Arkansas Rental Application for House

Description

How to fill out Rental Application For House?

Have you found yourself in a scenario where you require documents for various business or particular purposes nearly every day.

There are countless legal document templates accessible online, but locating ones you can trust is challenging.

US Legal Forms provides a vast array of form templates, such as the Arkansas Rental Application for House, designed to comply with federal and state requirements.

Once you find the right form, click Purchase now.

Select your desired pricing plan, complete the necessary information to create your account, and pay for the transaction using your PayPal or credit card.

- If you are already acquainted with the US Legal Forms website and have an account, simply Log In.

- Then, you can download the Arkansas Rental Application for House template.

- If you do not have an account and wish to start using US Legal Forms, follow these guidelines.

- Obtain the necessary form and verify it is for the correct city/county.

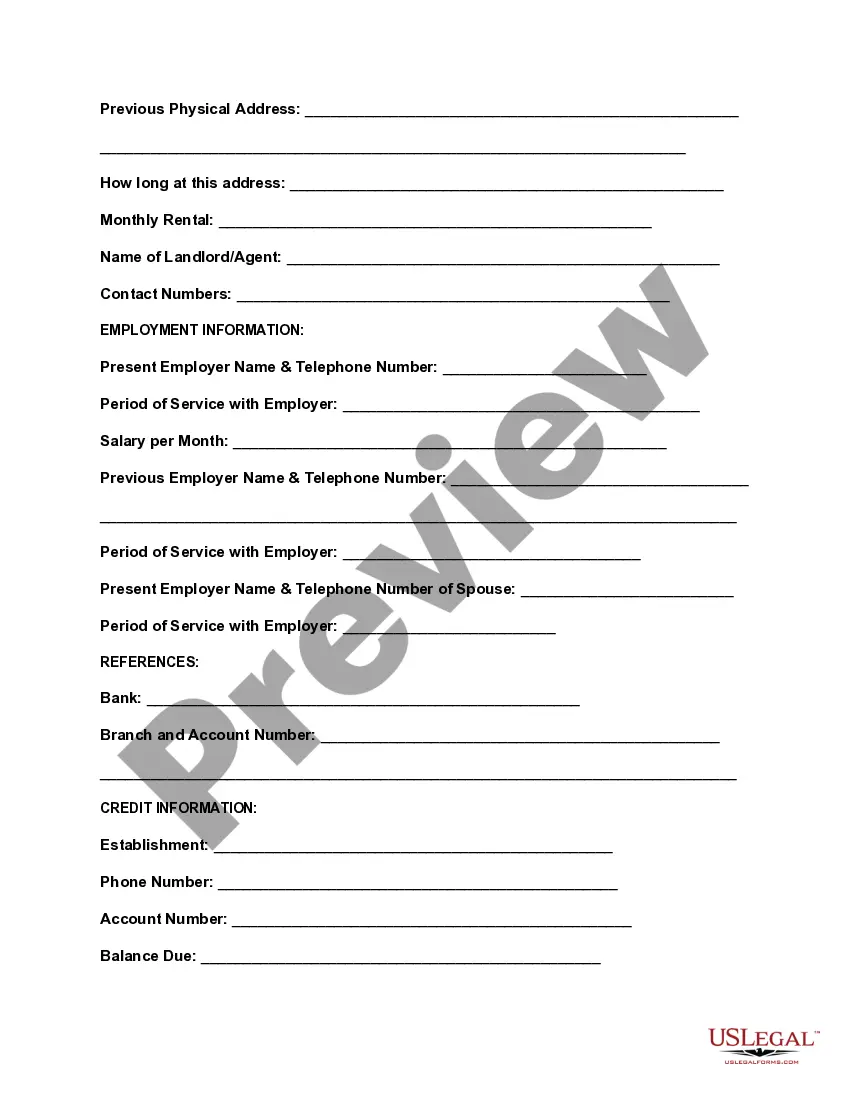

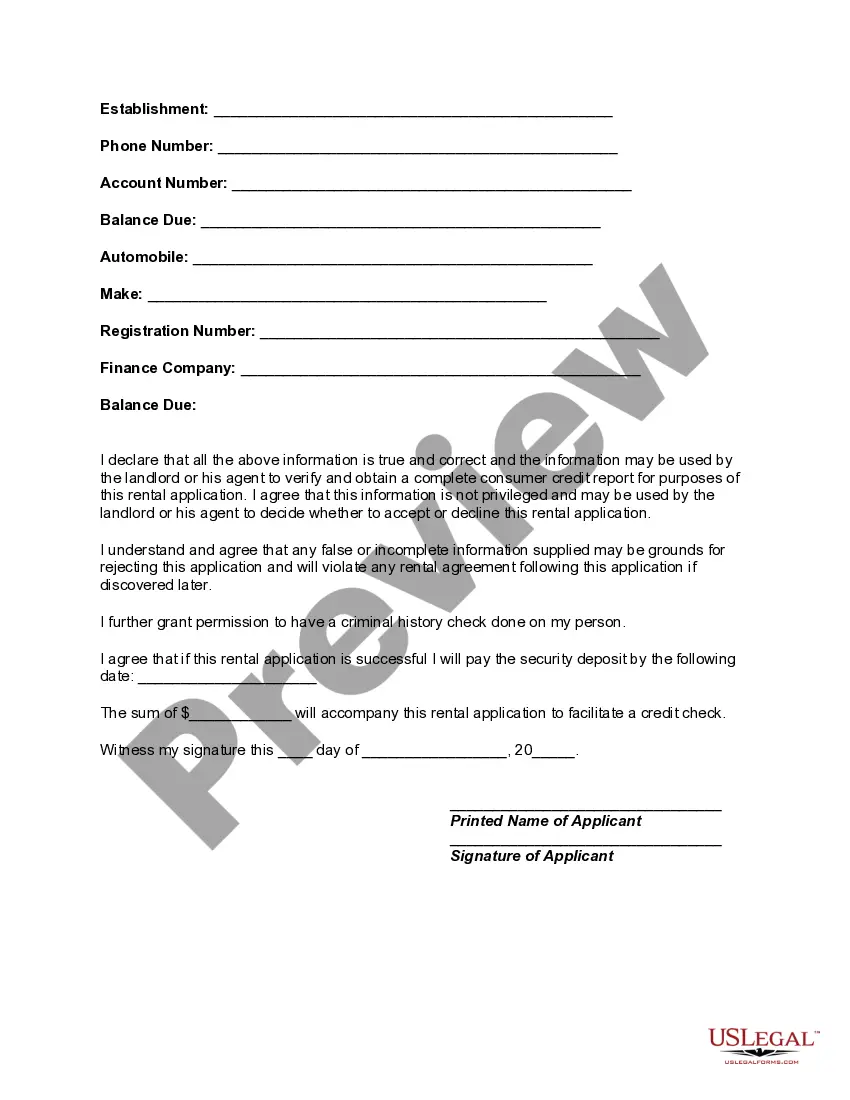

- Utilize the Review option to examine the document.

- Go through the summary to ensure you have selected the appropriate form.

- If the document does not meet your expectations, use the Research section to find the form that suits your needs.

Form popularity

FAQ

Rental applications can face denial for various reasons, but it often depends on the applicant pool and specific property requirements. A common reason for denial is failing to meet income or credit criteria listed in the Arkansas Rental Application for House. By preparing your application thoroughly, you can reduce the likelihood of denial and promote your candidacy.

A landlord may refuse rent for several reasons, including insufficient income, poor credit history, or negative references. They may also consider past rental behavior or lack of rental history. To improve your standing, ensure your Arkansas Rental Application for House is accurate and complete, highlighting your reliability as a tenant.

The chances of not getting approved for an apartment can vary, depending on your financial background and information on your Arkansas Rental Application for House. Factors like credit score, income stability, and previous rental history play significant roles. However, a well-prepared application can greatly increase your approval chances.

