Arkansas Collection Report

Description

How to fill out Collection Report?

Finding the appropriate legal document template can be quite a challenge. Clearly, there are numerous templates available online, but how do you locate the legal form you need? Utilize the US Legal Forms site.

The platform offers thousands of templates, including the Arkansas Collection Report, which can be utilized for business and personal purposes. All of the forms are verified by experts and meet state and federal requirements.

If you are already a member, Log In to your account and click the Download button to obtain the Arkansas Collection Report. Use your account to search through the legal documents you have previously ordered. Visit the My documents section of your account and obtain another copy of the document you need.

Complete, modify, and print and sign the downloaded Arkansas Collection Report. US Legal Forms is the largest repository of legal documents, where you can find various document templates. Use the service to download professionally crafted paperwork that complies with state regulations.

- If you are a new user of US Legal Forms, here are simple steps you should follow.

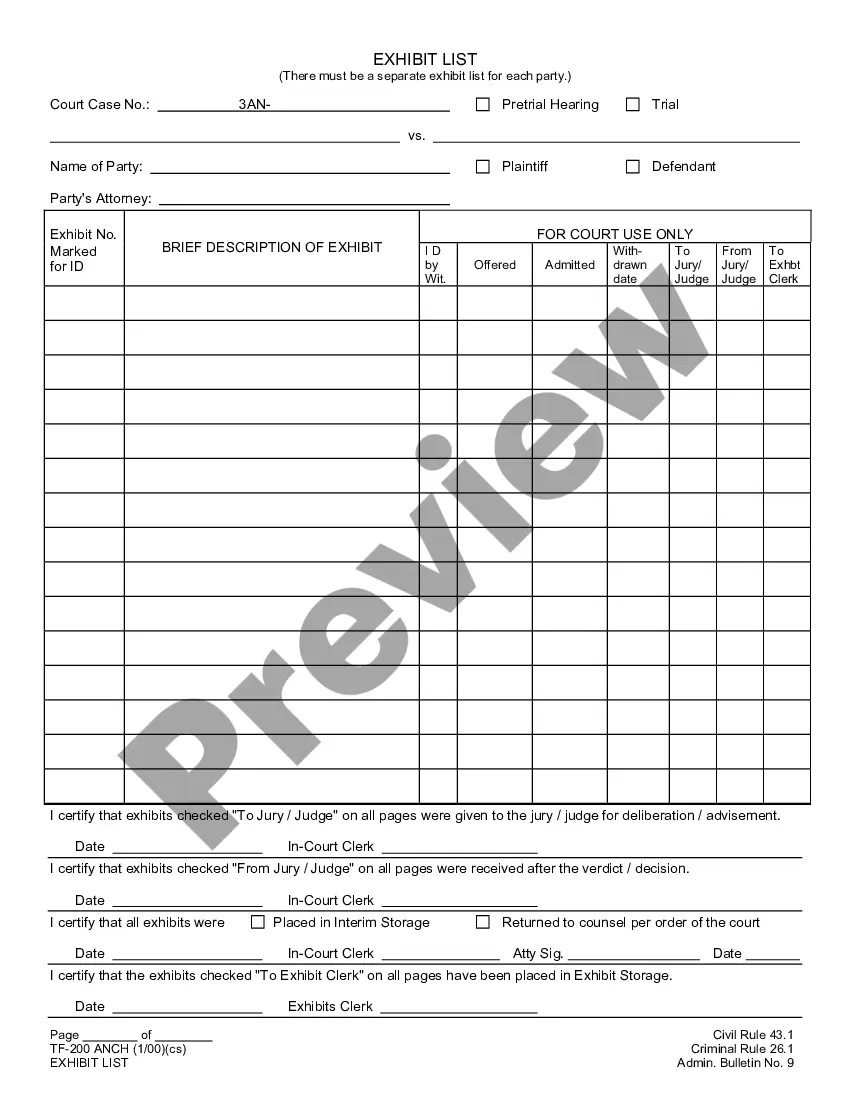

- First, ensure you have selected the correct form for your city/region. You can browse the form using the Preview button and read the form description to ensure it is suitable for you.

- If the form does not meet your needs, use the Search field to find the correct form.

- Once you are confident that the form is accurate, click the Buy Now button to access the form.

- Select the pricing plan you wish and fill in the required information. Create your account and pay for the order using your PayPal account or Visa or Mastercard.

- Choose the file format and download the legal document template to your device.

Form popularity

FAQ

Generally, a 10-year-old debt in Arkansas is considered expired under the statute of limitations for most types of debt. This means that creditors can no longer sue you for repayment. However, some debt collectors may still attempt to contact you about such debts. It's always wise to examine your Arkansas Collection Report to confirm the status of any old debts you might have.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

And some states also allow judgment liens on the debtor's personal property -- things like jewelry, art, antiques, and other valuables. In Arkansas, a judgment lien can be attached to real estate only (such as a house, condo, or land).

The average debt collection fee is typically between 20% to 35%. Several factors will impact how much a collection agency will charge. So let's break it down; Age of account Older debts are generally more complex to collect on, so they typically demand higher fees.

In most cases, the statute of limitations for a debt will have passed after 10 years. This means a debt collector may still attempt to pursue it (and you technically do still owe it), but they can't typically take legal action against you.

Although rarely asserted in the context of a collection action, under Arkansas law, an individual who is married or is the head of a family may claim as exempt up to $500 of their personal property (up to $200 if they are not married or the head of a family). Ark.

Checking Your Credit Report Most collection agencies report debts to the credit bureaus, so you may find the name and phone number you need on a recent copy of your credit report.

In cases against consumers for unpaid debts, the statute of limitations is three years in Arkansas. To achieve this short statute of limitations period, it must be filed as breach of contract claims, and there cannot be proof in writing, under A.C.A. 16- 56-105.

The statute of limitations is a law that limits how long debt collectors can legally sue consumers for unpaid debt. The statute of limitations on debt varies by state and type of debt, ranging from three years to as long as 20 years.

Under the Fair Credit Reporting Act, debts can appear on your credit report generally for seven years and in a few cases, longer than that. Under state laws, if you are sued about a debt, and the debt is too old, you may have a defense to the lawsuit.