Arkansas Telecommuting Worksheet

Description

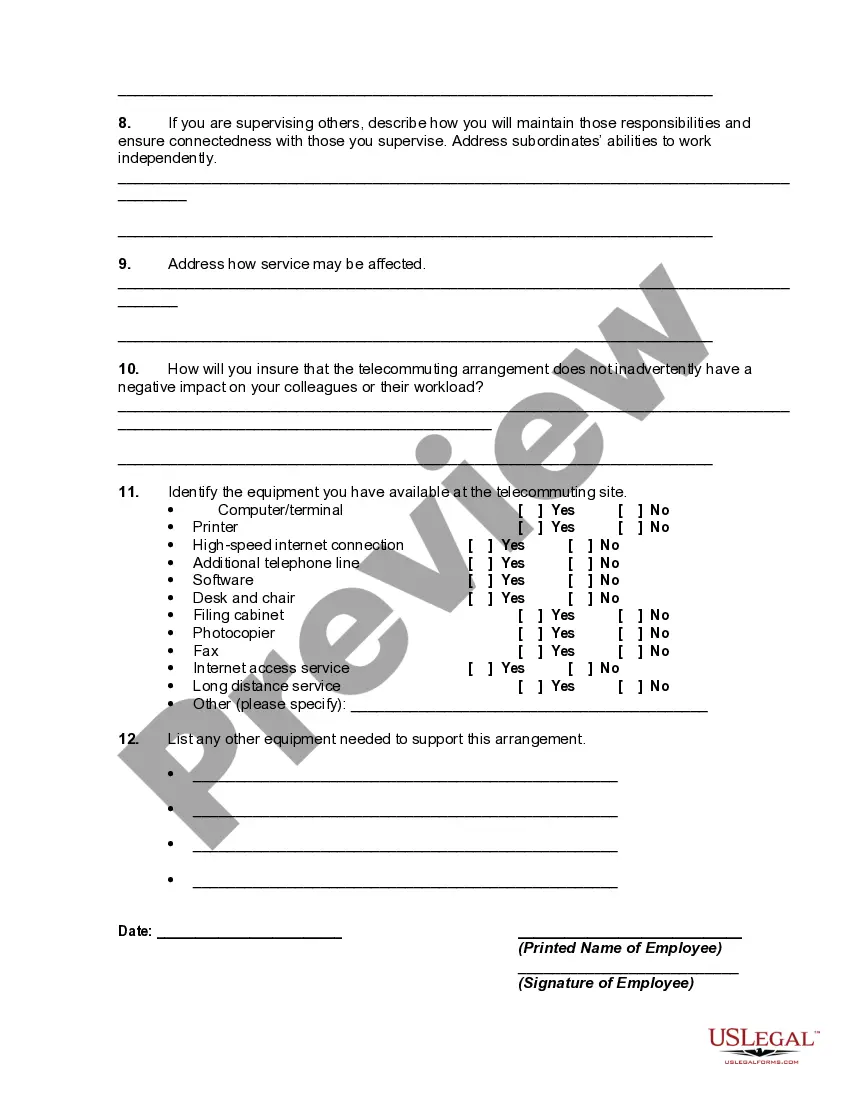

How to fill out Telecommuting Worksheet?

Finding the appropriate legal document template can be a challenge.

Indeed, there are numerous templates accessible online, but how do you locate the legal form you require.

Utilize the US Legal Forms website. The platform offers thousands of templates, such as the Arkansas Telecommuting Worksheet, suitable for both business and personal needs.

If the form does not meet your needs, use the Search field to find the appropriate form. When you are confident that the form is correct, click the Buy now button to purchase the document. Choose the pricing plan you prefer and enter the required information. Create your account and pay for the order using your PayPal account or credit card. Select the file format and download the legal document template to your device. Complete, edit, print, and sign the downloaded Arkansas Telecommuting Worksheet. US Legal Forms is the largest collection of legal documents where you can find many template records. Utilize the service to obtain professionally crafted papers that adhere to state regulations.

- All documents are vetted by professionals and comply with state and federal regulations.

- If you are already a registered user, Log In to your account and click the Download button to retrieve the Arkansas Telecommuting Worksheet.

- Use your account to view the legal documents you have previously purchased.

- Navigate to the My documents section of your account to obtain another copy of the document you need.

- If you are a new user of US Legal Forms, here are straightforward steps for you to follow.

- First, ensure you have selected the correct form for your city/region. You can review the form using the Review button and check the form description to confirm it is the right one for you.

Form popularity

FAQ

Under the executive order, the California Franchise Tax Board (FTB) provided guidance that a business would not have tax nexus with the state merely because of remote employees teleworking from a location in California, and that those employees would be treated as a de minimis activity for the purposes of the

The New Rules for Remote Work: Pandemic EditionCommunicate clearly and be decisive.Lead by example.Be extra flexible.Adjust work expectations.Rethink meetings.Move to more asynchronous work.Accept that productivity will probably suffer.Focus on outcomes rather than monitoring activities.More items...?

These include:Secure web-based timekeeping.Secure web-based document management.Web-based phone application.Video Conferencing application.Secure web-based HR.Tech support.

With more employees working remotely, employers are facing new tax and compliance issues. A business with a physical presence, such as an office or warehouse, always creates a state tax nexus. However, as the Wayfair ruling confirmed, a business can establish a tax presence even without physical presence in a state.

In general, if you're working remotely you'll only have to file and pay income taxes in the state where you live. However, in some cases, you may be required to file tax returns in two different states. This depends on your particular situation, the company you work for, and the tax laws of the states involved.

Texas: Presence of Single Employee in State Creates Nexus.

A remote work stipend, or remote work allowance, is a sum of money given to employees for them to use to access perks while working remotely.

The remote work policy outlines what's expected when working remotely. It should go into detail about all aspects of remote work. This includes expectations of working hours, legal rights, and cybersecurity requirements. Although this might sound challenging, with the right guidance, it won't be!

Nexus is typically created for income tax purposes if an entity: Derives income from sources within the state. Owns or leases property there. Has employees there who are engaged in activities that exceed "mere solicitation"

An employee living in a different state would normally not create nexus for the employer, but as a remote worker, that employee attributes presence to the employer through their performance of their employment duties at home.