Many apartments have an income requirement, often asking tenants to earn three times the rent. This policy helps landlords ensure that renters can comfortably afford monthly payments. When applying with the Arkansas Rental Application for House, be prepared to demonstrate your income to meet these requirements.

To fill out a rental verification form, start by gathering your previous rental history, including contact information for past landlords. Clearly state your rental duration, payment history, and any maintenance issues. Using the Arkansas Rental Application for House can simplify this process, as it provides you with a structured format to present your information effectively.

Getting approved for a rental often depends on your financial history and rental application details. Many landlords look for a steady income and a good credit score. When you use the Arkansas Rental Application for House, you present all your essential information clearly, making it easier for landlords to assess your application.

To afford a rent of $1500, financial experts suggest that your monthly income should be at least three times that amount. This means you should be earning around $4500 per month, or $54,000 per year. Using an Arkansas Rental Application for House can help you understand what landlords expect regarding income verification. Remember to factor in other expenses to ensure your budget remains comfortable.

Setting a credit score requirement for rental applications can help ensure reliable tenants. Generally, a credit score of 620 or higher is a good starting point for an Arkansas Rental Application for House. However, you might consider a lower score if applicants have strong rental references and stable income. Always balance credit requirements with a comprehensive review of each applicant.

To receive more rental applications, it’s important to market your property effectively. Use online platforms and advertise your listing with appealing images and detailed descriptions. Consider providing an easy-to-complete Arkansas Rental Application for House to encourage interested renters. Engaging with potential tenants through social media or open house events can also boost your application numbers.

Many people wonder if getting approved for a rental is difficult. The truth is, the approval process can vary depending on the landlord and their requirements. When filling out an Arkansas Rental Application for House, having a good credit score and solid rental history will improve your chances. Moreover, being prepared with required documents can streamline the process.