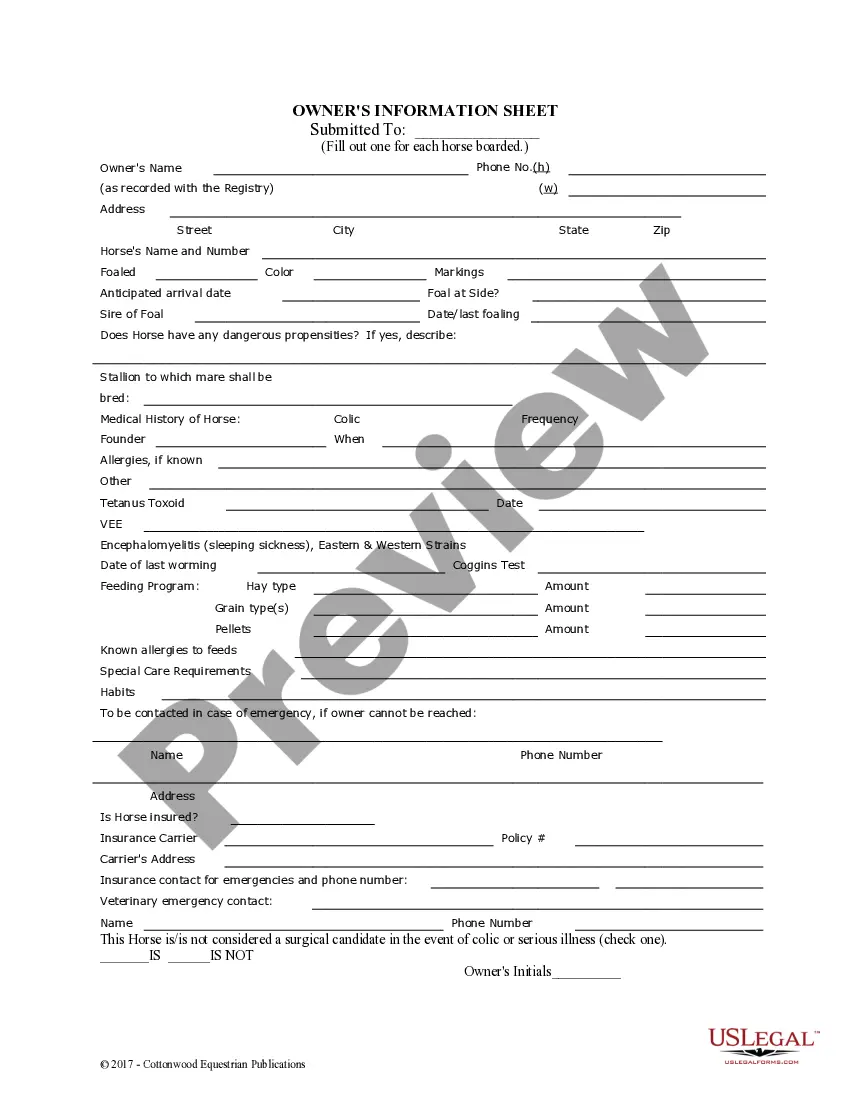

- Step 2. Use the Preview option to review the form's content. Be sure to read through the description.

- Step 3. If you are not satisfied with the form, use the Search field at the top of the screen to find other versions of the legal document template.

- Step 4. Once you have found the form you require, click the Purchase now button. Choose the pricing plan you prefer and enter your information to register for an account.

- Step 5. Complete the transaction. You can use your Visa or Mastercard or PayPal account to finalize the payment.

- Step 6. Choose the format of the legal document and download it onto your device.

- Step 7. Fill out, modify, and print or sign the Nebraska Final Notice of Past Due Account.

Form popularity

FAQ

When and Where to File. Mail to the Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903, or fax to 402-471-5927, prior to the change. Permanently Closing the Business. Form 22 should be filed to cancel one or more of the tax programs listed in line 5.

What you must doRead the notice carefully.You can submit your response by:If you agree with the changes, sign the enclosed Form 5564 and return it to us.If you don't agree, you have the right to challenge the proposed changes by filing a petition with the U.S. Tax Court no later than the date shown on the notice.More items...?08-Sept-2021

A waiver of deficiency means that the mortgage company has agreed not to sue you for the unpaid balance that may remain after the home is sold (whether via a foreclosure sale, short sale or deed in lieu of foreclosure).

To dissolve an LLC in Nebraska, simply follow these three steps: Follow the Operating Agreement. Close Your Business Tax Accounts....Step 1: Follow Your Nebraska LLC Operating Agreement.Step 2: Close Your Business Tax Accounts.Step 3: File Articles of Dissolution.

A notice of deficiency is issued when the IRS proposes a change to a tax return because they found that the information reported on a return does not match their records.

When and Where to File. Mail to the Nebraska Department of Revenue, PO Box 98903, Lincoln, NE 68509-8903, or fax to 402-471-5927, prior to the change. Permanently Closing the Business. Form 22 should be filed to cancel one or more of the tax programs listed in line 5.

If the taxpayer wishes to dispute the assessment he or she must file a protest with DOR. Protests may be filed by mail, addressed to the Nebraska Department of Revenue, Legal Section, PO Box 94818, Lincoln, NE 68509-4818 or electronically by using the State File Sharing system (ShareFile) on DOR's website.

So today, the IRS is required to prominently display on page one of the Notice of Deficiency the actual deadline for a response. Don't write the IRS to protest a Notice of Deficiency. In fact, only one response to a Notice of Deficiency is permitted: filing a petition in the U.S. Tax Court clerk's office in Washington.

A Form 941N is required even if no payments were made that were subject to income tax withholding. Paper filers should mail this return with payment to the Nebraska Department of Revenue, PO Box 98915, Lincoln, Nebraska 68509-8915.

If you have a valid Federal extension (IRS Form 4868), you will automatically receive a Nebraska tax extension. In fact, you are only required to file a Nebraska extension if you don't have a Federal extension but you want a state extension, or if you need to make a tentative payment for your Nebraska income tax.